Three Things We’re Hearing

- Personal loan rates are in flux

- Student lending is approaching peak season with a big question

- Consumer delinquencies continue at lower than expected rates

Today’s newsletter takes 2 minutes to read

Personal Loan Rates are in Flux

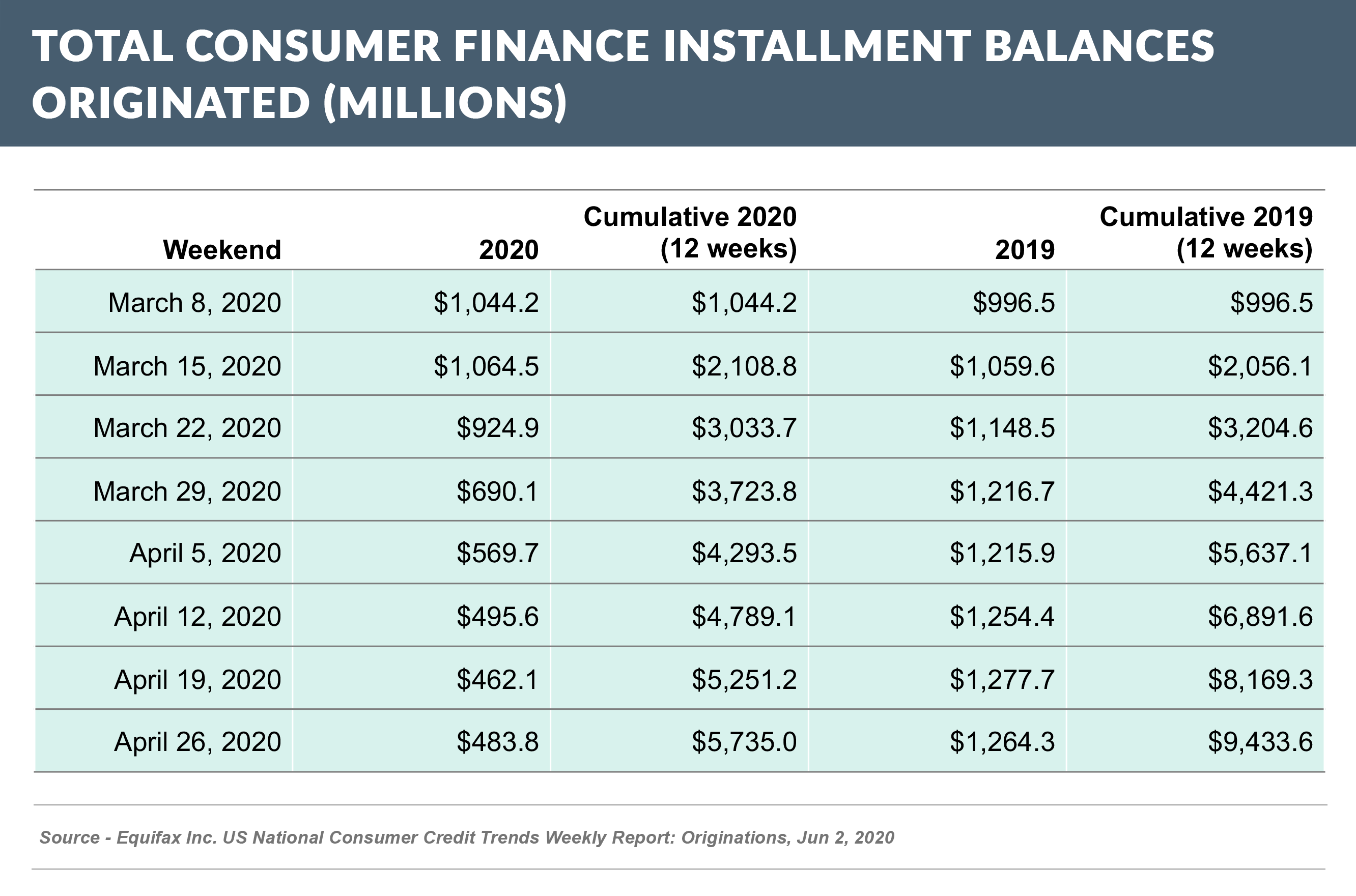

- Personal loan originations in April were roughly half the level of early March 2020 and 62% below April 2019 originations

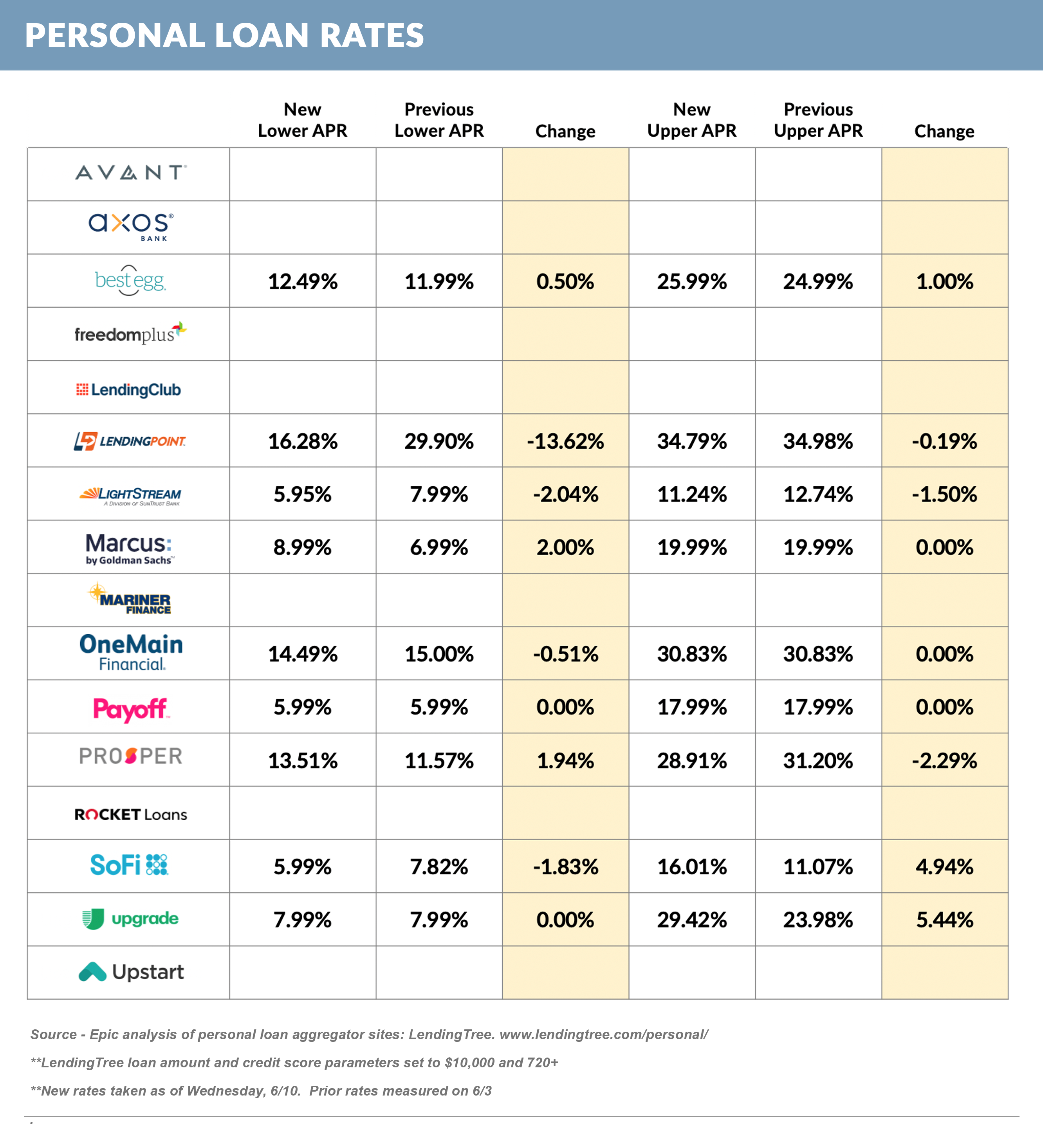

- However, recent securitization activity has brought a number of fintechs back to the aggregator and origination markets, with personal loan pricing fluctuating in both directions

Student Lending Still in Limbo

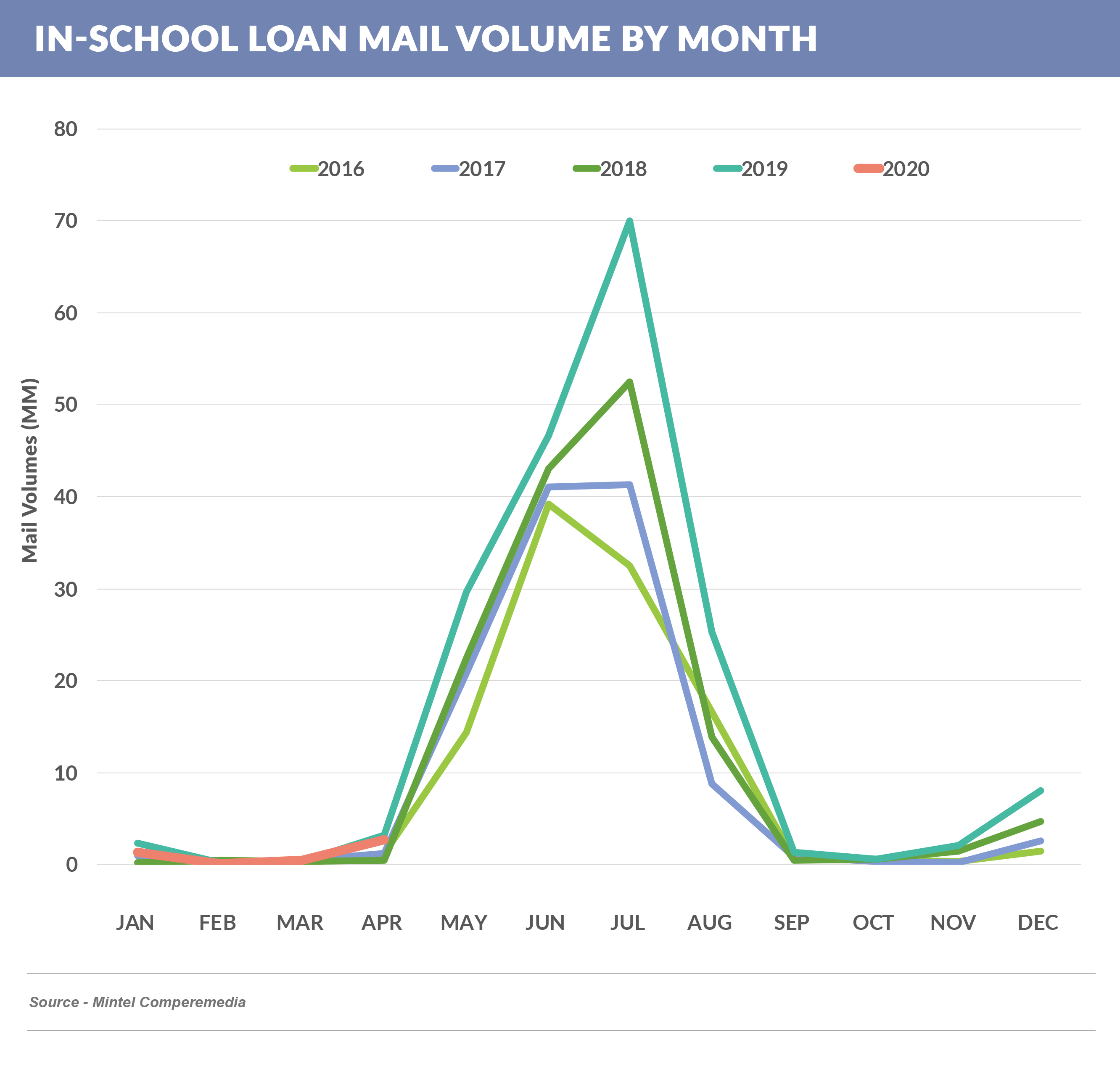

- Competition for in school student loans has increased in each of the past three years

- While early 2020 mail volume is down, previous year trends would indicate that competition is likely to heat up - 2019 volume overall was 33% higher than 2018, driven largely by increased volume from Discover (+26%) and College Ave (+90%v

- January through April 2020 mail volume is down 18% vs. 2019, likely impacted by the pandemic

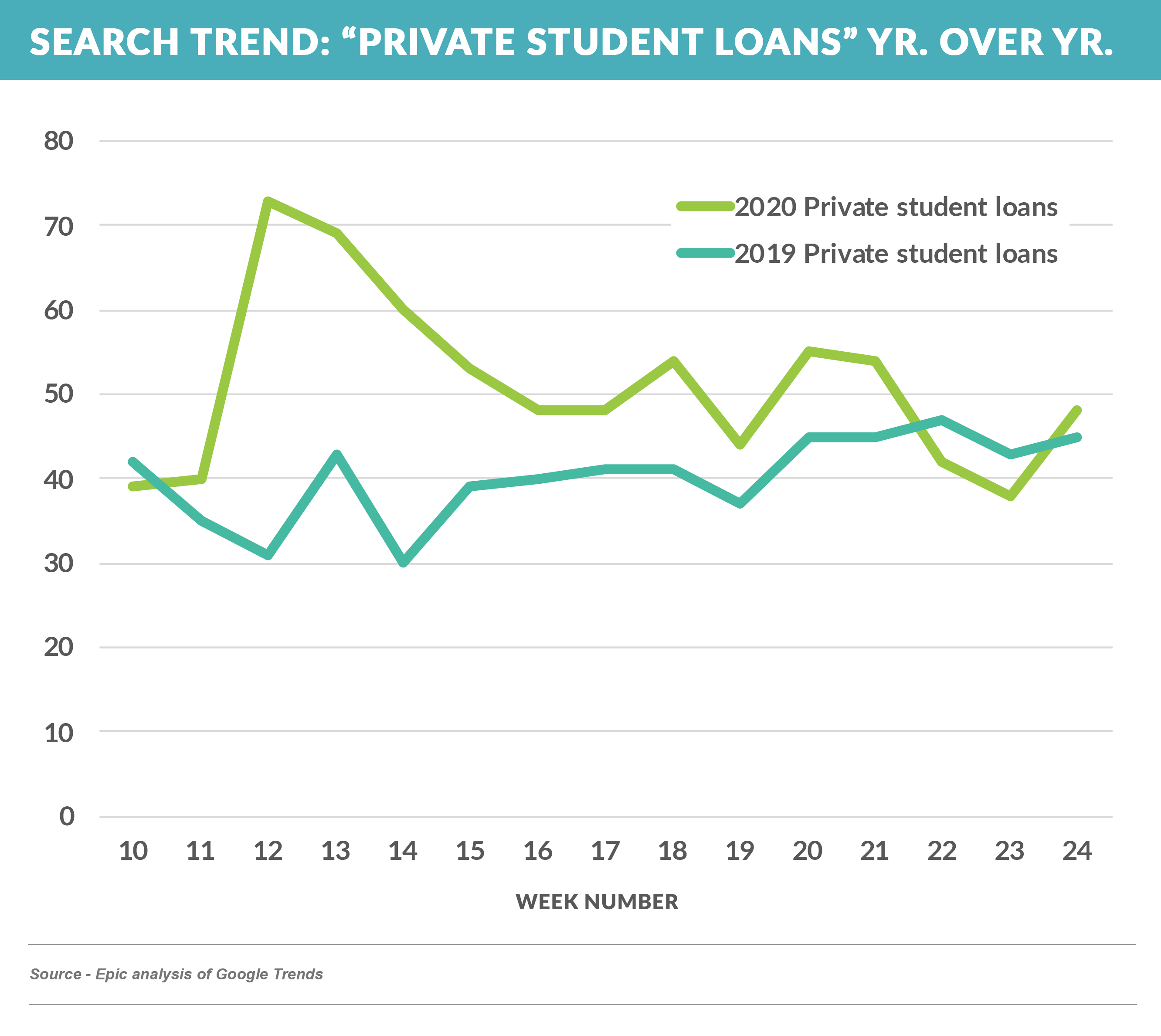

- However, online search volume for “Private Student Loans” has been running higher than last year, possibly due to stress on families’ finances due to the pandemic, increasing loan demand

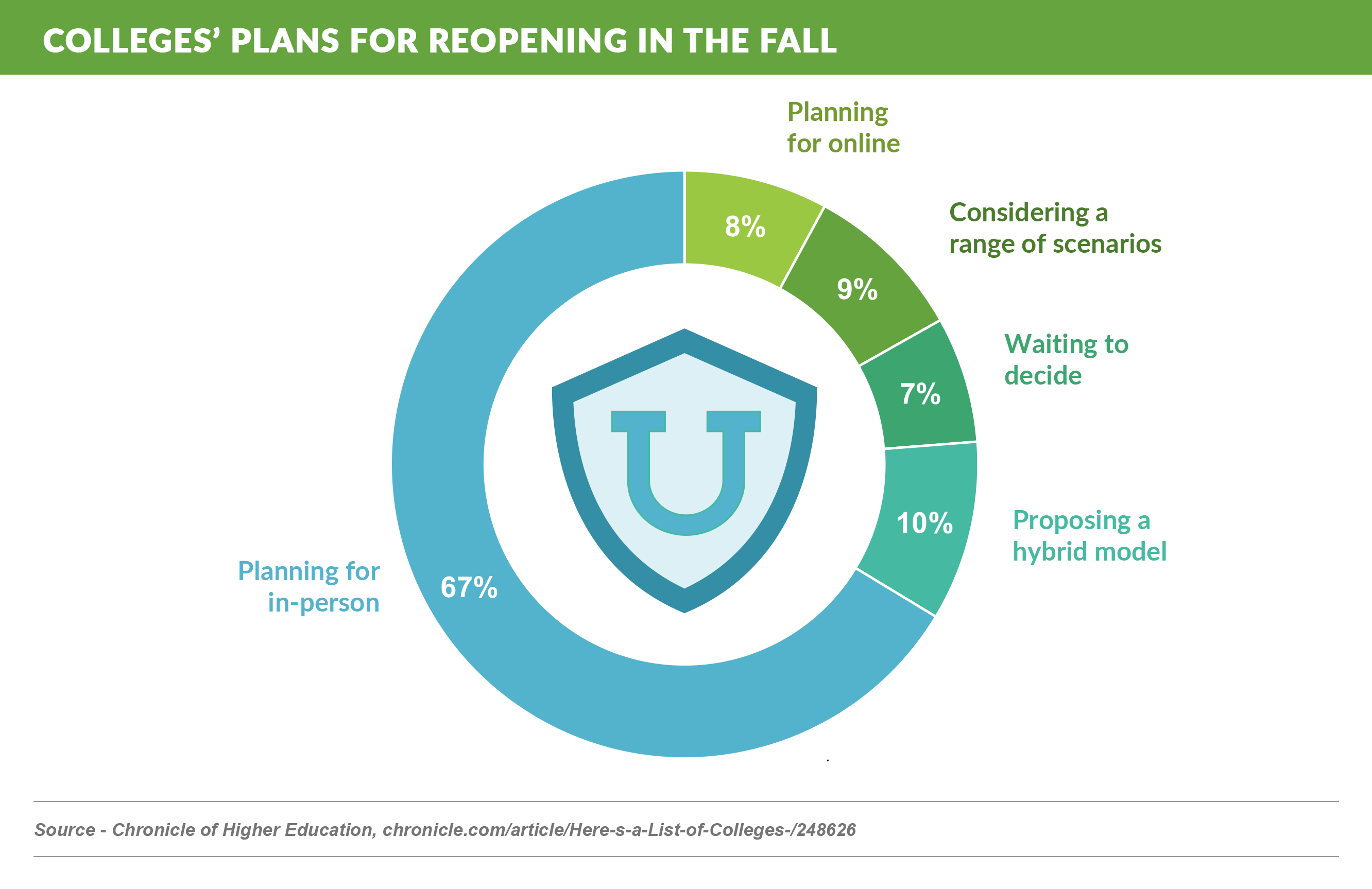

- The pandemic continues to provide uncertainty; however, recent announcements from colleges have continued to trend towards students being on campus this fall

- Many families are likely waiting longer to make their final decisions on loans

Payments

- We continue to hear that consumer loan asset quality is holding up better than would be expected in the current economic environment

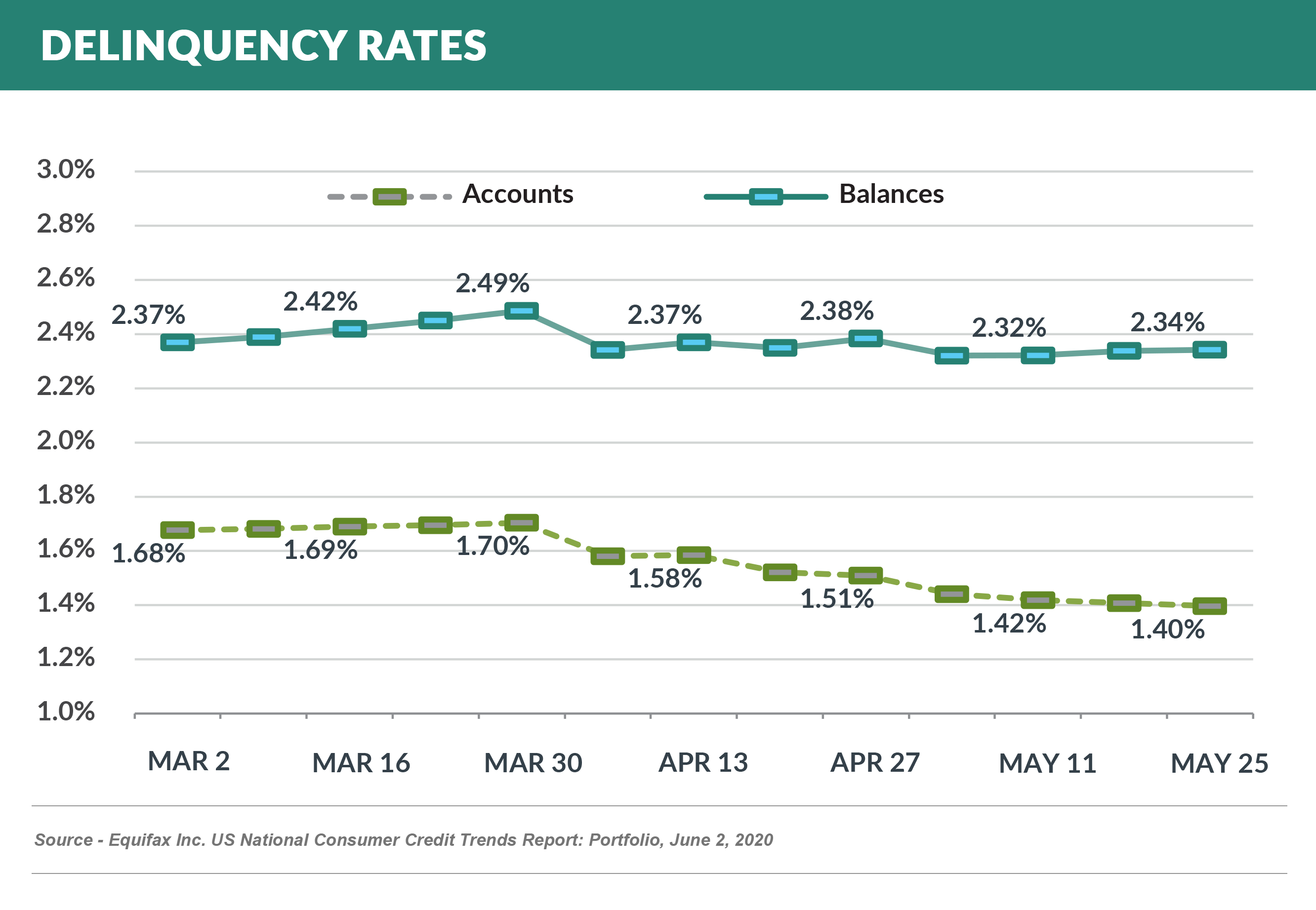

- This chart from Equifax shows credit card delinquency actually down since early March

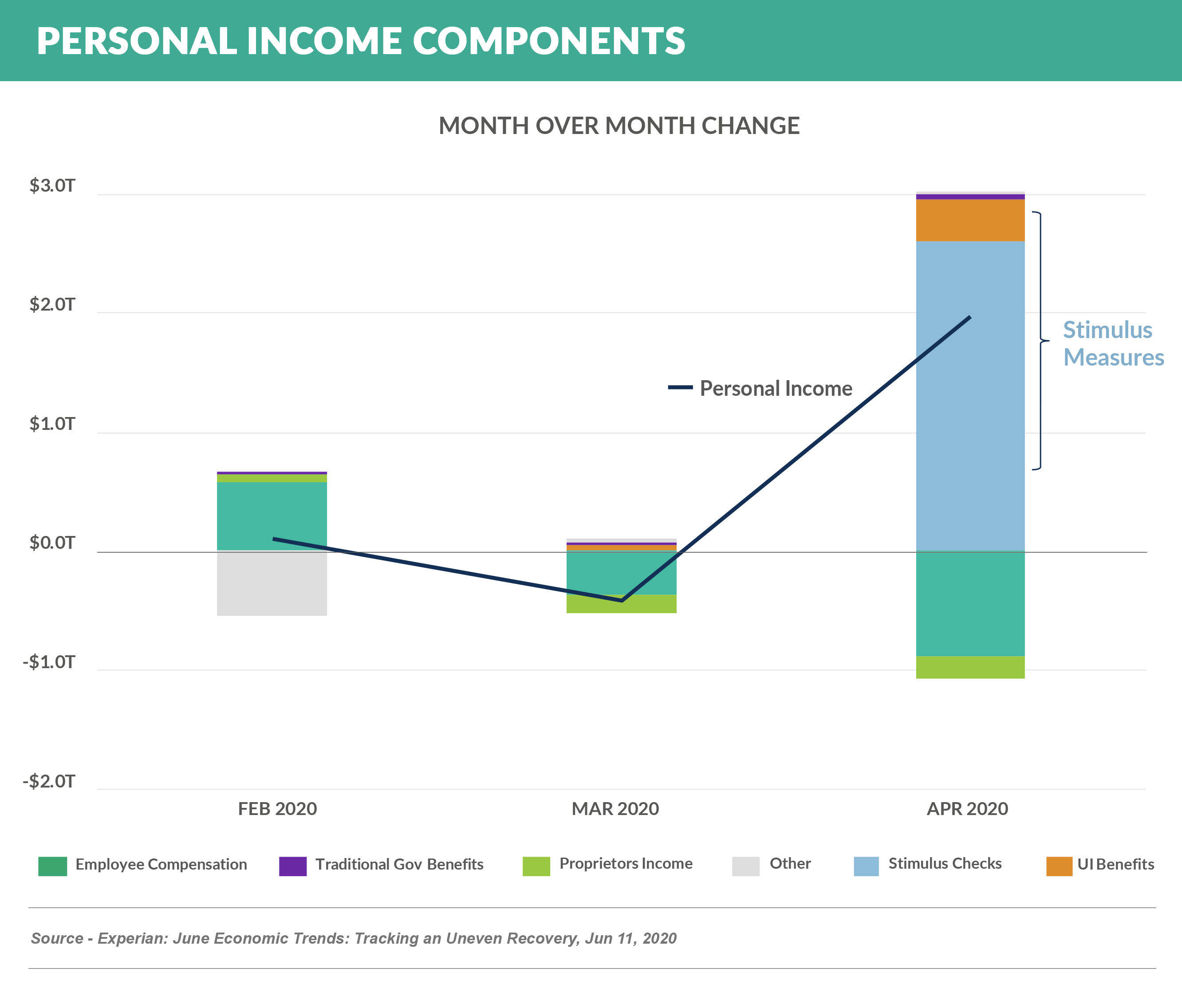

- One factor explaining this is the data below showing that personal income has actually risen since February due to stimulus measures and unemployment benefits

Going Forward

- Lending markets continue to slowly reopen

- Post forbearance asset quality remains a wild card

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.