Three Things We’re Hearing

- Consumers like aggregators!

- Future credit card delinquency trends

- Direct mail delivery slows down

A three-minute read

Consumers Like Aggregators!

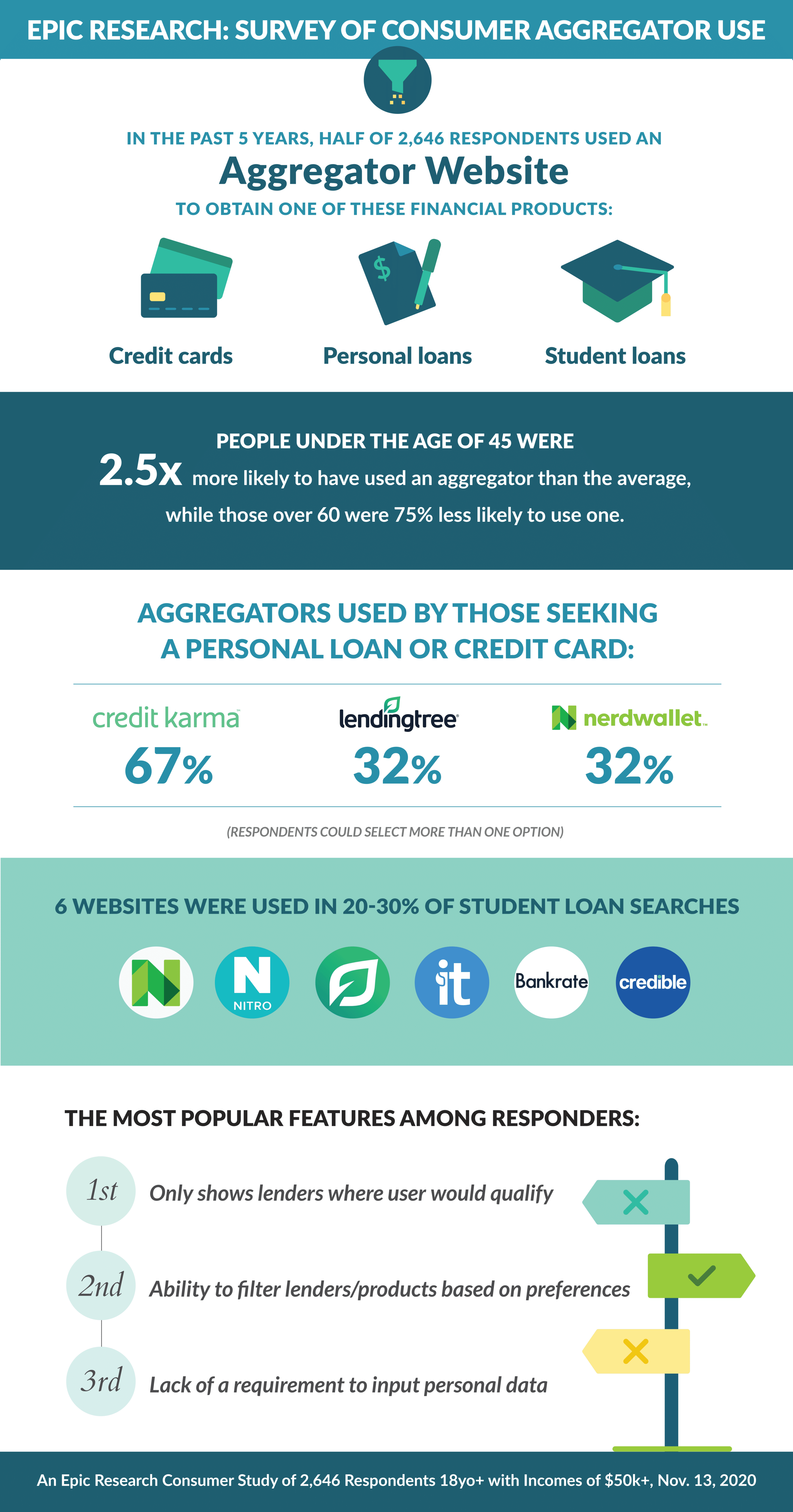

- A large number of consumers have used comparison websites (“aggregators”) to take out loans in recent years, with younger people much more likely than older to use one

- Consumers were drawn to the sites by online search and ads, as well as referrals from friends or family

- To receive the full survey results, please click here

Future Credit Card Delinquency Trends

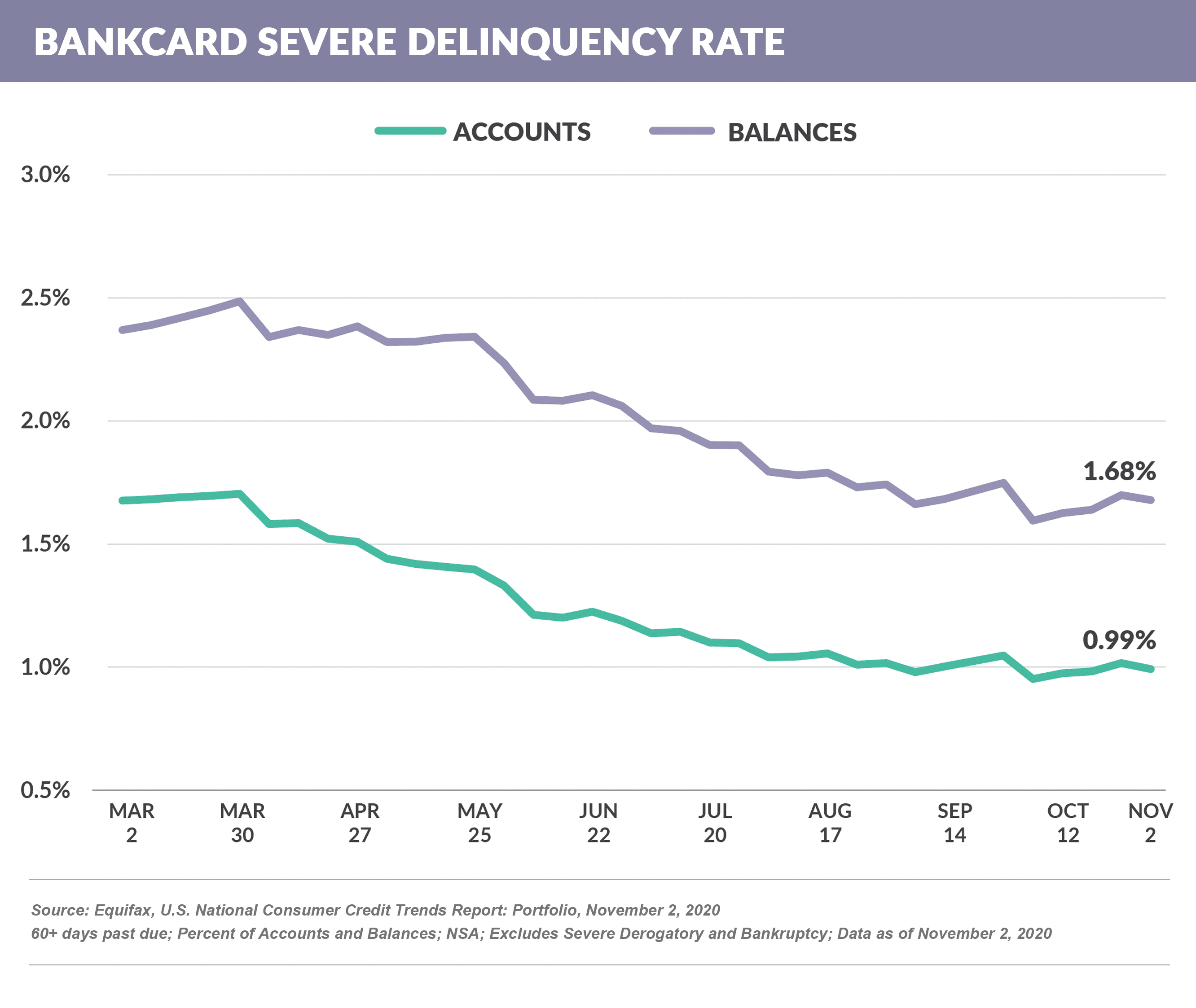

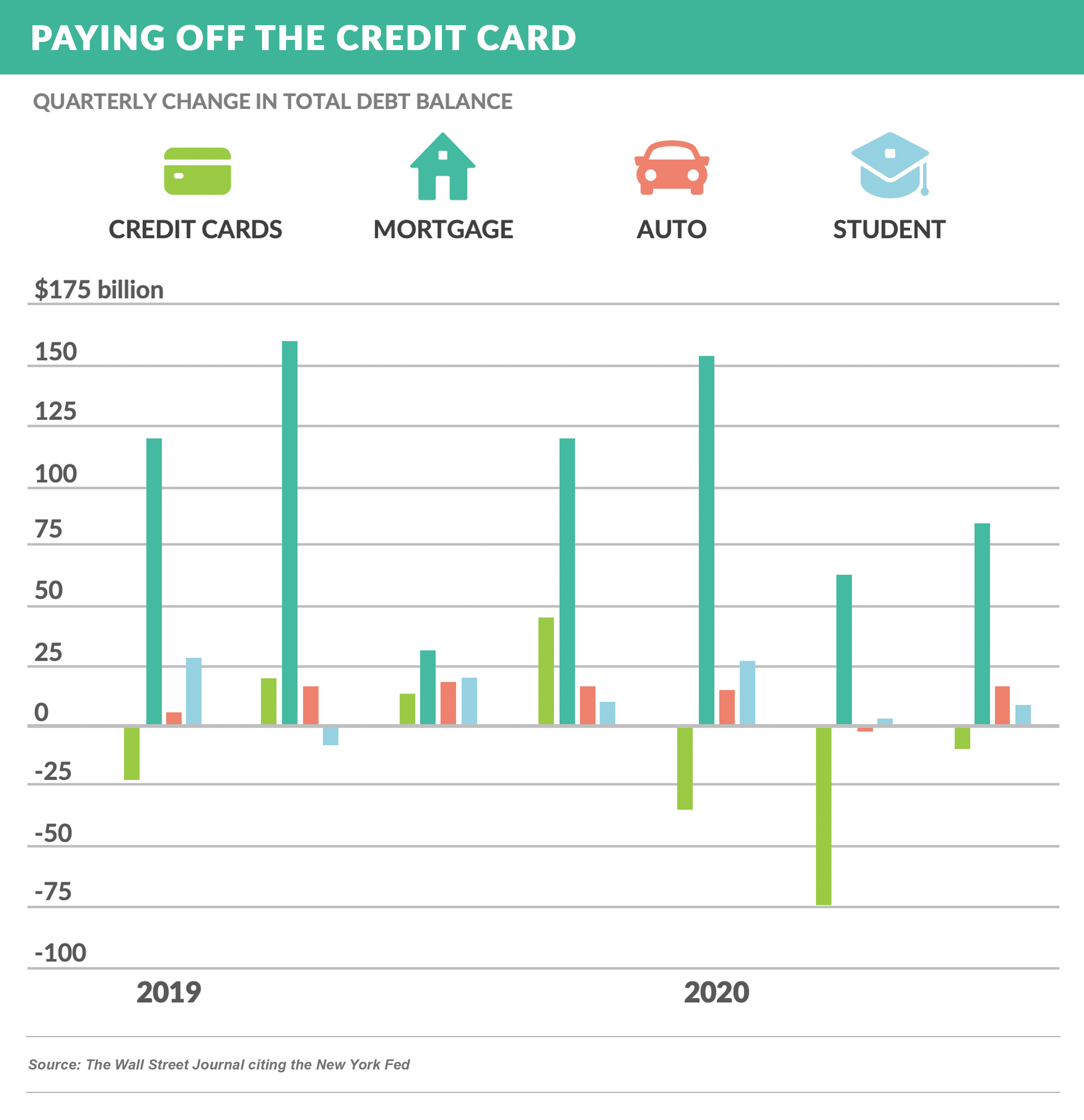

- Trends of lower credit card delinquency and losses have not changed recently, with Equifax reporting a 60+ delinquent balance rate of 1.68%, 34% lower than in February

- These record low delinquency levels come despite:

- Historic high levels of unemployment

- Typical seasonal upward trends

- 12.8% lower balances than February

- The end of some government supplemental payment programs

- The end of issuer forbearance programs

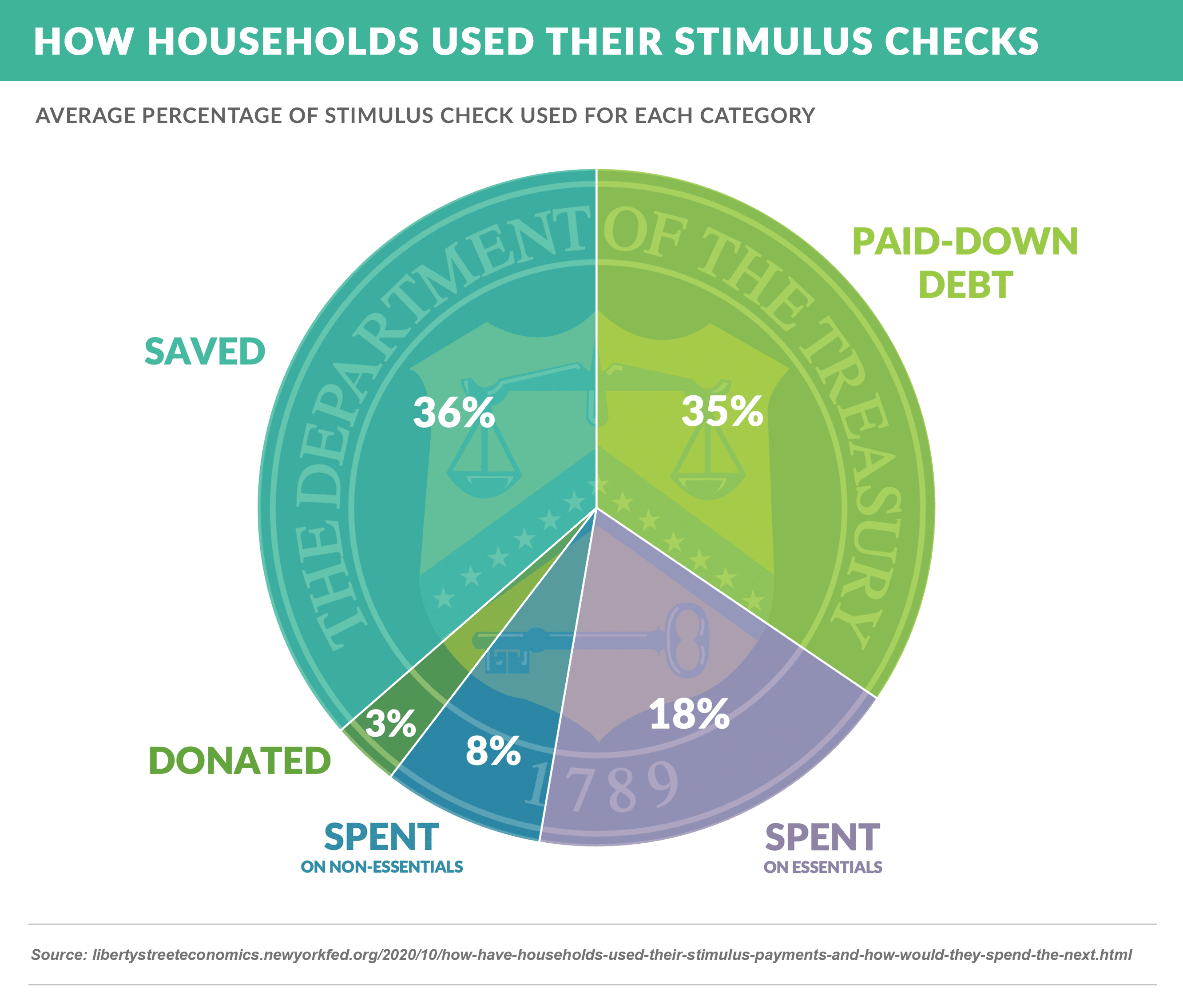

- Given that a large number of consumers used stimulus payments to pay down debt…

- …and the government payment programs have ended, the remaining question is whether the low delinquency trend will end without another stimulus package

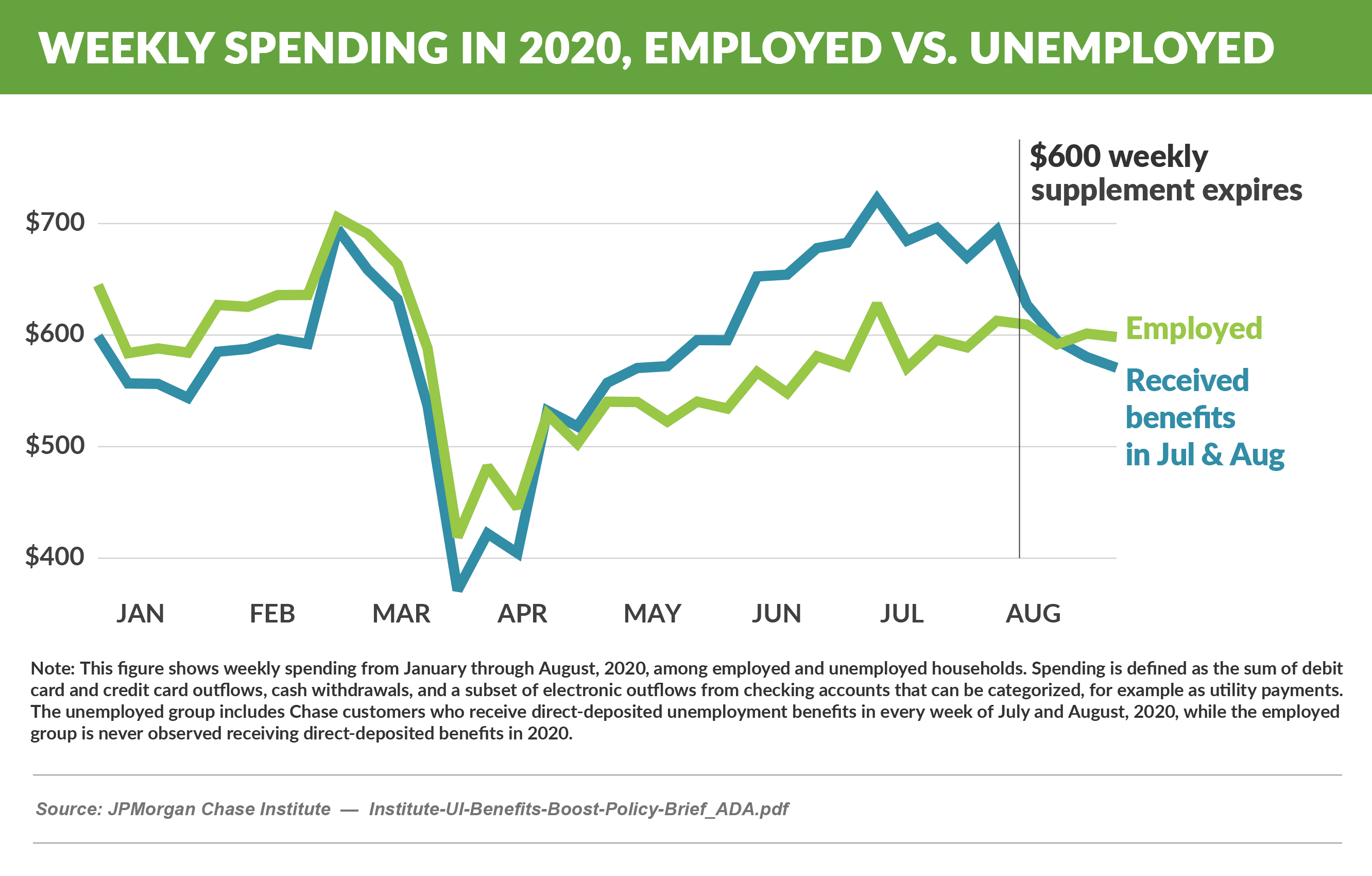

- The recent trend in spending by the unemployed shows a large drop since the expiration of supplemental unemployment benefits

- A recent policy brief published by the JPMorgan Chase & Co. Institute concluded:

- “Eventually, without further government support or significant labor market improvements, jobless workers may exhaust their accumulated savings buffer, leaving them with a choice to further cut spending or fall behind on debt or rent payments.”

Direct Mail Slows Down

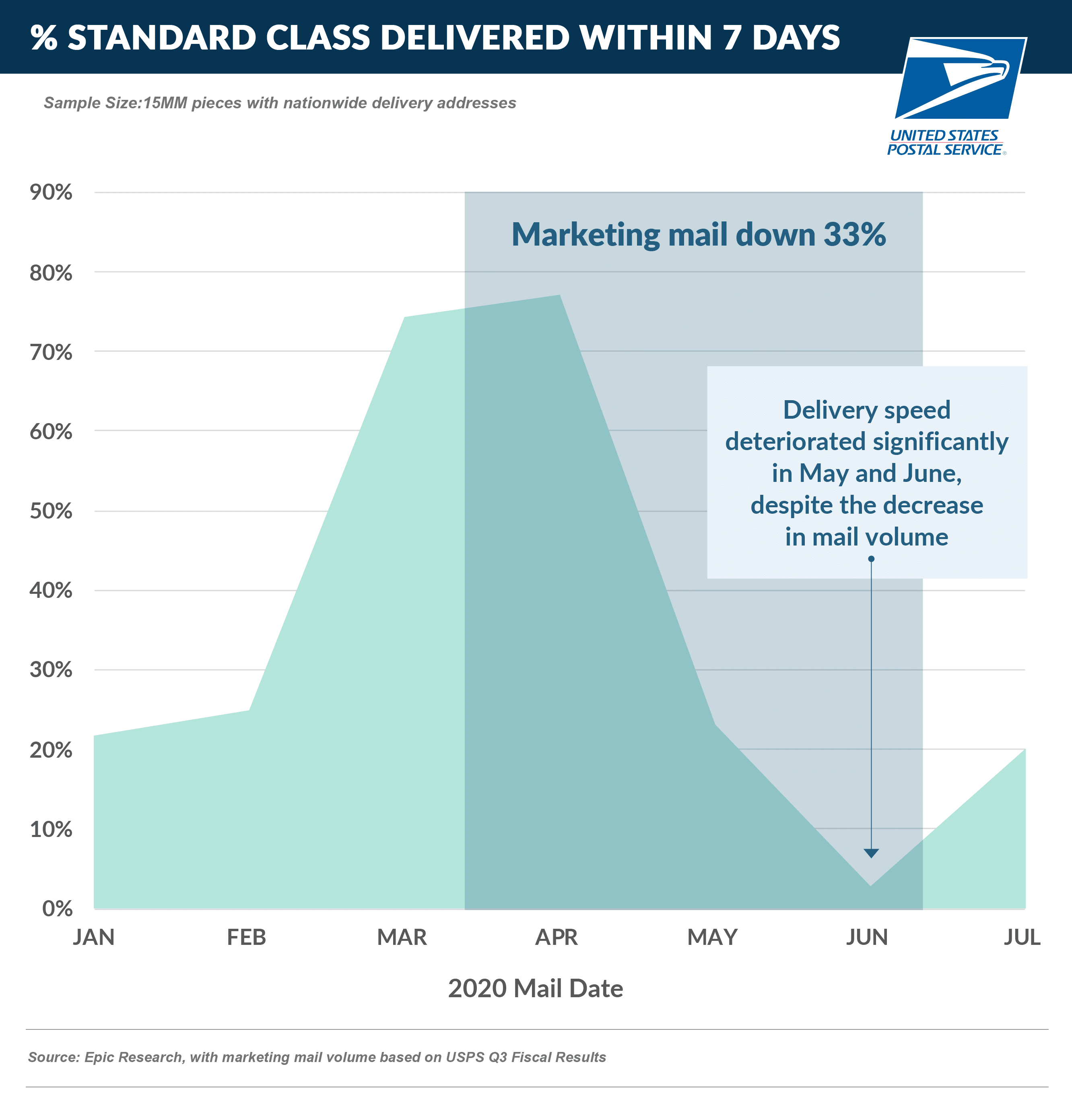

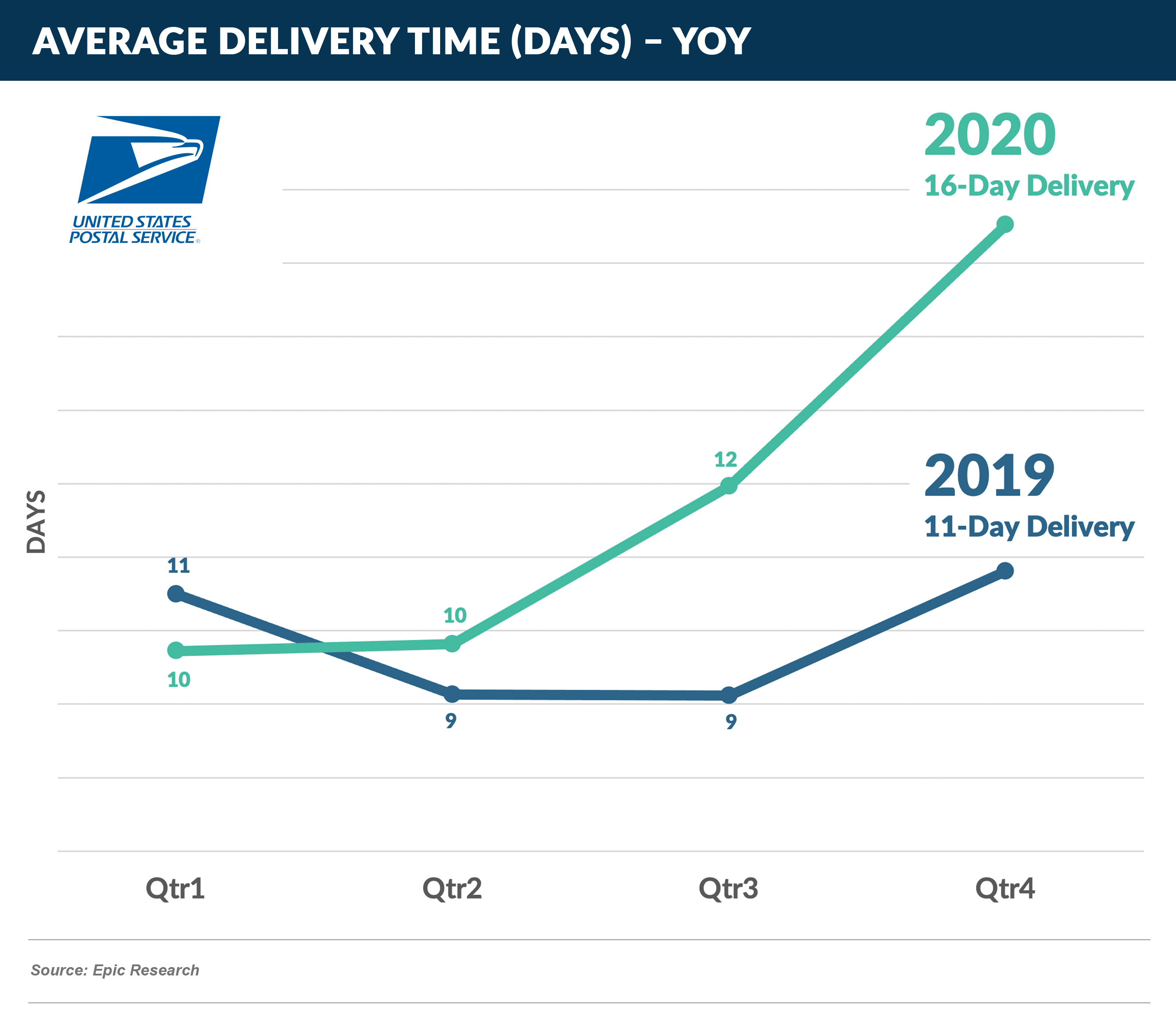

- Direct mail accounts for roughly 60% of all acquisition marketing spending in consumer financial services. We have recently commented on mail delivery delays by the USPS and their possible impact on consumer loan direct mail solicitations

- Epic recently surveyed several geographically diverse printers to gauge the actual change in mail delivery time for credit card, personal loan, and other financial product solicitations

- The results confirm delays for the USPS overall, with the average solicitation in 3Q ’20 taking three days longer to arrive in consumers’ homes than in 3Q ’19, and early Q4 showing an even worse delay of an additional five days

- Slower mail speed has historically had an adverse impact on response rates and certainly disrupts tracking of actual responses versus a historically-derived response curve

Quick Takes

- PNC is buying BBVA’s US retail bank, creating the 5th largest retail bank in the country and giving PNC a presence in 29 of the largest 30 US MSAs

- Despite the fact that consumers have been paying down credit card balances, auto loans and mortgages have seen growth

Thank you for reading.

The next Epic Report will publish in two weeks on December 5th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.