Three Things We’re Hearing

- Consumers increasingly use personal loans for home improvements

- Local banks are a surprisingly popular choice for personal loans

- Credit card delinquency continues to defy gravity

A two-minute read

Consumers Increasingly Use Personal Loans for Home Improvement

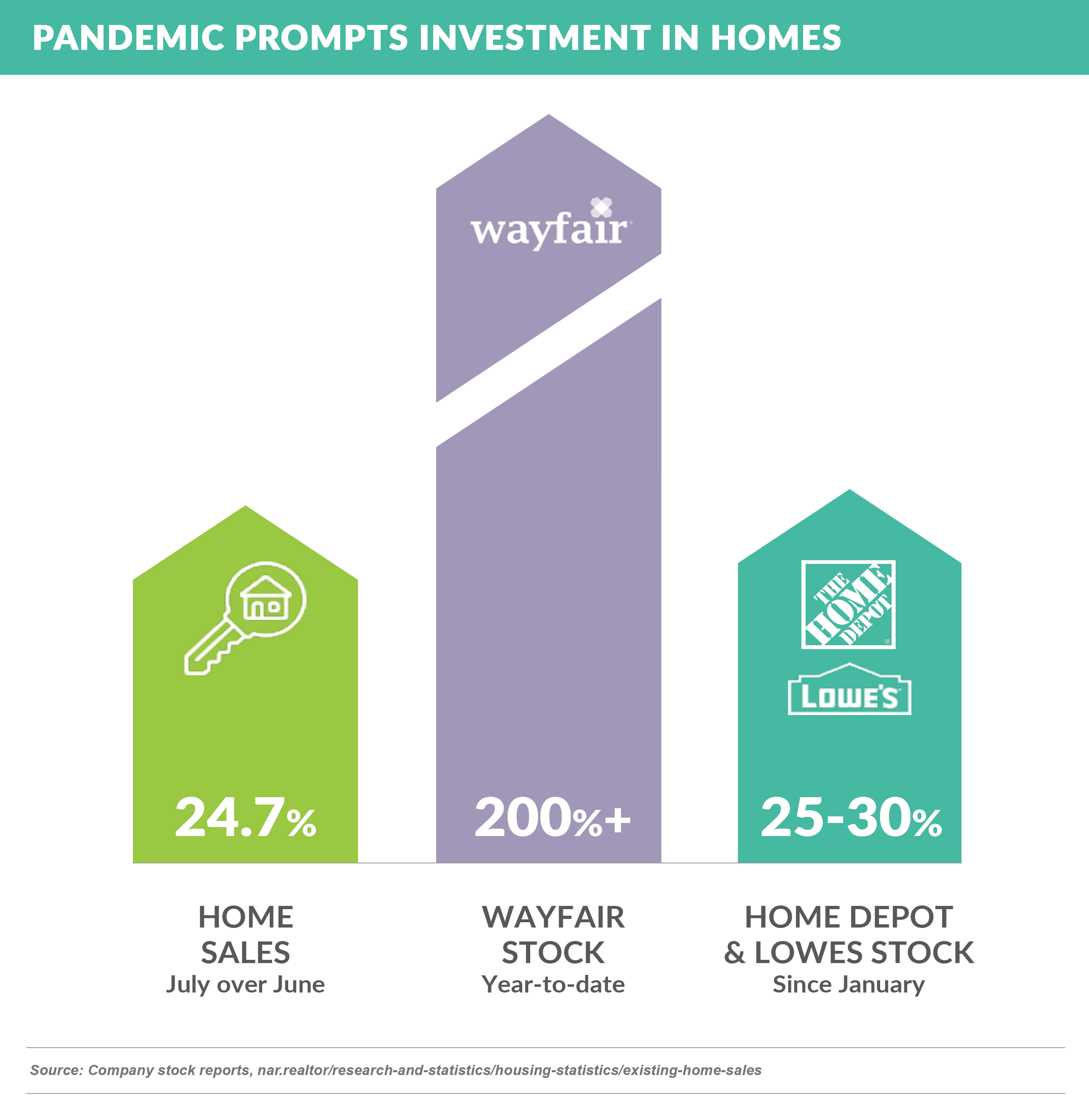

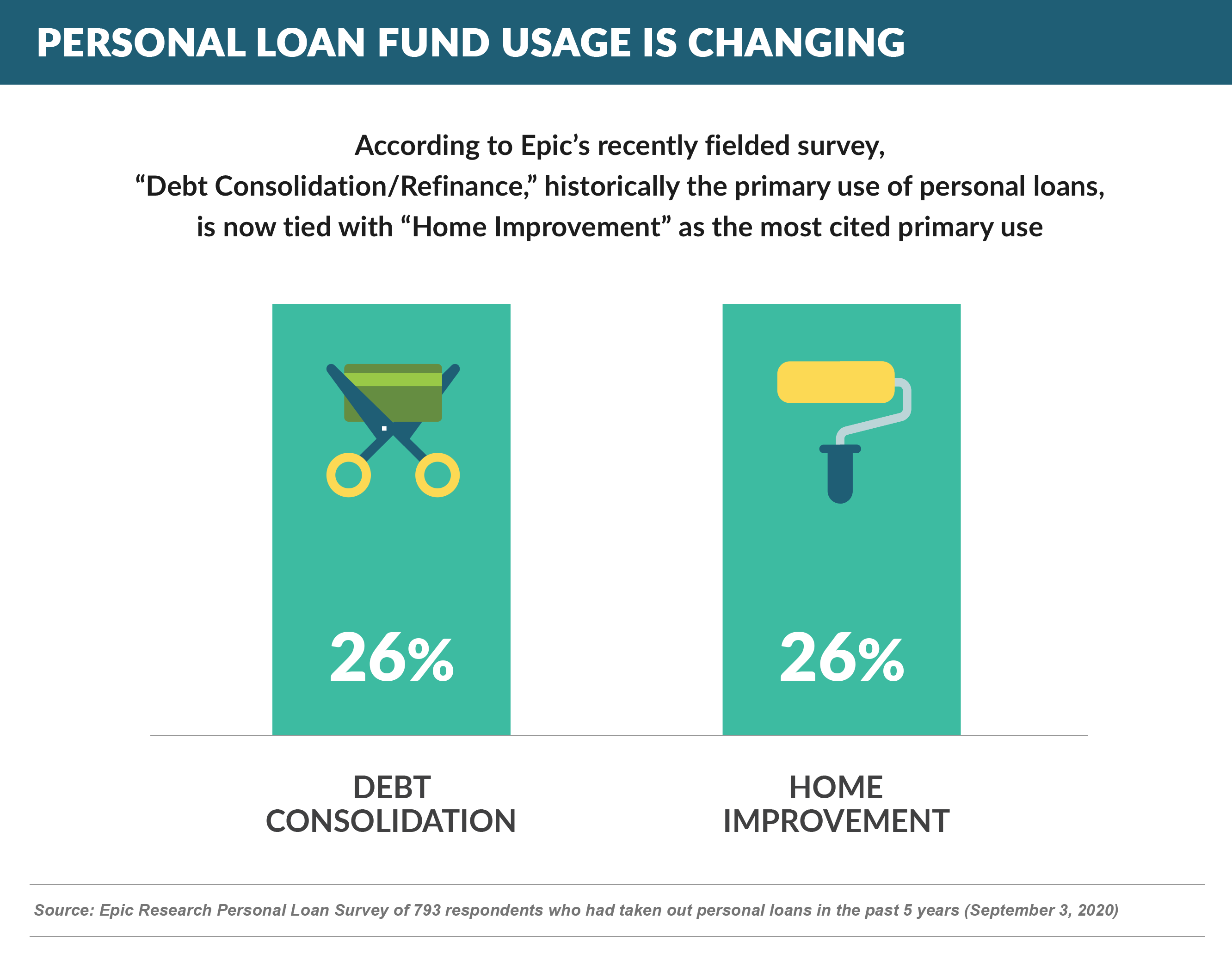

- Many consumers have adapted to the pandemic by investing more in their homes

- This may account for the increased number of consumers using personal loan proceeds to pay for home improvements

- A review of personal loan acquisition creative over the past several years shows a few attempts at home improvement positioning, however the vast majority of creative has focused on refinancing credit card debt

Local Banks are a Surprisingly Popular Choice for Consumer Loans

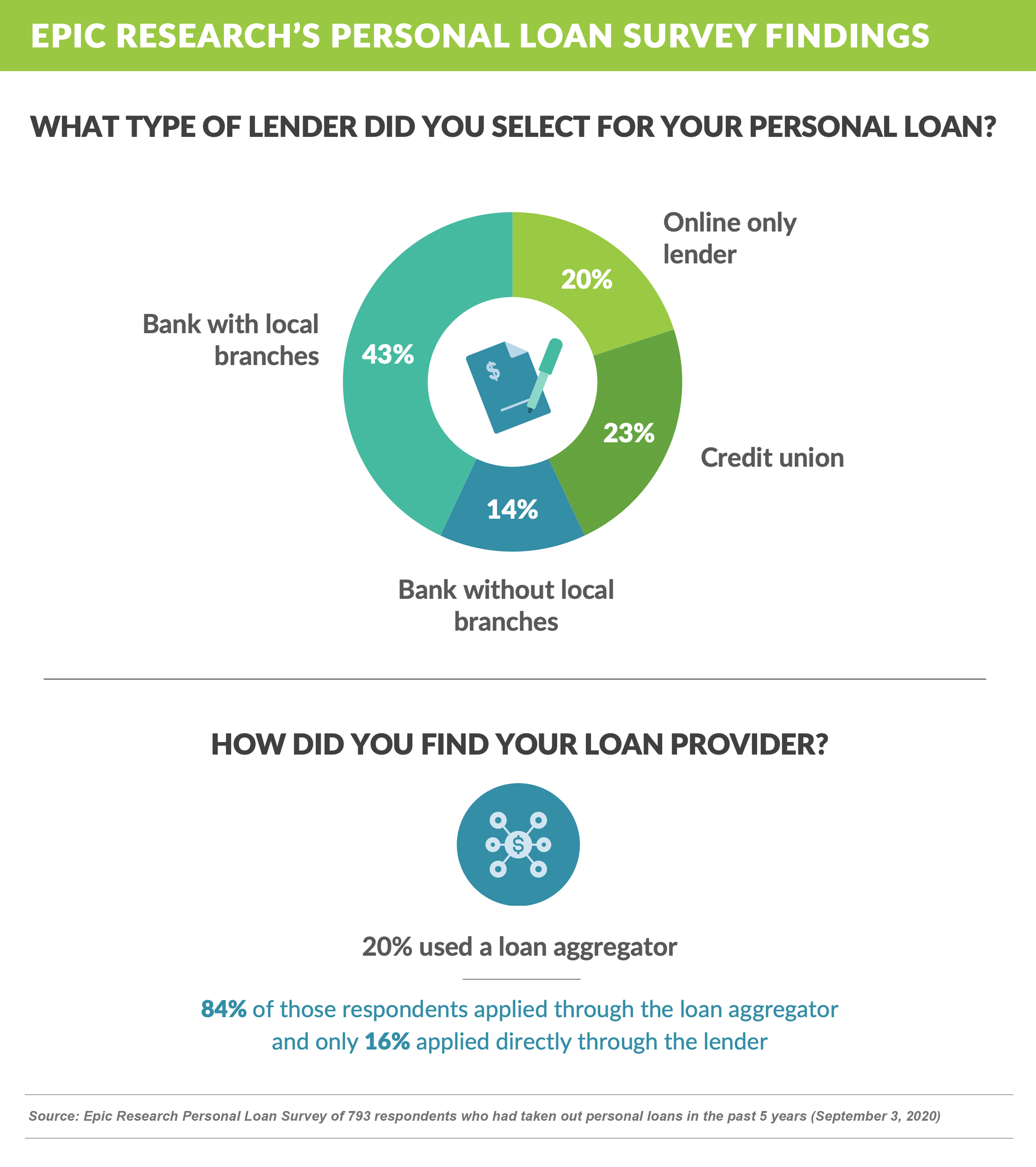

- The personal loan product was rejuvenated in 2006 when LendingClub launched a technology-based platform to source and sell personal loans

- The amount of attention since paid to it and its many “fintech” competitors, as well as online loan aggregators, would lead many to believe that local banks have missed the tremendous growth in the personal loan market over the past 10+ years

- We were surprised when our personal loan survey revealed that most customers chose a “Bank with Local Branches” for their personal loan

Credit Card Delinquency Continues to Defy Gravity

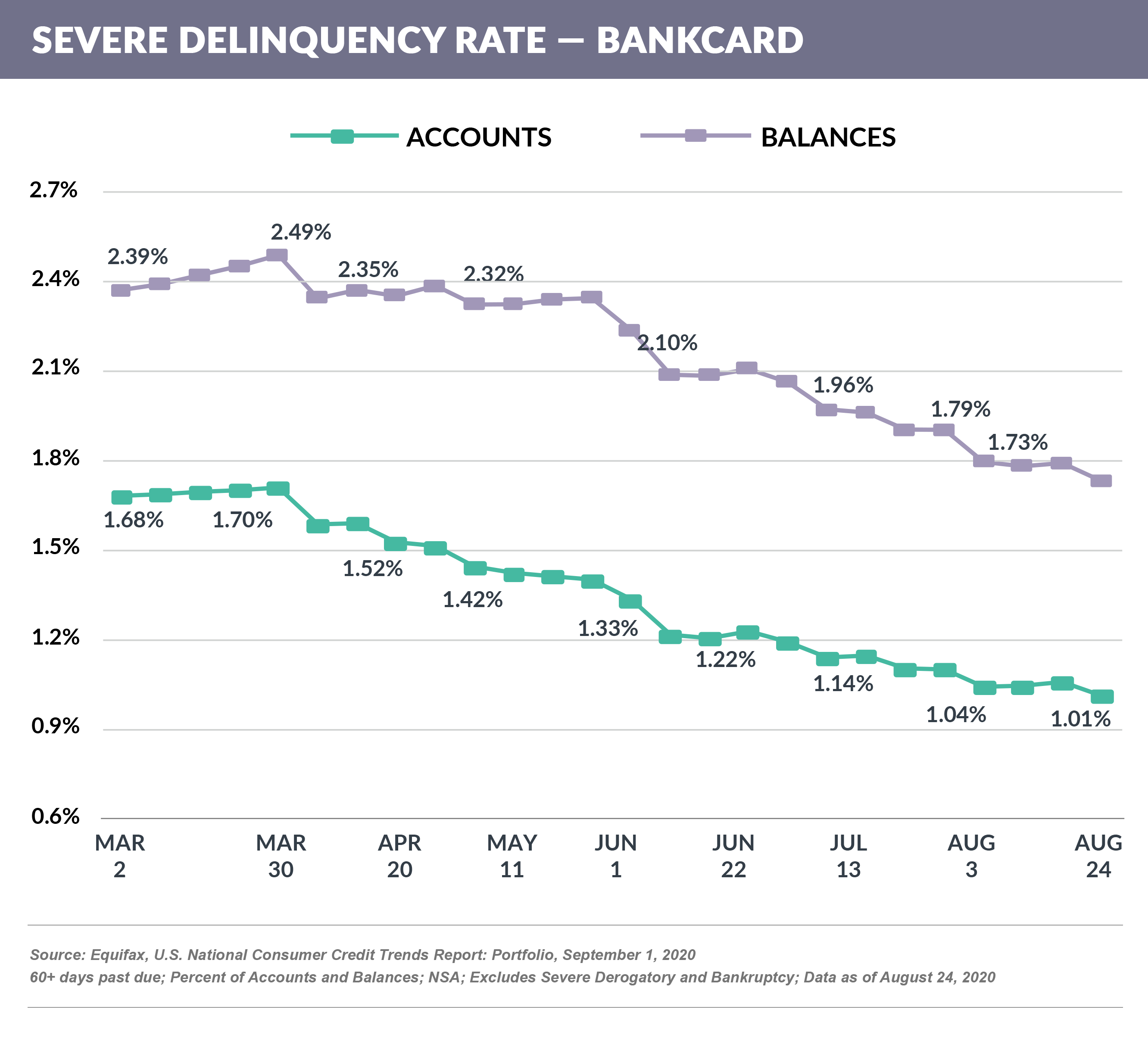

- Credit card delinquencies through the end of August continued their decline

- This is notable due to multiple factors:

- The early August end to supplemental unemployment payments

- Continued high unemployment

- The traditional seasonal upswing in delinquency rates

- Drastically lower new customer acquisition

- In the past six months, consumers have responsibly increased payment rates and avoided taking on much new debt, but the negative headwinds listed above are not going away any time soon

- How this ends up is anyone’s guess, however as one lending executive recently told us, “Asset quality is too good. I feel like I could leave the office on Friday with everything doing well, then come in Monday to the end of the world”

- Let’s hope not

Quick Takes

- Credit Suisse reports that industry executives indicate student loan originations look to finish the summer season down 15% - 20% from last year, primarily due to COVID-related uncertainty

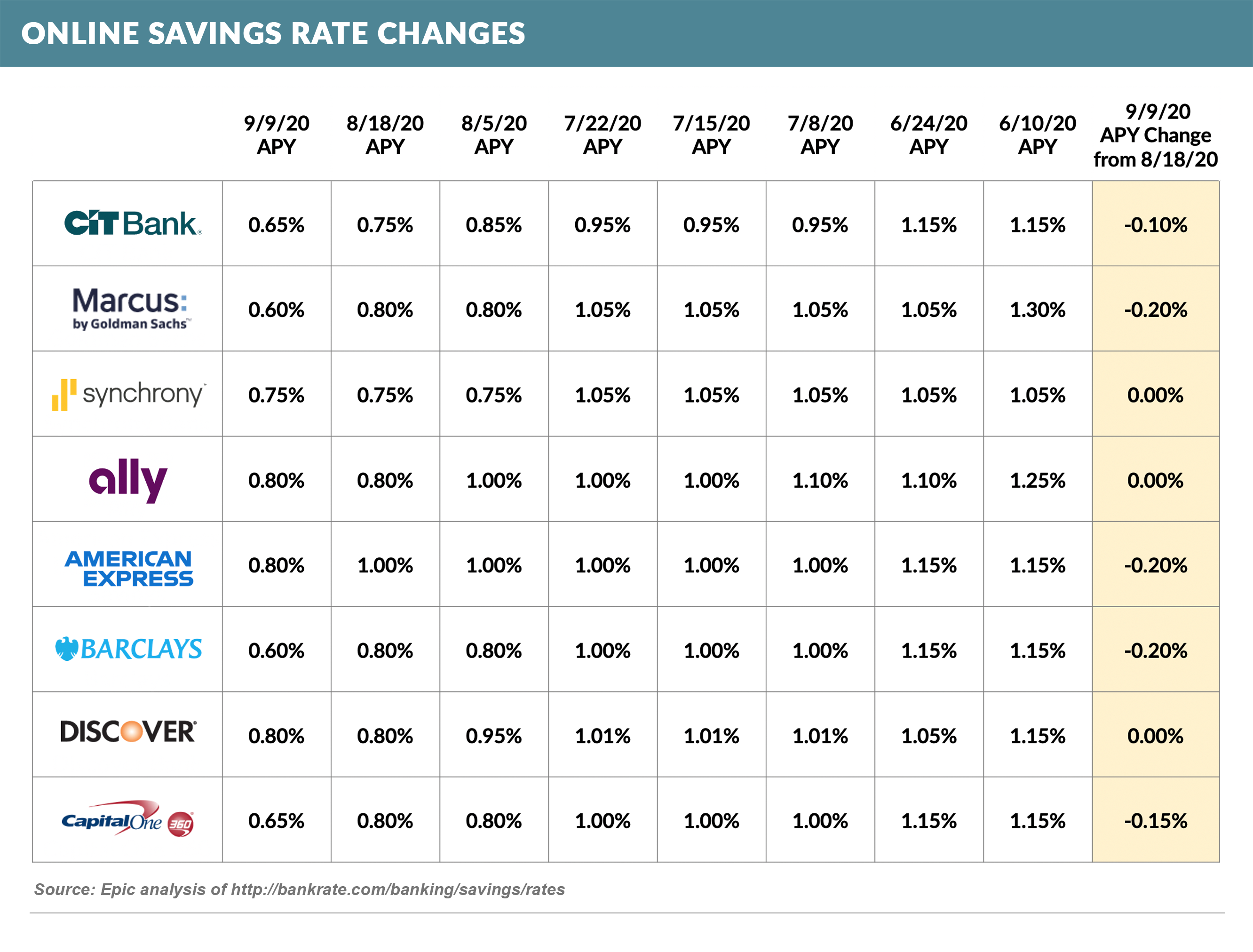

- Online savings rates continue their decline

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.