Four Things We’re Hearing

- Financial services ad spending rebounds

- Visa and Mastercard issuers shrink in 2020

- Millennials bank just like us

- Cash-back credit cards are in vogue

A two-minute read

Financial Services Ad Spending Rebounds

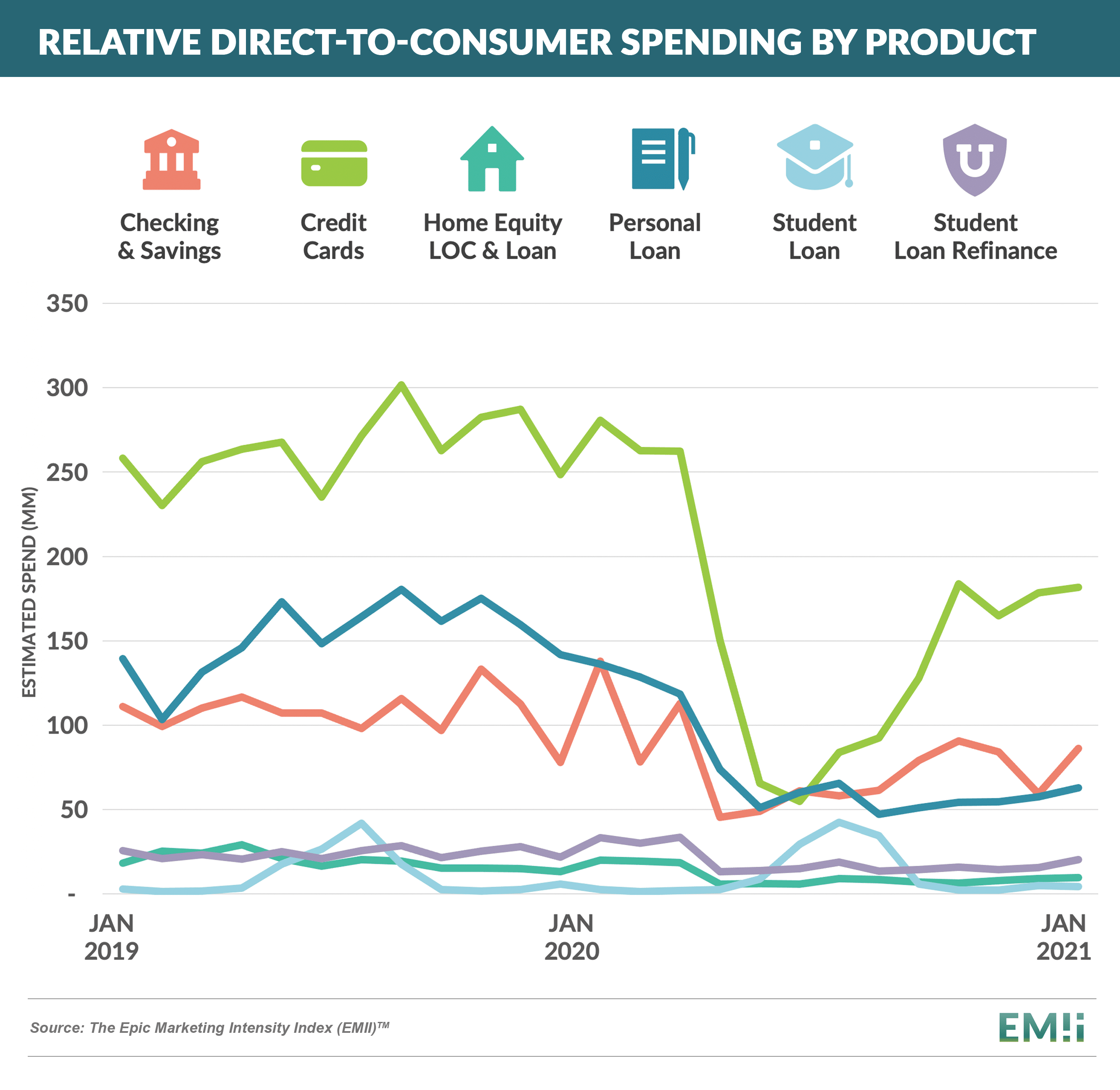

- Financial services ad spending in all channels (digital, direct mail, paid search) has rebounded since the sharp drop in April 2020

- Spending on credit card and checking has recovered to levels 70 – 80% of previous peaks, while personal loan spending has remained depressed

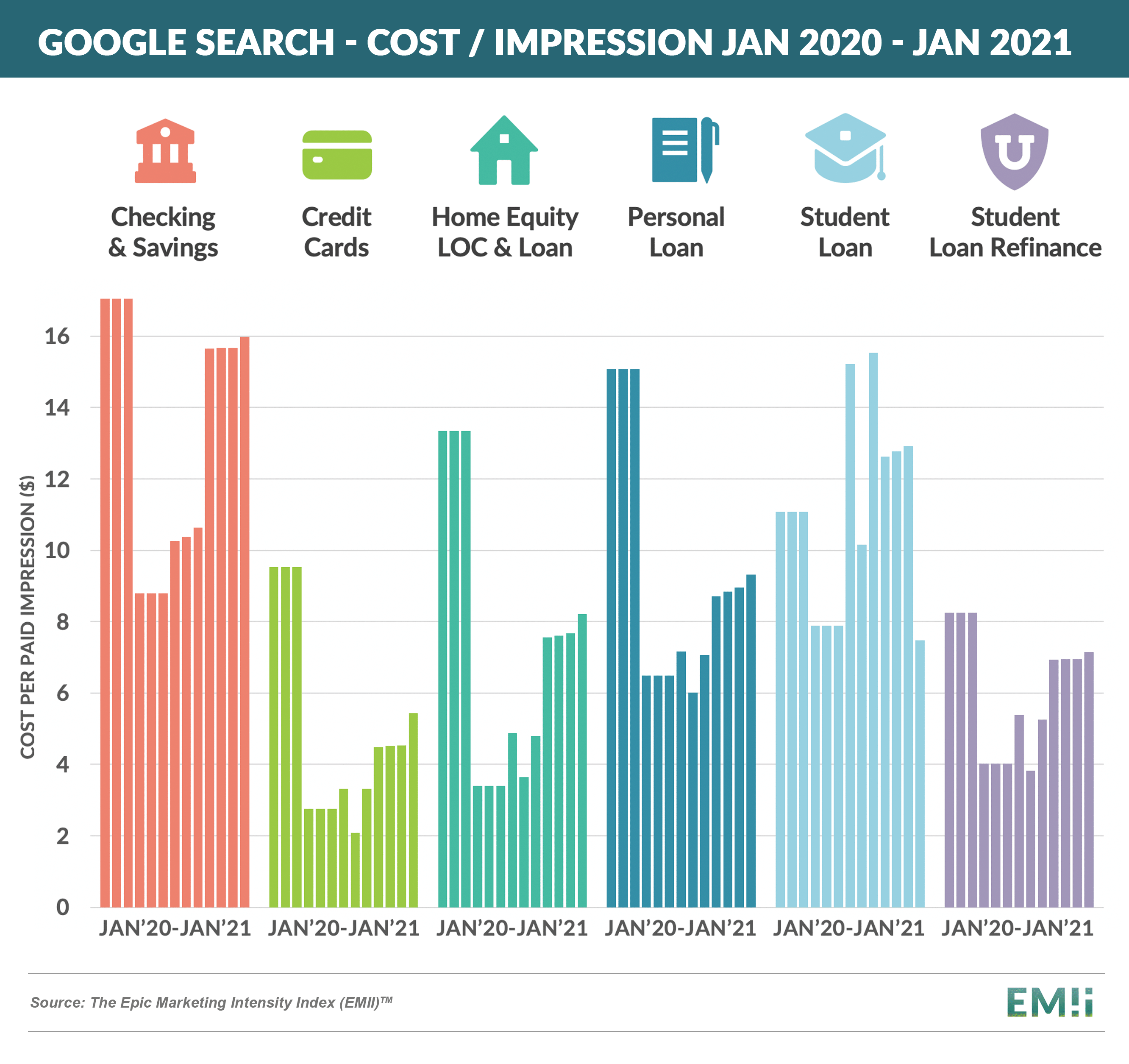

- Keyword search costs have recovered for checking/savings faster than other products, with the exception of student loans, which was the least affected of any product in 2020

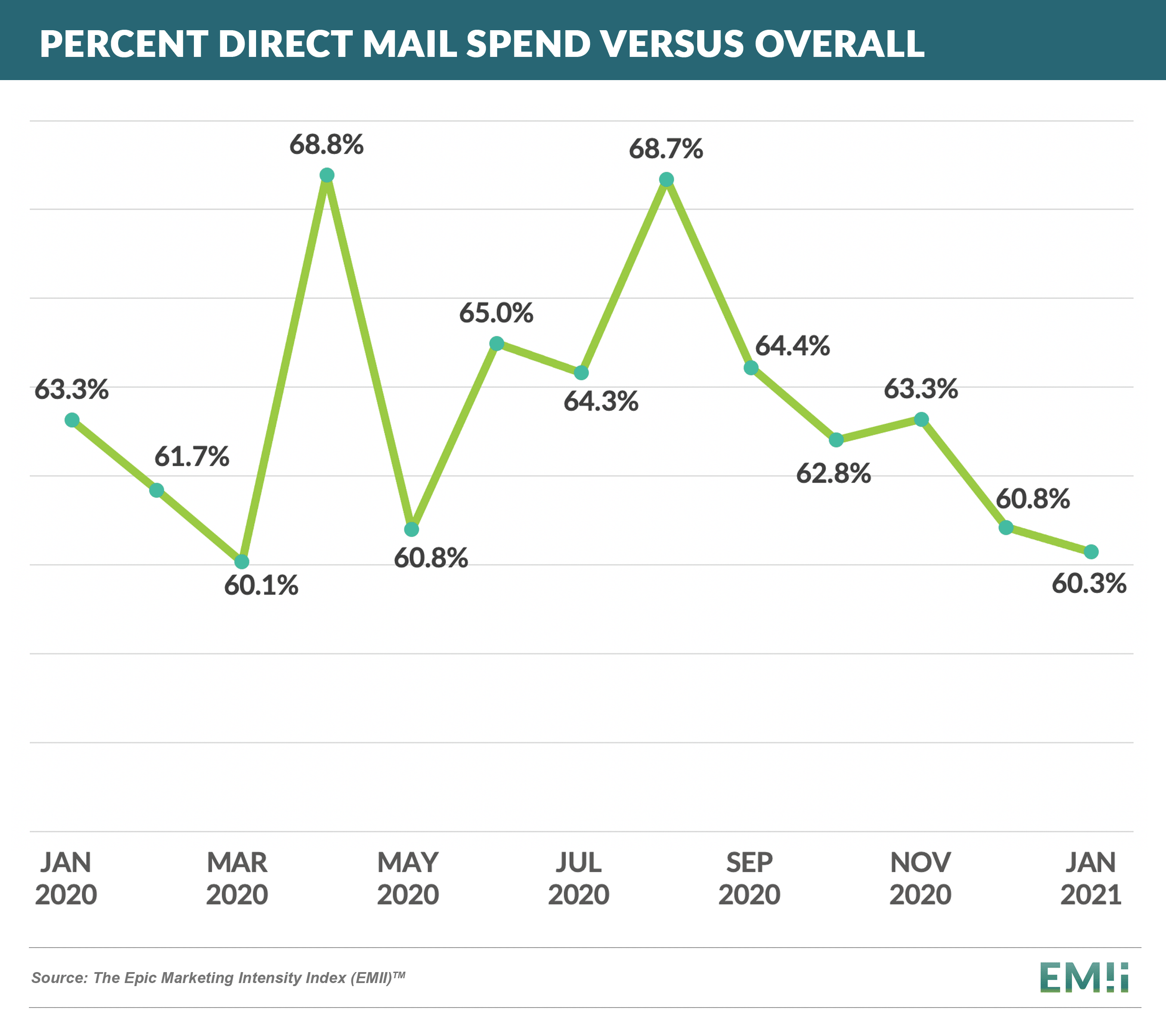

- Direct mail remains the dominant channel of marketing spend for new customer acquisition for all products, despite dropping slightly in the fourth quarter

Visa and Mastercard Issuers Shrink in 2020

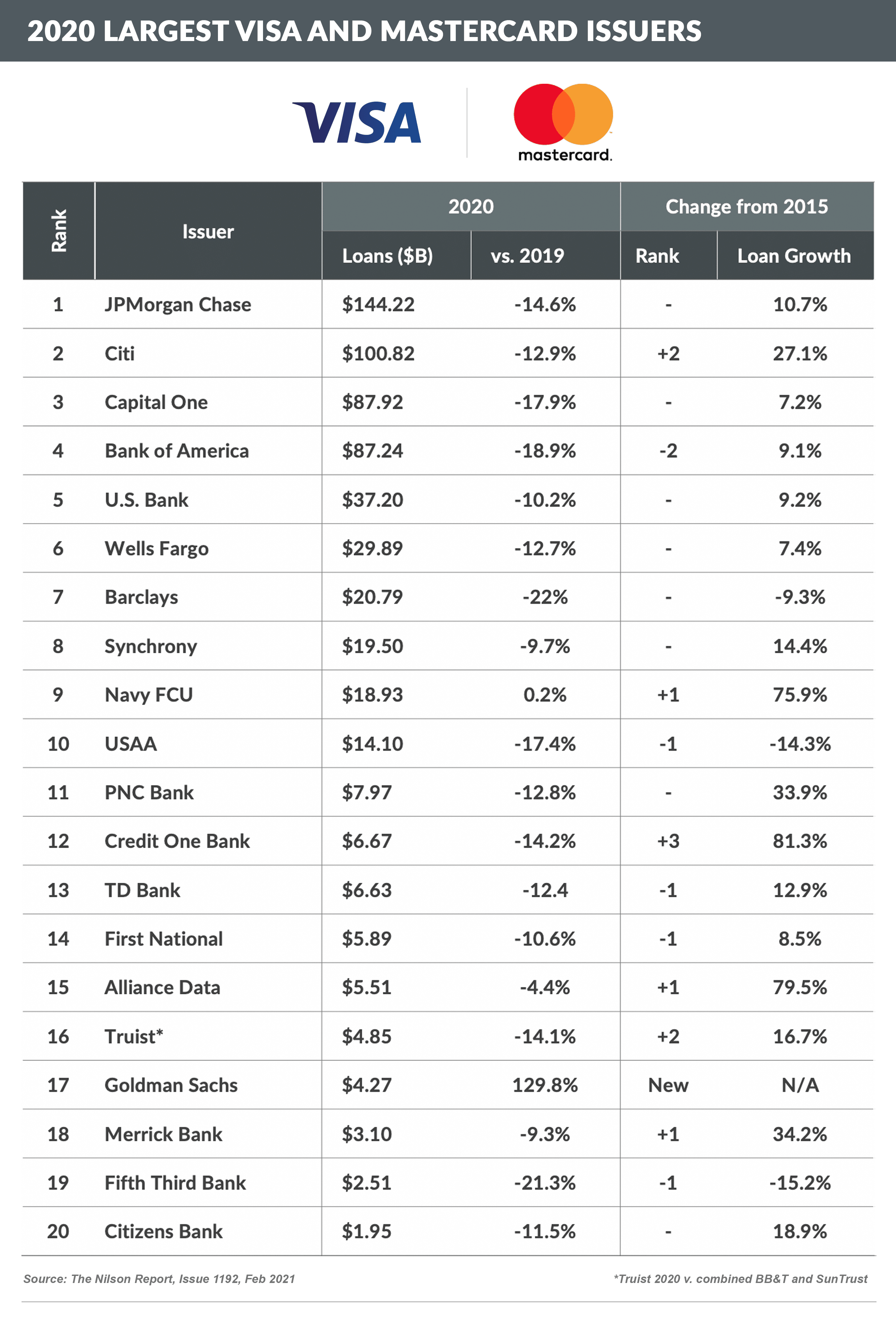

- 2020 rankings of Visa and Mastercard issuers reflect the pandemic-related shrinkage of card portfolios, with all issuers except Navy FCU and Goldman Sachs showing lower receivables than in 2019

- There has been little movement in the rankings in the past five years, though some issuers have posted significant gains:

- Citi (+27.1%) was the fastest growing large issuer during the period, fueled in part by taking over the Costco and L.L.Bean cobrand programs

- Credit One (+81.3%), Alliance Data (+79.5%), Navy Federal Credit Union (+75.9%), and Merrick Bank (+34.2%) were the other notable fast-growing portfolios

- Goldman Sachs reached the top 20 following its 2015 Marcus debut

Millennials Bank Just Like Us

- Millennials, those currently 26 – 40 years old, tell us that some of their banking preferences are not much different than those of older consumers

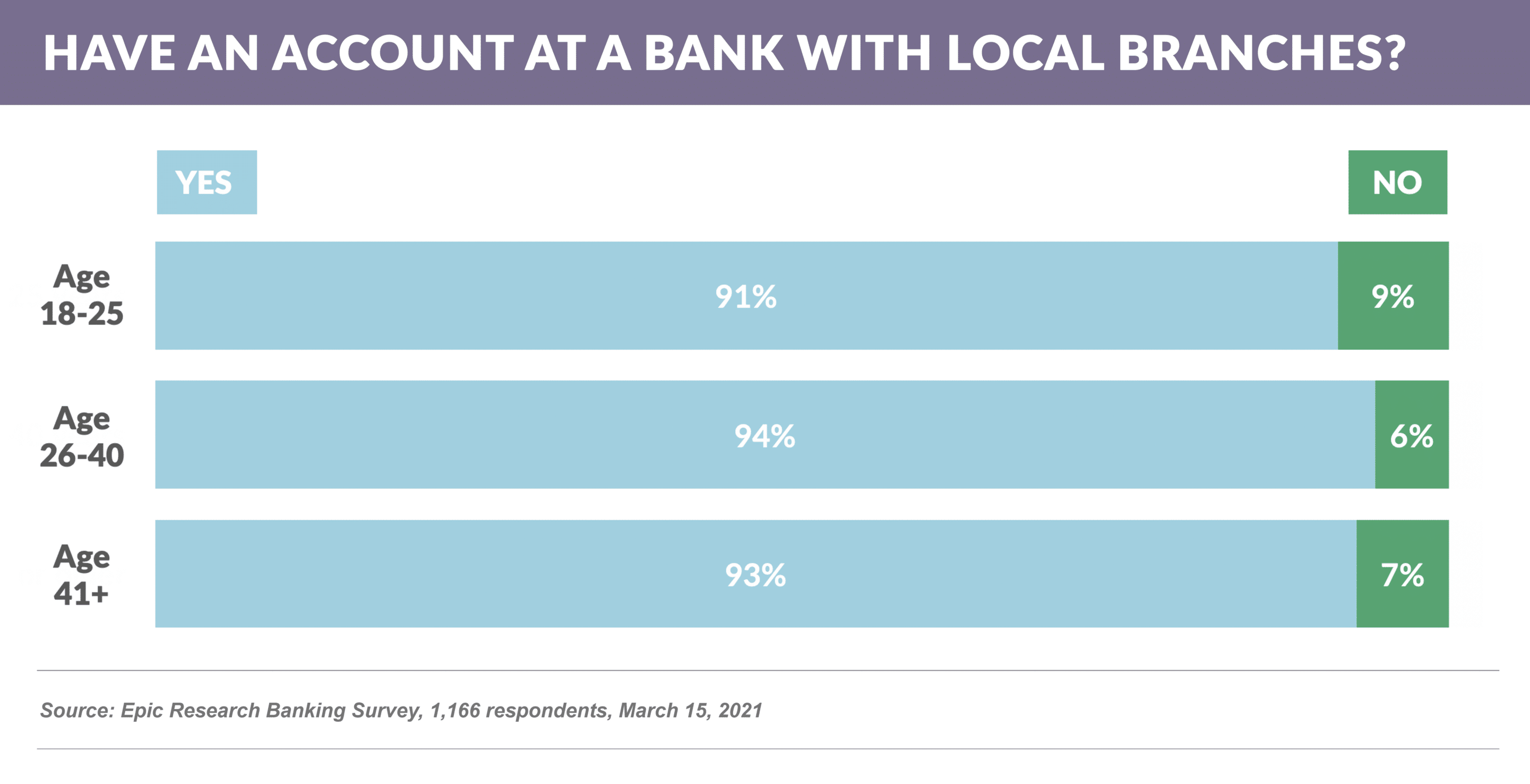

- For example, 94% of millennials surveyed say they have accounts with banks that have branches in their local community, comparable to older and younger groups

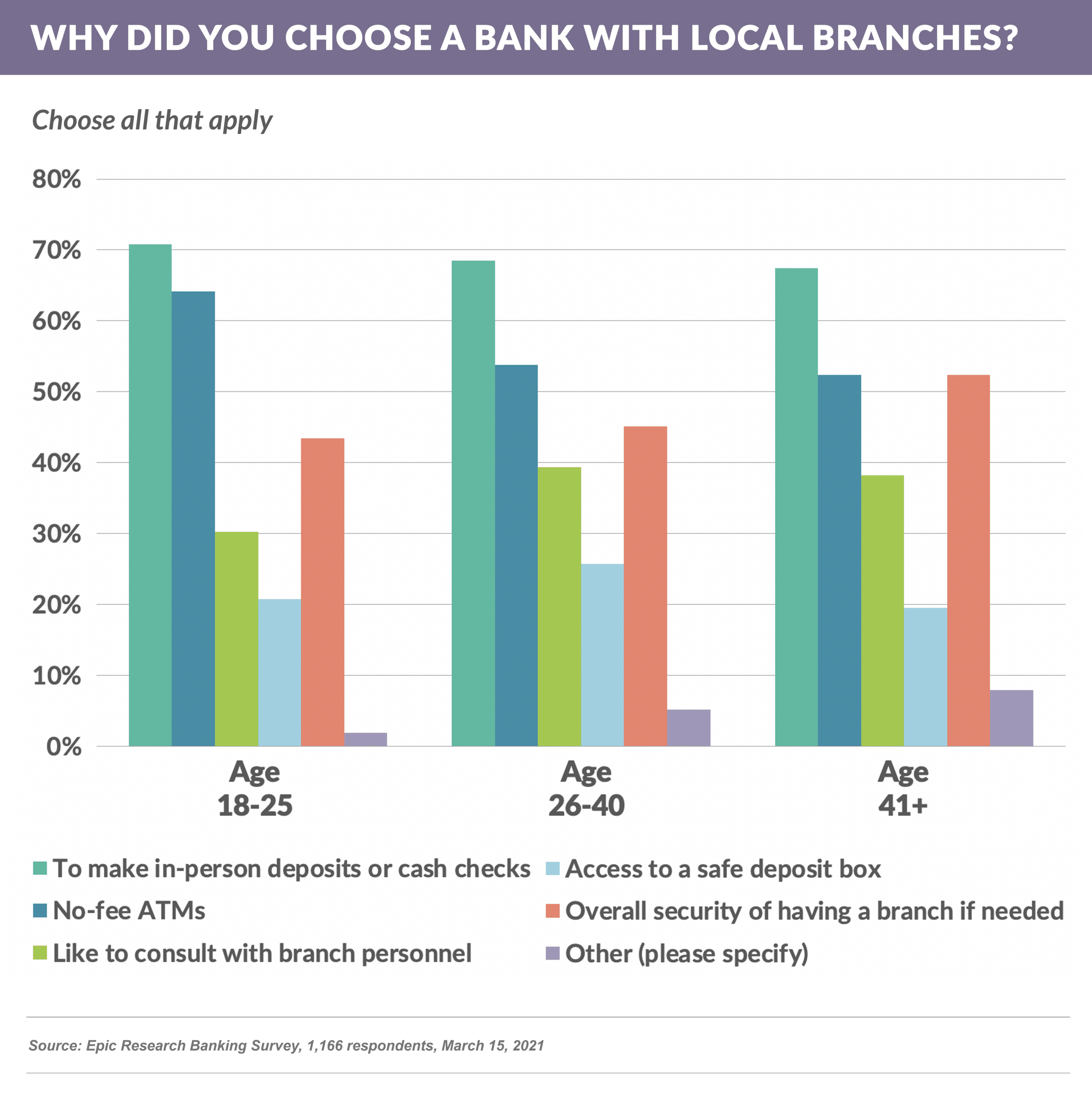

- Most of those surveyed said they chose banks with local branches so that they could make in-person deposits and cash checks, with no-fee ATMs and “security of having a branch if needed” coming next

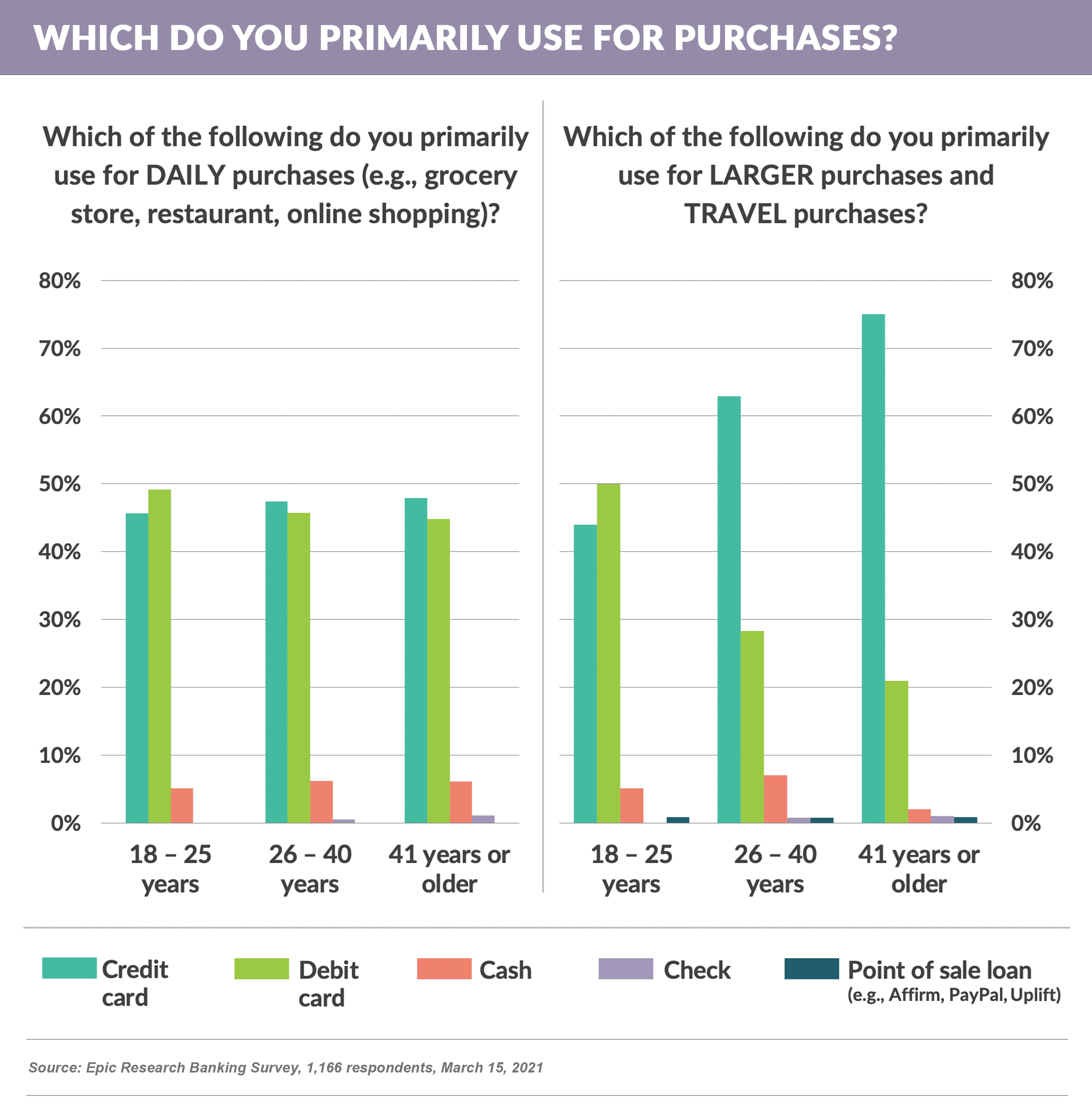

- Credit and debit cards were used equally for “daily purchases”, with credit cards being the most popular choice for “larger purchases” in the older demographics

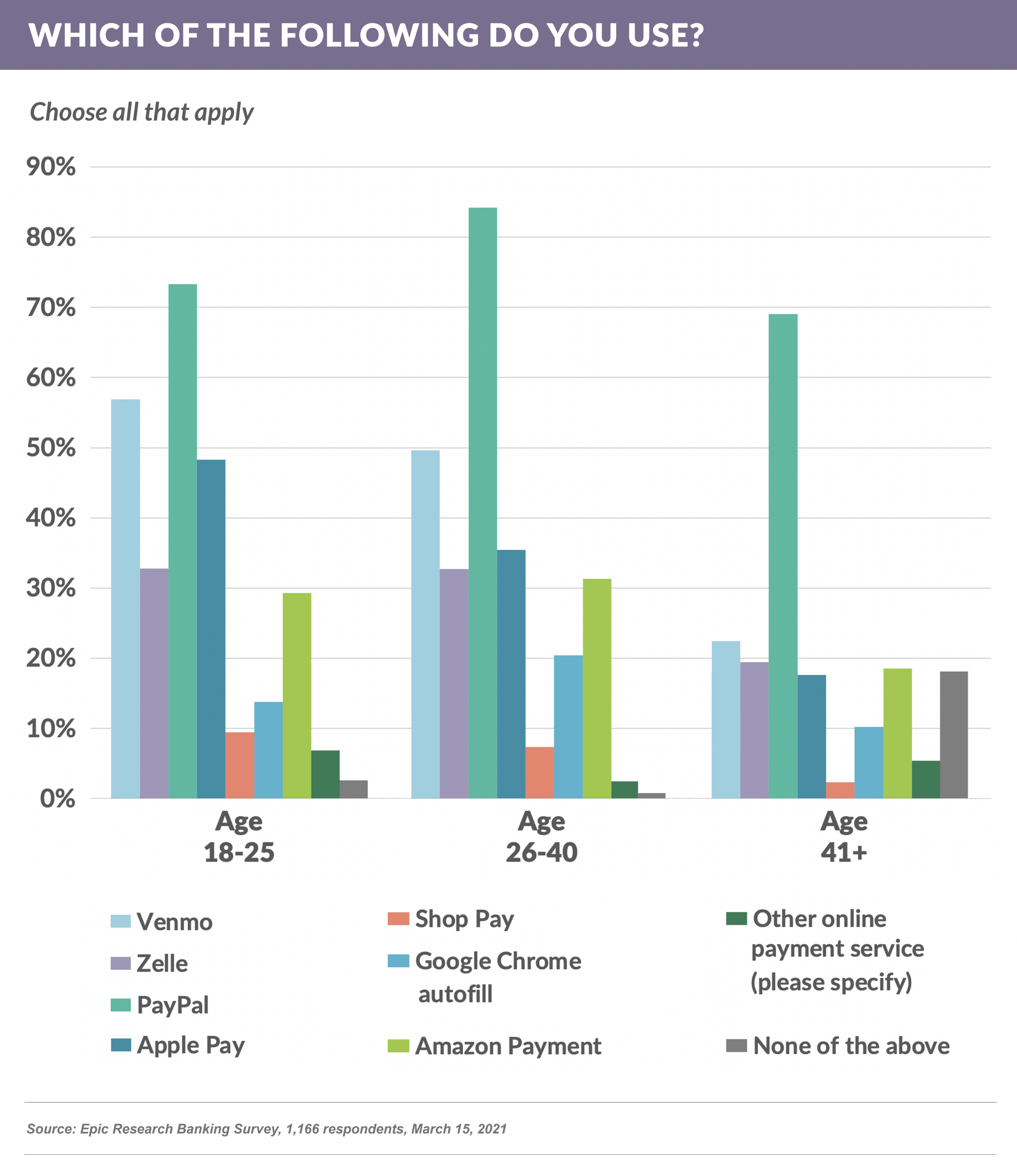

- PayPal was the most popular alternative payment method selected by all age groups, with Venmo and Apple Pay next most popular with younger consumers

Cash-Back Credit Cards are in Vogue

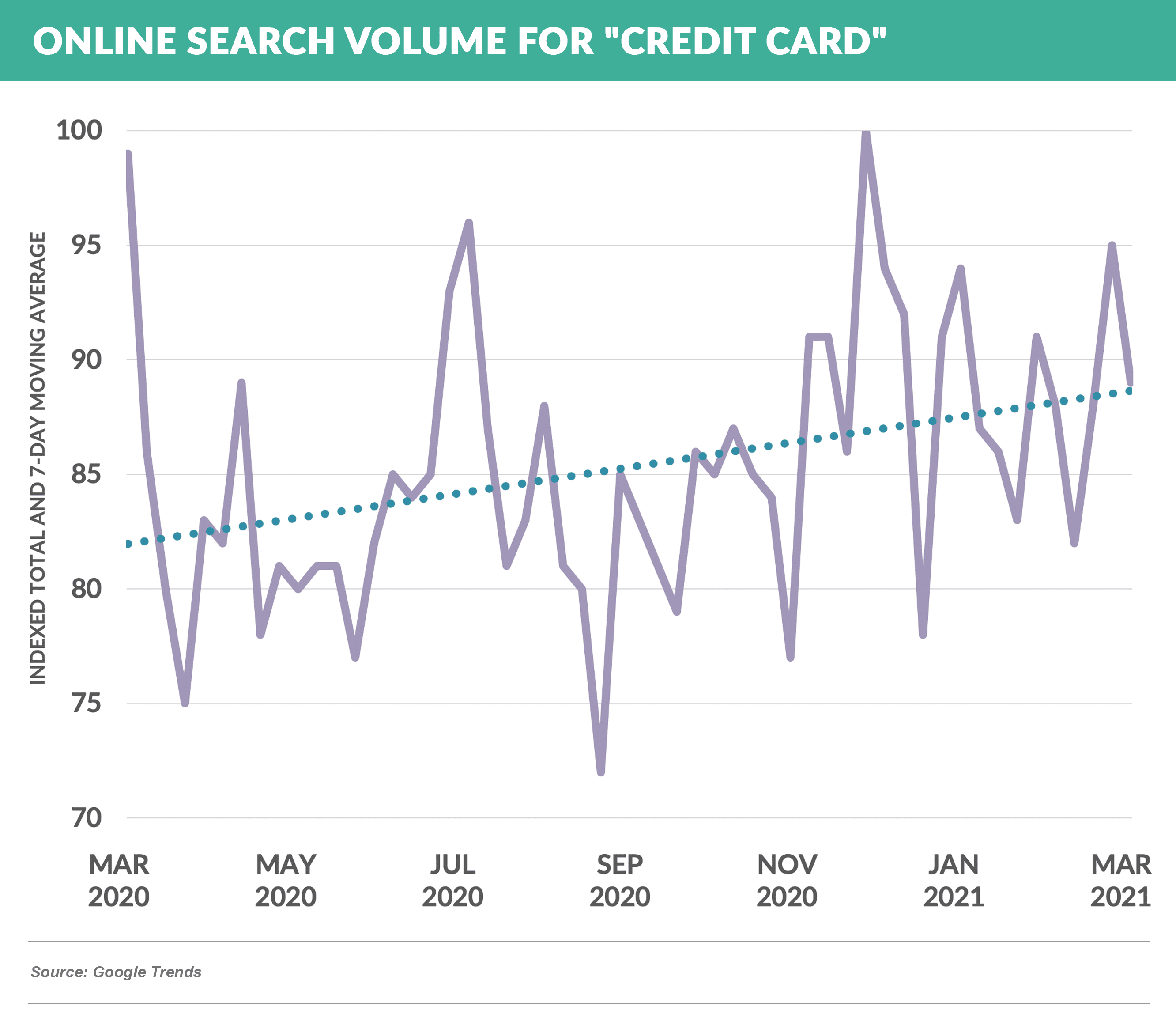

- Online search volume for the term “credit card” has trended higher since 1Q 2020

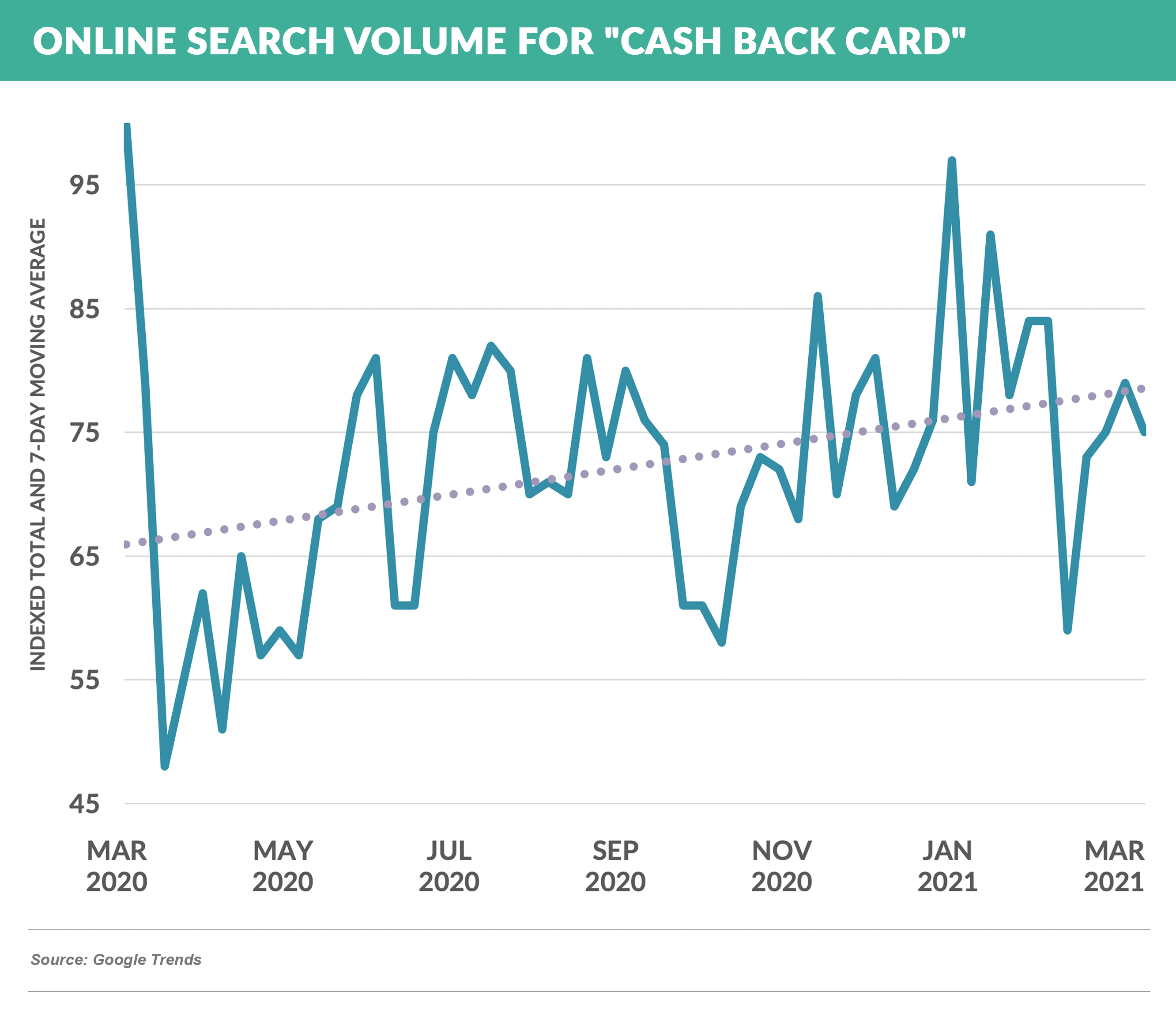

- While searches for “Travel Rewards Card” and “0% Credit Card” are down, “Cash Back Card” keyword search trends are up

- These trends reflect the increasing preferences for cash-back cards and decreasing preferences for travel cards reflected in previous Epic surveys

Quick Takes

- SoFi is buying a bank, which should provide more stable, low-cost deposits and more uniform regulatory structure

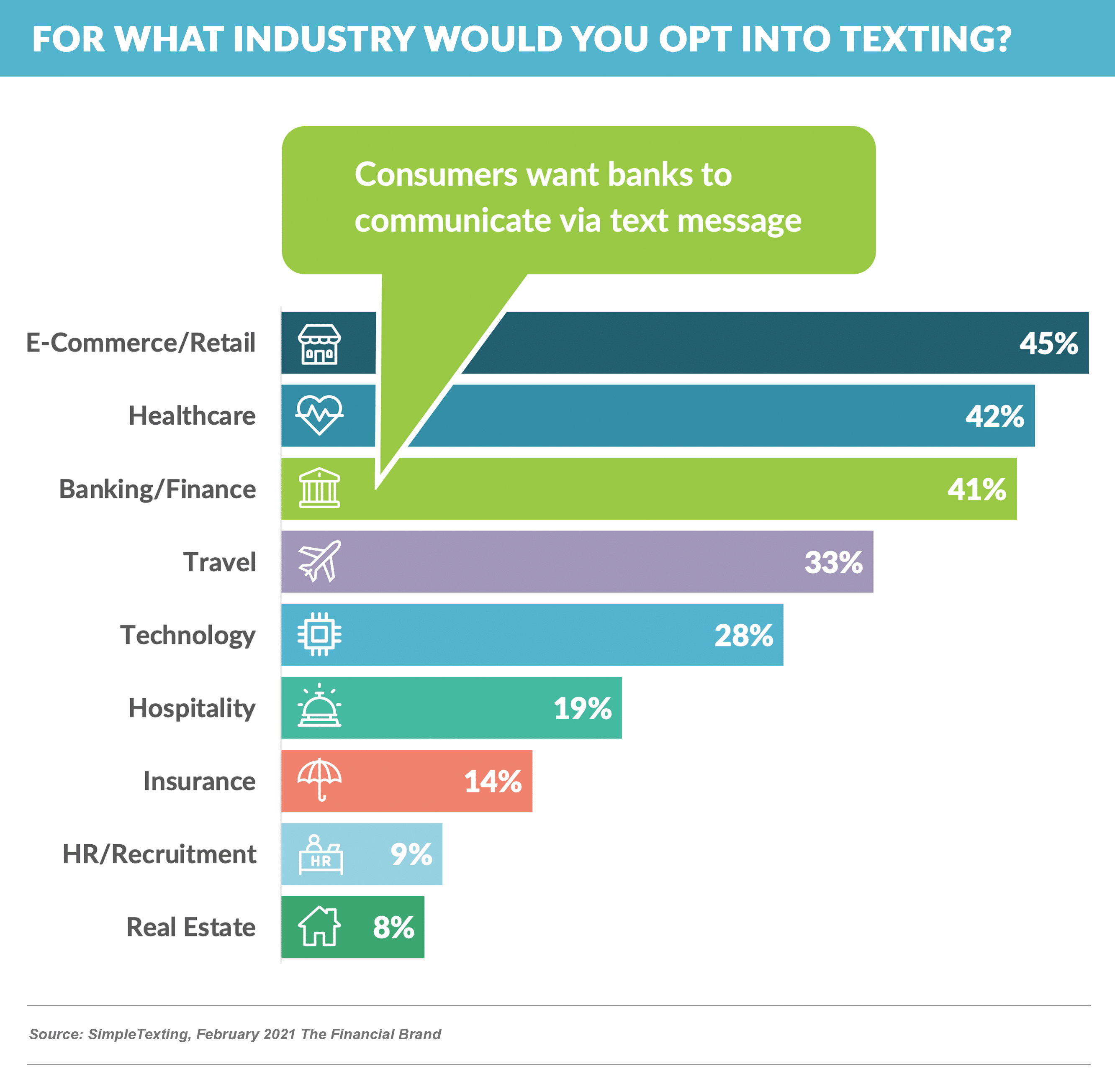

- Texting is a growing means of communication amongst banks, with consumers showing a willingness to receive messages from their financial institutions

Thank you for reading.

The next Epic Report will publish on April 3rd.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.