Three Things We’re Hearing

- Student loan payment consumer spending impact

- What in the BNP-L???

- Education refinance payment consumer rebound?

A four-minute read

If the Epic Report was forwarded to you, click here if you’d like to be added to our mailing list

Student Loan Payment Consumer Spending Impact

- The September Epic Report highlighted the potential impacts of the October resumption of federal student loan payments

- Epic surveyed 697 consumers to understand their student loan status and assess the impact of payment resumption on their future spending behaviors

What in the BNP-L???

- BNPL users have doubled since 2021, yet despite the rapid growth, only 8% of Americans have used BNPL for online purchases in the last year and there have been recent signs of that expansion slowing, with Business Insider forecasting annual growth of only 14.8% over the next four years

- Growth of some of the largest US providers – Affirm, Klarna, and Zip – is forecasted to slow to near single digits by 2027

- Monthly average users for both mobile and web have actually plateaued over the past year

- In addition to ease of use and low cost, consumers like BNPL programs because they do not otherwise have the purchasing capacity, indicating a potential concentration of less credit worthy users

- Credit cards remain king of consumer payments, and the path for BNPL to significantly challenge that dominance is unclear

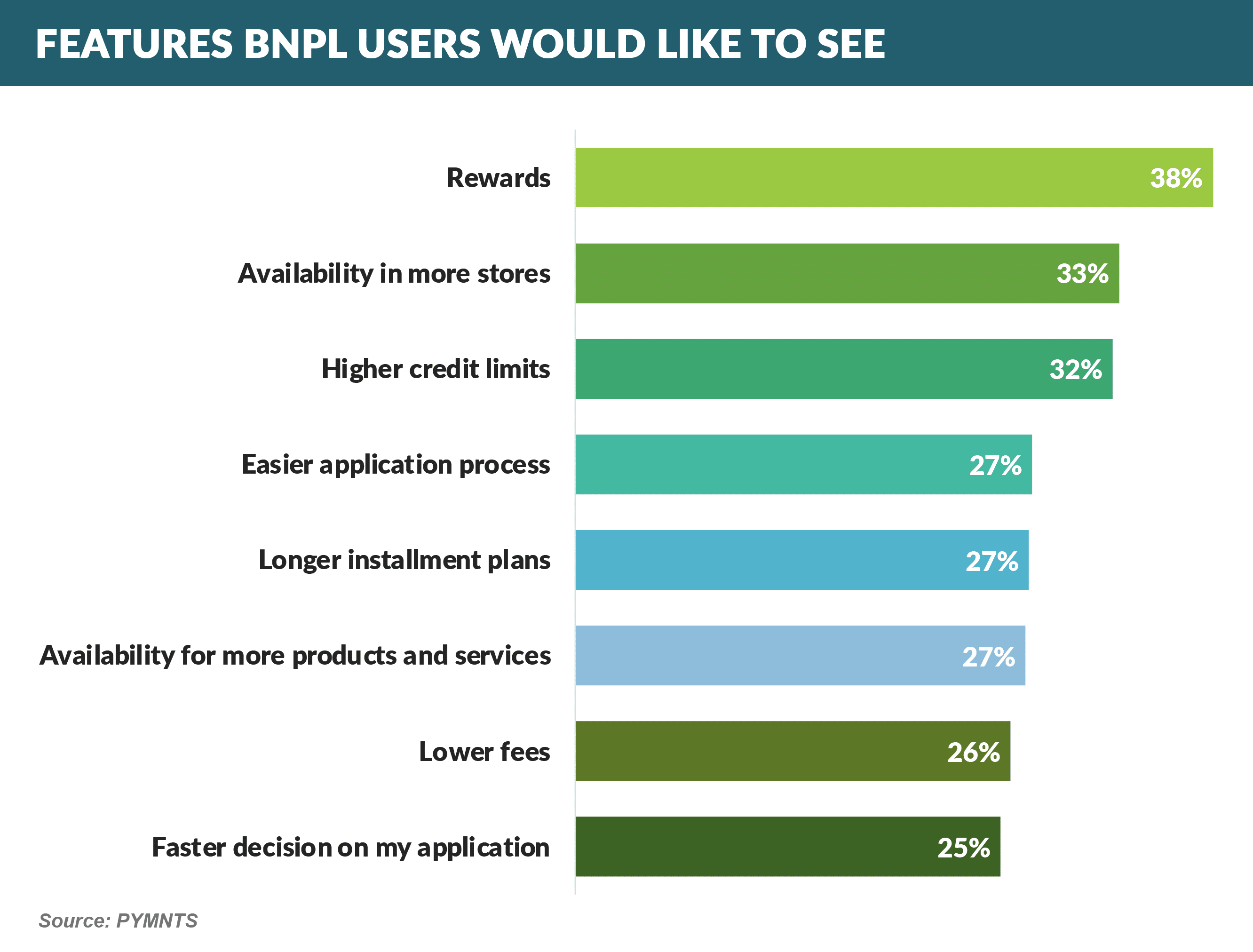

- BNPL usage is focused on the younger and non-prime segment and a recent survey showed rewards as the number one product enhancement to attract incremental usage

- Adding rewards to BNPL will be challenging, as credit card rewards are funded by premium product interchange, interest revenue, and annual fees – none of which are available sources of revenue on most BNPL products

- In addition to having a major disadvantage with in-store acceptance, BNPL product economics have become more challenging for providers as higher funding costs and credit losses stress already thin profit margins. The CFPB reported BNPL profit margins declined to 1.01% in 2021, a number that is now undoubtedly lower with the subsequent rise in interest rates

Education Refinance Marketing Set for Rebound

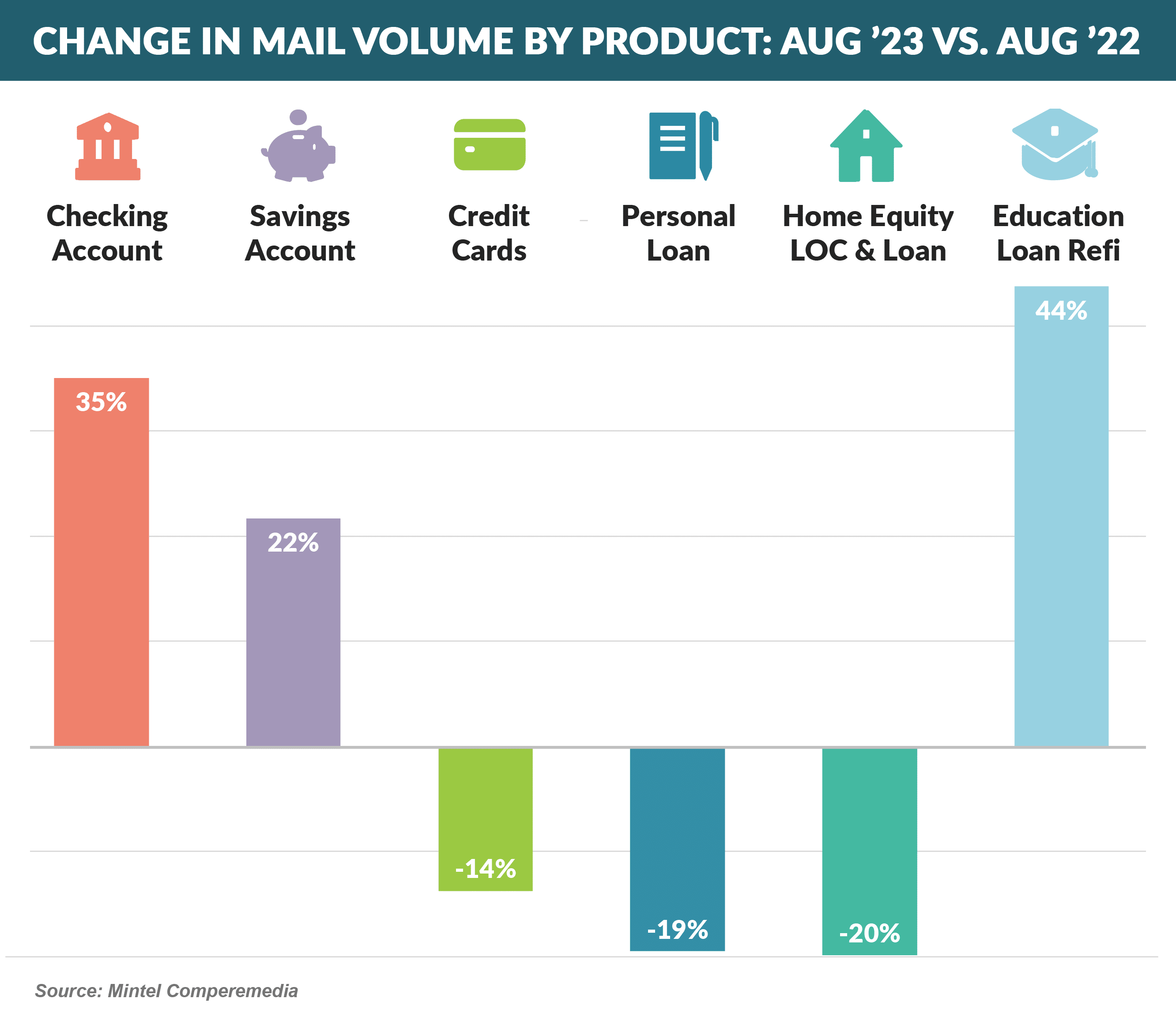

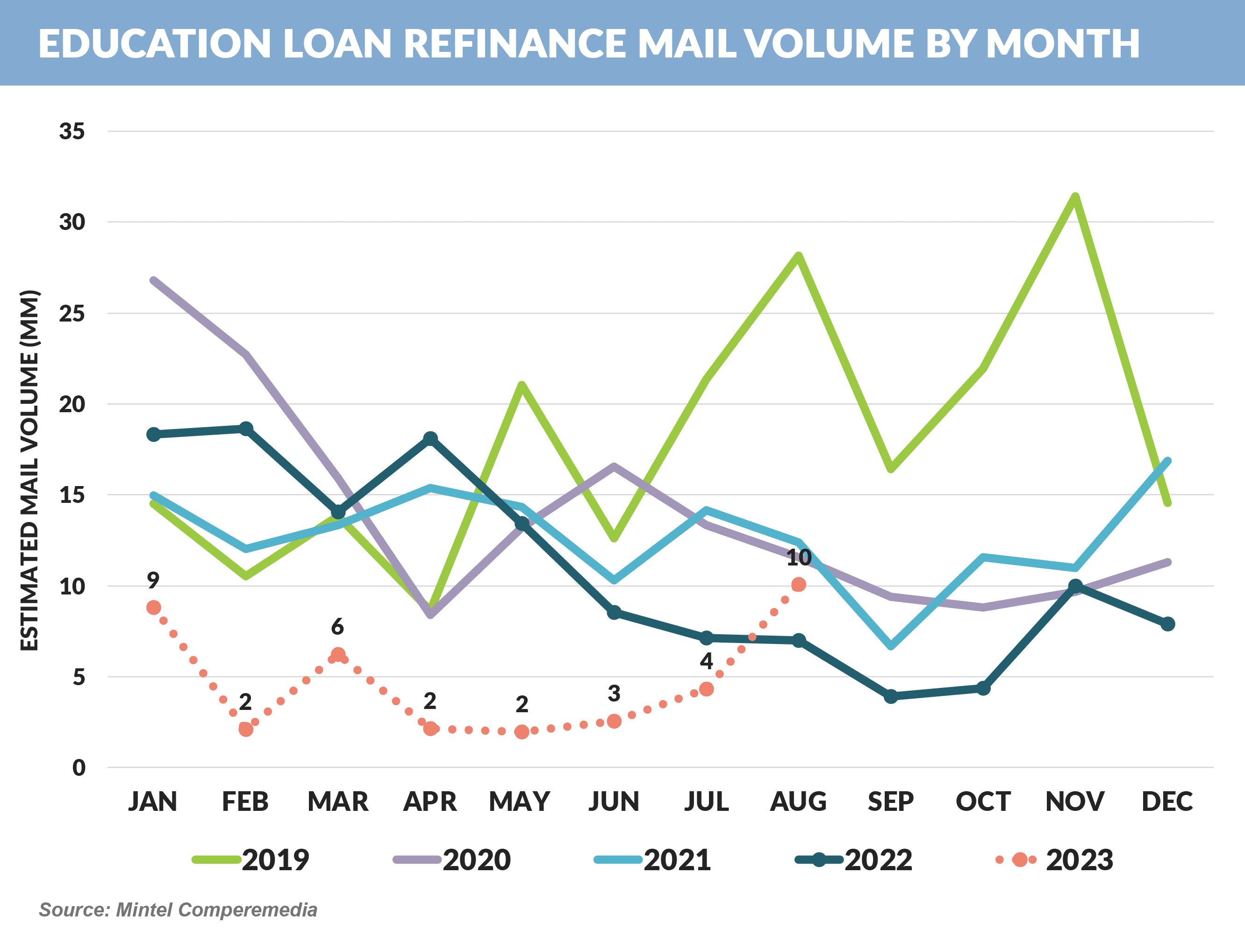

- Checking, education refinance, and HELOC saw increases in mail volume in August

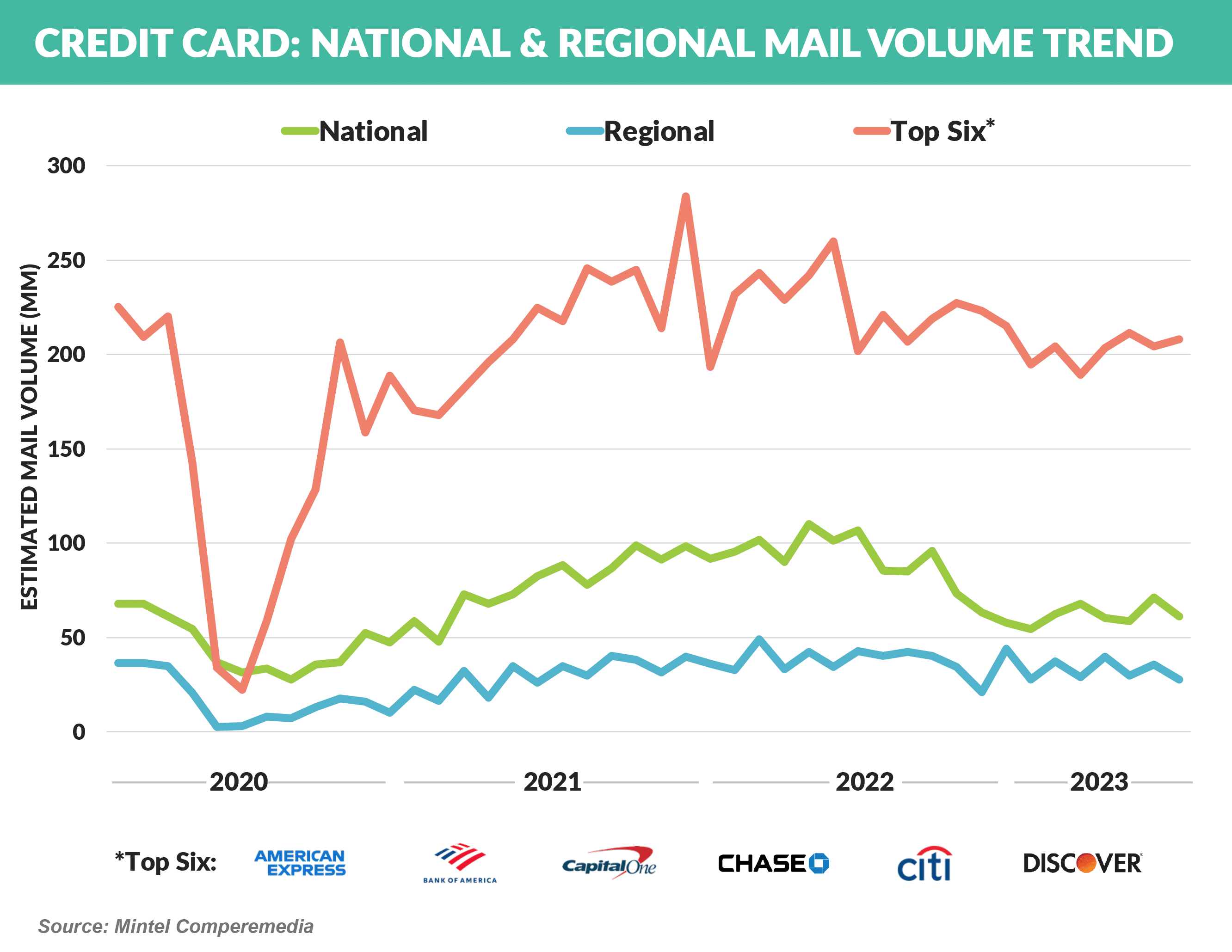

- The top six card mailers have consistently accounted for two-thirds of monthly mail volume over the past two years

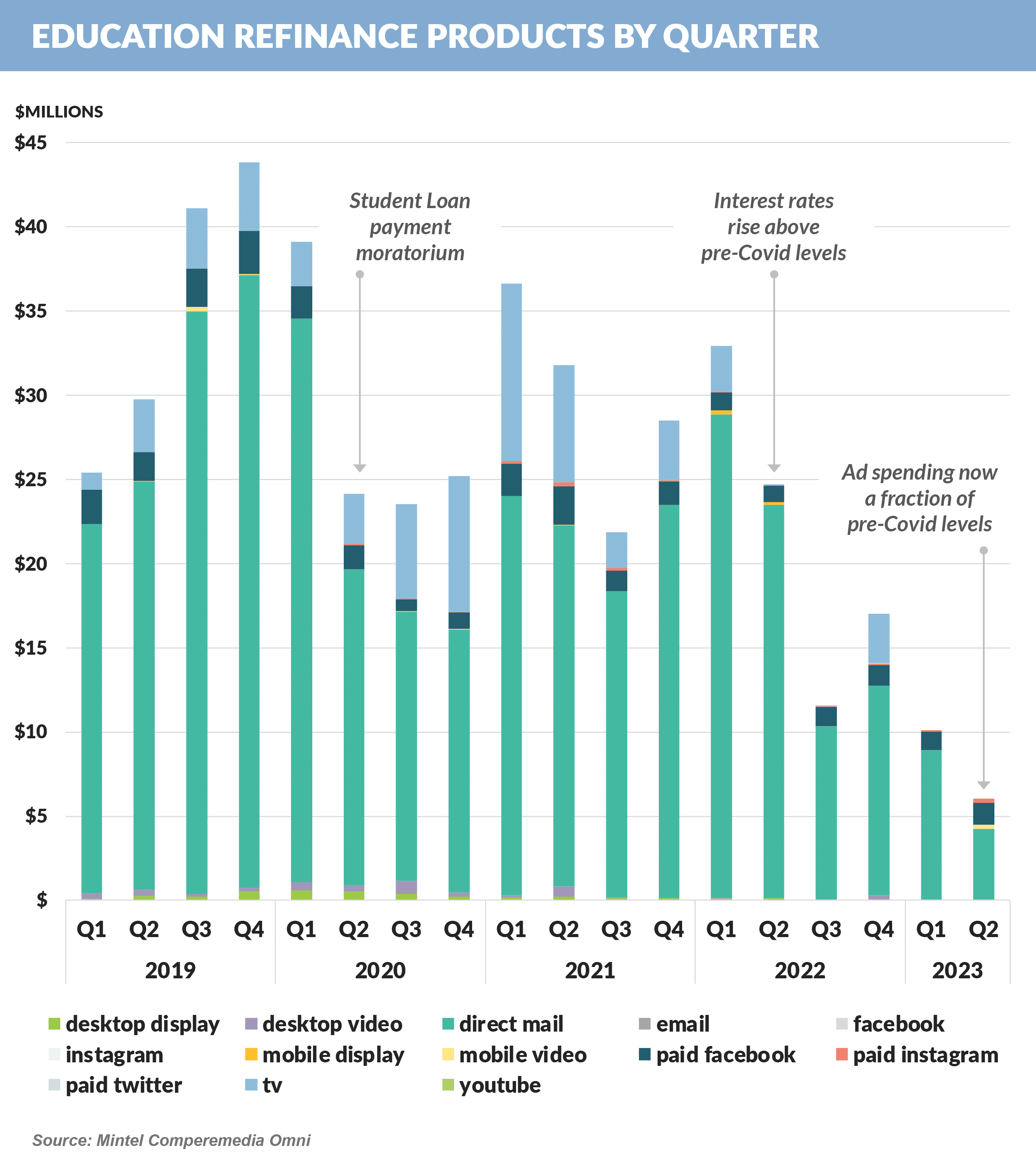

- Spending on education refinance loans plummeted in the past year due to a combination of the federal student loan payment moratorium and higher interest rates that reduced the benefit of refinancing existing loans, many of which are at lower fixed rates

- While high interest rates constrict the population of student loan holders who benefit from refinancing, there are still individuals who can lower their monthly payments, combined with the end of the payment pause, should lead to an increase in education refinance marketing, which already turned up in August

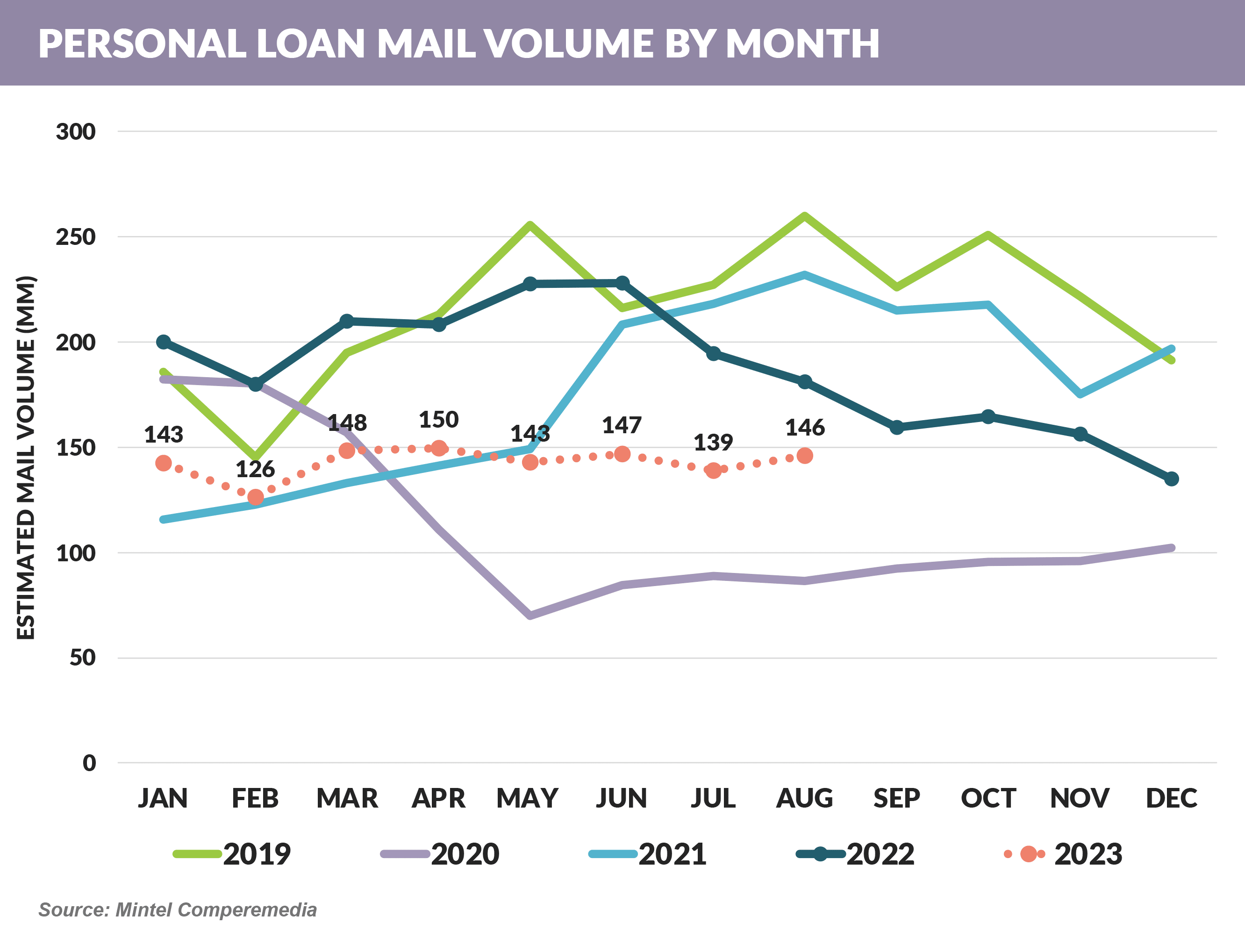

- Personal loan mail has remained in a steady range throughout 2023 at a level two-thirds that of 2022

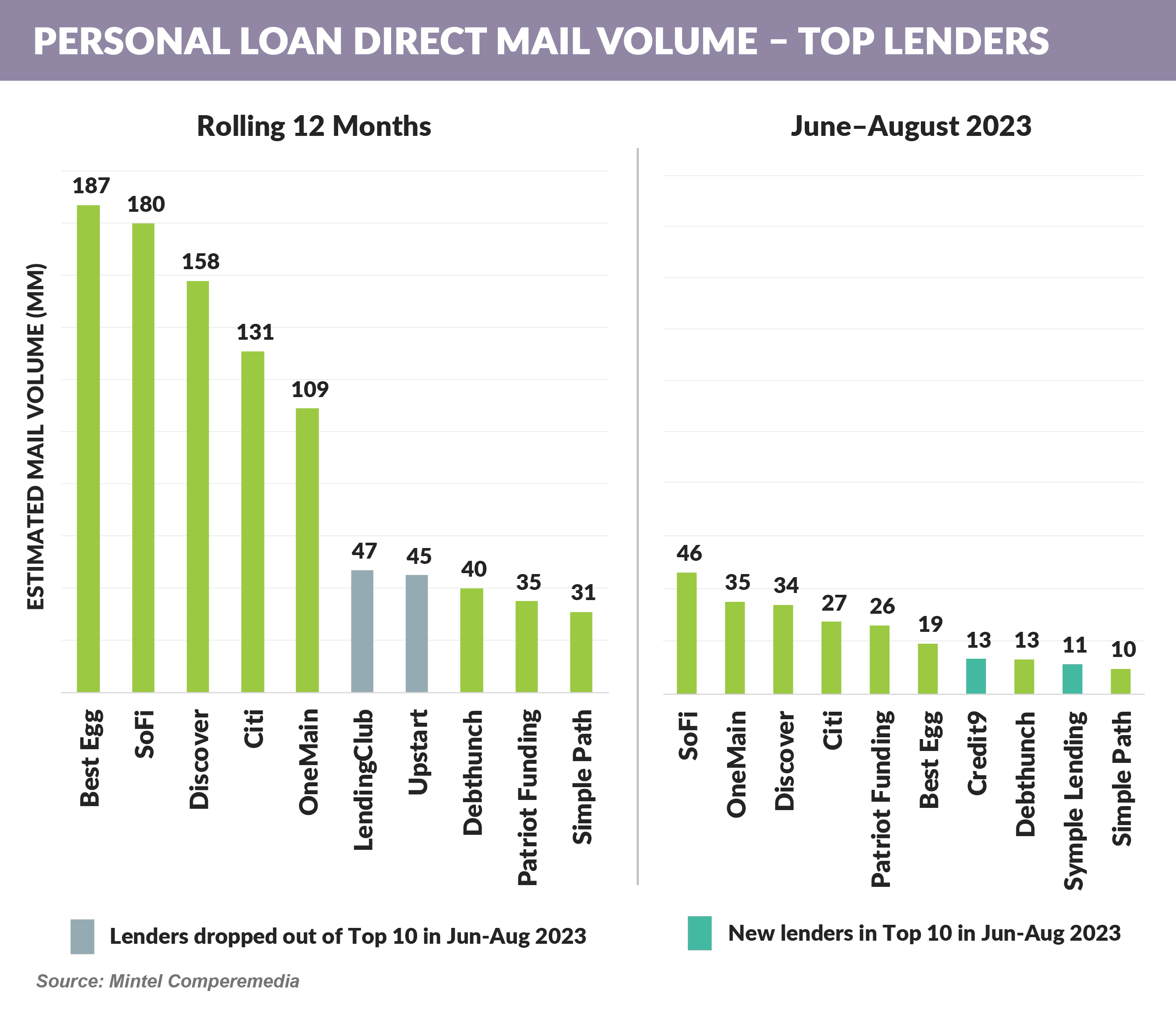

- However, there was some movement amongst top mailers

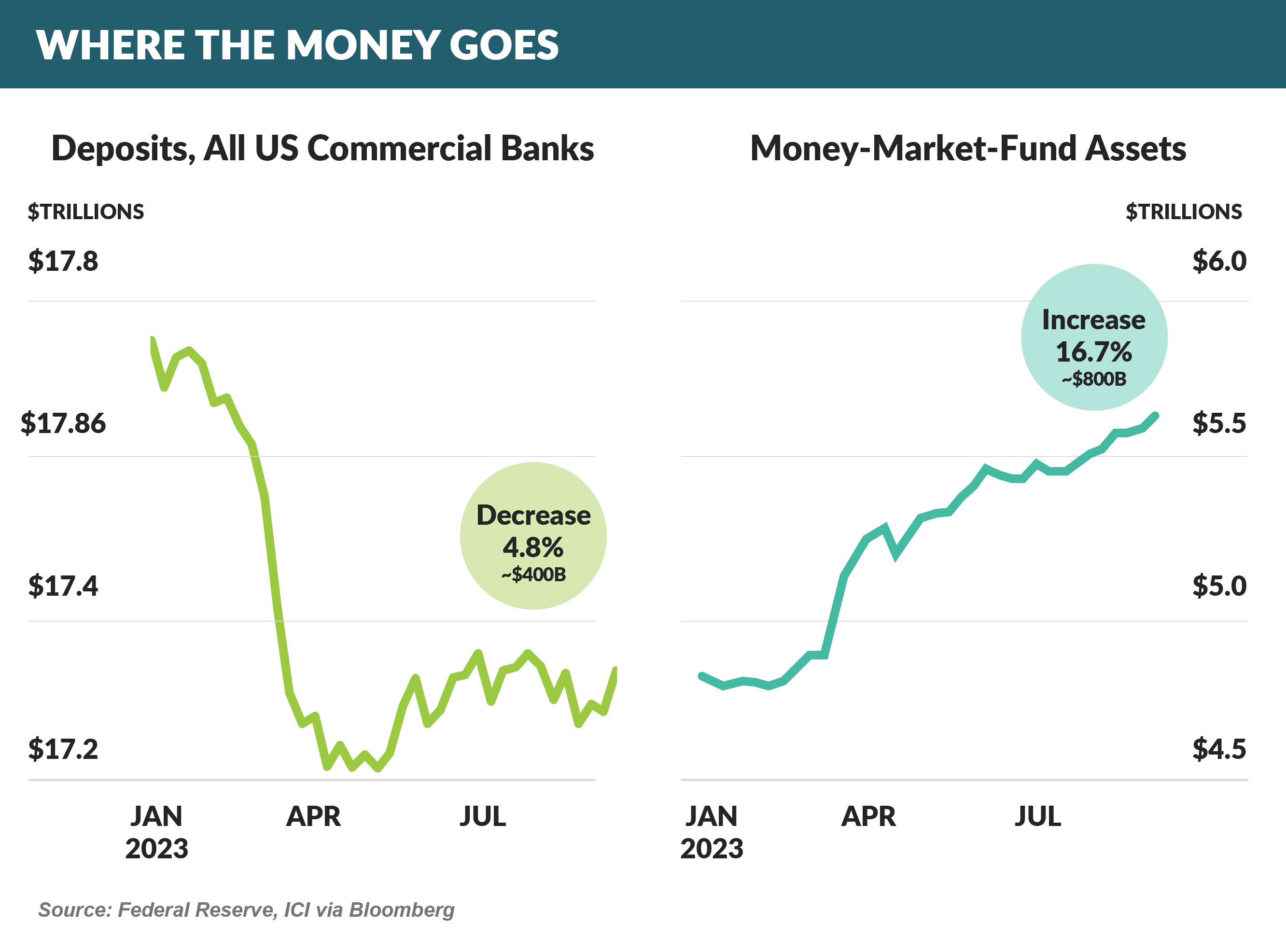

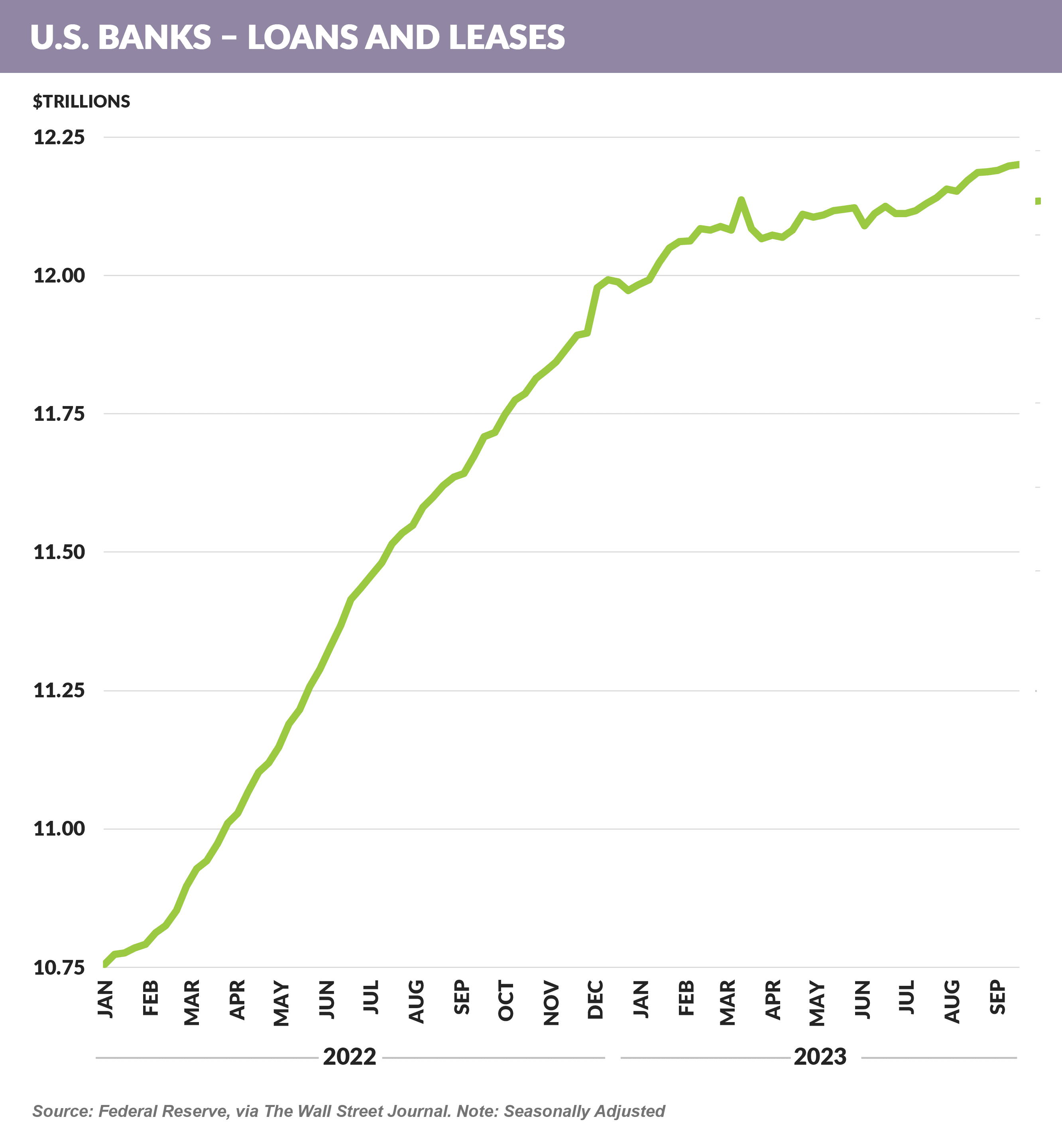

- US bank deposits fell for the first time since 1994, slipping 4.8% in the year through June to about $17.3 trillion as customers withdrew money to invest in higher-yielding alternatives

- Higher interest rates, stricter capital requirements, and the economy have halted 2023 loan growth

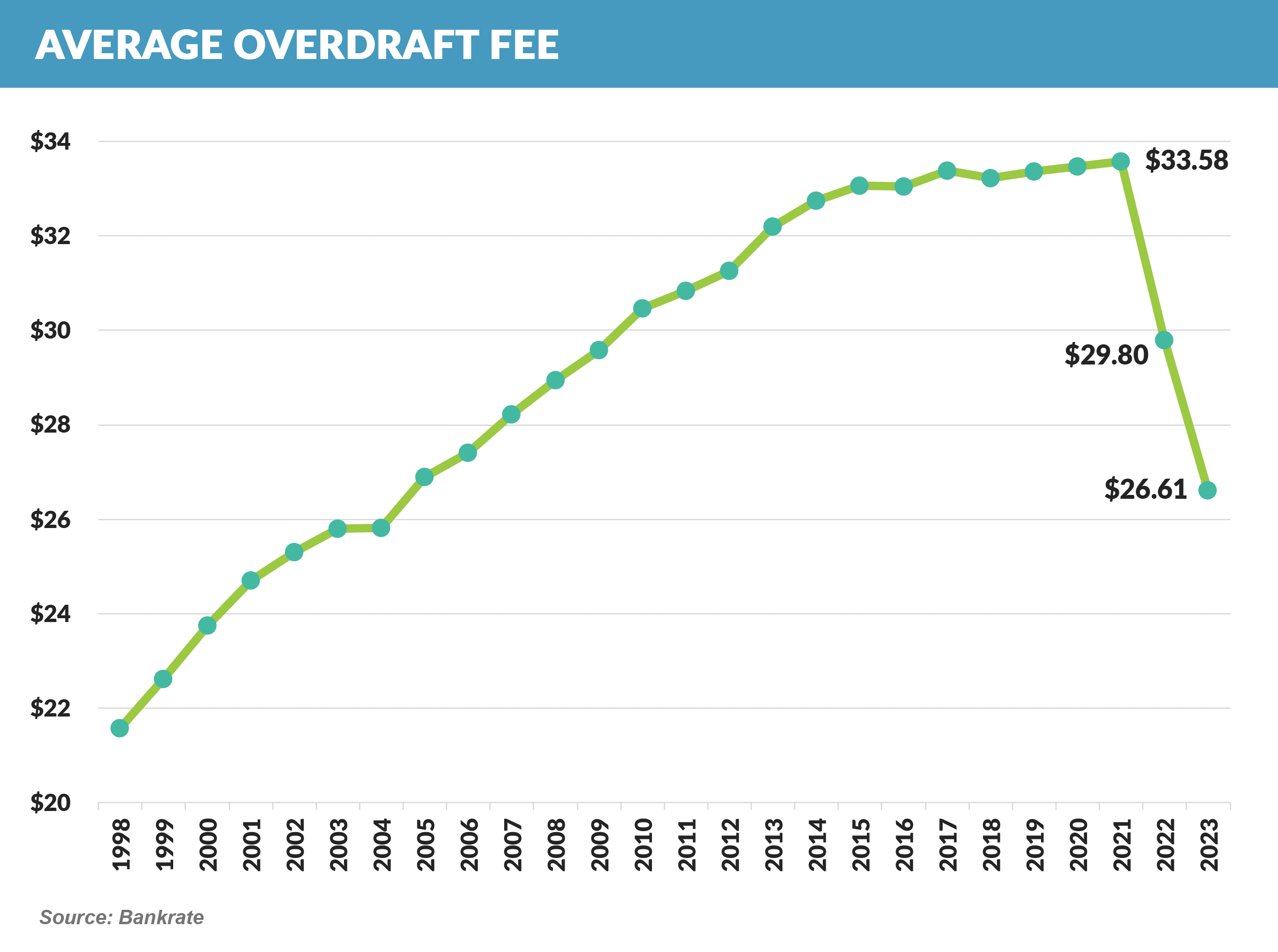

- The average bank overdraft fee has steadily dropped since 2021, decreasing to $26.61 in 2023 from $29.80 in 2022 and $33.58 in 2021

- These decreases follow policy changes by many banks either lowering or eliminating overdraft fees

- Most of the Top 20 banks (Citi and Capital One the first among them) have eliminated overdraft fees, but according to Bankrate, most banks still assess them

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on November 4th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.