Three Things We’re Hearing

- Stimulus payments continue to boost consumers’ finances

- Financial services ad spending still lags

- Three predictions for 2021

A two-minute read

Stimulus Payments Continue to Boost Consumers’ Finances

- As we reported in the January 9th Epic Report, consumers’ financial situations were helped significantly by the $1 trillion of payments they received from the government and other sources

- Most of those programs expired by December, and a new wave of stimulus checks have since been issued

- To assess how the new payments might continue to impact consumers, last week Epic surveyed 1,107 consumers about their current financial situation

- These findings would indicate a continuation of consumers’ responsible financial habits during the pandemic – lower spending, paying down bills, and saving more

Financial Services Ad Spending Still Lags

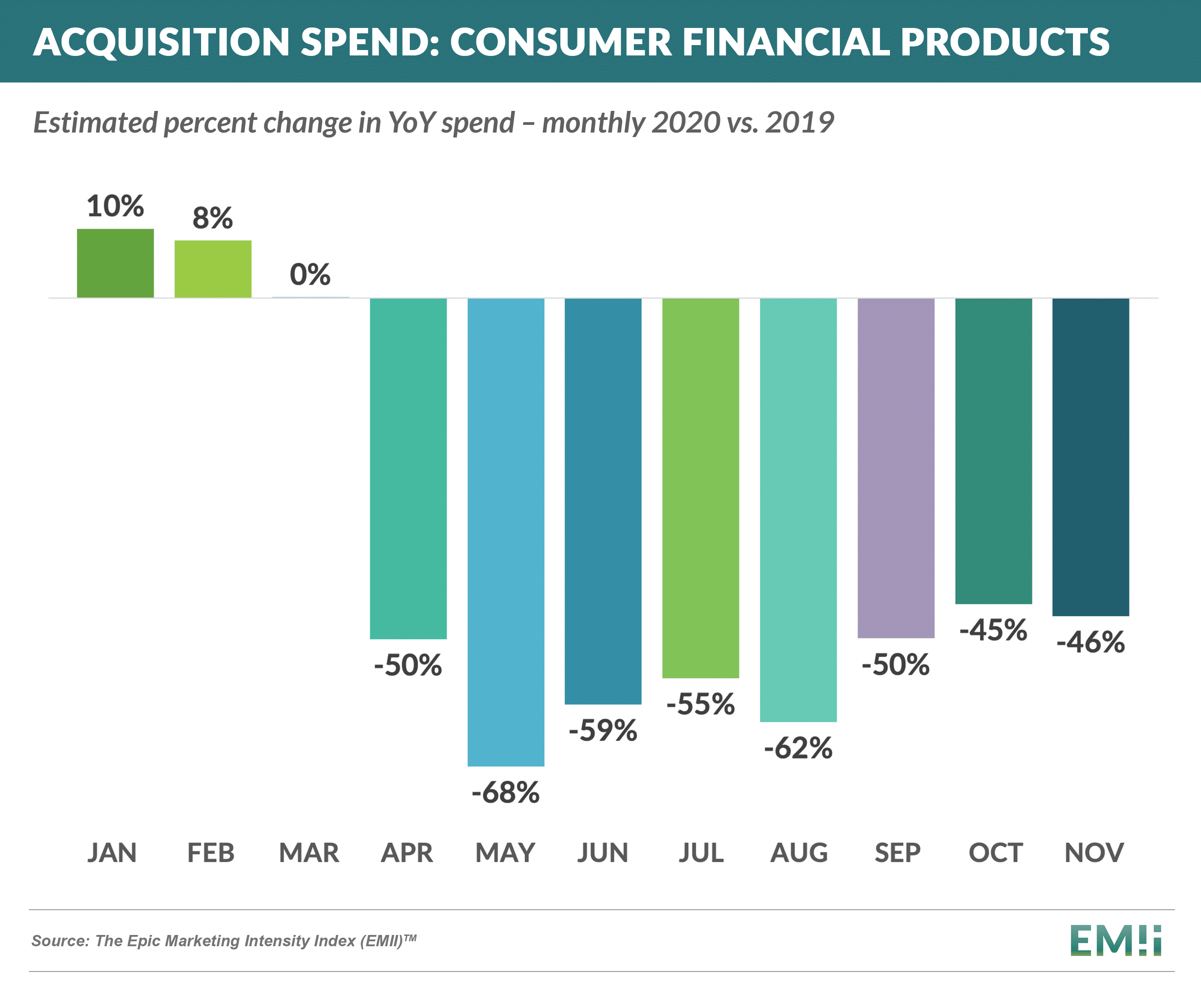

- 2020 began with spending on consumer financial services advertising 8 – 10% higher than in 2019; however, in May overall spending dropped by two-thirds

- Although spending has slowly recovered, November 2020 spending was still 46% below November 2019 levels

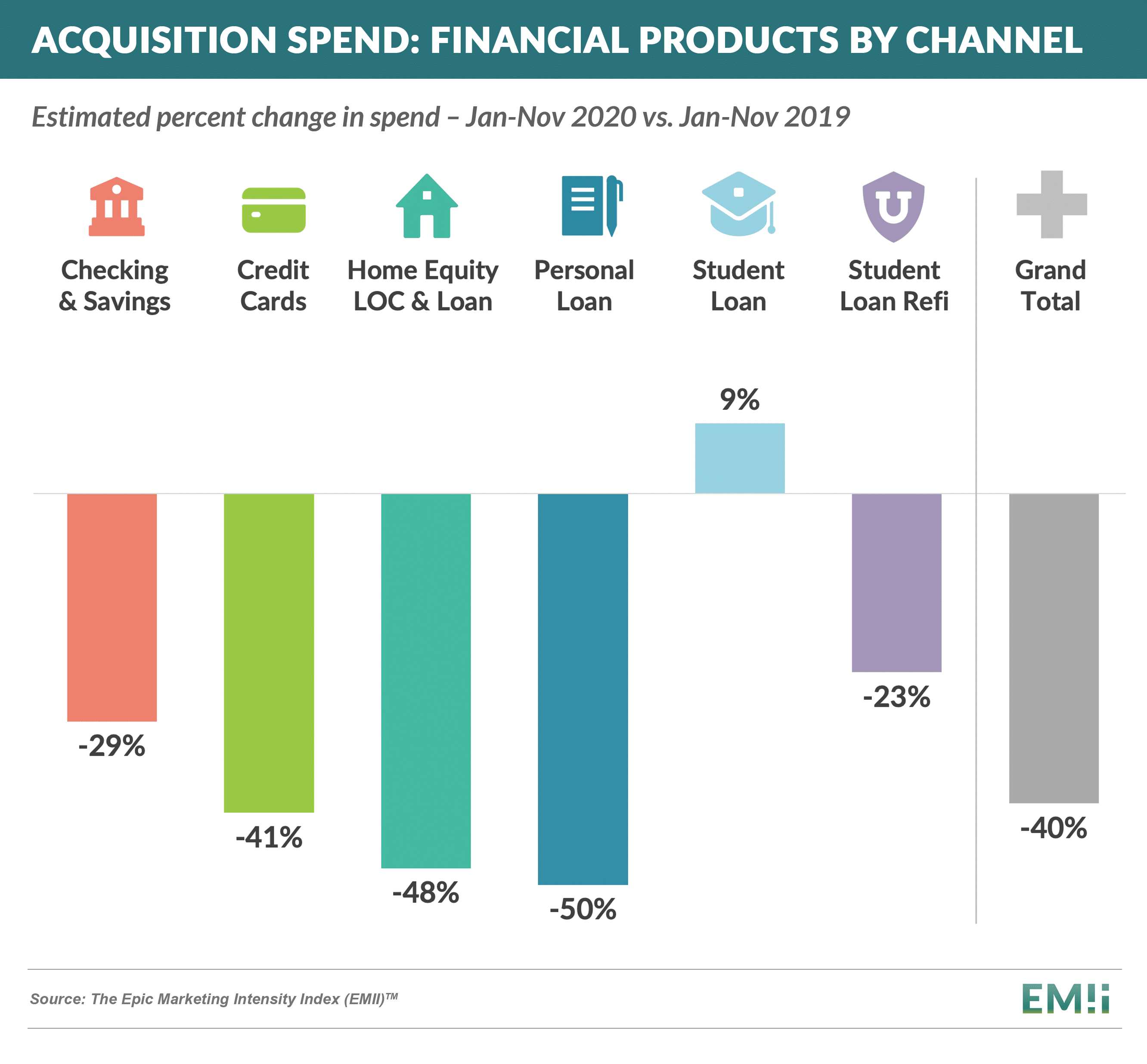

- The Epic Marketing Intensity Index (EMII) measures acquisition spending for consumer finance products (cards, loans, deposits, home equity, education) and channels (direct mail, search, paid digital)

- The drop was most pronounced in credit cards, HELOC, and personal loans, while student lending spending was up 9%

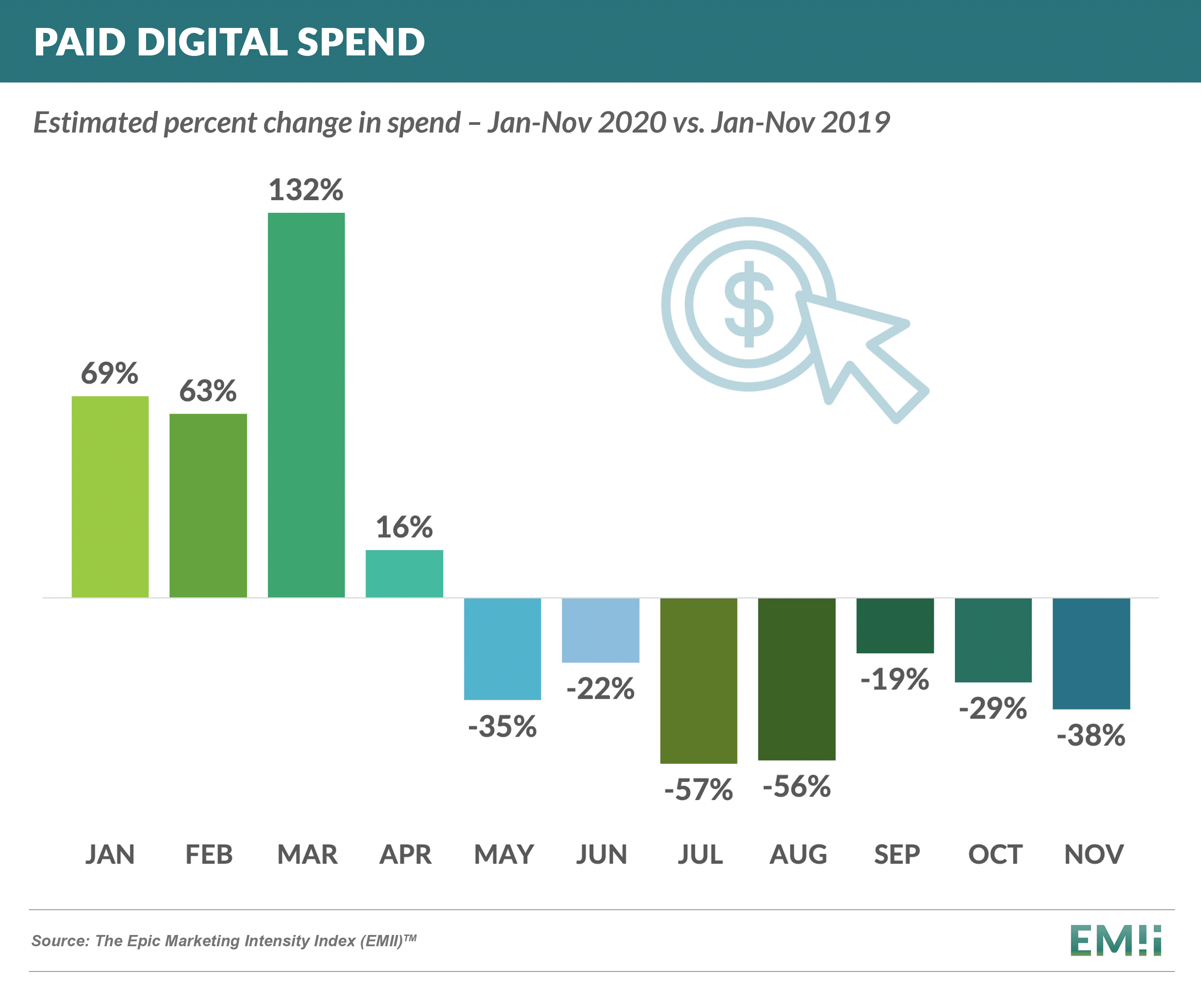

- Paid digital spending was on a tear early in the year, with March 2020 spend over 100% greater than 2019, prior to dropping at rates consistent with other channels

Three Predictions for 2021

- 1. Financial services advertising spending will recover to pre-COVID levels by the fourth quarter

- Credit card mail volume, accounting for the highest expense of any category of any product, has shown a steady recovery close to pre-COVID levels, with other products and channels having also rebounded in varying degrees

- With the dominant lenders returning to the market in force, the rest of the industry will follow suit rather than risk missing the opportunity

- 2. Consumer delinquencies will not see a substantial spike

- Unlike other financial shocks, the COVID-related financial shock was not accompanied by sharp increases in consumer delinquency and credit losses

- With recent additional government payments and expected future stimulus measures, the worst is behind us and banks will begin releasing reserves

- 3. Cash back and “generic” rewards cards will gain share

- Our research shows two-thirds of consumers prefer to have most banking products with one bank

- It also shows a preference for cash-back and rewards cards and less preference for ones tied to a specific airline or other co-brand partner

- Retail banks will seize this opportunity to make their card products more competitive and grow their credit card portfolios

- Let us know what you think!

Quick Takes

- Synchrony and Walgreens have announced a new credit card that will be connected with Walgreens’ new customer loyalty program, myWalgreens

- US Bank has accelerated its previously announced branch closure program

- After closing 300 branches in the year preceding September 2020, they closed another 400 in the fourth quarter of 2020

- Closures have continued into January as temporary pandemic-related closures are becoming permanent

- General Motors and Goldman Sachs finally announced their new partnership on the GM Card, with a targeted launch date in September

Thank you for reading.

The next Epic Report will publish on February 6th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.