Three Things We’re Hearing

- Younger consumers more likely to switch primary banks

- Personal loan mail volume plateaus

- Large issuer card mail volume approaching pre-COVID levels

A four-minute read

Younger Consumers More Likely to Switch Their Primary Banks

- As we noted in the last Epic Report, Epic has surveyed consumers over the past year to assess their behaviors and preferences regarding financial services products, which have revealed some distinct patterns and key differences between younger consumers (those 18-44 years old) and older consumers (age 45+)

- We last reported on how these differences impact credit card and personal loan choices

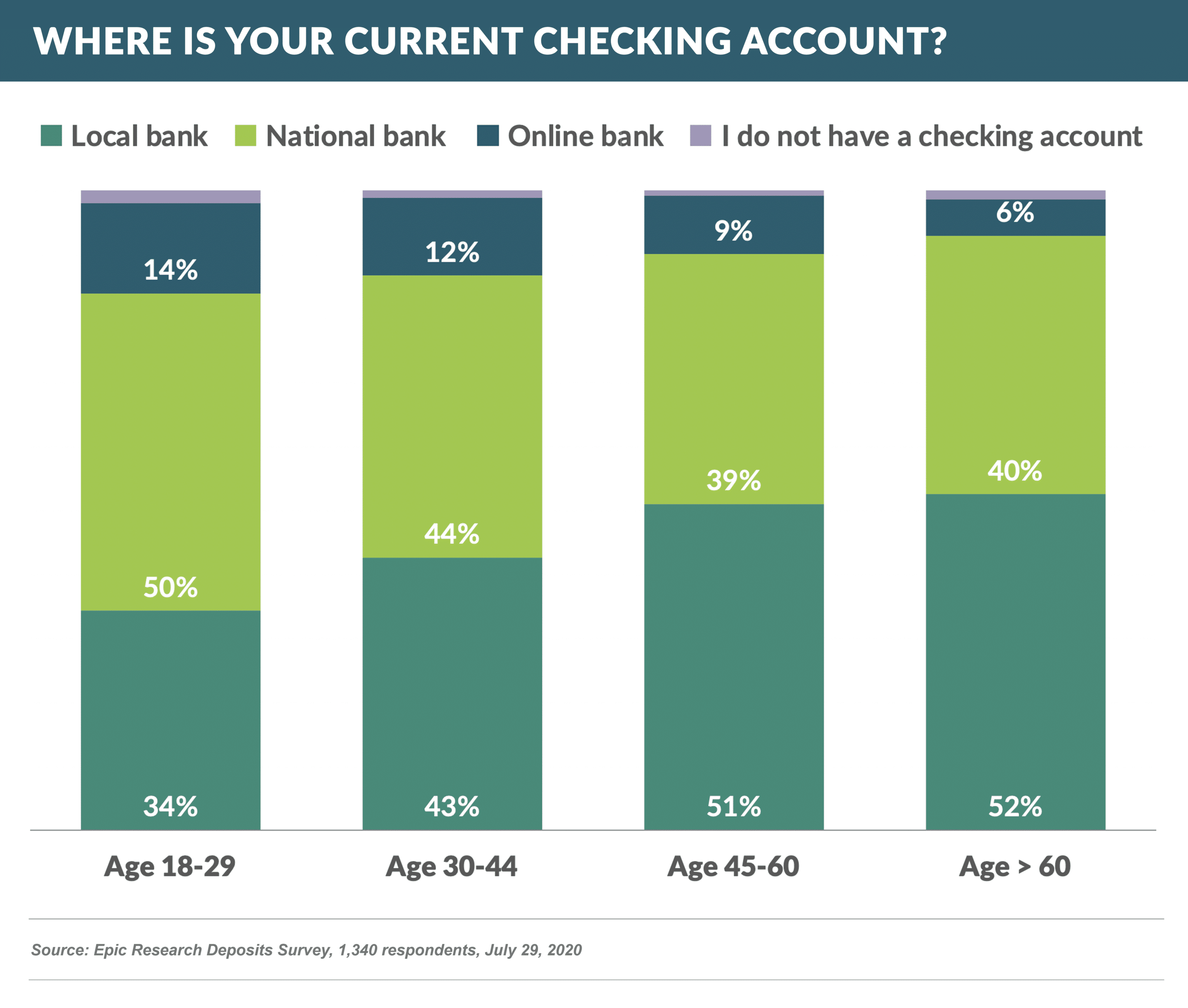

- Younger consumers were also most likely to have their checking accounts with “national banks” (e.g., Chase, Citi, Bank of America, Wells Fargo) or “online banks”, while older consumers were most likely to have their accounts with “local banks”

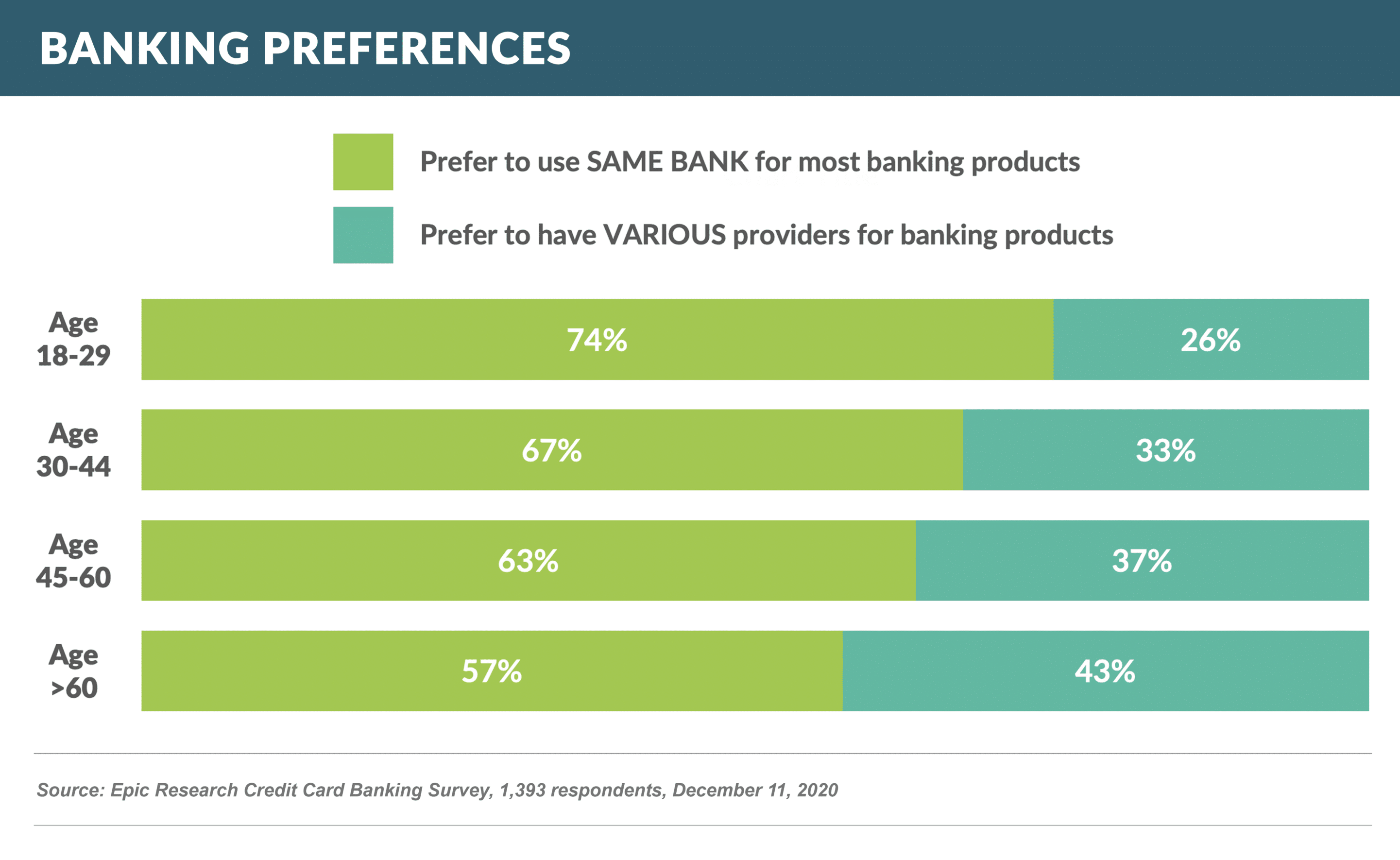

- As we previously shared, younger consumers are also more likely to prefer having all of their financial products at one bank

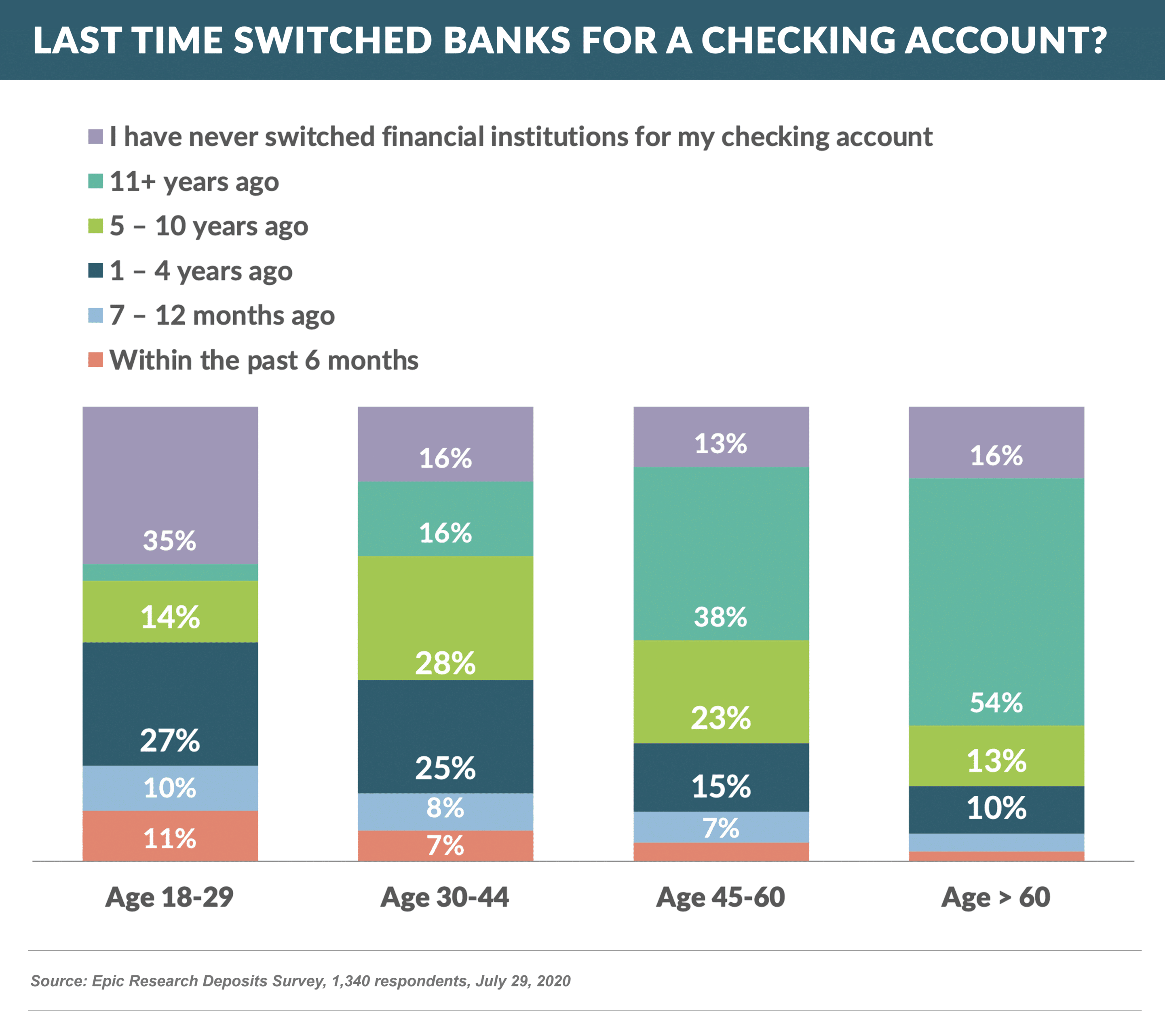

- Checking account relationships are historically very “sticky”, however younger consumers reported switching banks more recently: 44% of 18-44 year olds had switched banks in the past four years while only 20% of those 45+ had

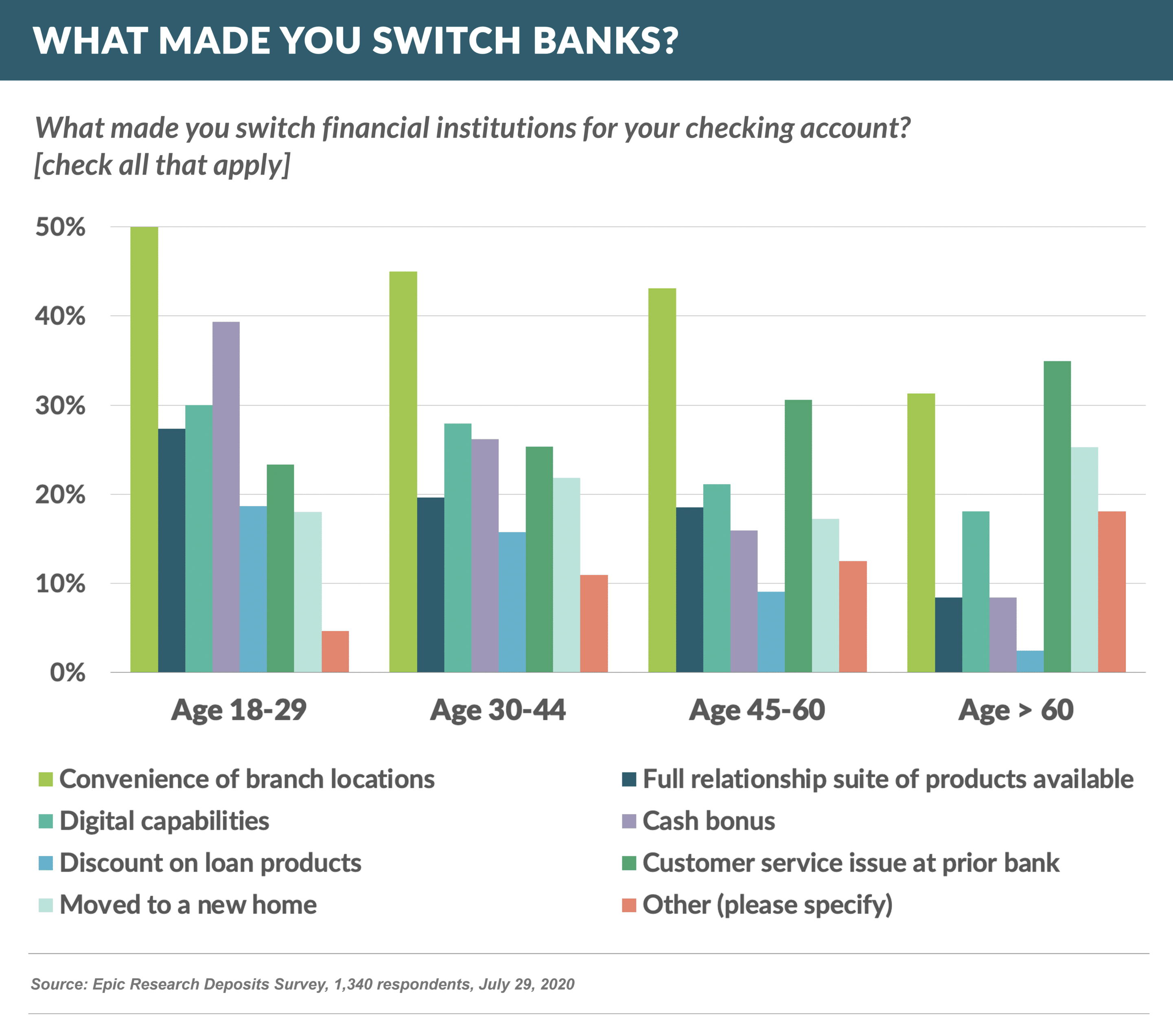

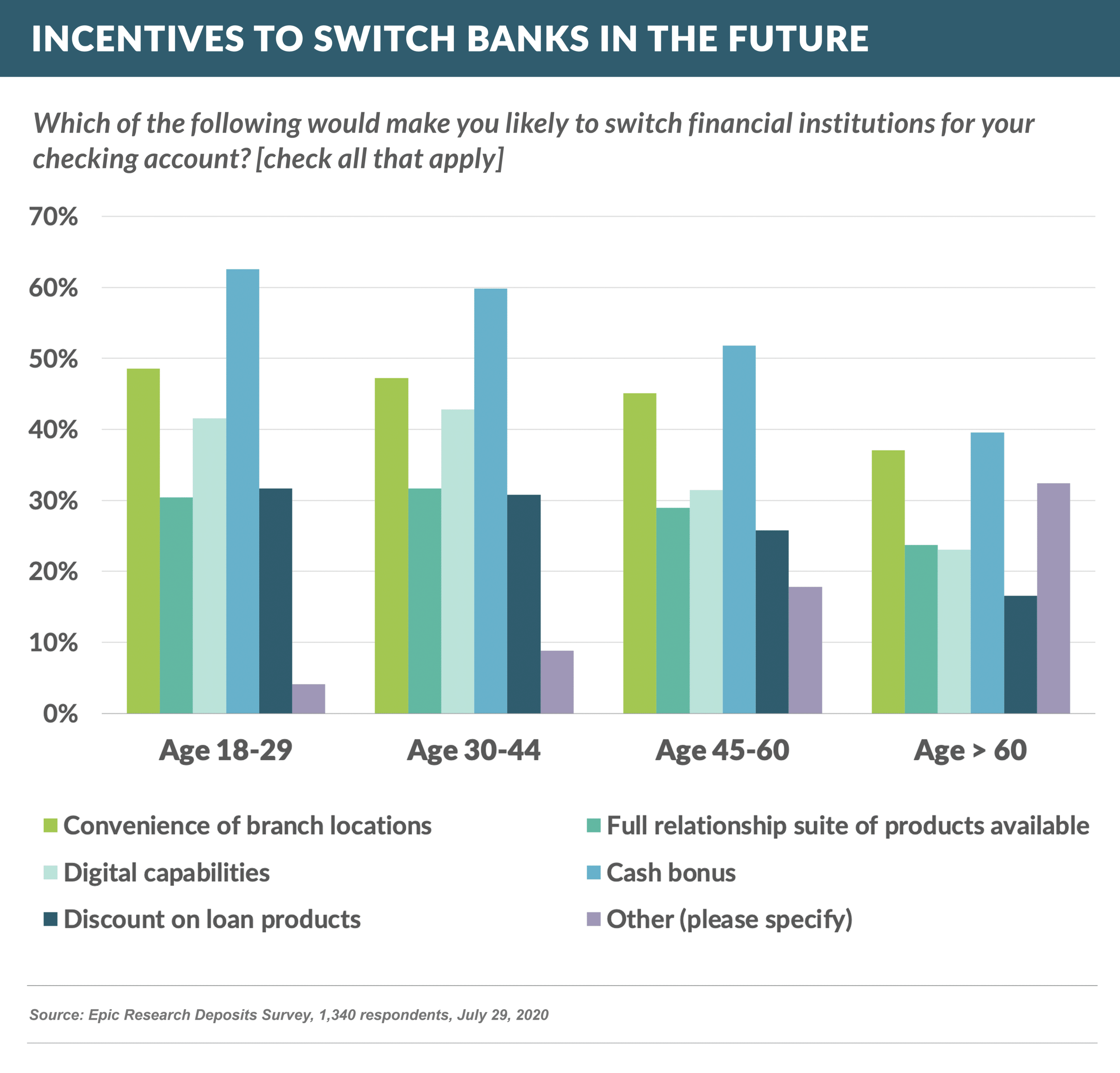

- For those who had recently switched banks, branch convenience was a large driver among all age groups, but younger consumers were more driven by cash bonuses than older consumers and were less swayed by customer service issues

- Although most consumers among all age groups cited “cash bonus” as the factor that would make them likely to switch banks in the future, it was selected most by younger consumers, who also favored “digital capabilities”

- Older consumers disproportionately selected “other”, often explaining that they would not switch banks for any reason

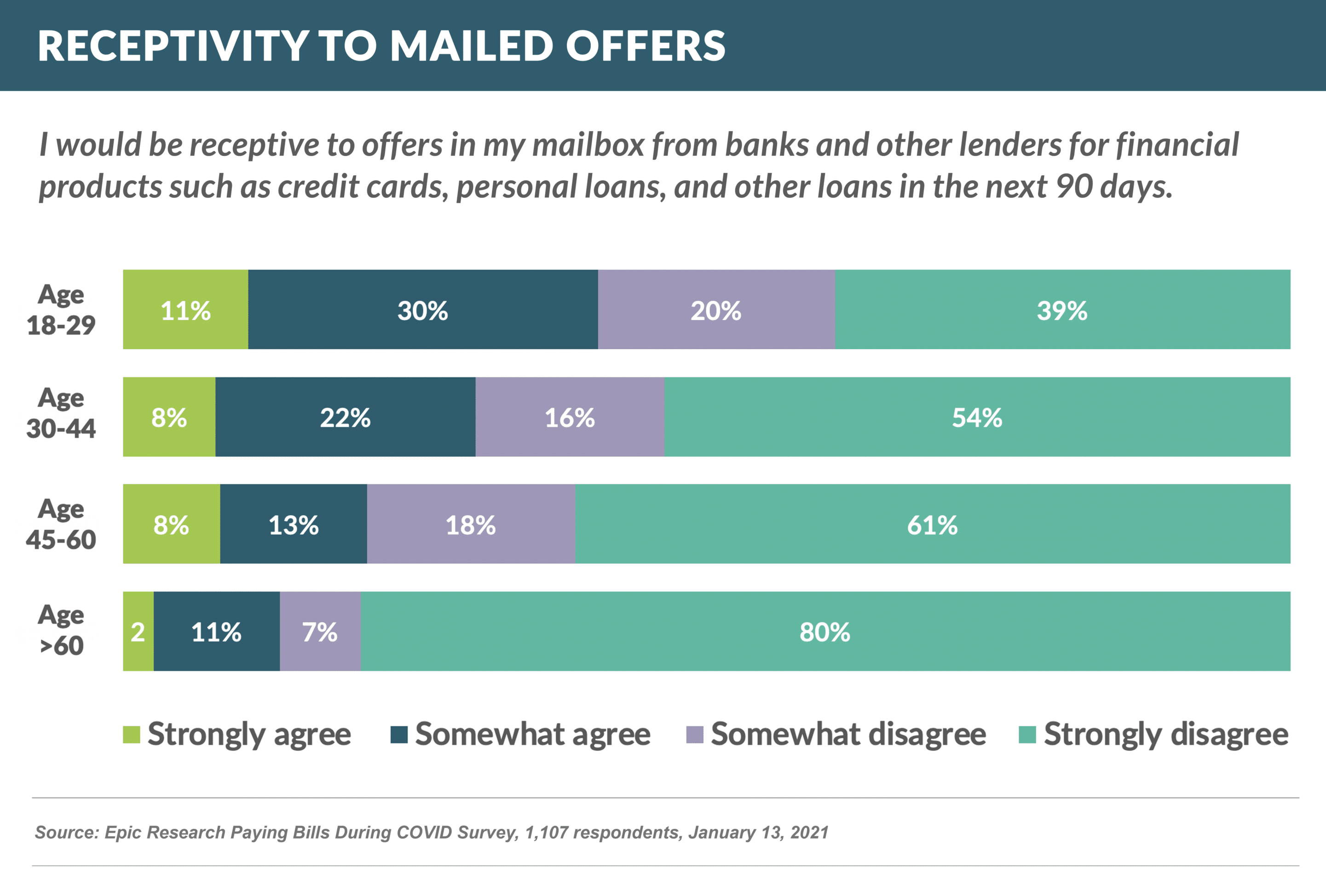

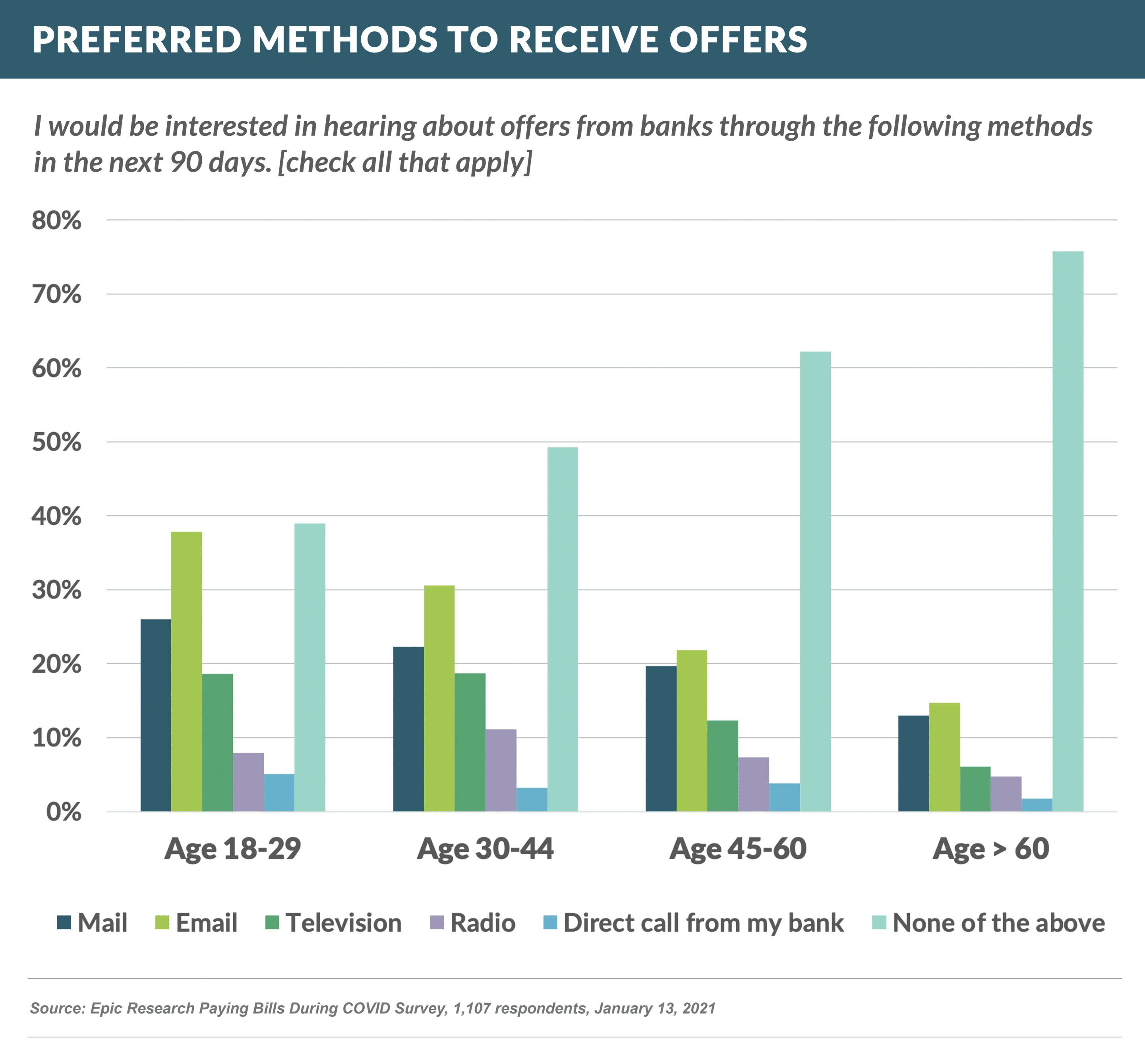

- Once again disproving the conventional wisdom that direct mail is on the way out, younger consumers are twice as likely to be receptive to mailed offers for financial products

- However, when given the option, all consumers – including younger ones – expressed a greater interest in receiving offers via email

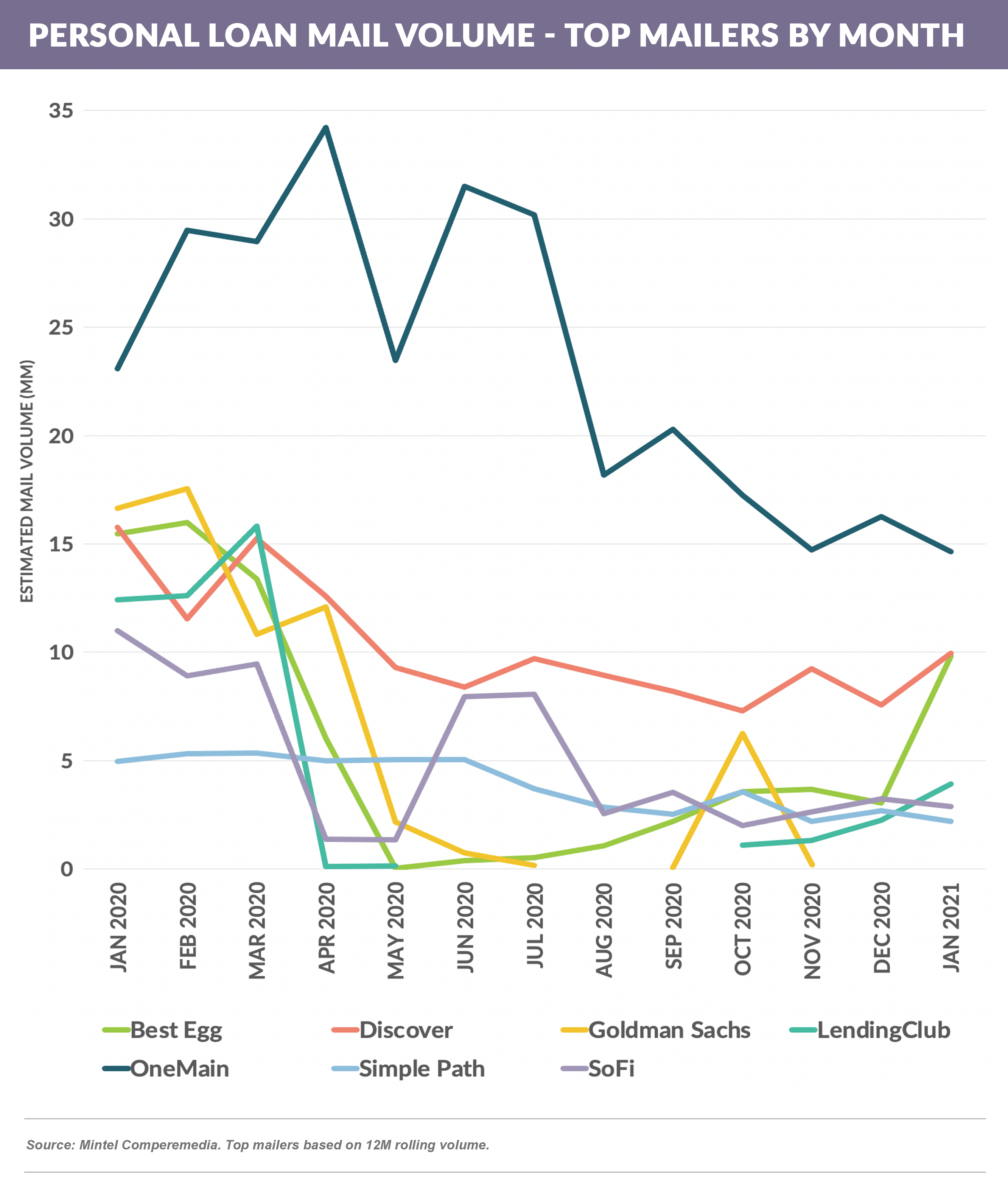

Personal Loan Mail Volume Plateaus

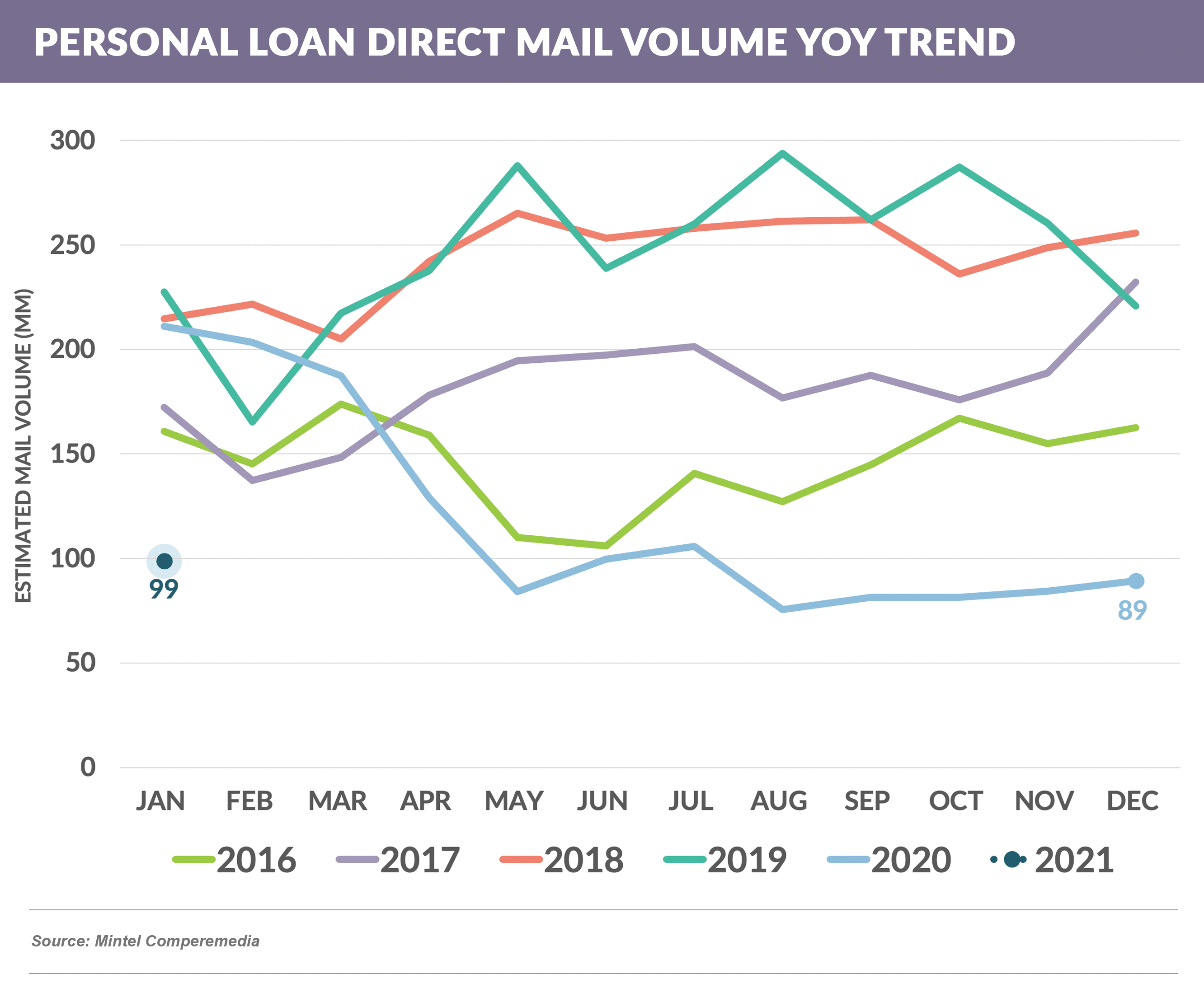

- Personal loan direct mail volume has remained flat in the past ten months, at a level of 40%-50% of the pre-COVID numbers

- While the drop has been seen across most issuers, there are some interesting patterns

- OneMain has steadily been by far the largest mailer, despite lowering its mail volume by half

- Discover consistently ranks as the second largest mailer, but is only down around a third from last January/February’s numbers

- Best Egg retreated from being a dominant mailer, but ramped up significantly in January to tie Discover for second

- One-time top mailer Goldman Sachs has all but eliminated direct mail since April

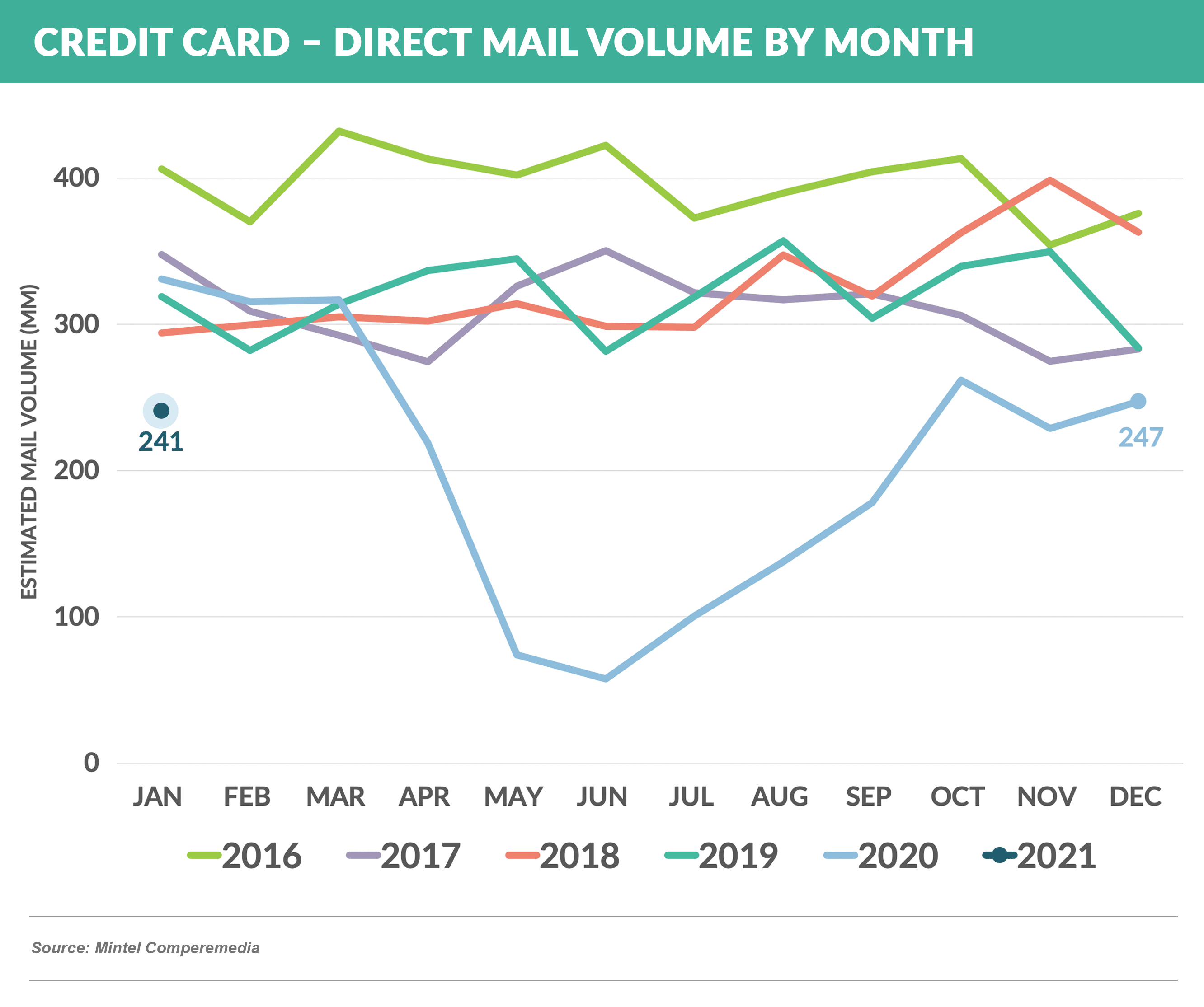

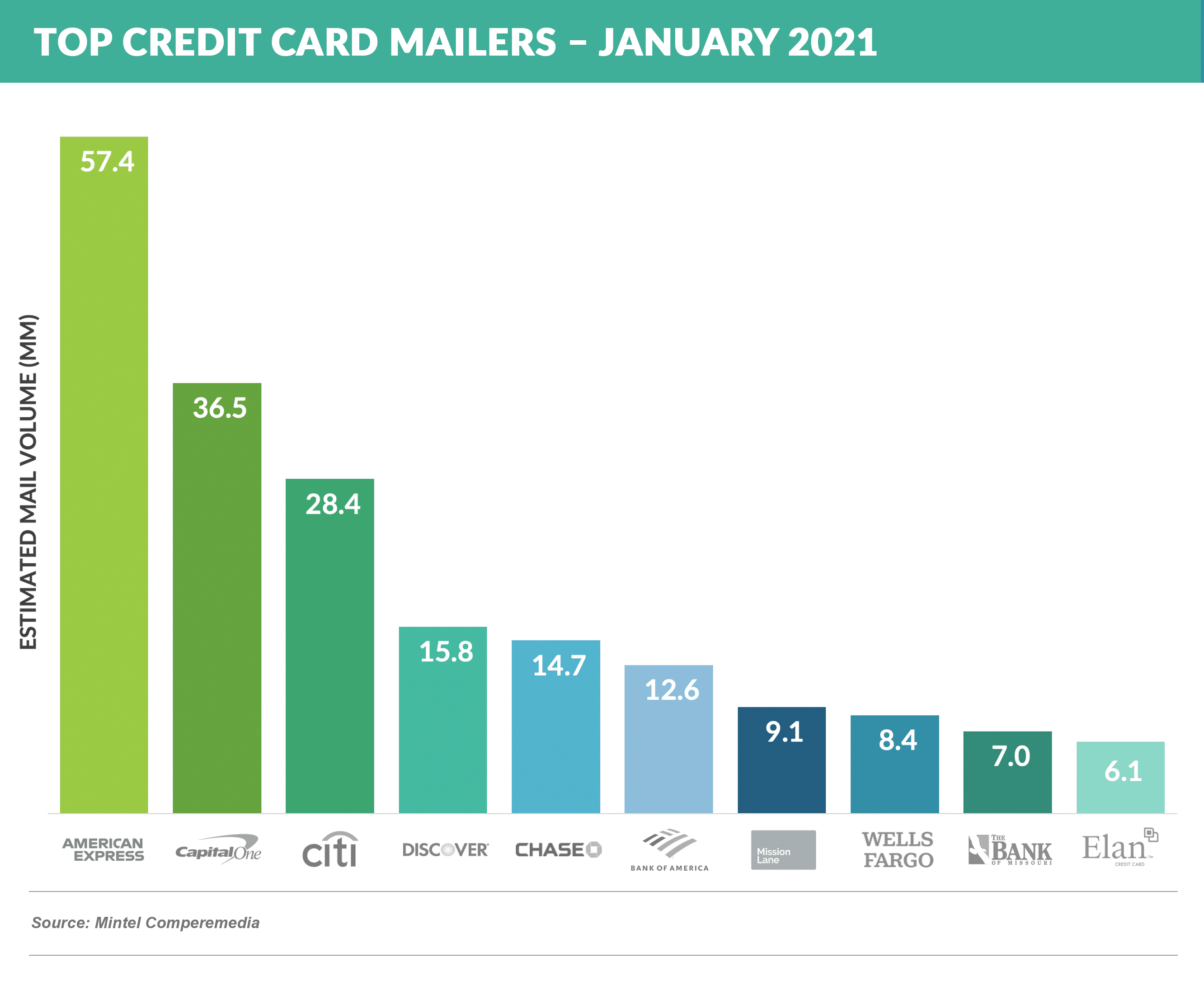

Large Issuer Card Mail Volume Approaching Pre-COVID Levels

- Credit card mail volume has rebounded more than personal loan volume, but has plateaued in the past four months at a level around 70% of pre-COVID volumes

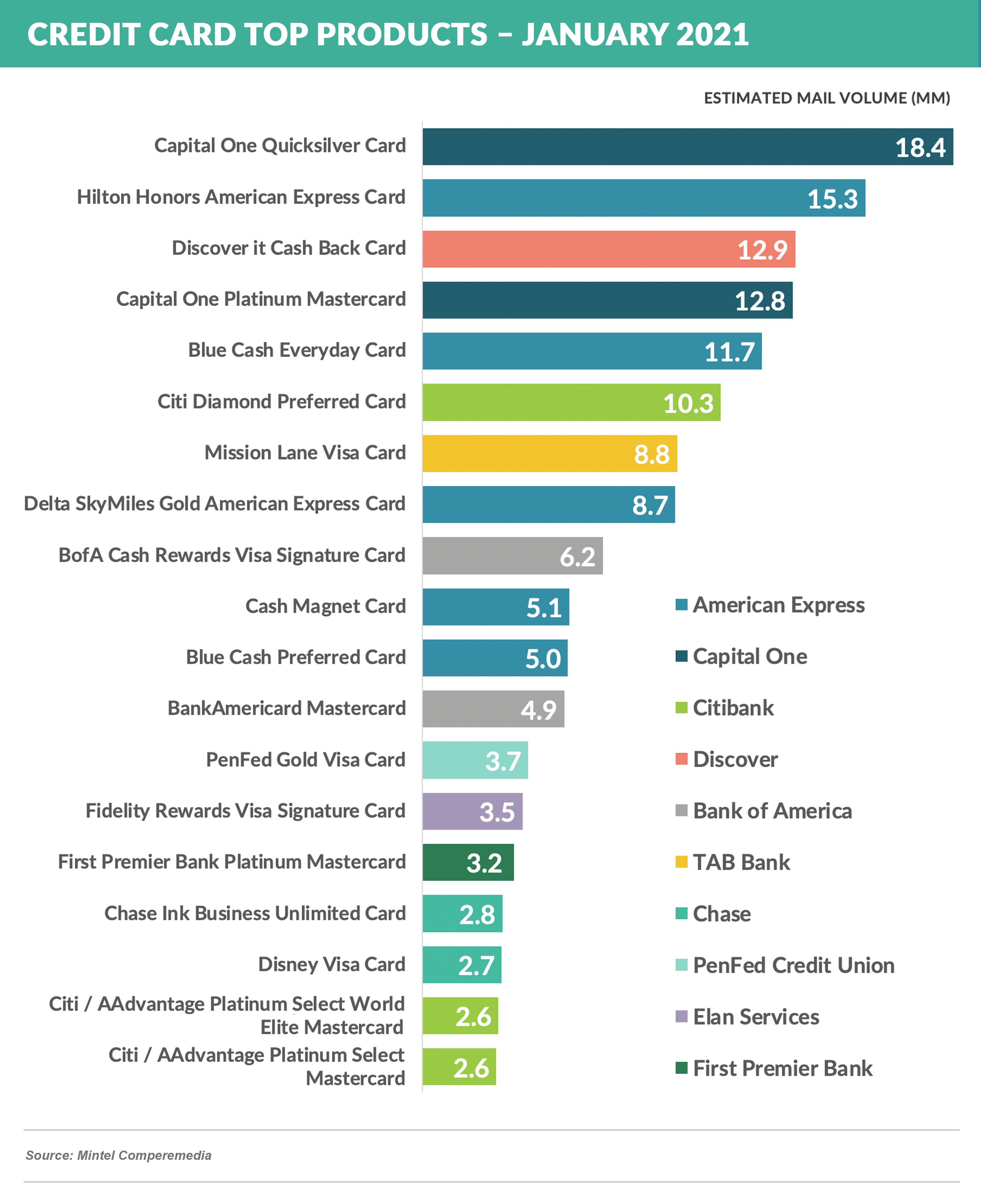

- American Express has led the way since last August, far outpacing number two Capital One, with other large scale issuers Citibank, Discover, Chase, and Bank of America having increased their activity since Fall

- Cash back cards continue to be popular, however a few travel co-brands have entered the list, led by the Amex Hilton Honors card that was joined by lower volume offerings from Delta SkyMiles, Disney, and AAdvantage

- Direct mail continues to drive 60%+ of new customer acquisition in both credit cards and personal loans

Quick Takes

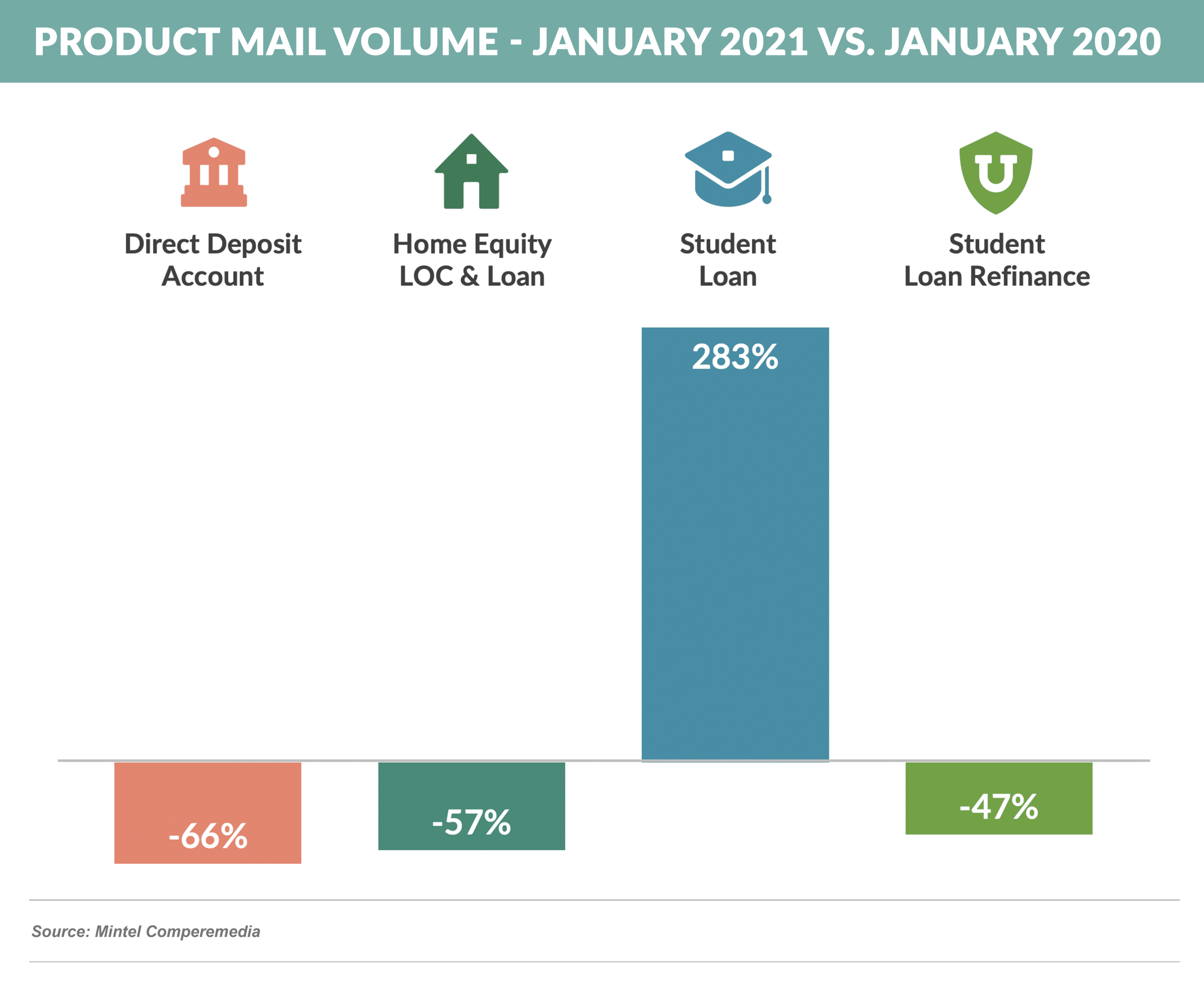

- Other January ’21 mail volumes remain significantly lower than January ’20, except for student lending, which was driven by a large increase in mail by Discover

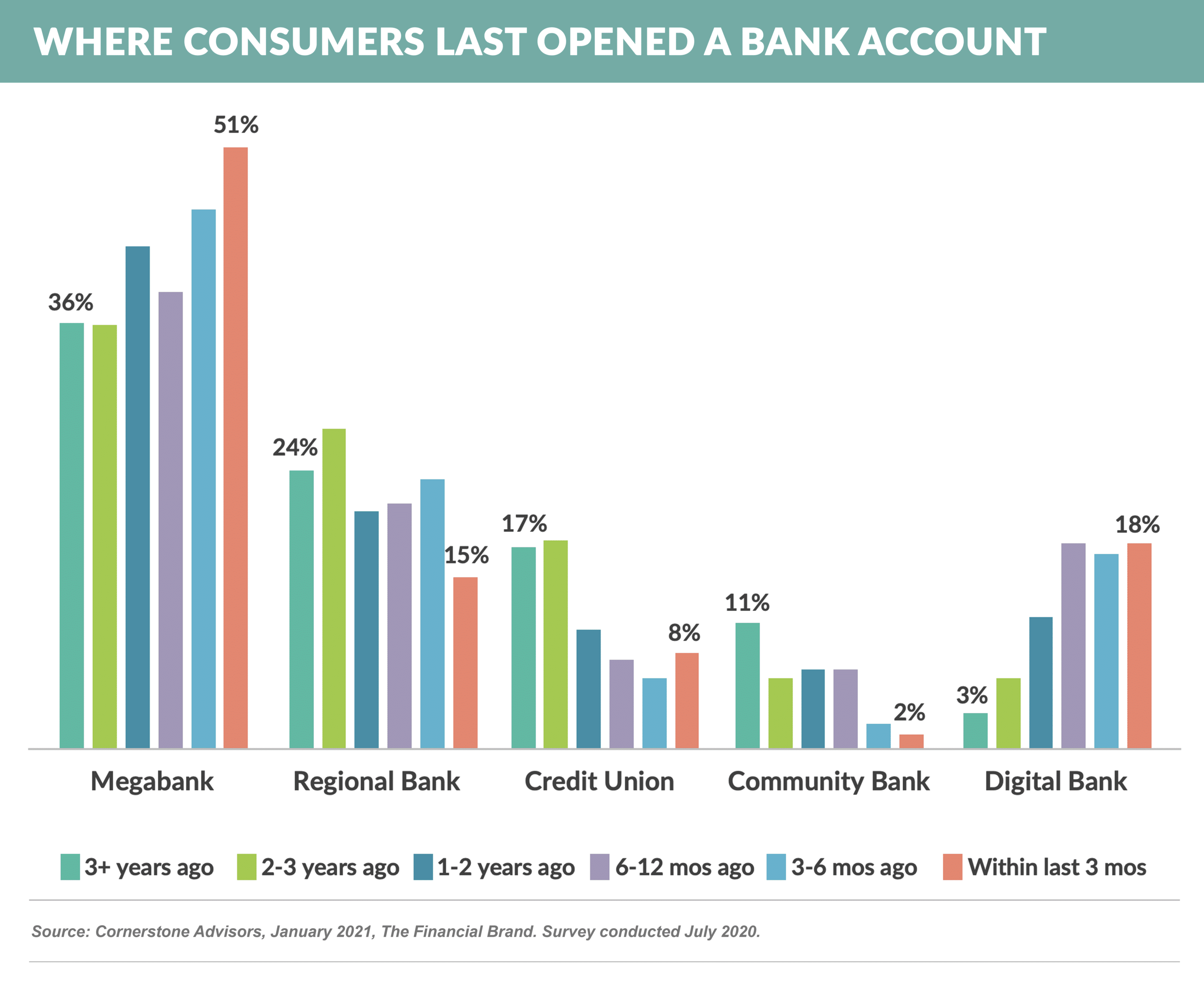

- Related to our banking research above, Cornerstone Advisors recently detailed survey findings showing a growing trend of all consumers opening new banking relationships at “megabanks” and “online banks”, with almost 70% of those who have opened a new bank account in the past three months having done so at a bank in one of those two categories – up from 39% three years ago

- Given a slow growth environment in card portfolios due to less marketing and high consumer payment rates, some issuers countered by revving up credit line increase programs to credit-worthy customers who have continued to use their cards

Thank you for reading.

The next Epic Report will publish on March 20th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.