Three Things We’re Hearing

- Consumers rarely switch checking accounts – branches matter

- Is small business lending headed for a repeat of ’08/’09?

- Early post-forbearance delinquency holding up, balances drop

A two-minute read

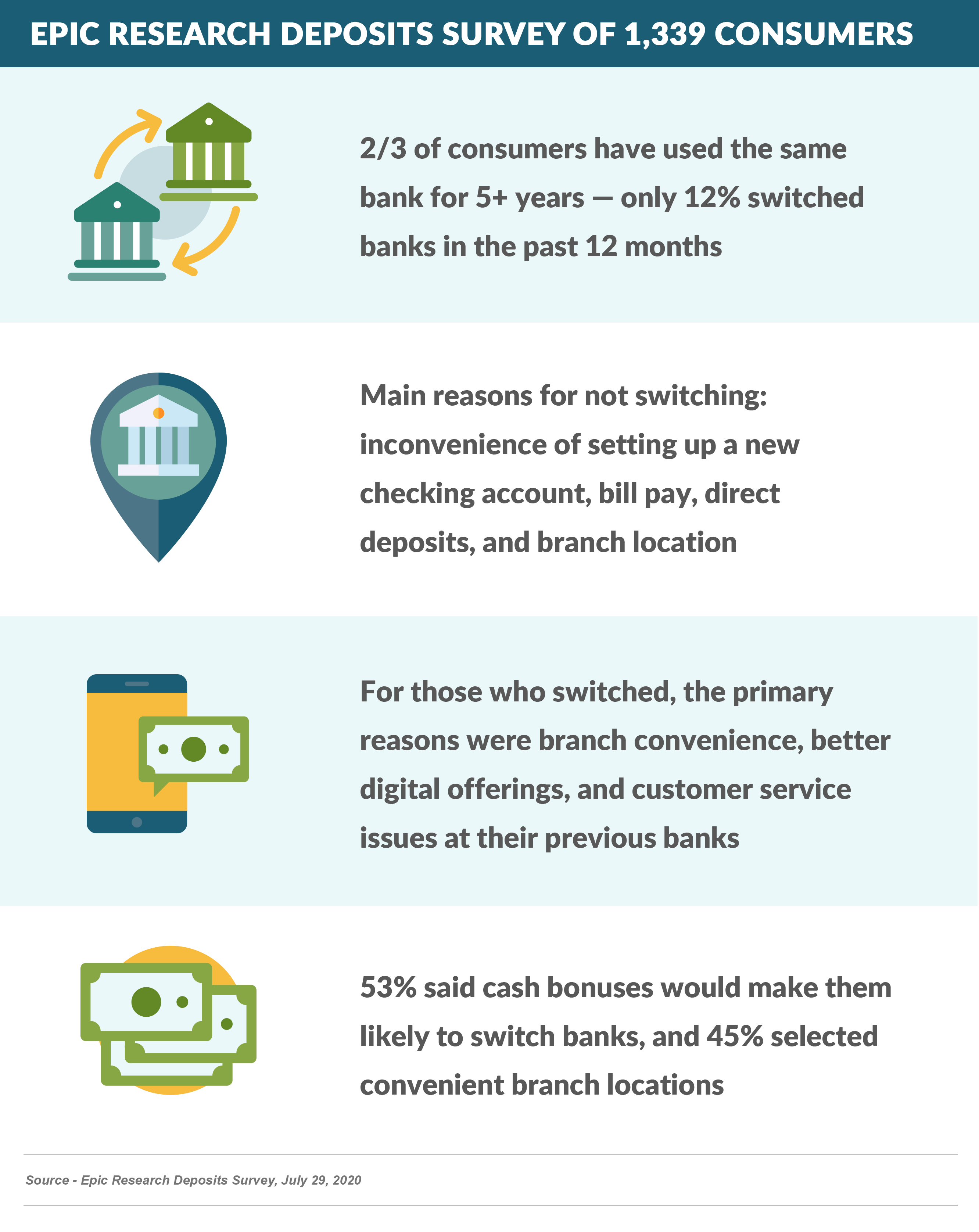

Consumers Rarely Switch Checking Accounts – Branches Matter

- An Epic survey conducted this week revealed that half of consumers have used the same bank for checking for over 10 years, with friction associated with switching being the primary “new purchase” hurdle

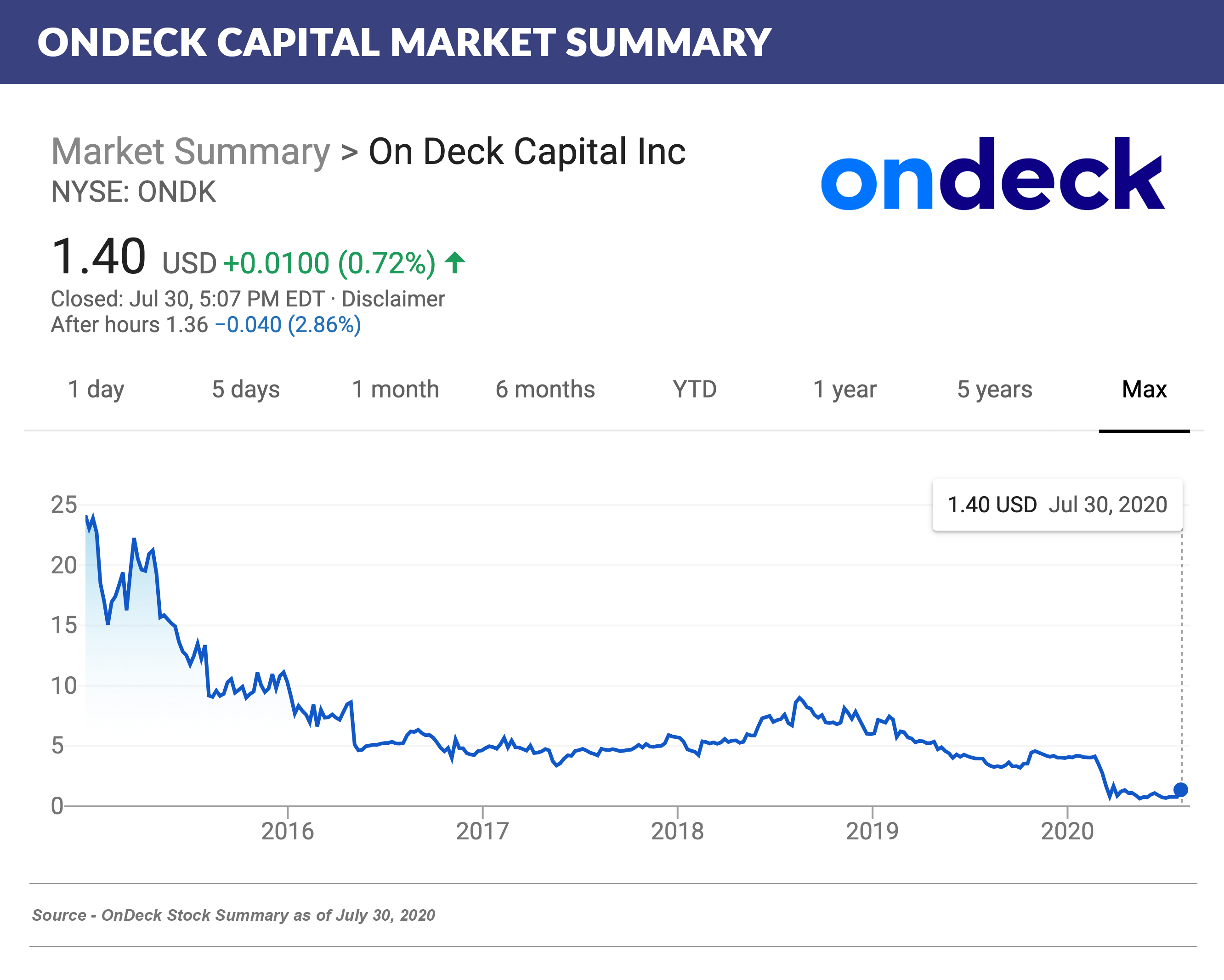

Is Small Business Lending Headed for a Repeat of ‘08/’09?

- Small business credit suffered disproportionately in the ’08/’09 recession, with many portfolios’ loss rates going from historic averages of 4%-5% to 20%+ and small business card company Advanta going out of business

- It’s too early to read the effect of the current downturn on small business, but if OnDeck is any indication, things could again get rough for the sector

- At the end of April, OnDeck reported that 45% of its loans were in some stage of delinquency

- That was followed by the announcement this week that OnDeck has agreed to be acquired by Enova for $90 million in cash and stock, a far cry from their $1+ billion post-IPO market cap

Early Post-Forbearance Delinquency Holding Up, Balances Drop

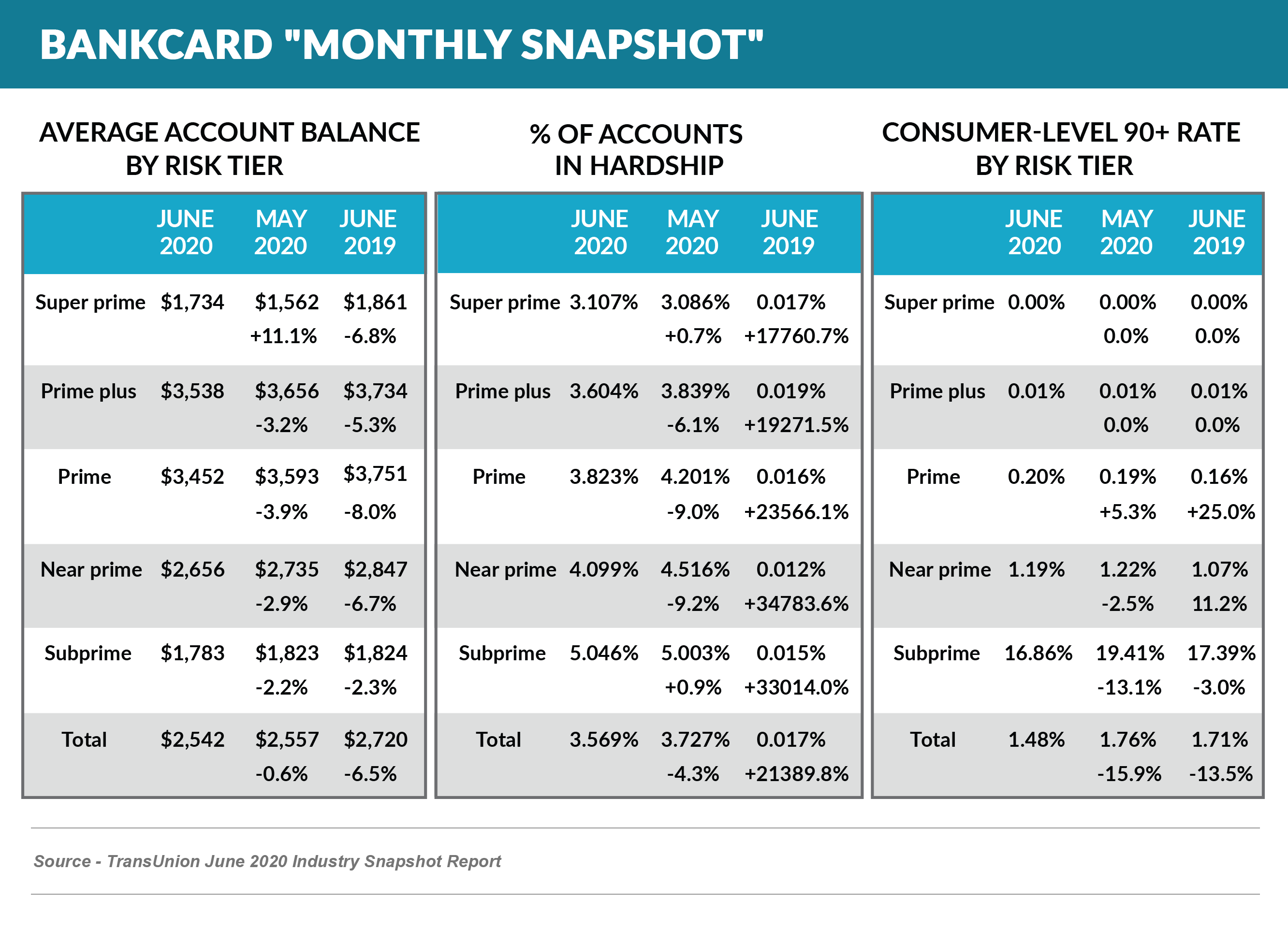

- TransUnion’s June “Monthly Snapshot” shows May to June declines in average bankcard balance, delinquency, and the number of accounts in forbearance

- The earliest post-forbearance data points are positive

- As has been previously noted, delinquency has been artificially positive due to widespread forbearance programs and supplemental government consumer payments

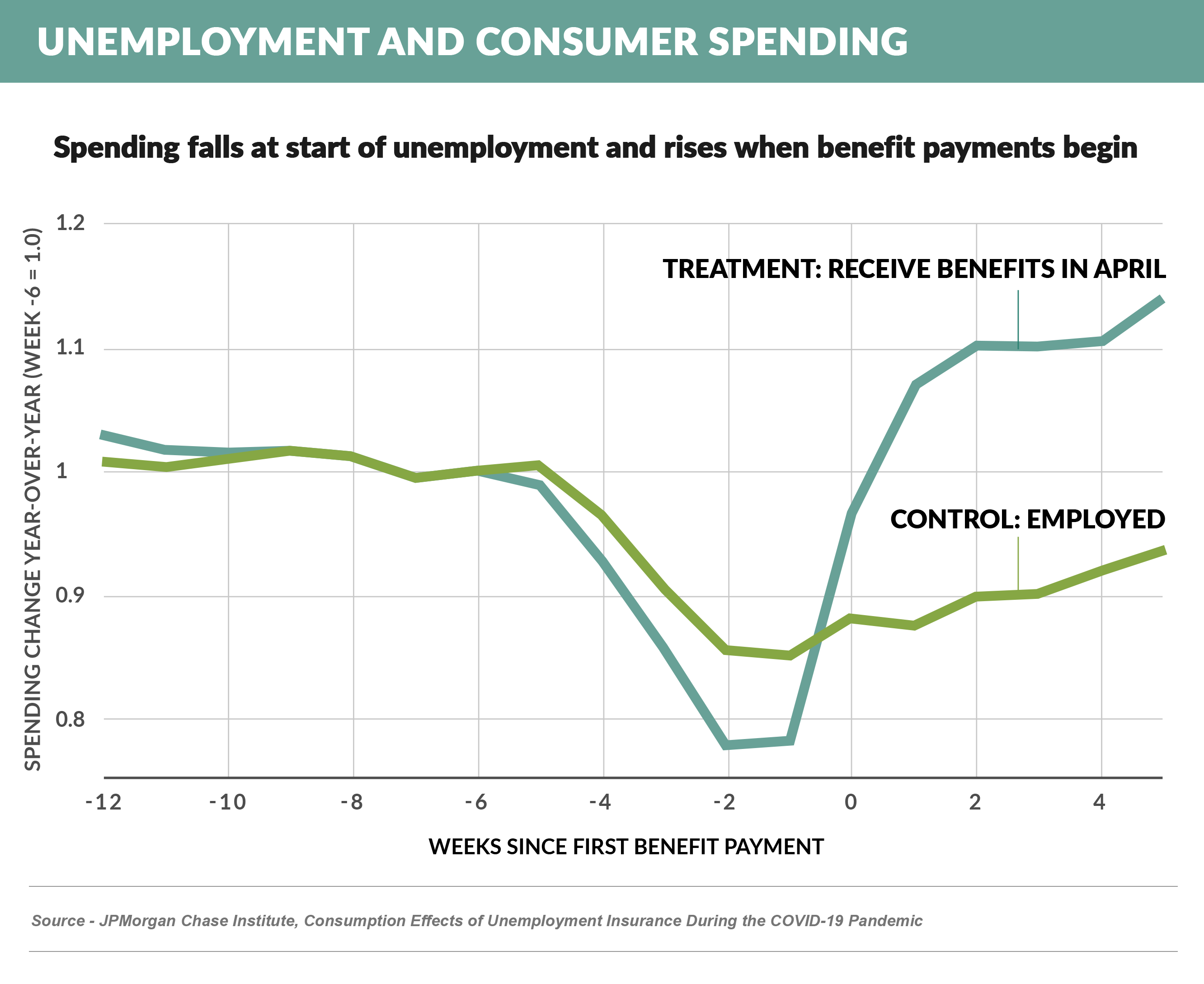

- A JPMorgan report shows dramatic positive change in consumer spending for those who have begun receiving benefits payments

- The TU data conforms with issuers’ Q2 earnings reports, citing favorable post-forbearance behavior

- Issuers also broadly reported lower overall balances, with most issuers showing declines of 10%+ since year-end 2019

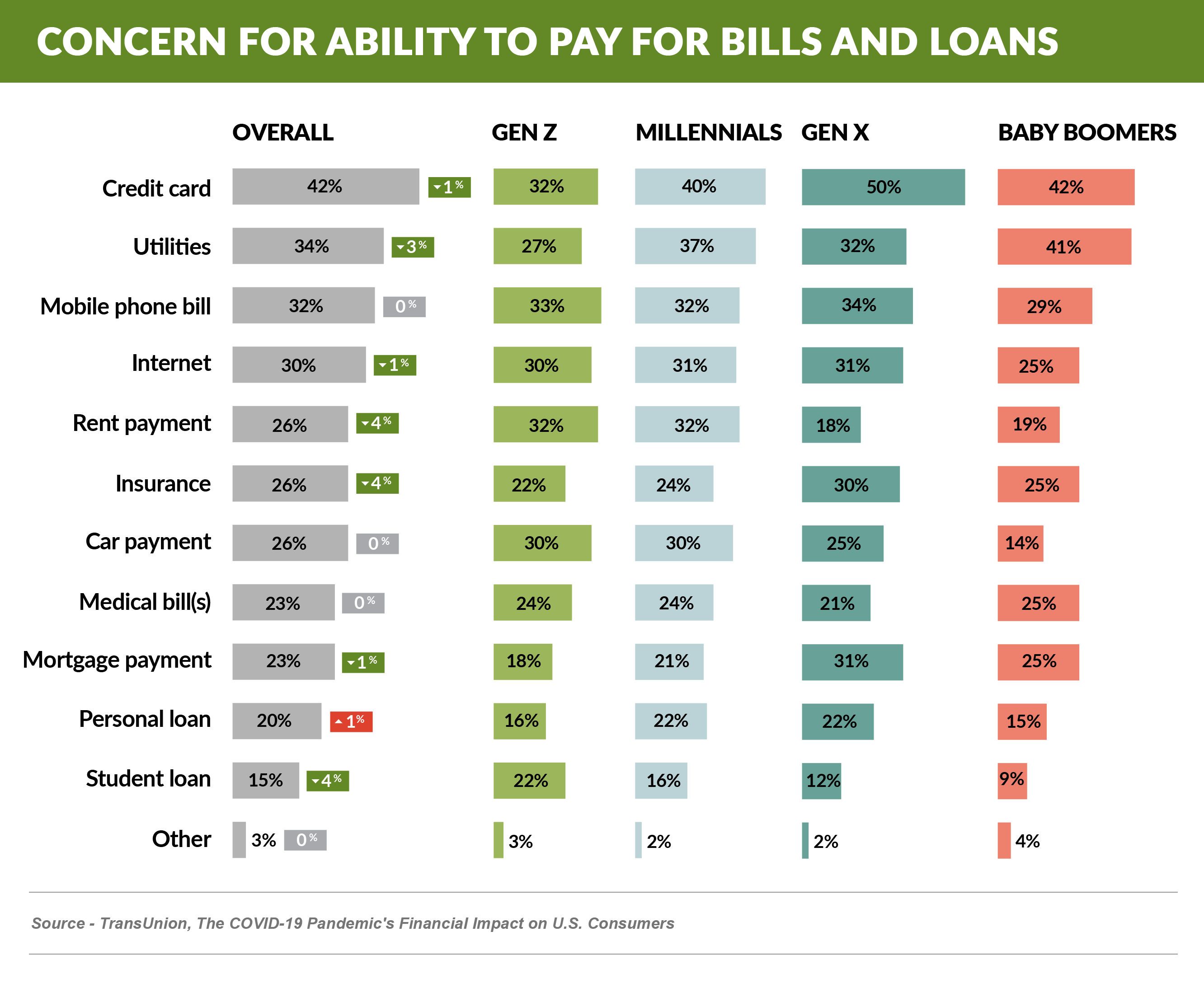

- A TU survey also shows that credit card bills are at the top of consumers’ lists of payment concerns, which may be another indication of future asset quality deterioration

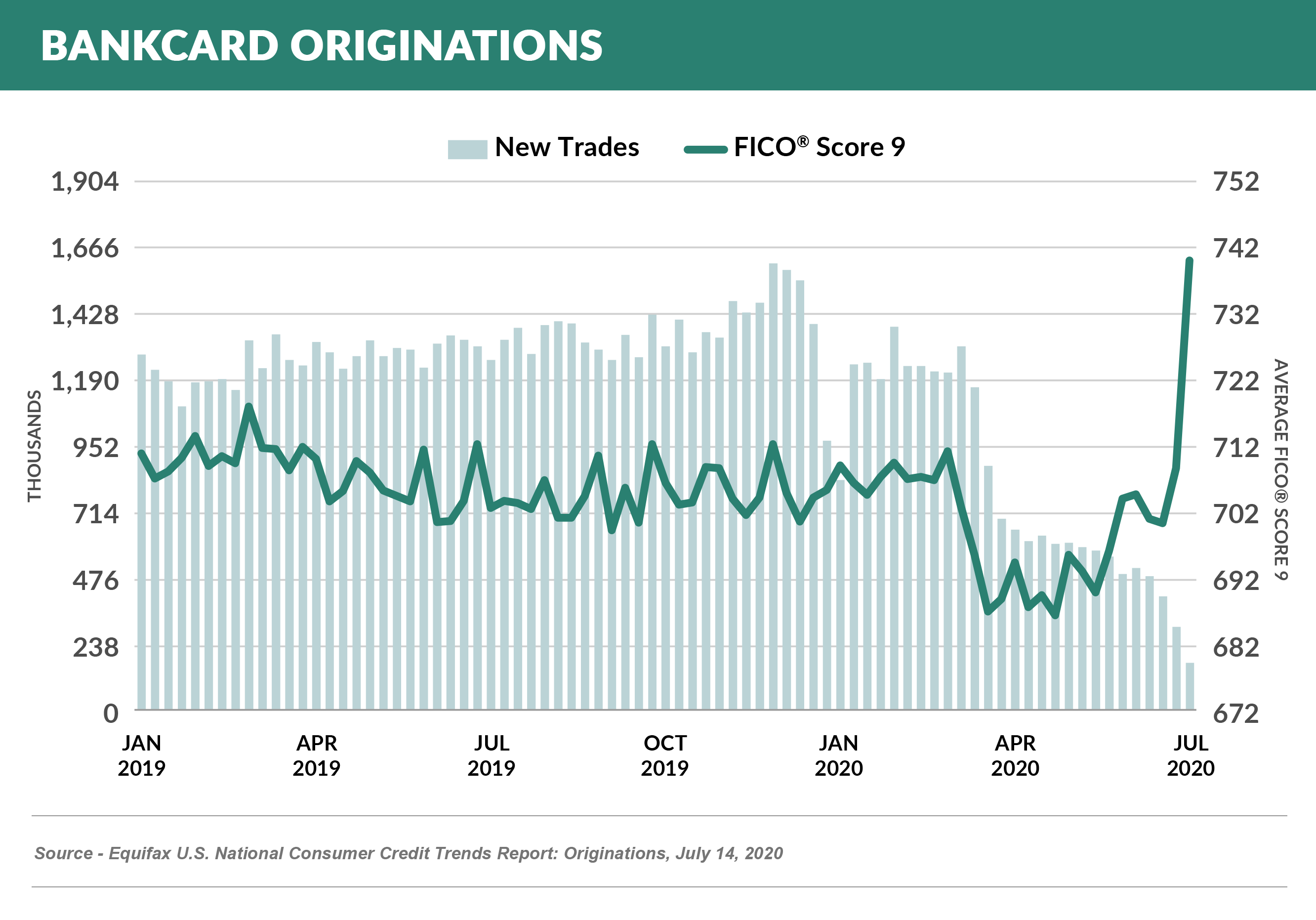

- Annecdotal reports of bankcard issuers tightening credit standards are born out from an Equifax report showing a sharp rise in average FICO score for the relatively low volume of recently acquired credit card accounts

Quick Takes

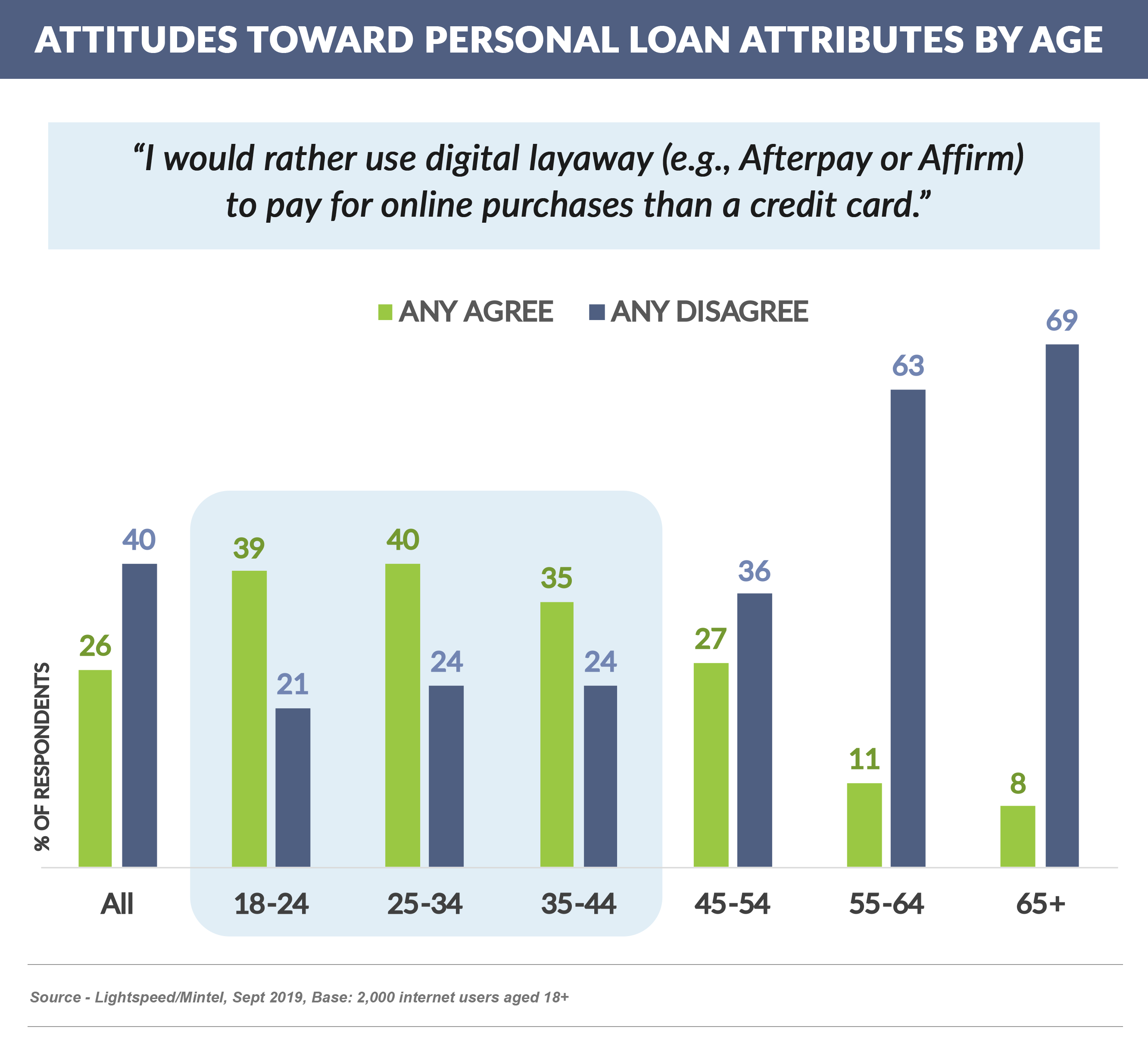

- McKinsey forecasts point of sale financing to grow at 20% per year from 2018-2021, with companies such as AfterPay, Affirm, and Klarna gaining prominence

- A study by Lightspeed/Mintel reveals that younger people prefer these “digital layaway” products over credit cards

Going Forward

- With card acquisition at the lowest point in recent history, which issuers will have the tools to take advantage of the dearth of competition to prudently grow their portfolios?

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.