Five Things We’re Hearing

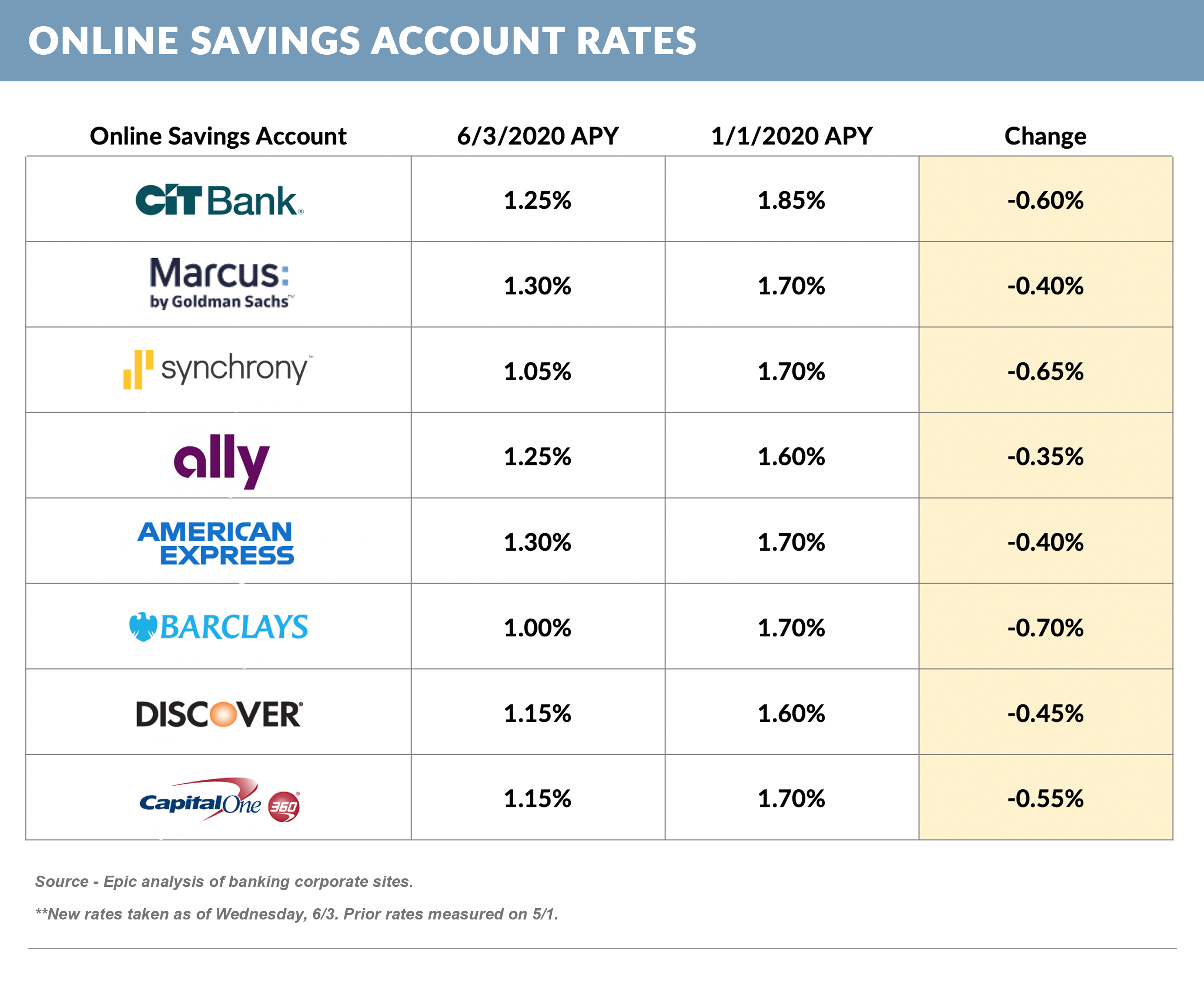

- Banks are backing off from new deposits while consumers are still interested

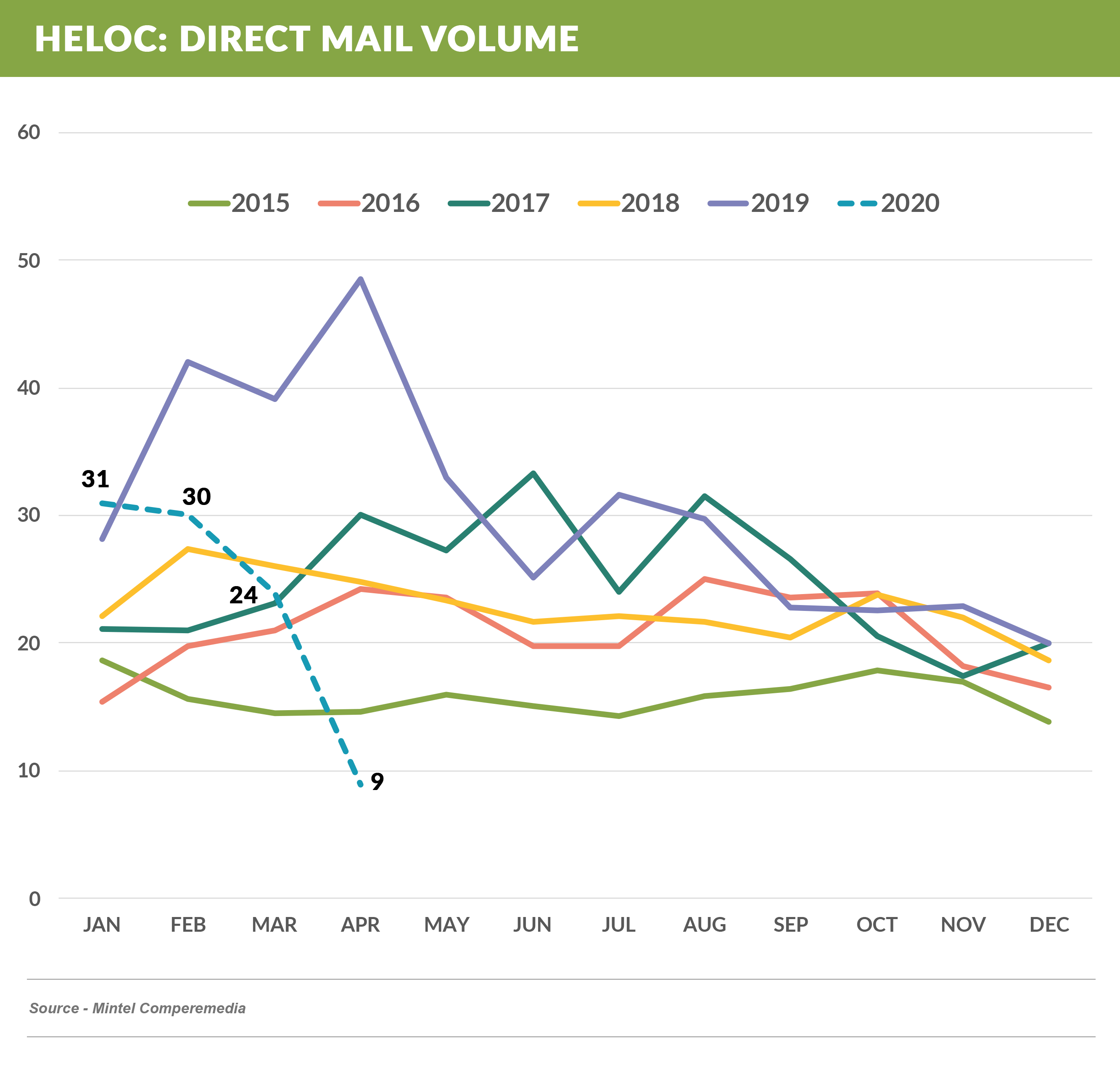

- Mirroring the broad decline in new loan acquisitions, HELOC mail volume was down substantially in April

- Many lenders are boosting their efforts on income verification

- Consumers are gradually becoming more confident in their ability to pay bills

- Are the ABS markets opening up?

Today’s newsletter takes 3 minutes to read

Banks Lose Interest in Deposits, While Consumers Don’t

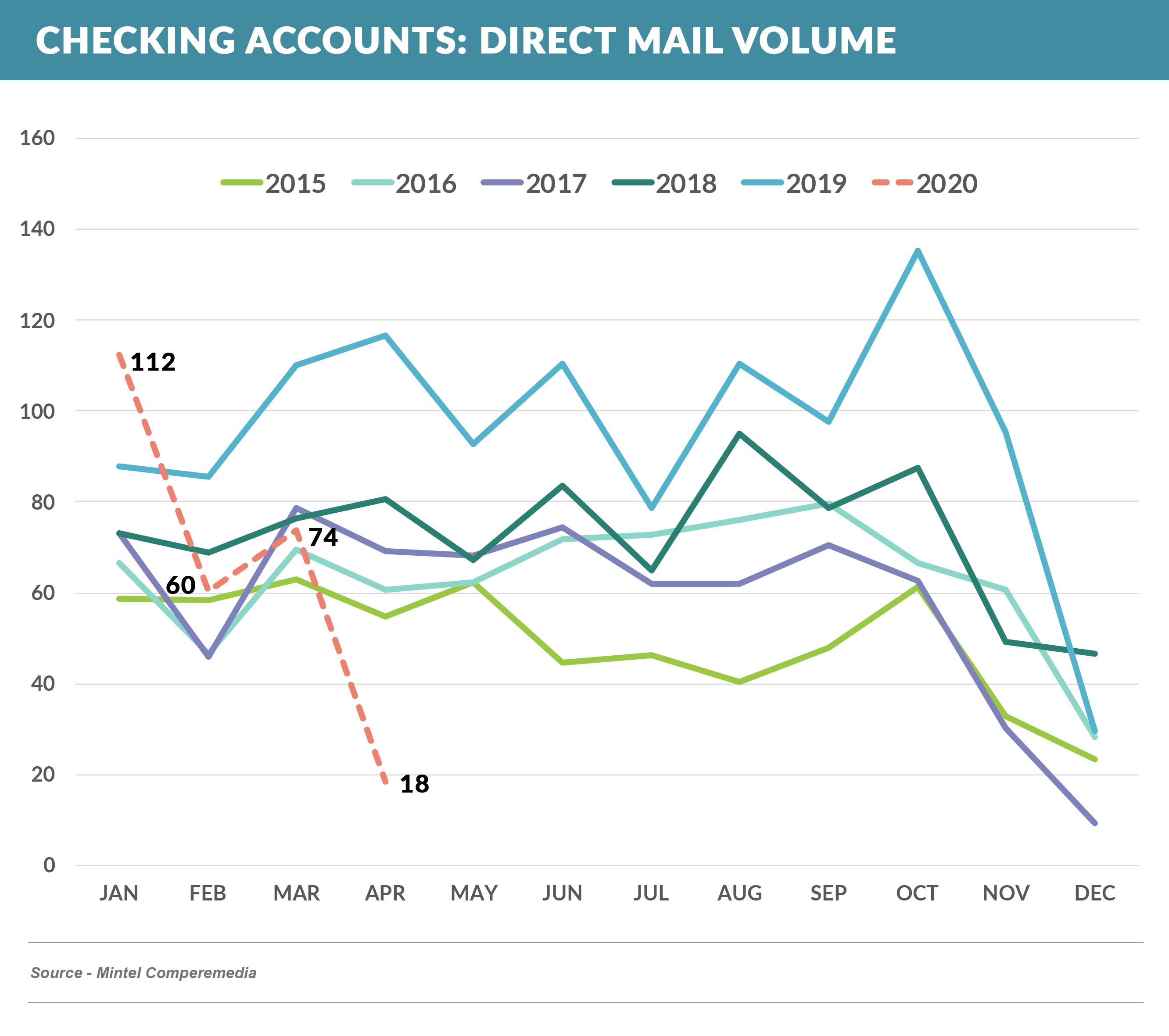

- Pandemic uncertainty, low rates, and declining new loan volume have led to a pullback in new customer marketing for checking and savings products

- Mail volume soliciting new checking accounts dropped 75% in April

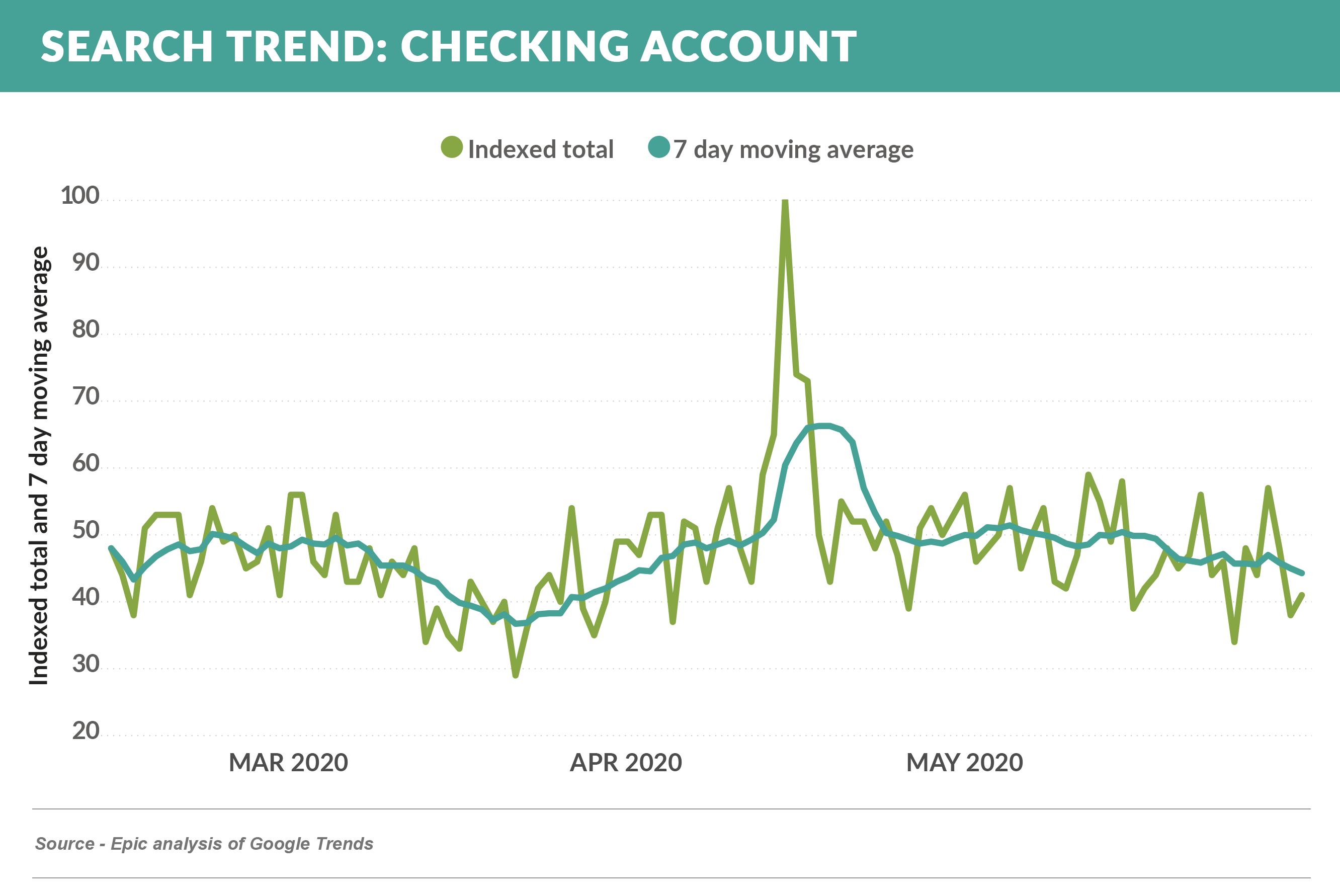

- While consumer interest, as measured by online search volume, has risen since late March

- Online savings rates continue their decline, with current rates 35-70bps lower than January rates

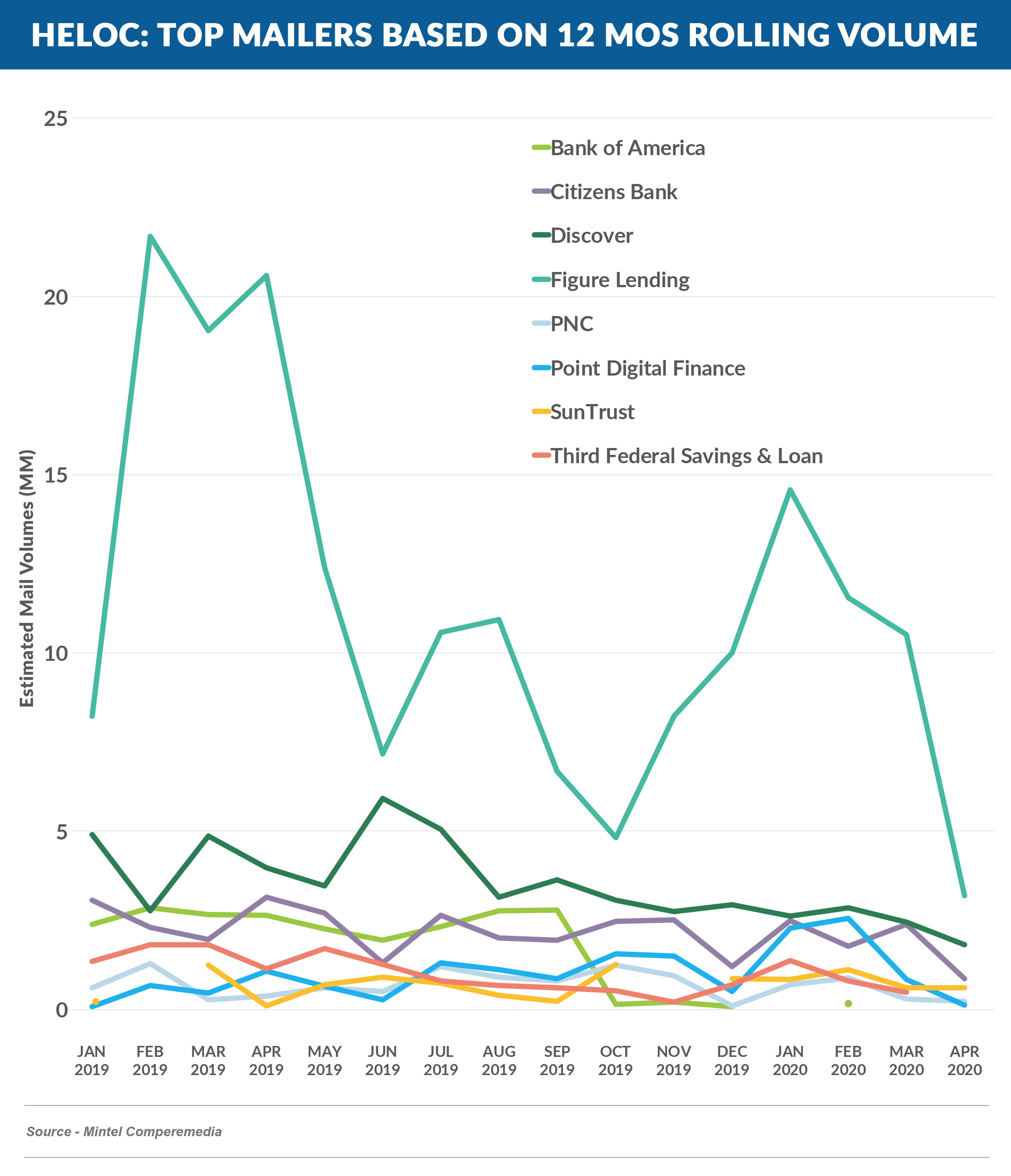

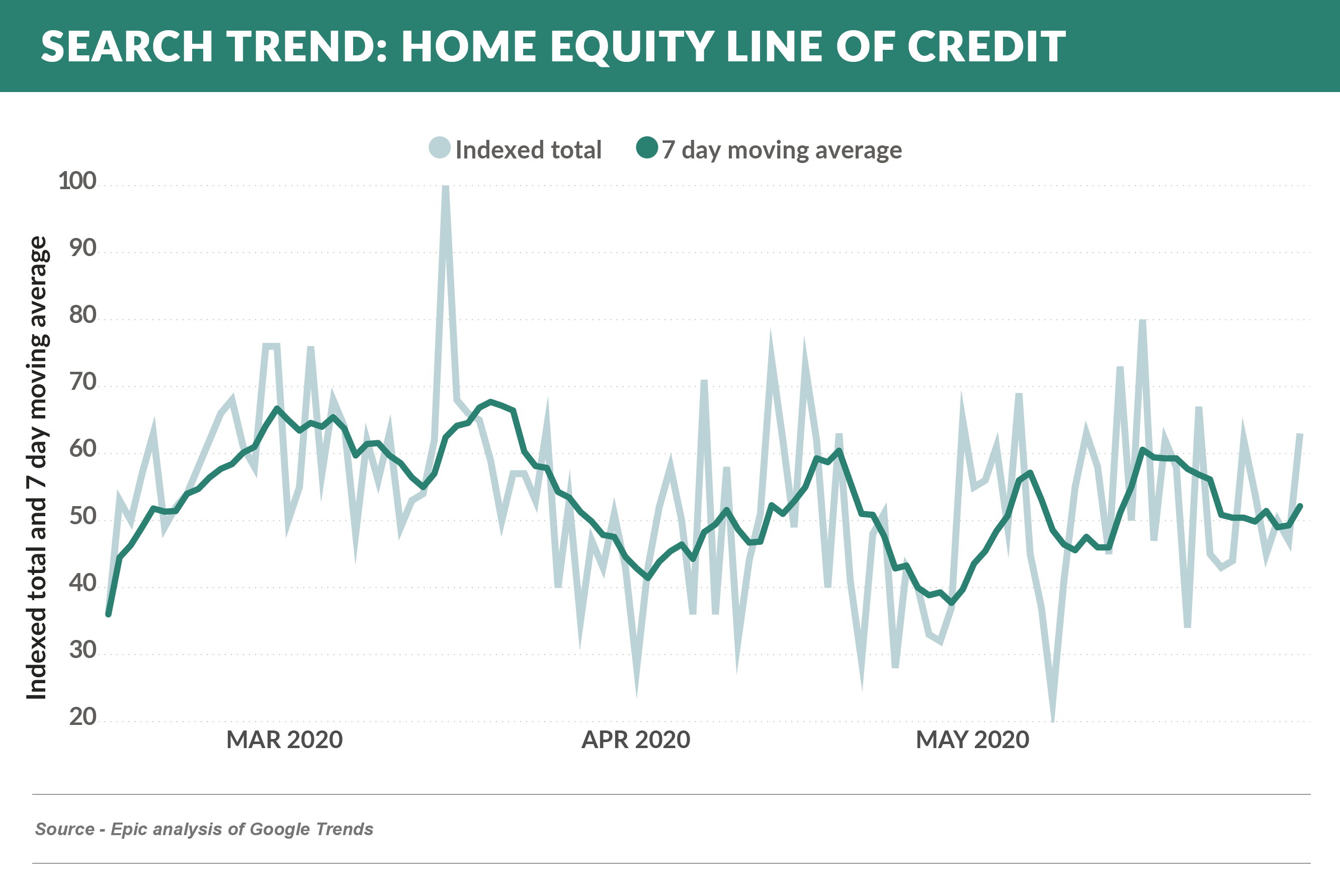

Home Equity Line Acquisition Efforts Also Drop

- Following the trend of other loan segments, April HELOC mail volume was down over 60% from March

- Figure, which has dominated the HELOC direct mail channel for the past year, saw a sharp drop in April mail volume, while other mailers also declined

- Conversely, consumer demand for HELOC has remained fairly consistent

Lenders Focus on Employment and Income Verification

- 42.5 million unemployment claims in the past 80 days have made credit underwriting a challenge

- Lenders are reacting by increasing employment and income verification despite its inefficiency

- Most are targeting verification efforts on the 10-15% of applicants who might be of higher risk of having lost their jobs:

- Self-employed

- Hourly workers

- Those in high risk industries such as hospitality and travel

- Prospects in geographies with higher unemployment, such as Nevada and areas of Florida

- DDA activity for customers and automated tools such as Plaid for prospects are the preferred tools for looking at transaction data to support the presence of recent income

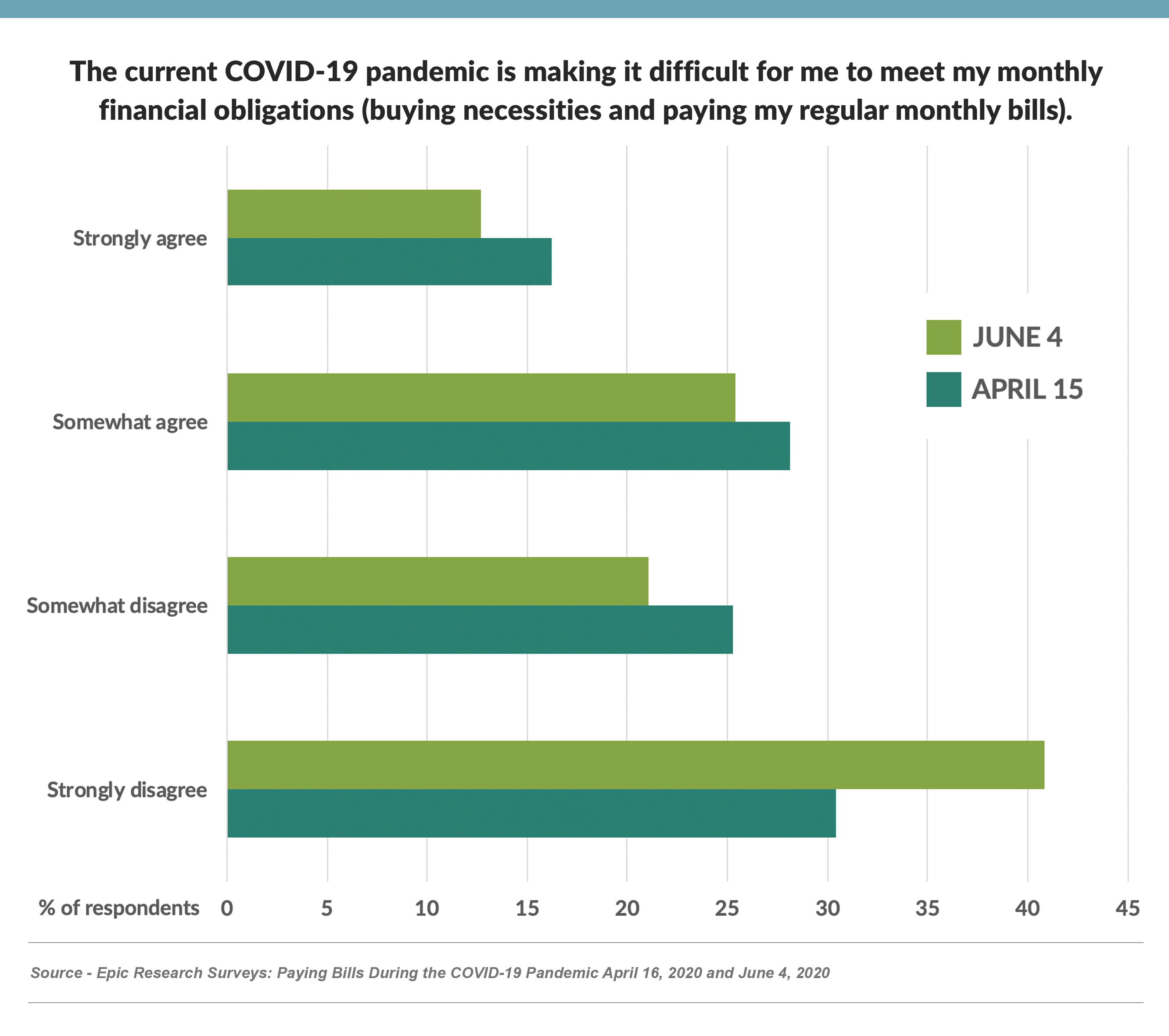

Consumers are Feeling Better About their Finances

- Our research shows consumers are more optimistic about their personal finances than they were six weeks ago

- Epic repeated a survey from mid-April regarding consumers’ ability to pay their bills

- While there were no dramatic shifts in attitudes, there was a general positive shift in confidence in their personal financial situation, shown by a 12-point rise in those disagreeing that the pandemic had made it harder to pay their monthly bills

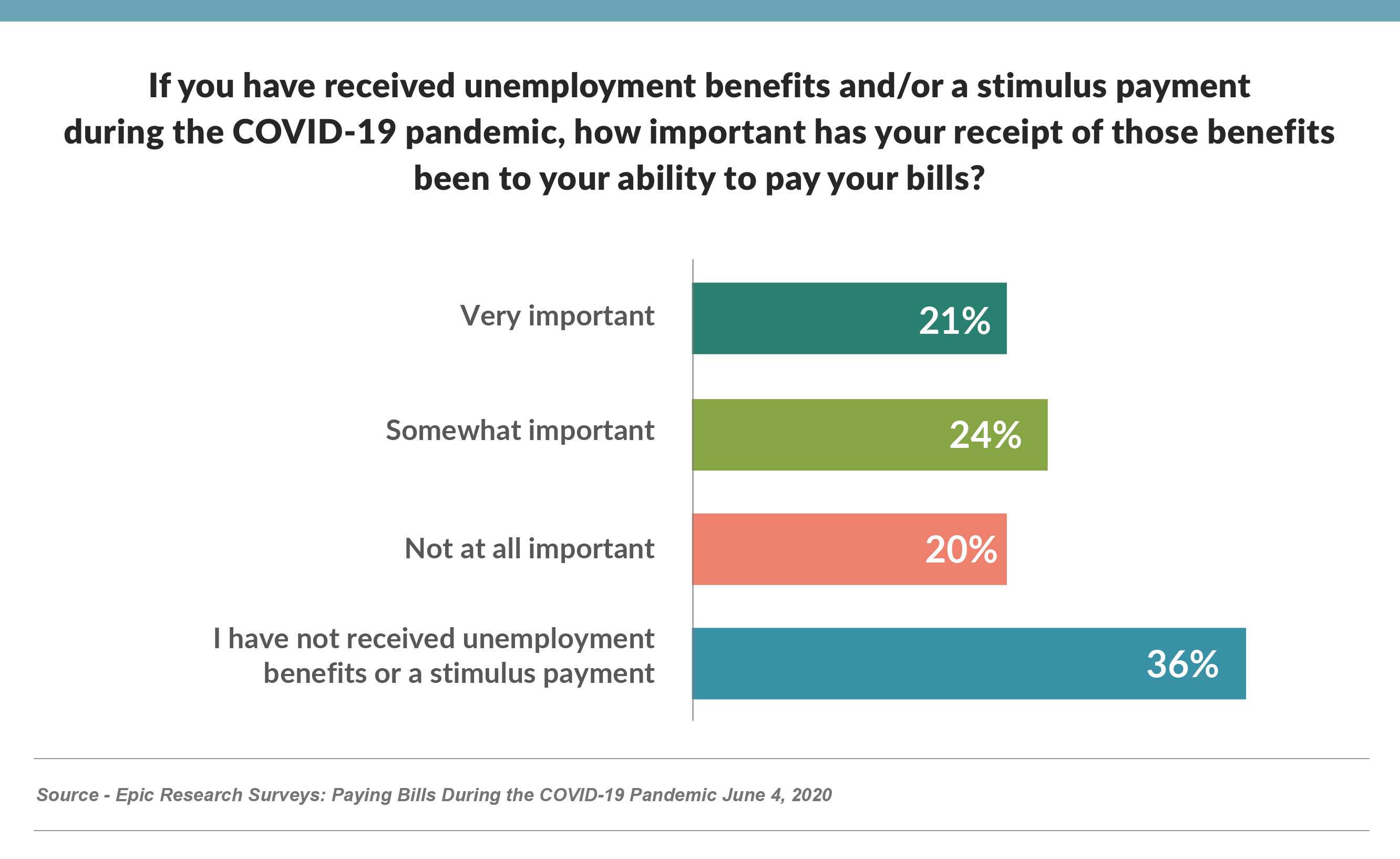

- There has been much said about the fact that unemployment benefits and stimulus checks have helped consumers keep up with their bills, which is supported by 45% of respondents saying they are important

More “Green Shoots” – ABS Markets Opening?

- In the past few months, we’ve noted the withdrawal of some capital markets-based lenders from the new customer acquisition market due to the “drying up” of the ABS markets

- Recent weeks have seen some positive change in select categories:

- Student Loan Refi – Signs of a return to functioning ABS markets - Navient and CommonBond are in market with deals, following SoFi’s late May closing of its first refi securitization since the pandemic hit

- Depending on the sector, securitization markets are largely functioning, particularly those that would get TALF support (which some say is unnecessary at this point)

- Card ABS is fine as it has a decades-long history from which to assess potential asset quality shocks

- Personal loan is a lot better than it was, but still struggling – it’s not TALF-eligible, has a thinner investor base, and is not recession-tested, so investors are skittish – OneMain completed a securitization in early May, which is a positive datapoint, but we would note that OneMain is a much more established issuer than other non-banks in the industry

Going Forward

- Anecdotally, the trend seems to have gradually shifted from “what can we stop doing” to “let’s plan to start again”

- We expect to see a continued increase in new customer marketing across select product categories as the summer progresses

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution lis

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.