Three Things We’re Hearing

- Consumers like digital banking

- Lenders re-entering the market

- Overall financial services ad spending still recovering

A three-minute read

Consumers Like Digital Banking

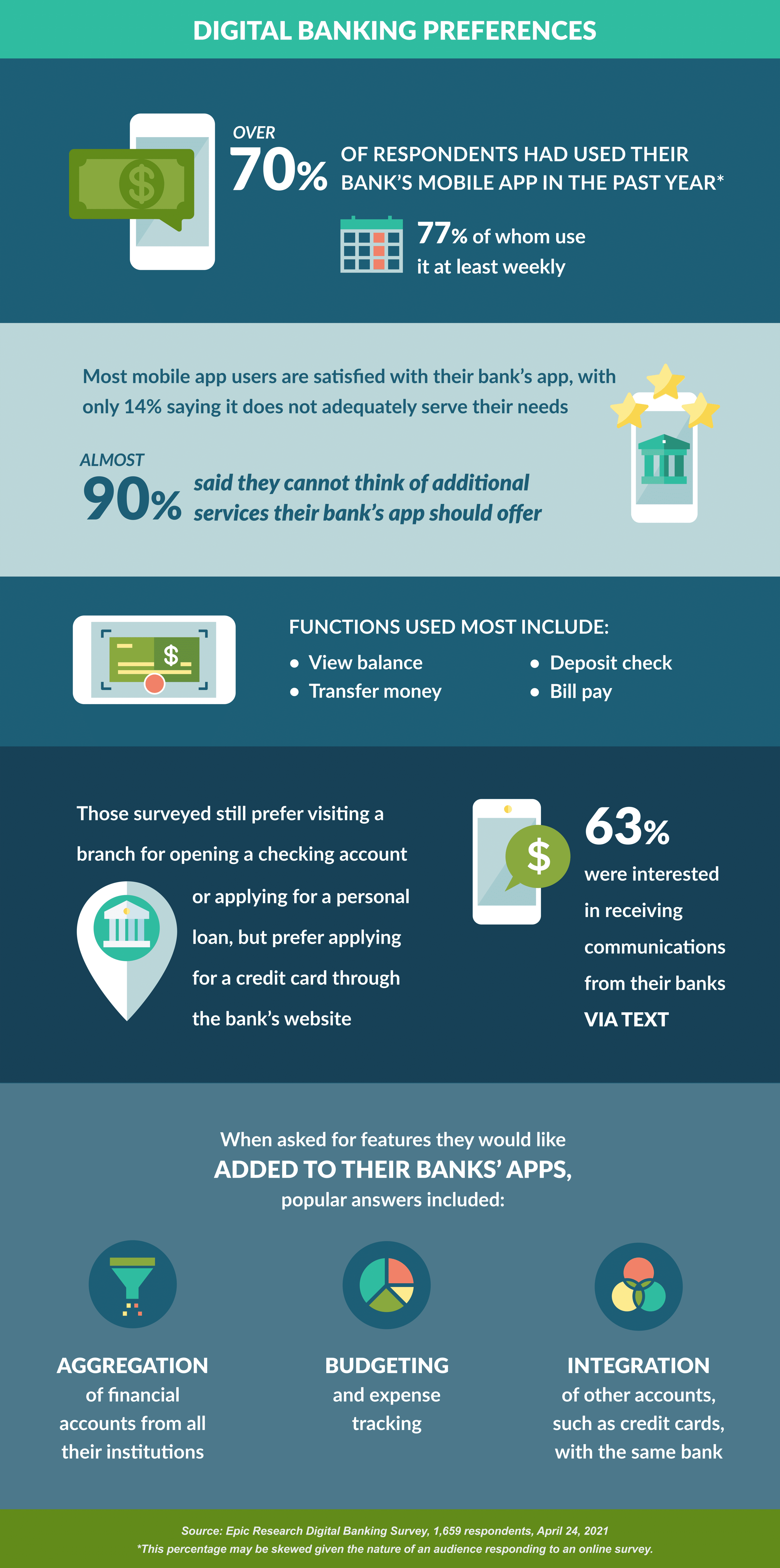

- Epic recently surveyed 1,659 consumers regarding their preferences in digital banking services

- We found consumers use their banking apps frequently and that they are happy with their banking app's features, however many still prefer a branch for some services

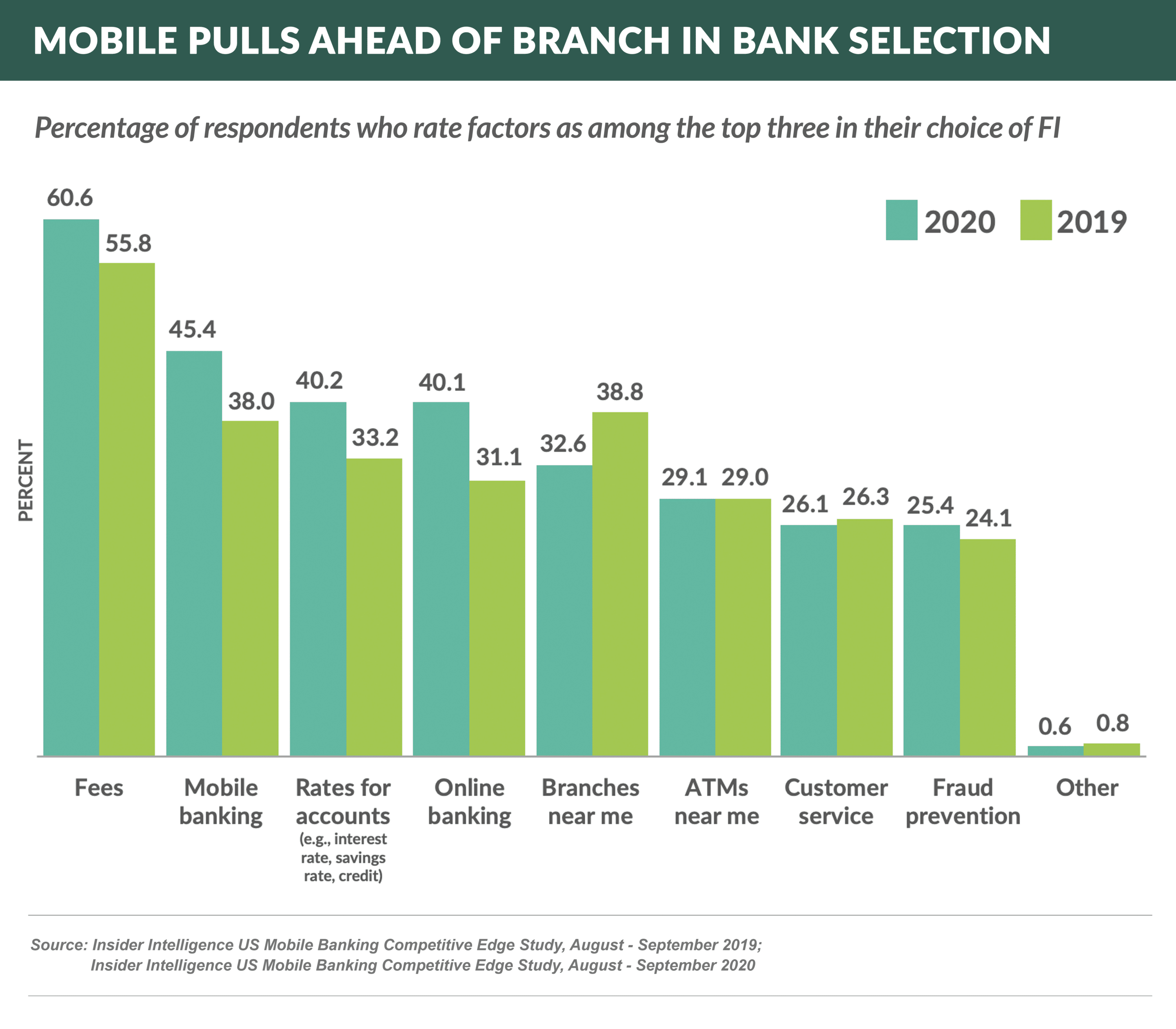

- Additionally, a survey conducted by Insider Intelligence showed mobile and online banking to be amongst the top factors consumers cite in selecting a bank

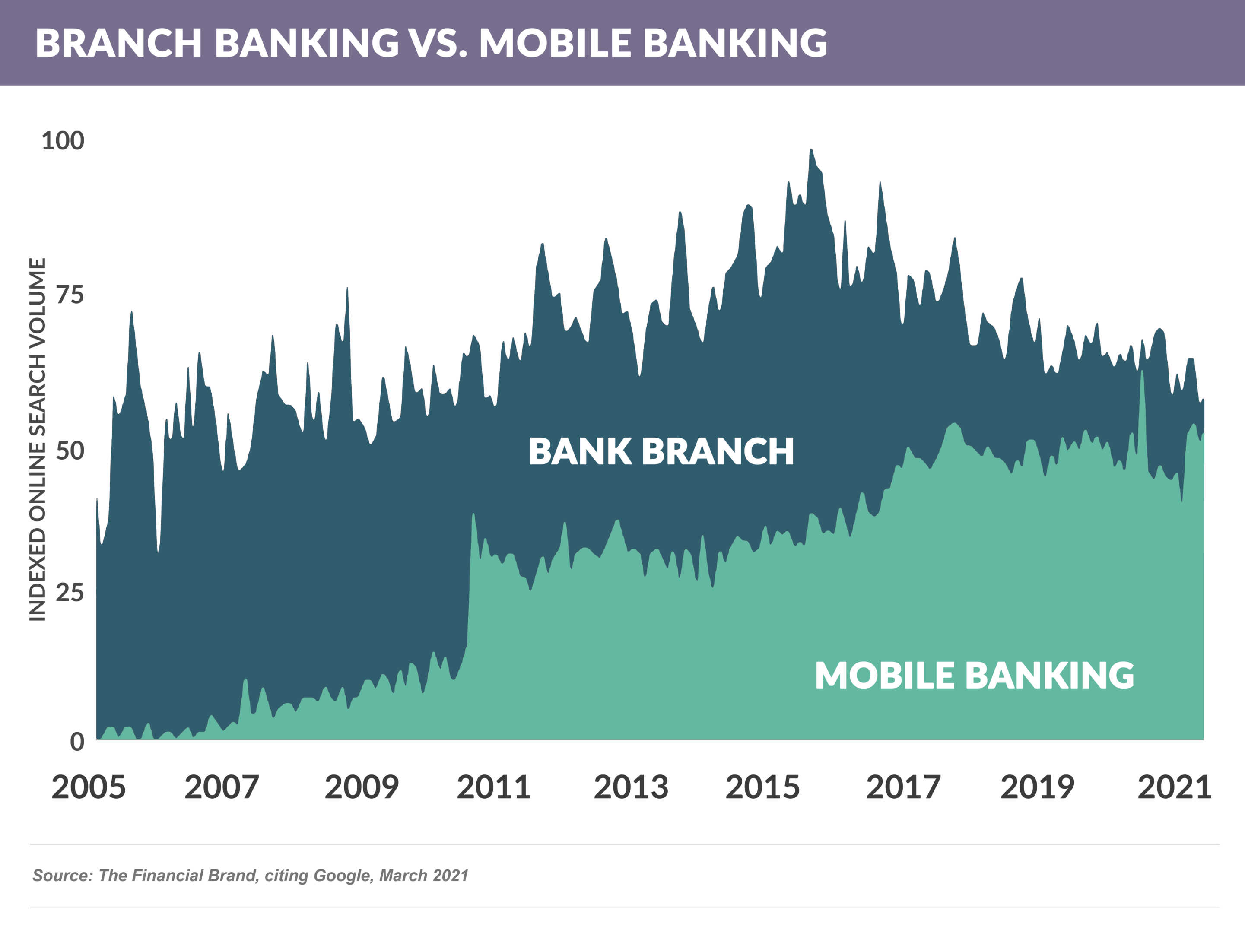

- Google search data over the past 15 years confirms the rise in consumer interest in mobile banking

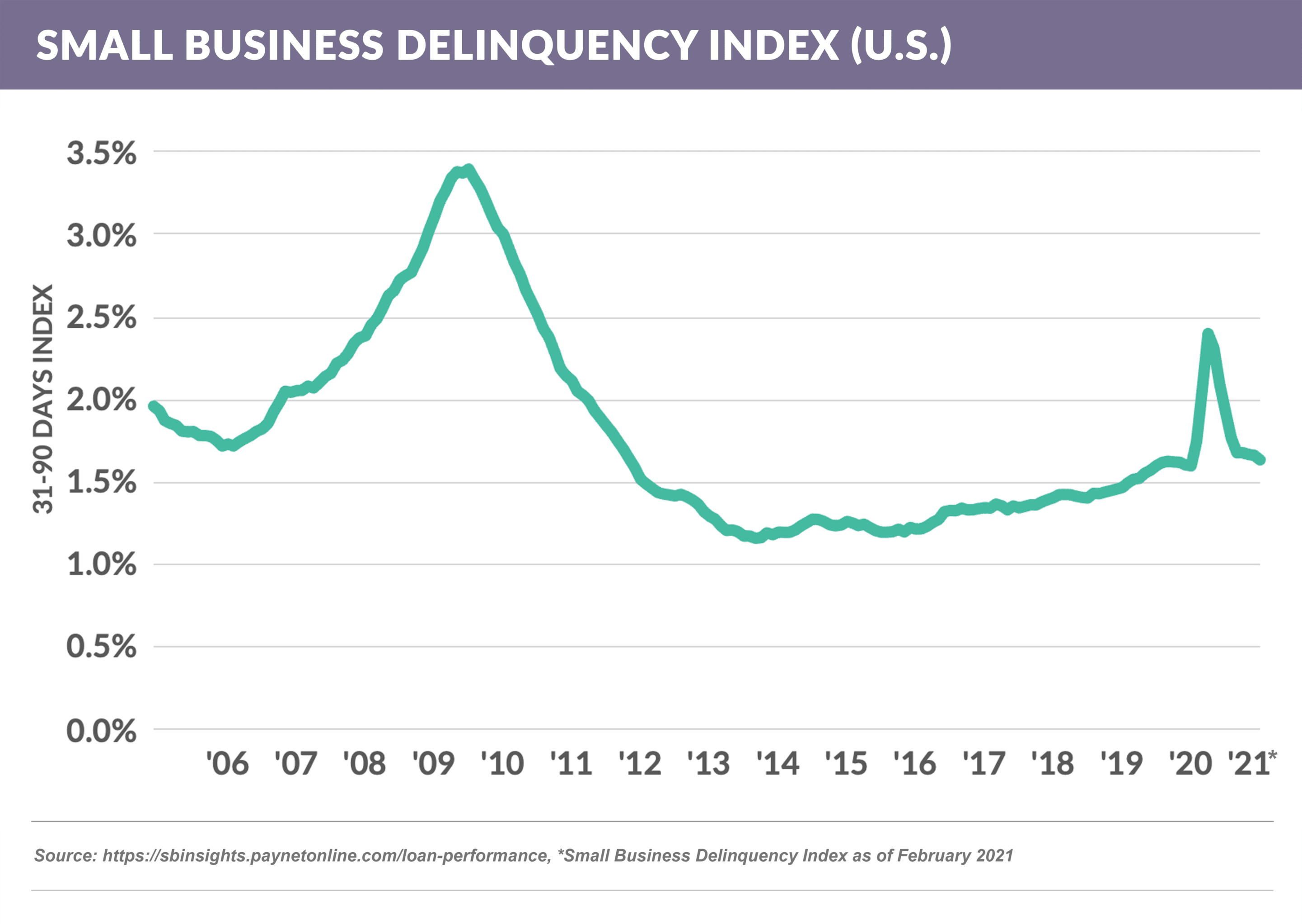

Lenders Re-Entering the Market

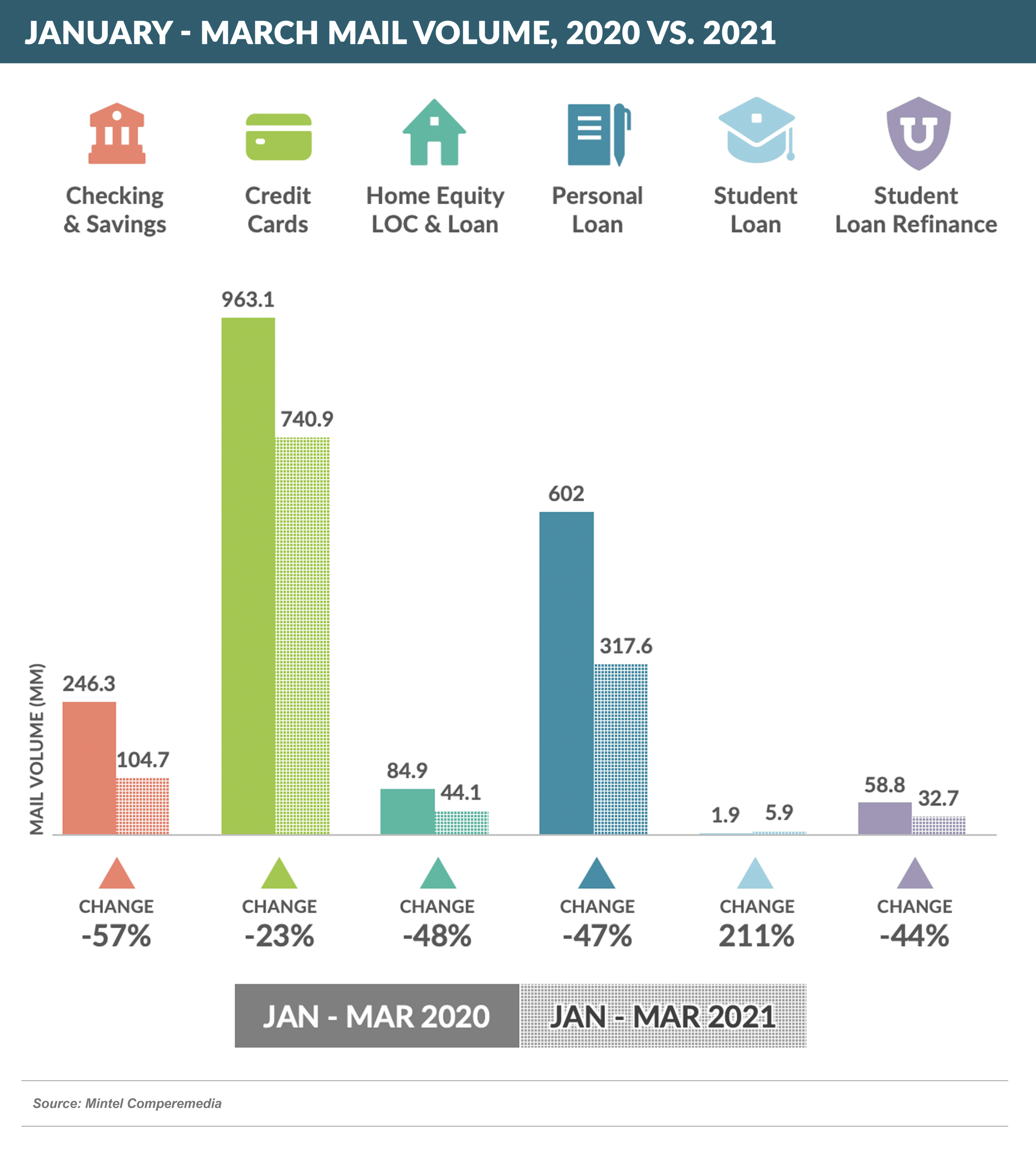

- March saw a continued slow recovery in financial services product mail volume (mail remains the most dominant solicitation channel across most products)

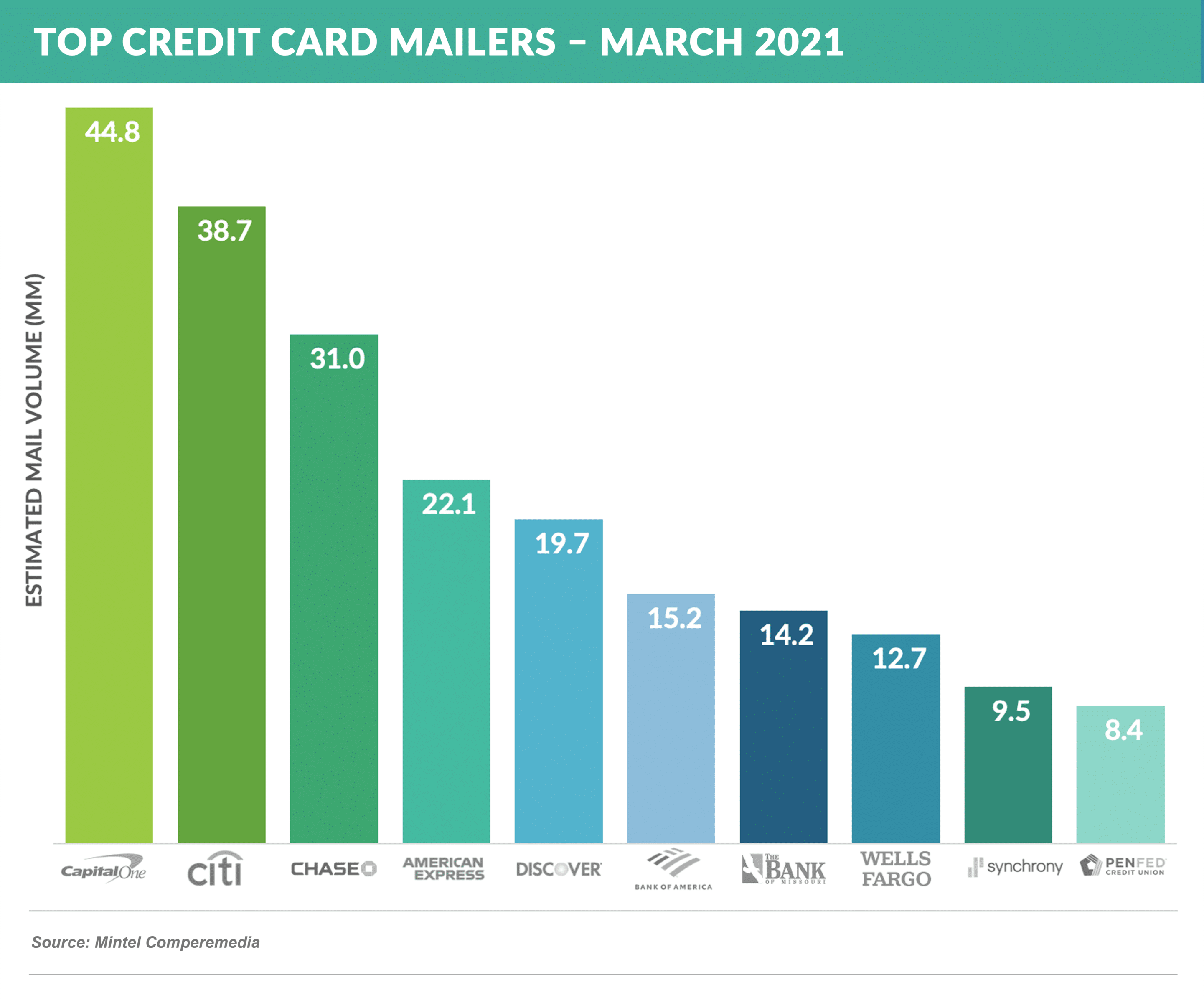

- Credit Card

- Credit card mail volume continued to creep back to pre-COVID levels with March volume of 271.4M representing 85% of late 2019 / early 2020 volumes

- Capital One, Citi, and Chase led the way, with American Express, Discover, and Bank of America next

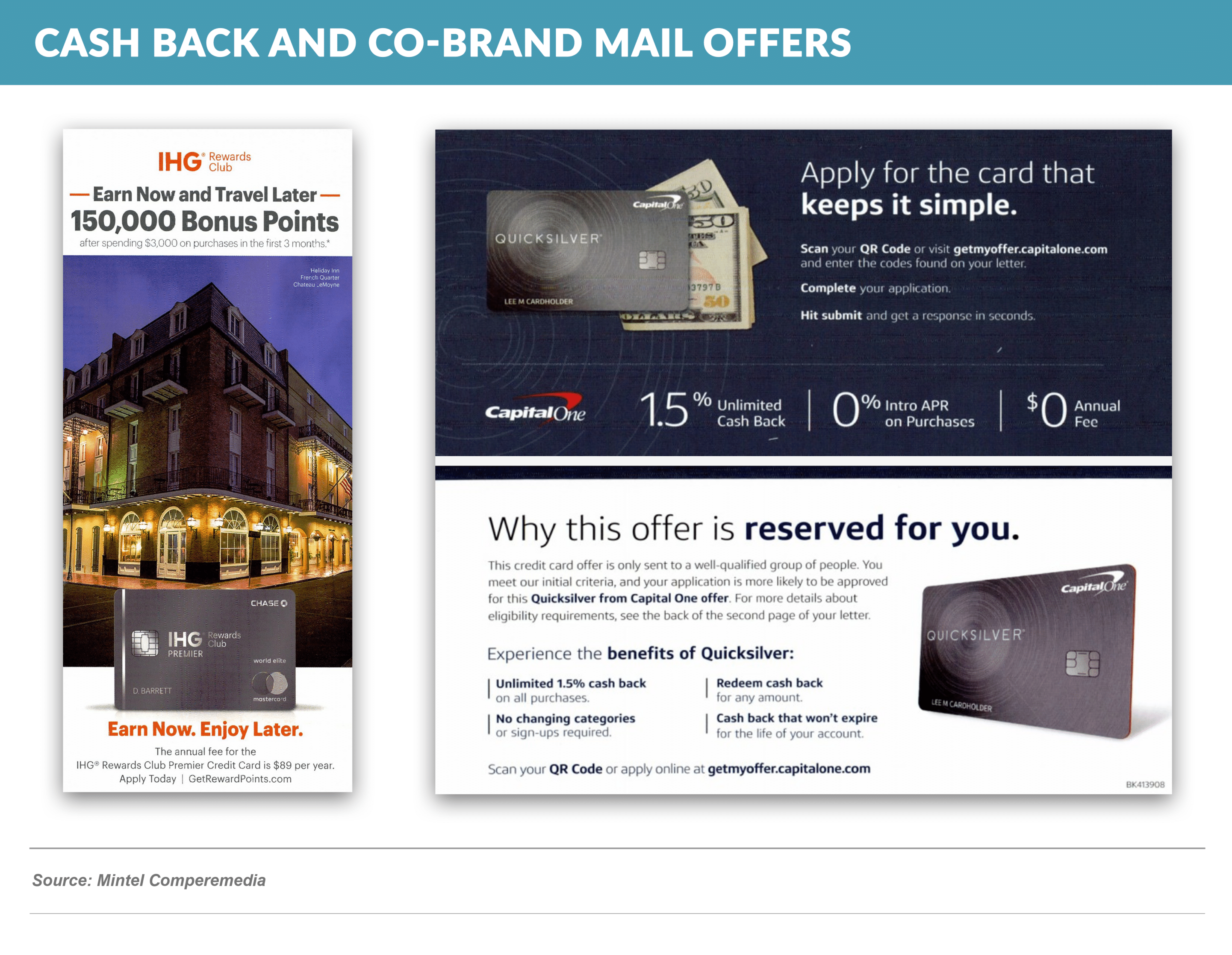

- Cash back and rewards cards again dominated mail with some co-brand mail volume present

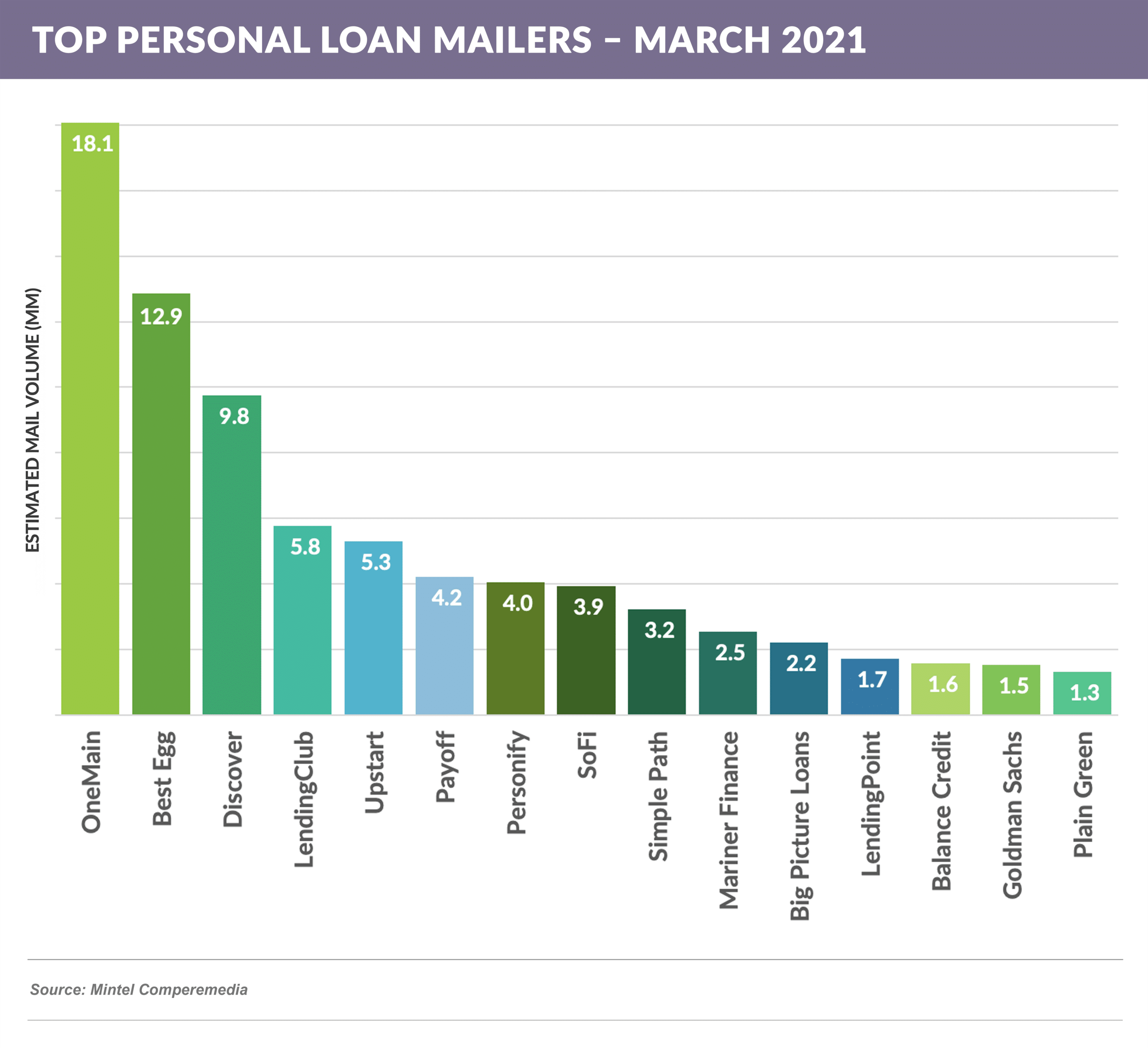

- Personal Loan

- Fintechs are once again leading the personal loan mail channel, with no retail banks appearing among the top 15 mailers

- Retail banks have successfully competed in this market in the past, and with their substantial funding and brand advantages, as well as an over-abundance of deposits, they may be missing this opportunity for loan growth

Overall Financial Services Ad Spending Still Recovering

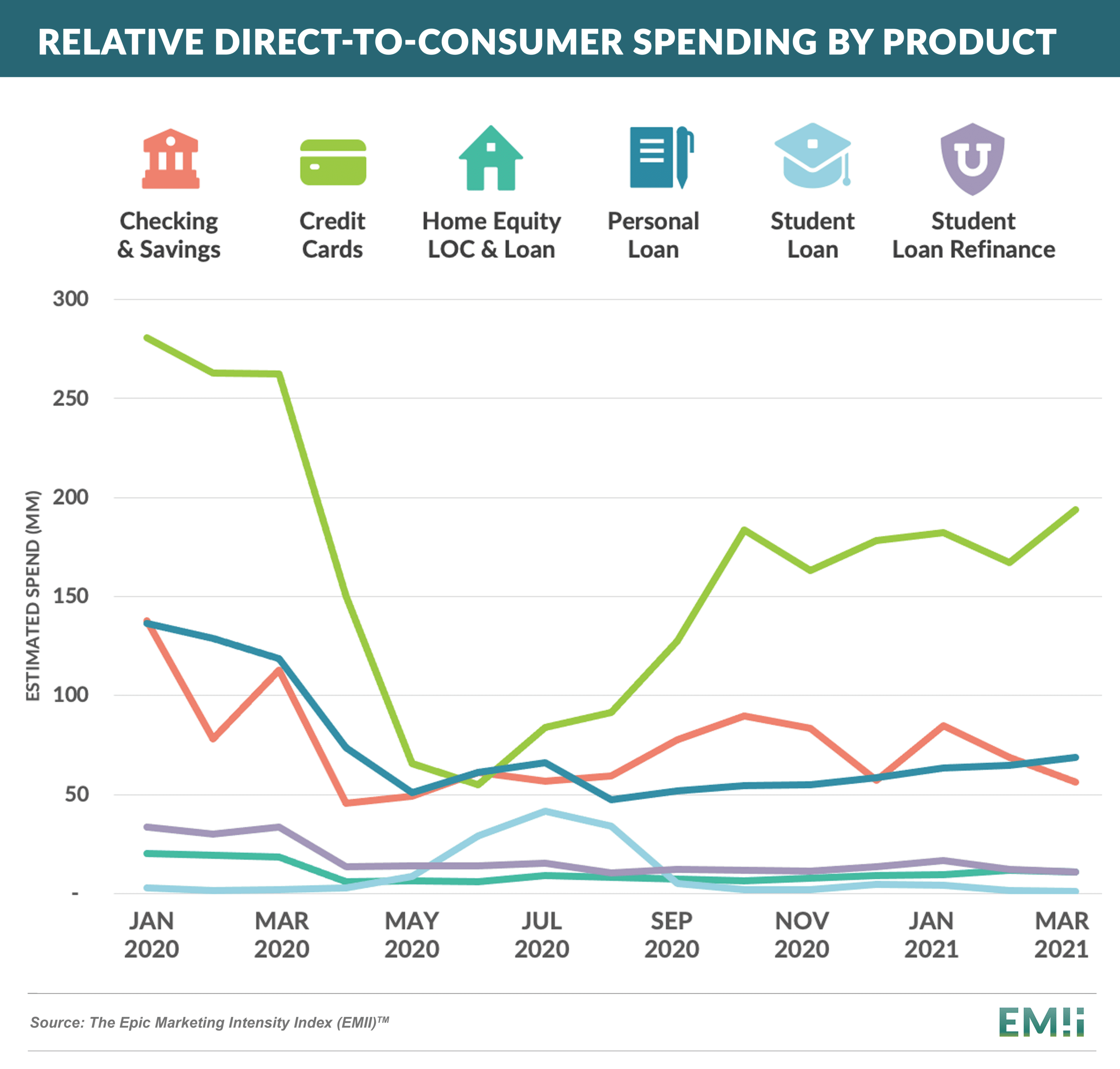

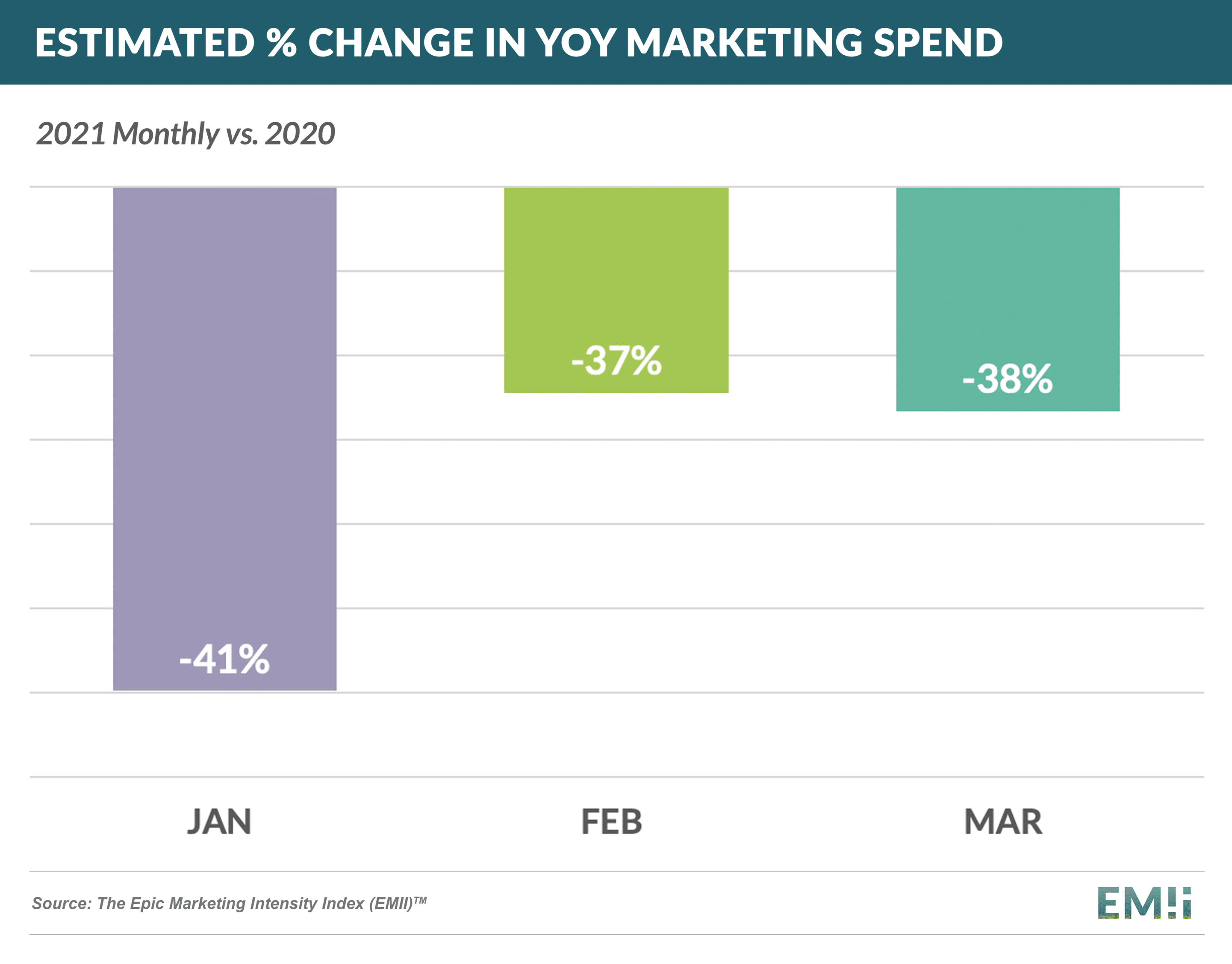

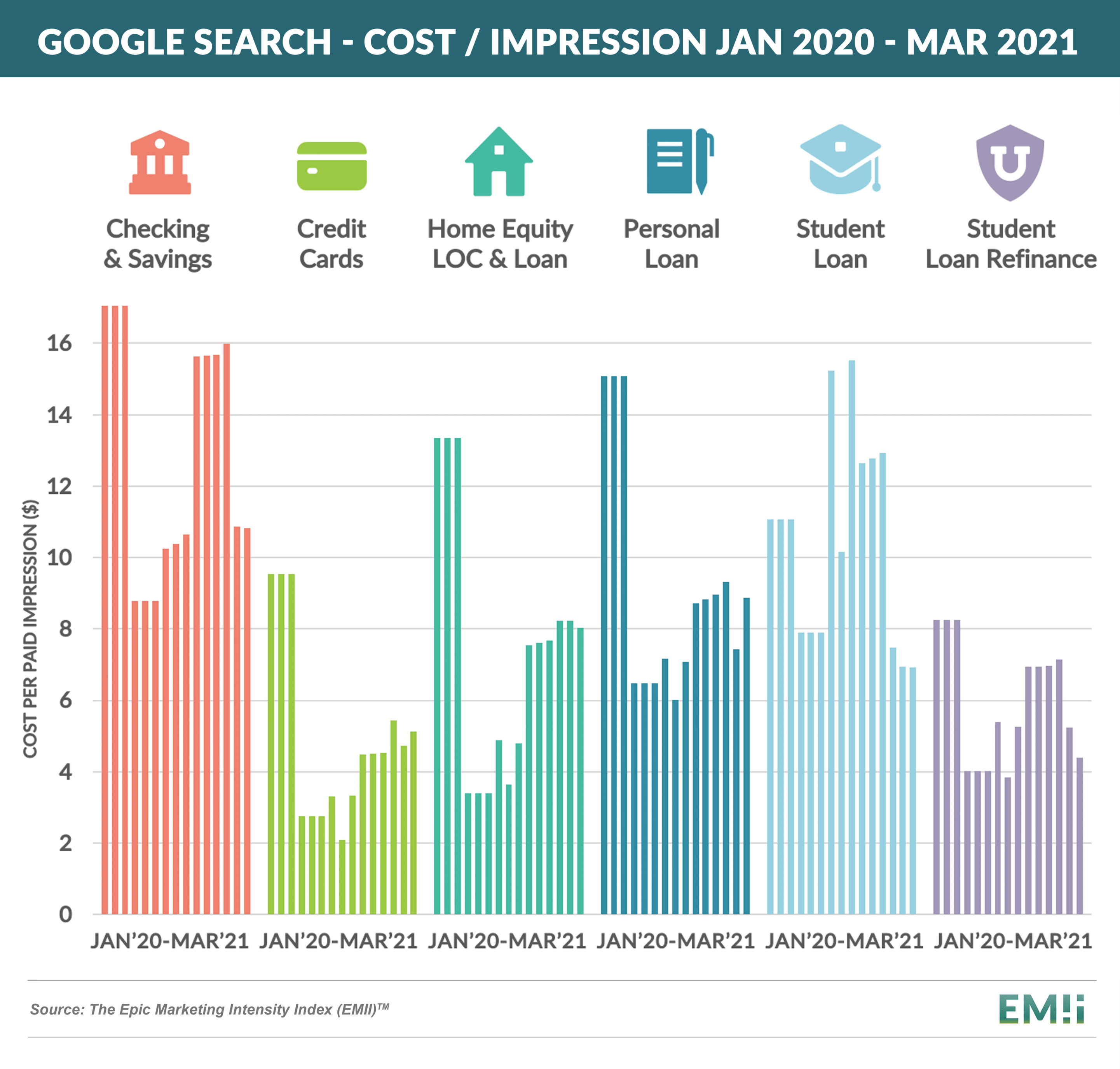

- The Epic Marketing Intensity Index (EMII) – which measures estimated marketing spend across direct mail, search, and paid digital – shows a trend towards recovery across most products and channels

- When observing marketing spend across digital channels as well as mail, the upward trend is inconsistent, with card spending recovering fastest and checking and savings spending being negatively impacted by the deposit glut

- Overall spending for all products, while recovering in recent months, remains 38% below the levels of one year ago

- Student loan spending has bucked the trend, with peak season spending out-pacing prior years

- Ad spend recovery should be expected to continue throughout 2021 as banks use the benefit of reserve release to fund marketing programs

Quick Takes

- Co-brand credit card activity

- Goldman Sachs is reportedly in discussions with JetBlue regarding taking over its card program from Barclays, however there has been no official word on the outcome of the discussions

- Gap has discontinued its 22 year relationship with Synchrony and signed with Barclays to issue both co-brand and private label cards

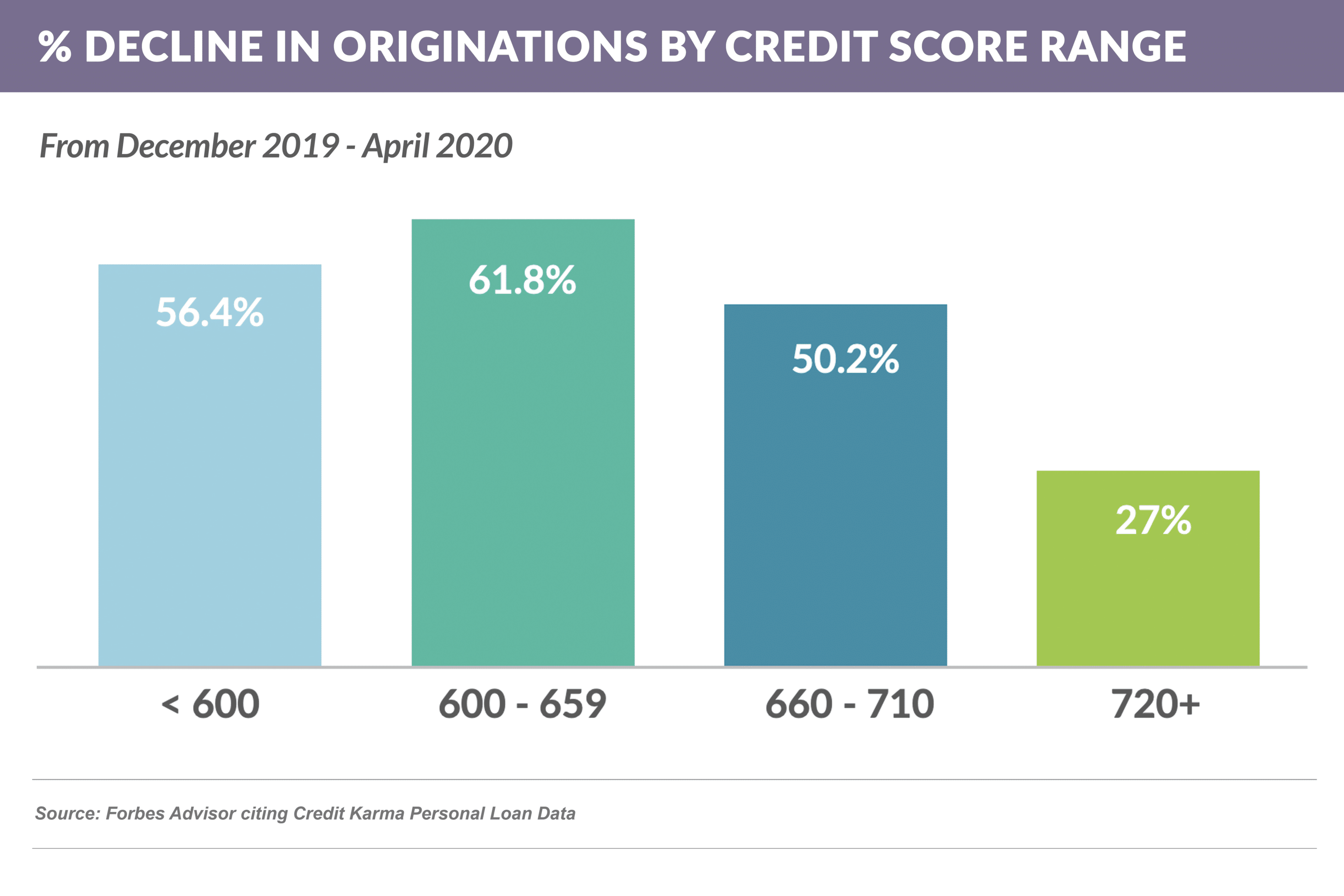

- Recent data from Credit Karma shows the significant impact of post-shutdown credit tightening on personal loan originations, with less-than-prime loans decreasing ~60% — twice the decline of prime

Thank you for reading.

The Epic Report publishes the first Saturday of each month. Our next issue will publish on June 5th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here