Three Things We’re Hearing

- Time to (not) Panic about Card Delinquency???

- Performance-Based Marketing: Growth Without Upfront Cost

- Is Home Equity Marketing Finally Back???

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Time to (not) Panic about Card Delinquency???

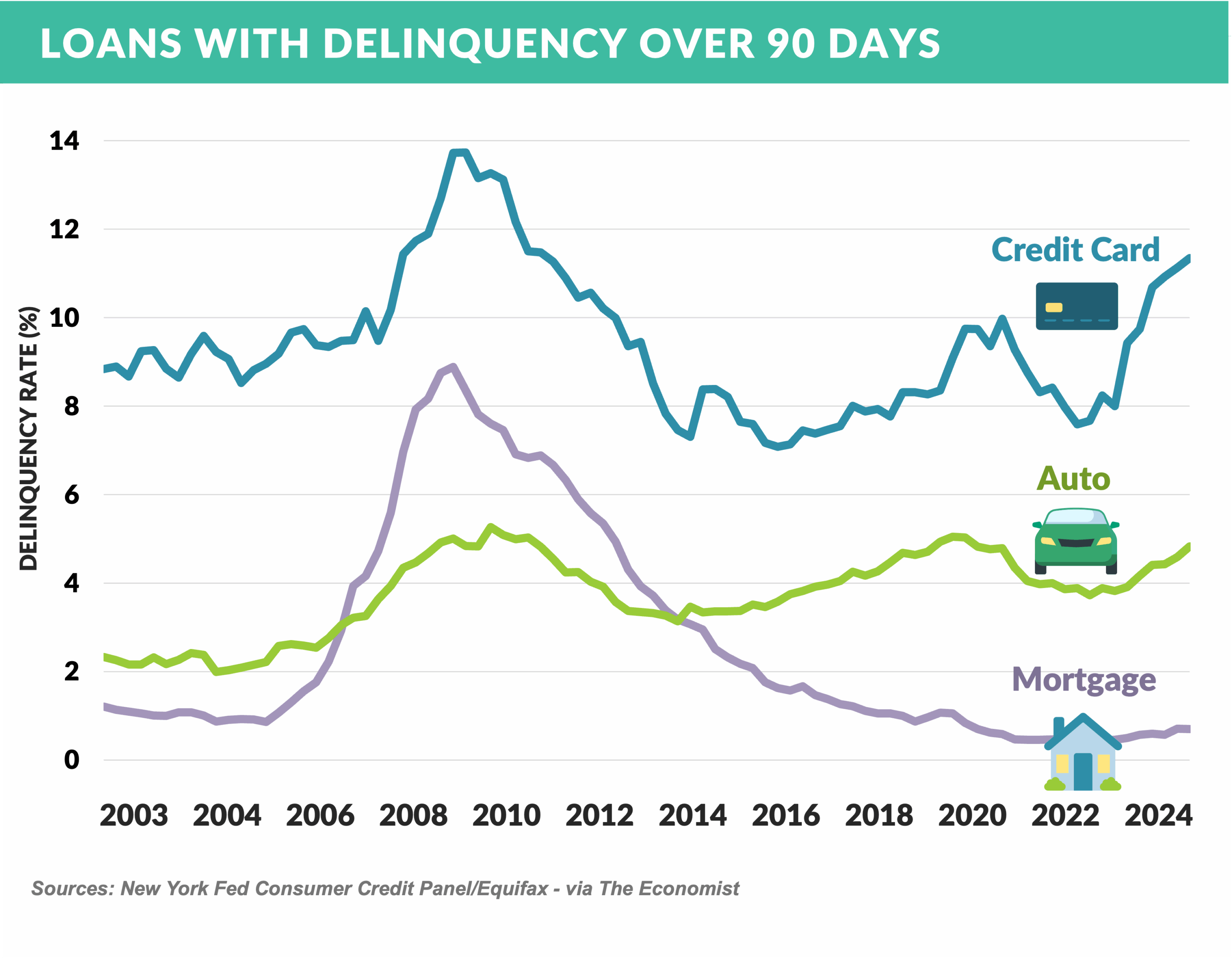

- Following a post-Covid decline, 2024 saw credit card delinquency rise to its highest level since the end of the 2008/09 financial crisis

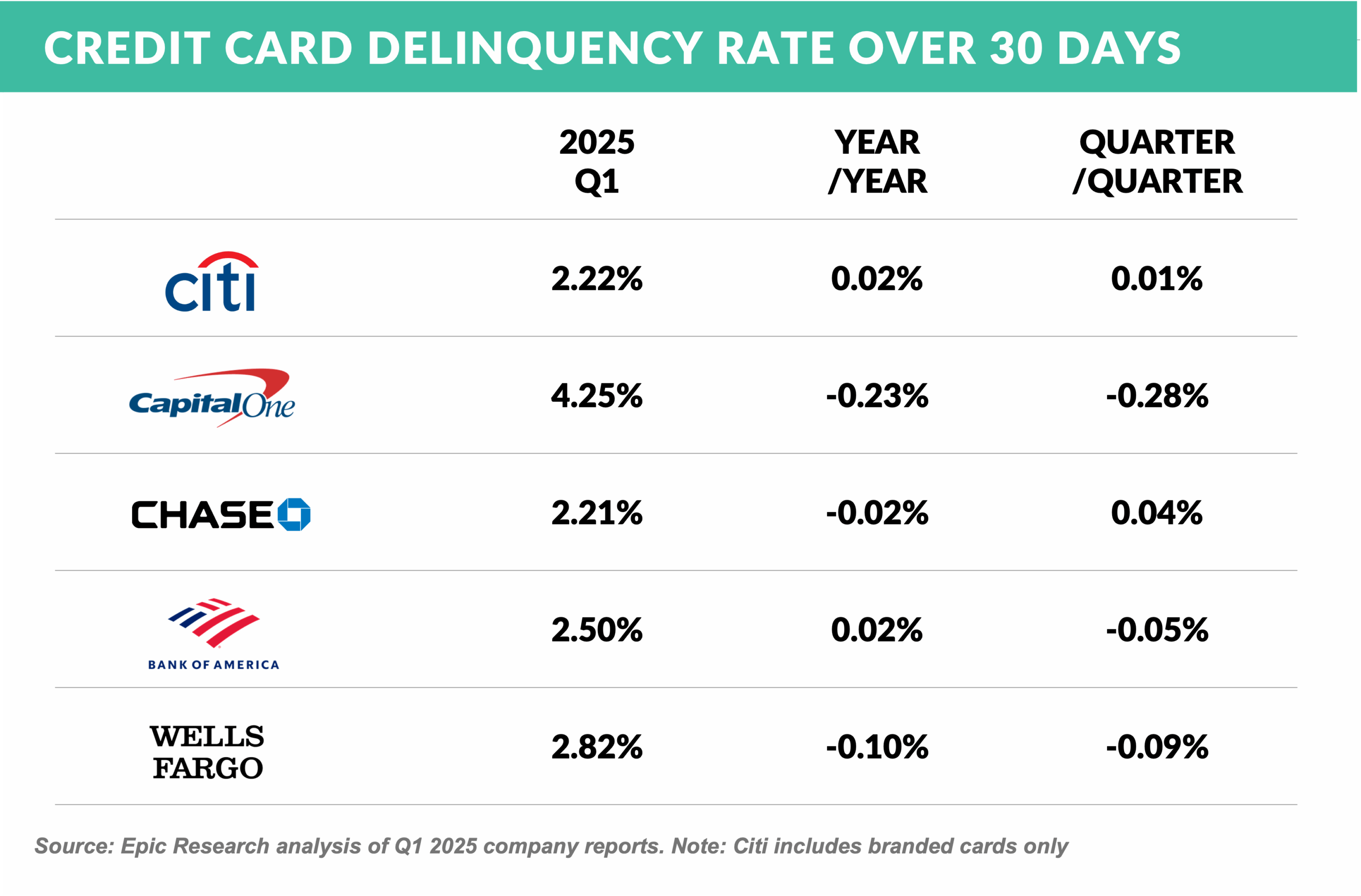

- However, the most recent results for major “prime” issuers are flat and slightly down

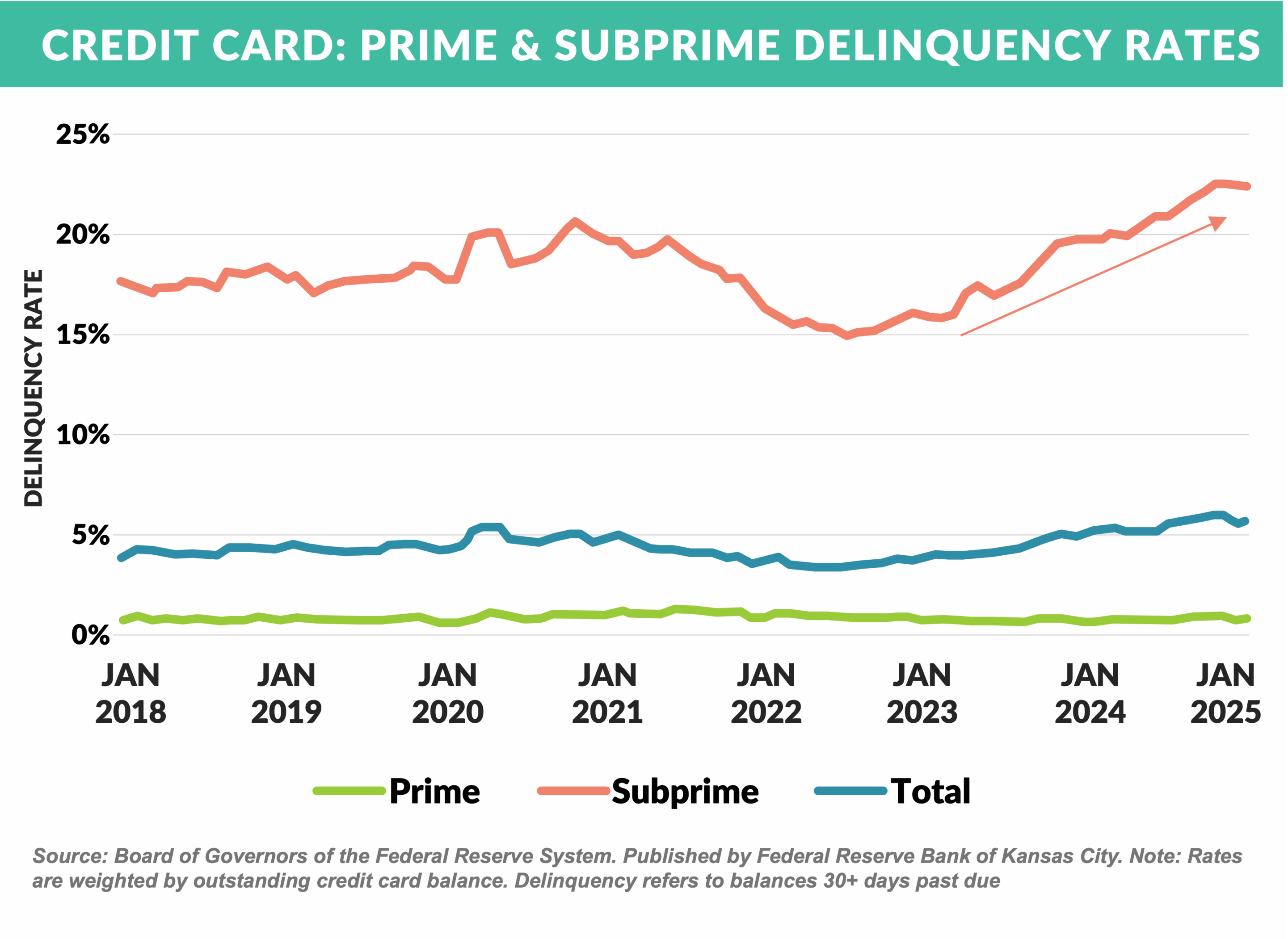

- With the bulk of the past several years’ increase coming from subprime cards

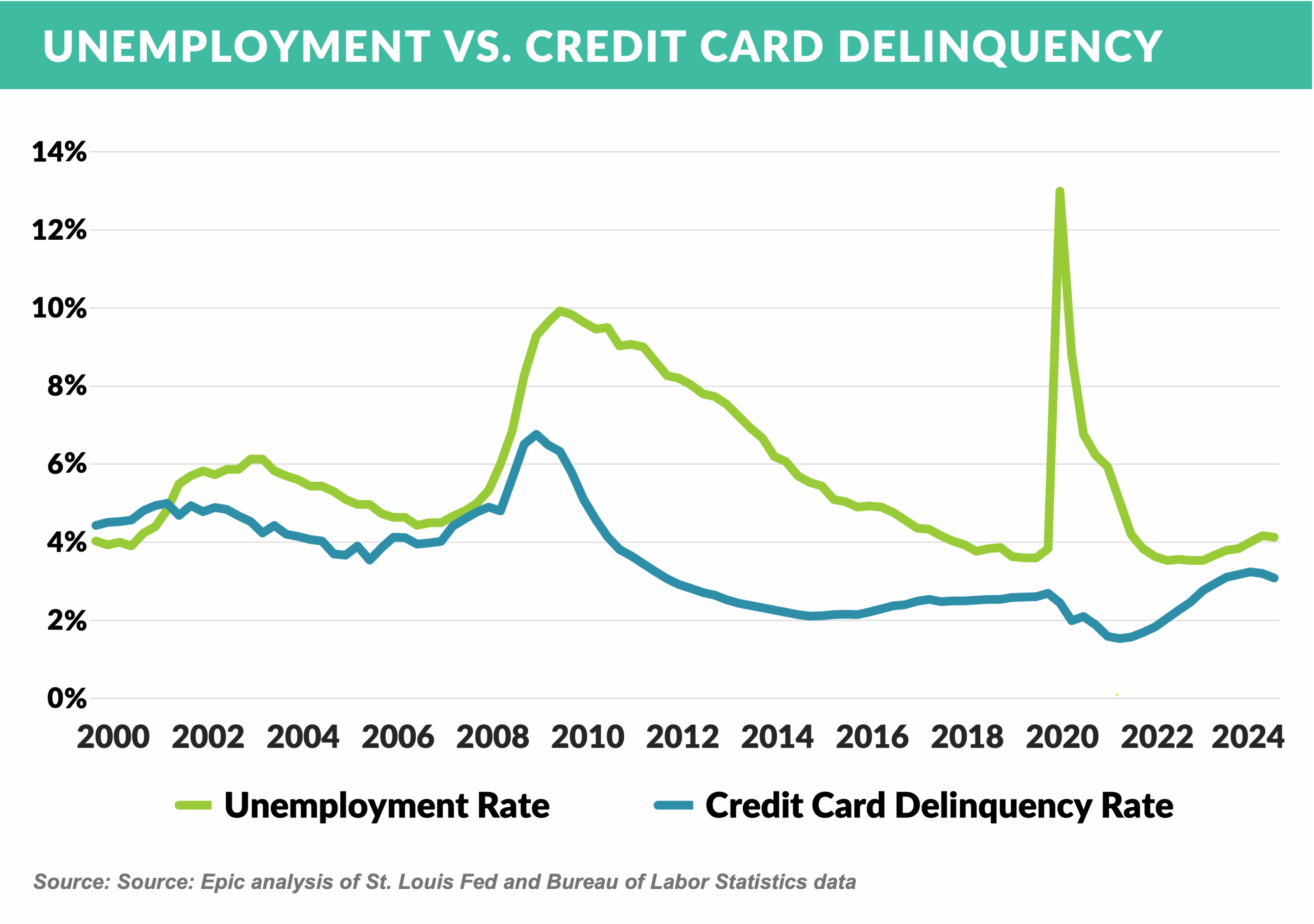

- Card delinquency has historically correlated somewhat to unemployment; however, the recent rise has outpaced the relatively flat (excluding the Covid bump) unemployment rate

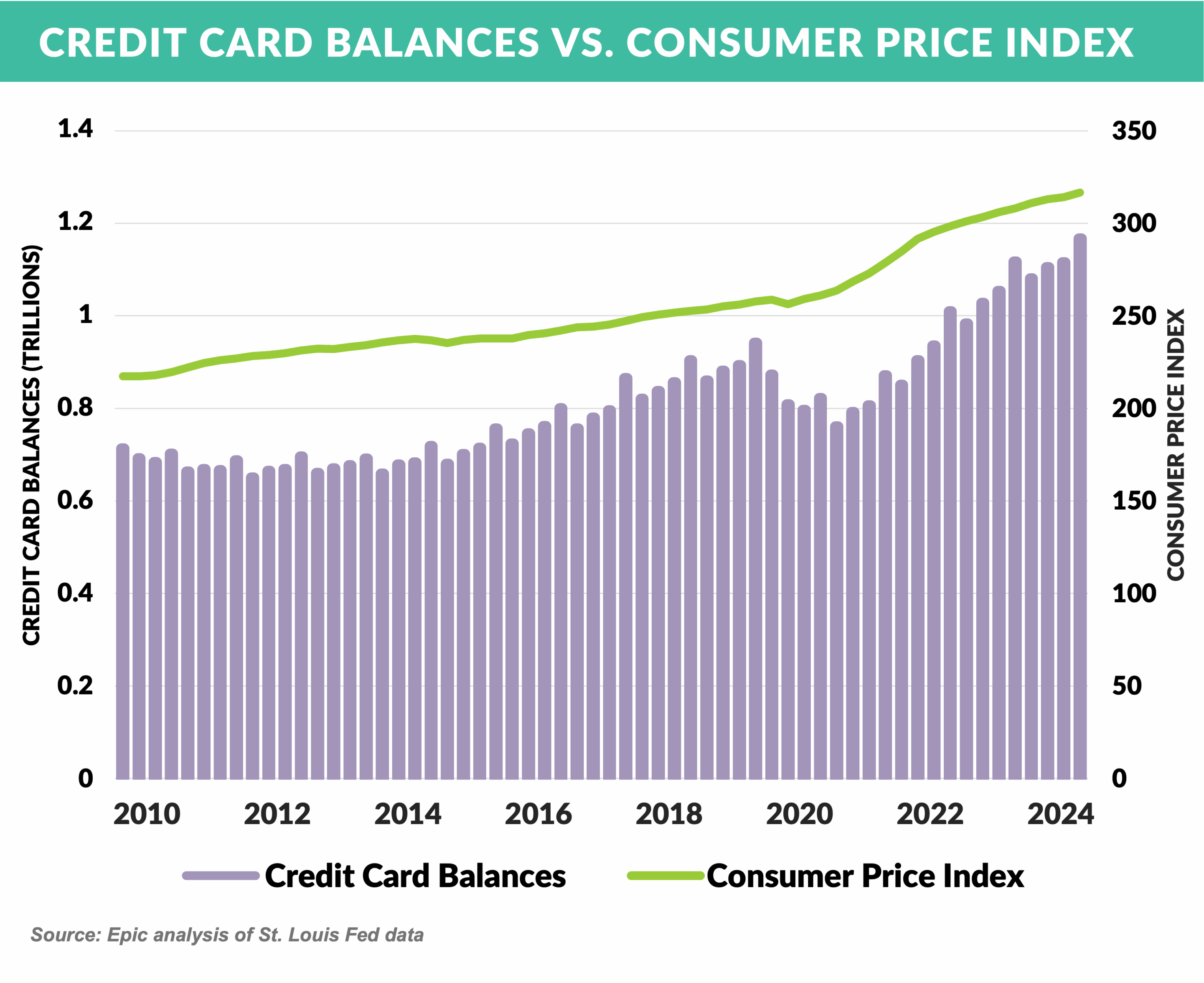

- Credit card balances hit a record high last quarter, but at around 6% of disposable income, they’re still in line with the past 15 years — well below the 8% peak from the early 2000s borrowing boom — and are up only slightly more than inflation

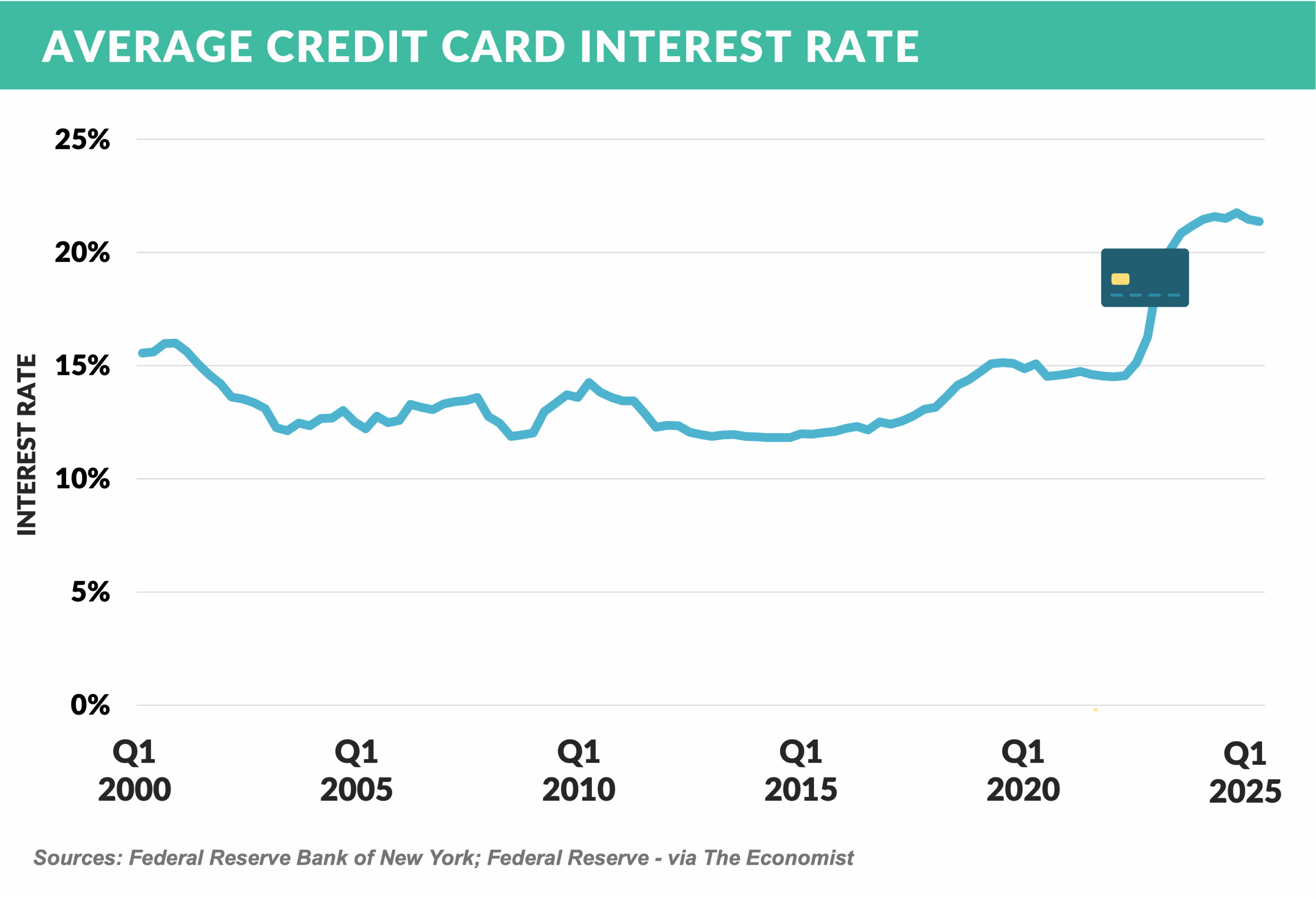

- Other than the spike in subprime delinquency, another possible factor in the rise in card delinquency vs. other loan products is that APRs on most card balances are variable whereas those on autos and mortgages are fixed

- Average card interest rates are up over 700bps since 2022

Performance-Based Marketing: Growth Without Upfront Cost

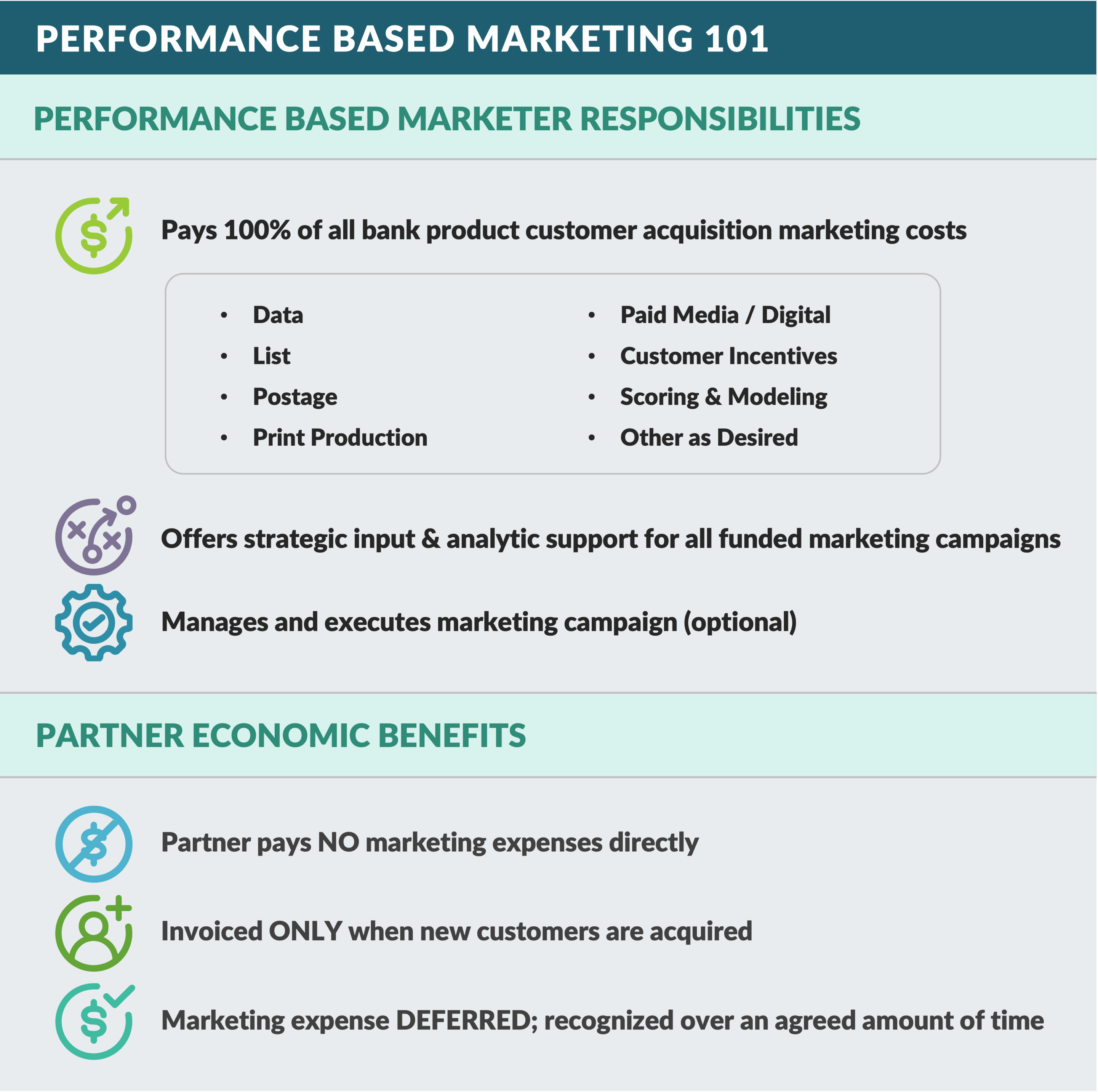

- In today’s environment of earnings pressure and tightened budgets, many banks and fintechs are rethinking their marketing strategies

- One increasingly popular approach Epic offers our clients: performance-based marketing

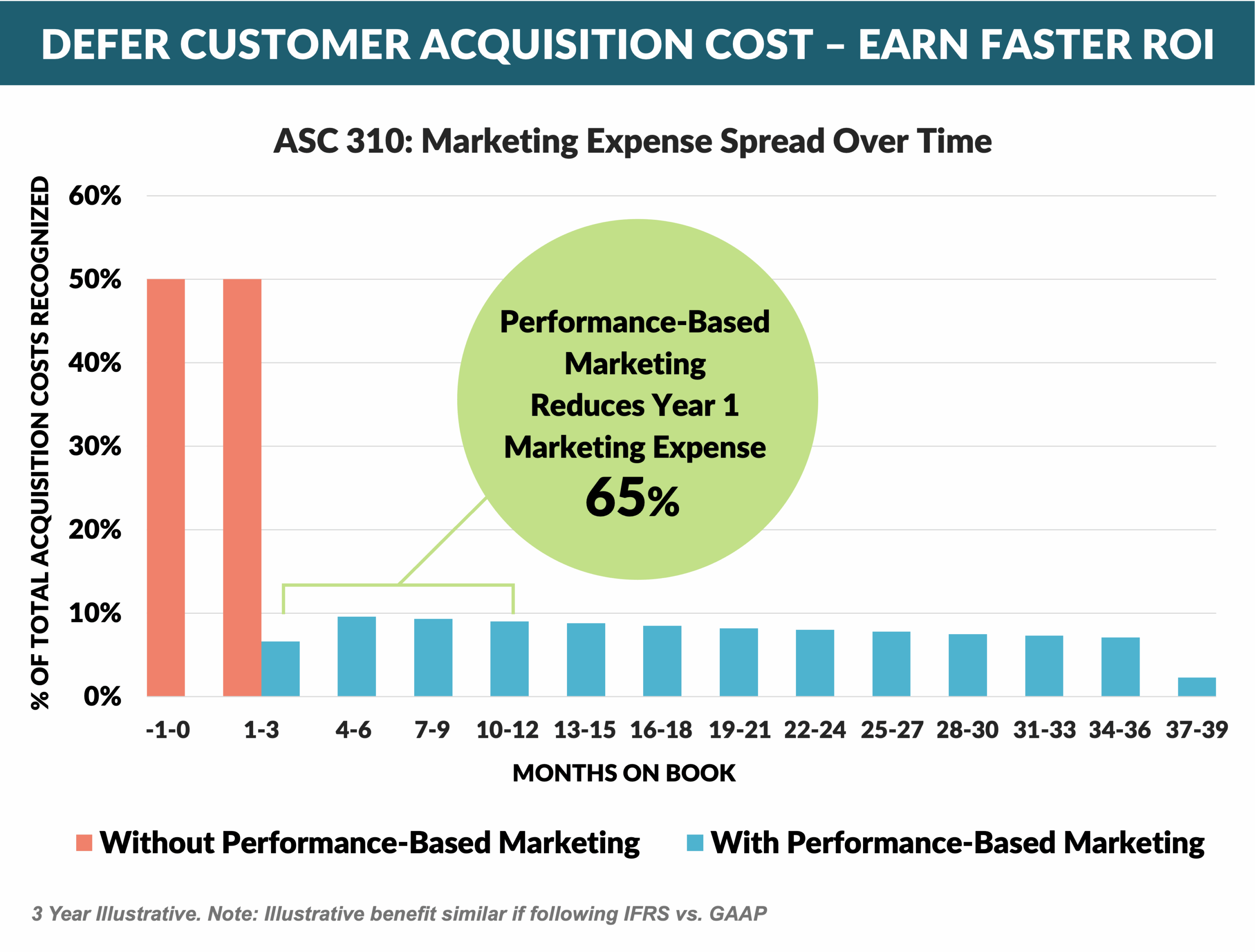

- This model allows institutions to take advantage of immediate growth opportunities by deferring marketing expense across direct mail and digital channels

- Here’s how it works:

- Epic runs marketing campaigns on behalf of the bank or fintech, with payment tied only to successful outcomes — such as approved applications or funded accounts

- The payments for successful outcomes are typically amortized over time, allowing the institution to benefit from continued customer acquisition without the upfront burden of traditional marketing spend

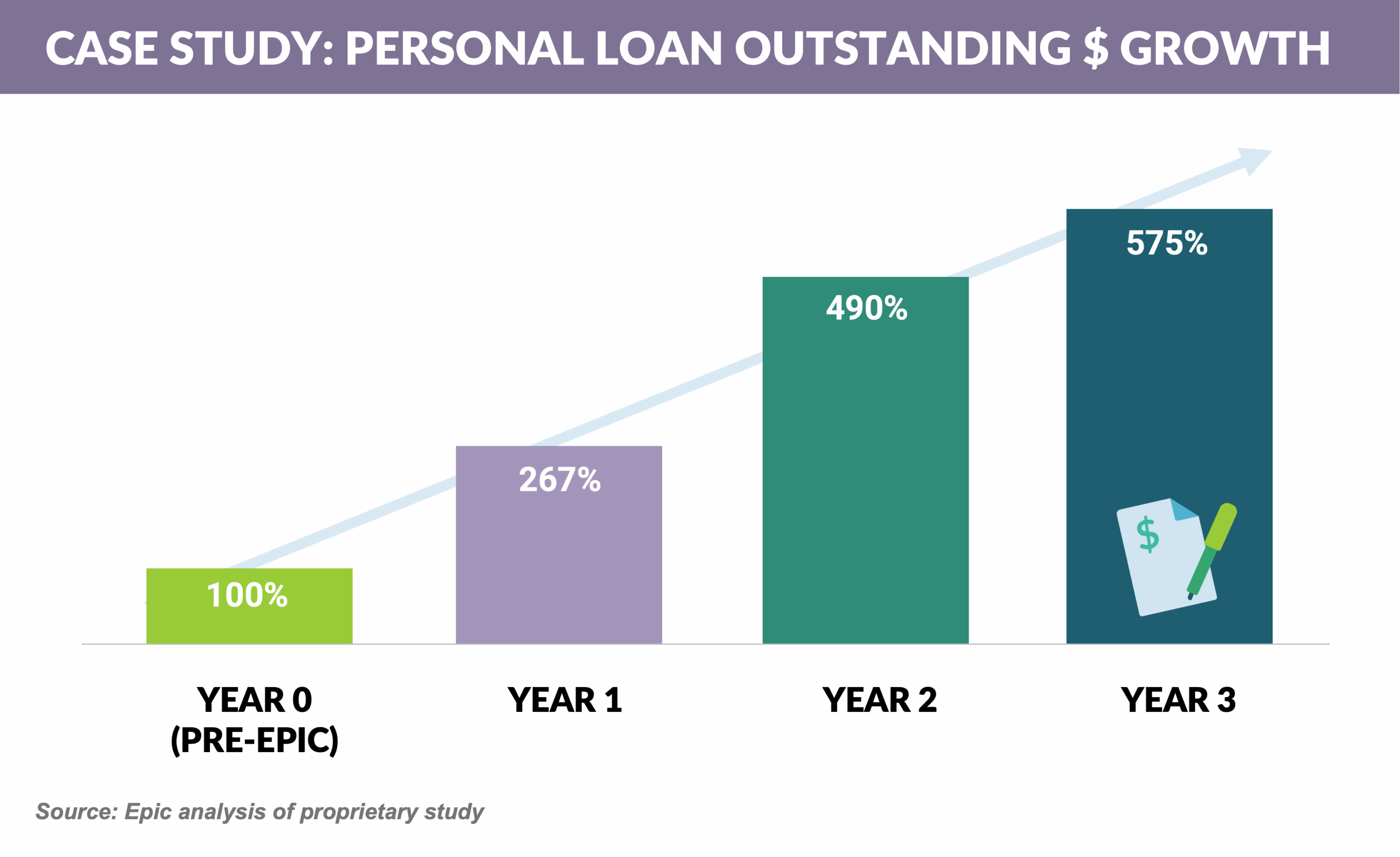

- Performance-Based Marketing from Epic has helped a number of our clients supercharge their growth

- Marketing costs align with results

- Customer growth continues despite budget constraints

- Value is created without the pain of the J curve

- Epic can help design and implement performance marketing services for you (learn more)

Is Home Equity Marketing Finally Back???

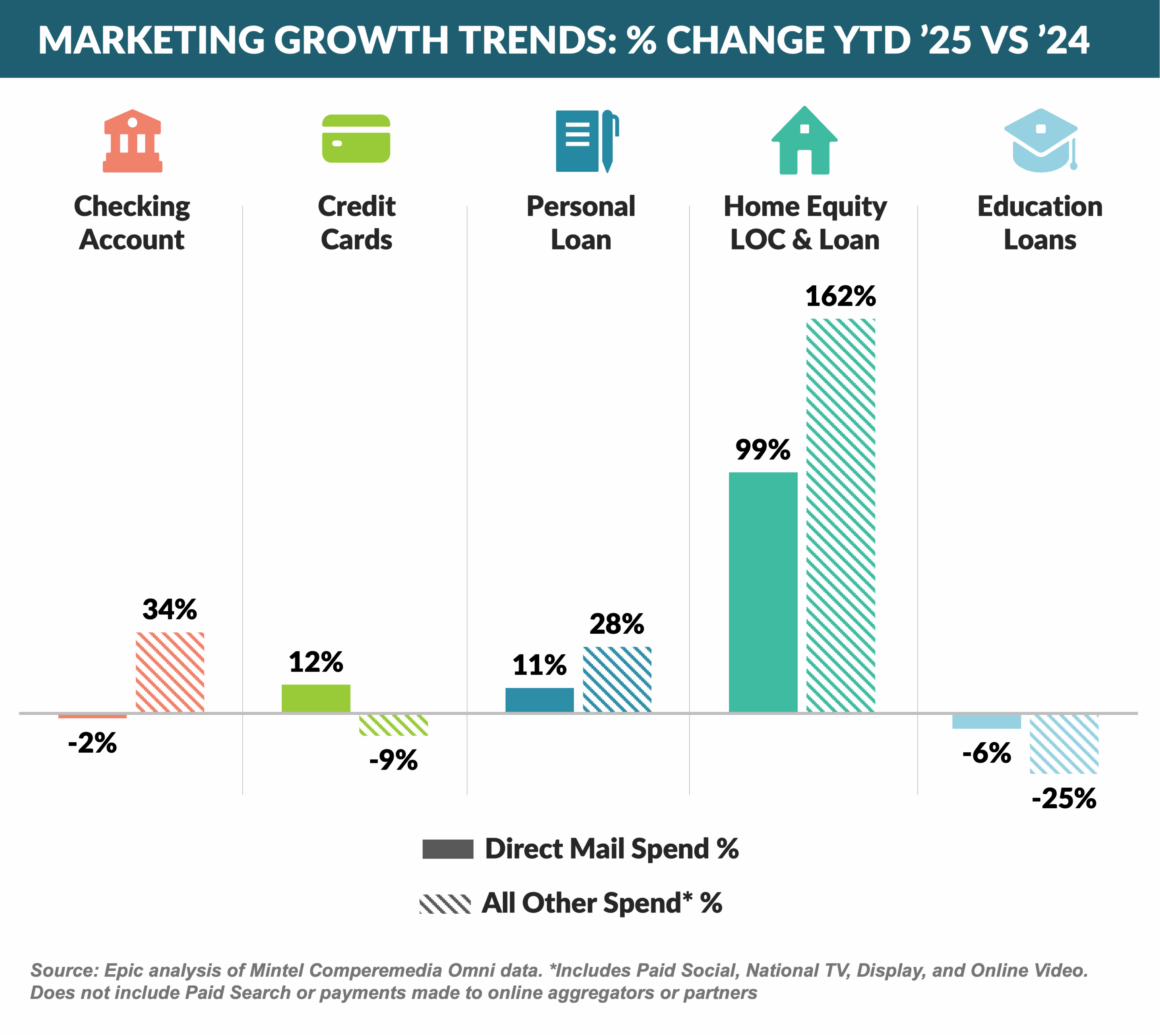

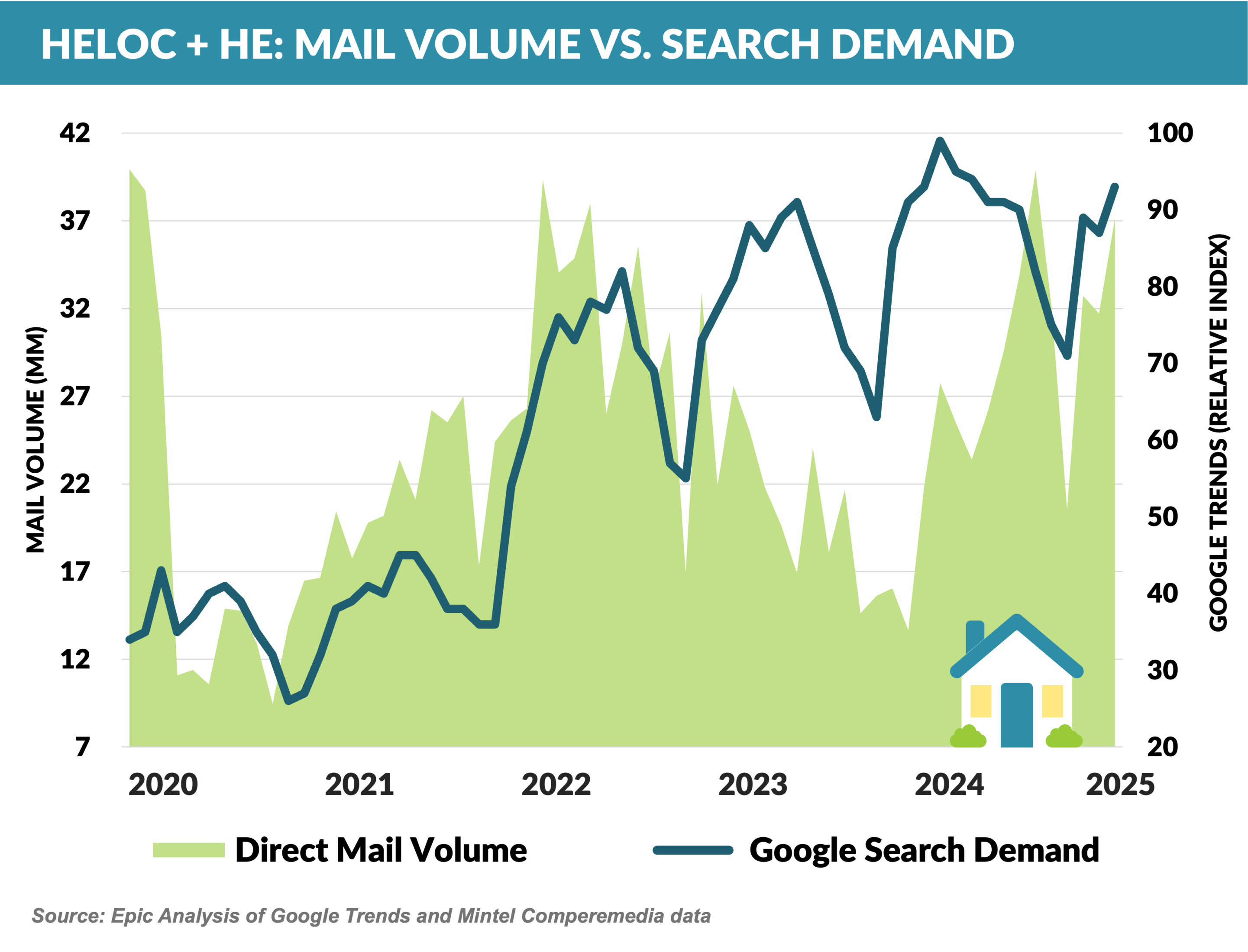

- Home Equity product marketing leads consumer marketing YTD, with mail volume up 99% and other channels up 162%

- The home equity spike helps close the “supply/demand” gap seen over the past two years

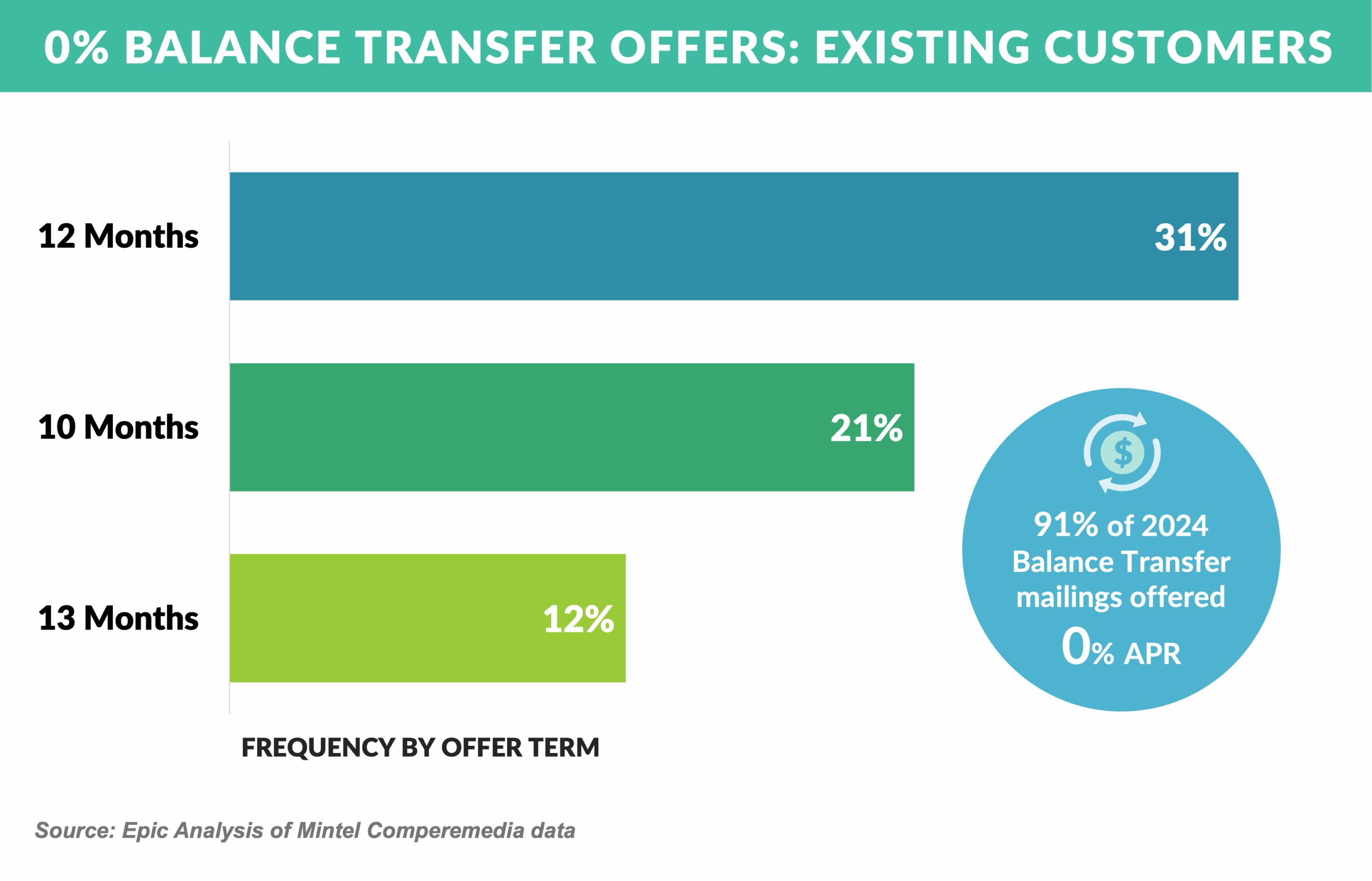

- As noted in the April Epic Report, issuers have recently extended terms on 0% balance transfer (BT) offers to as long as 24 months for new customers

- Issuers are also increasingly mailing 0% BT offers to existing cardmembers

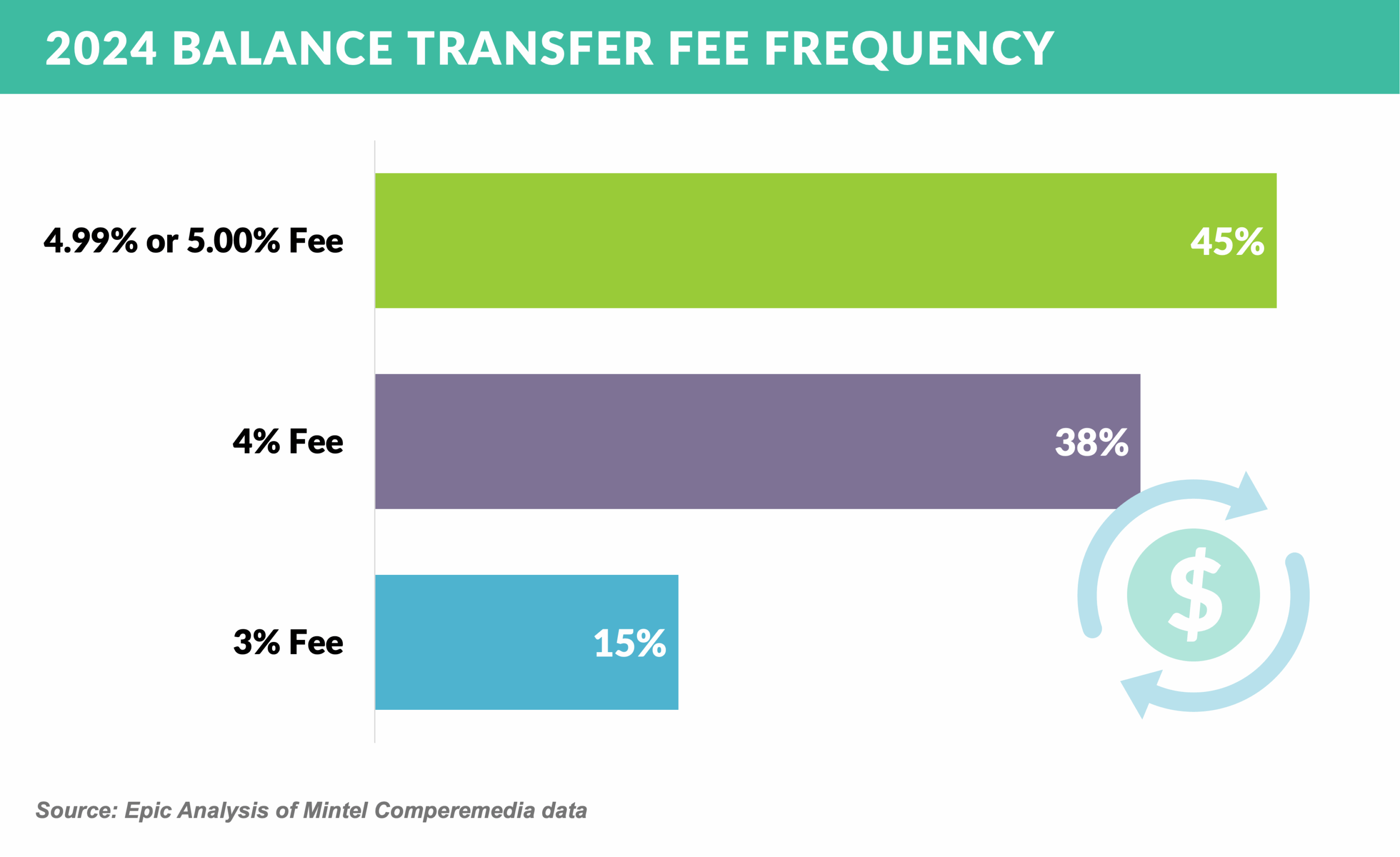

- BT fees on 0% customer offers have been trending upward since 2023, partially to help offset the rising cost of funds and pending late fee caps (proposed caps that have recently been rescinded), while low and no fee offers have mostly disappeared

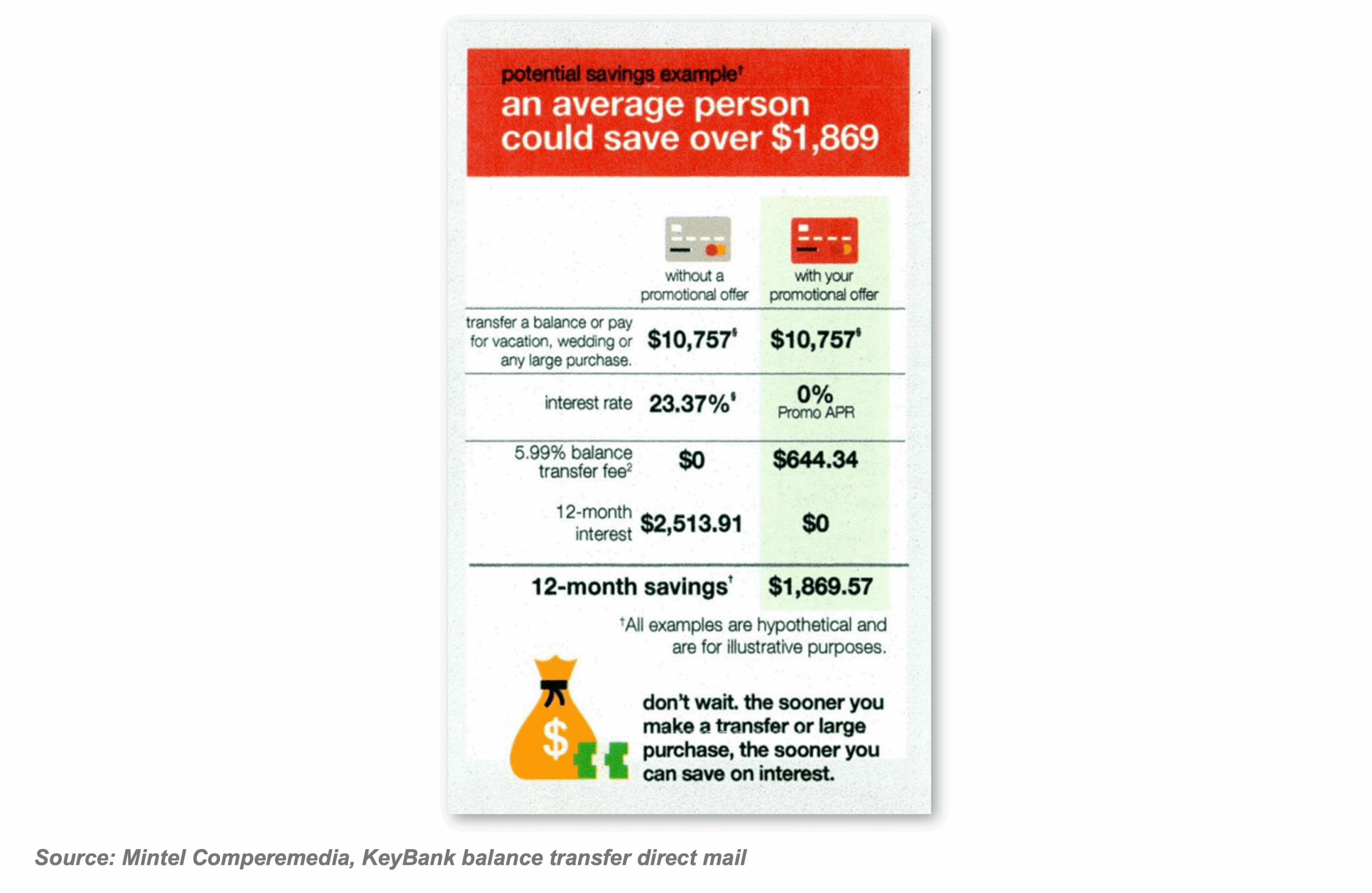

- Late 2024 and early 2025 customer mail included offers from US Bank and Key Bank with fees of 5.49%+, with the KeyBank mailing below calling out the value of the offer, including the BT fee

- With the CFPB losing interest in card fees, watch this space!

- The Senate voted to overturn a CFPB rule protecting consumers from overdraft fee abuses by America’s largest financial institutions

- The rule was finalized by the CFPB in December and is set to go into effect on October 1 and would reduce overdraft fees charged by insured depository institutions and credit unions with more than $10 billion in assets from the average $35 charged today to $5, or an amount that covers costs and losses

- The vote is in line with recent trends to relax regulation of bank fees

- Wyndham has announced the Wyndam Rewards Debit Card, powered by Galileo Financial Technologies — SoFi's Technology Platform — and is issued by Sunrise Banks N.A. and backed by Mastercard

- The debit card offers one point per dollar spent at Wyndham, as well as gas and grocery, and one point per two dollars spent elsewhere with a 2,500 point sign-on bonus, and an anniversary bonus up to 7,500

- For comparison, the Wyndham Earner cobrand credit card offered by Barclays offers a 30,000 point sign-on bonus, and one point for every dollar spent with higher levels for Wyndham, gas, and grocery spend

- Affirm announced that it plans to begin furnishing information about all its payment plans to Experian

- Affirm was the first BNPL provider to report to a credit bureau, having previously reported information about its longer-term payment programs, and will now include biweekly payment plans, Pay in 30 (single installment), Pay in 2 and Pay in 6

- The new loan reporting will not be factored into consumers’ traditional credit scores in the near term, but it may in the future as new credit scoring models are developed

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue in June.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Find out how we can help you.