Three Things We’re Hearing

- Consumers still value travel rewards cards

- Competition in the credit card sector is back

- Personal loan issuers remain hesitant

A four-minute read

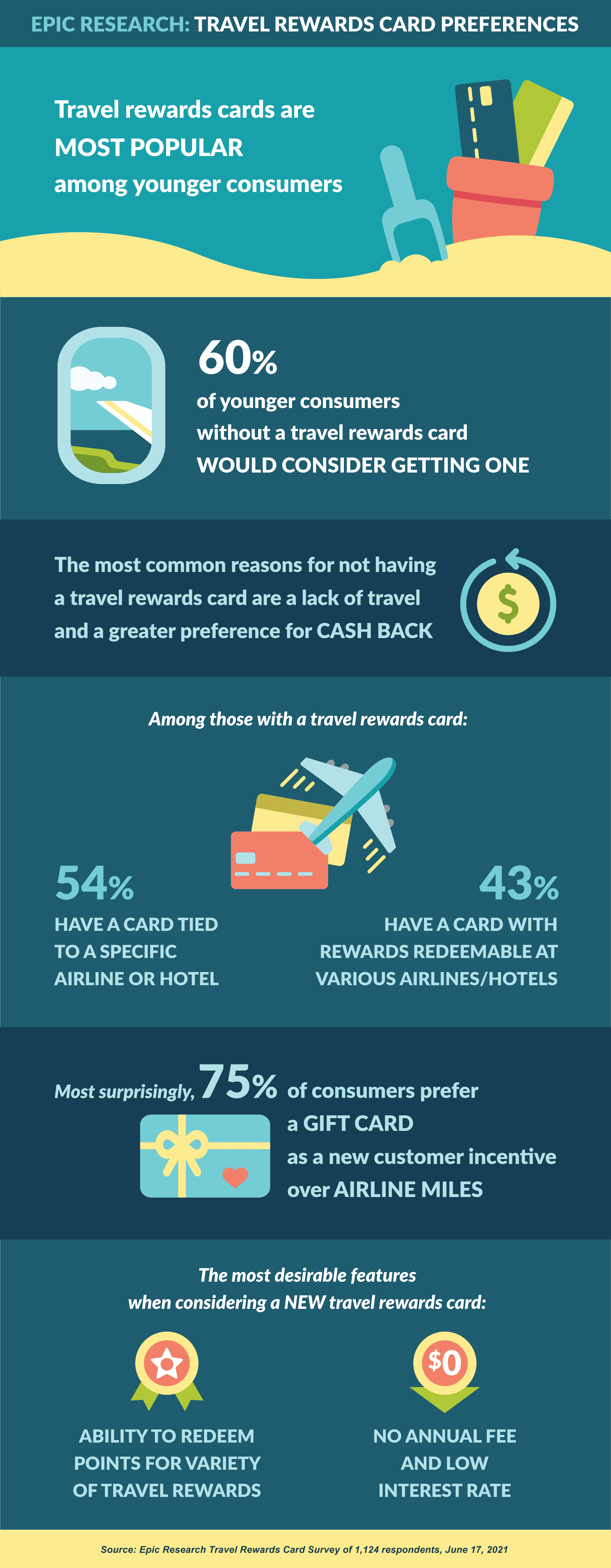

Consumers Still Value Travel Rewards Cards

- With both credit card marketing and travel opening back up this summer, Epic recently surveyed 1,124 consumers regarding their preferences for travel rewards credit cards, which revealed:

Competition in the Credit Card Sector is Back

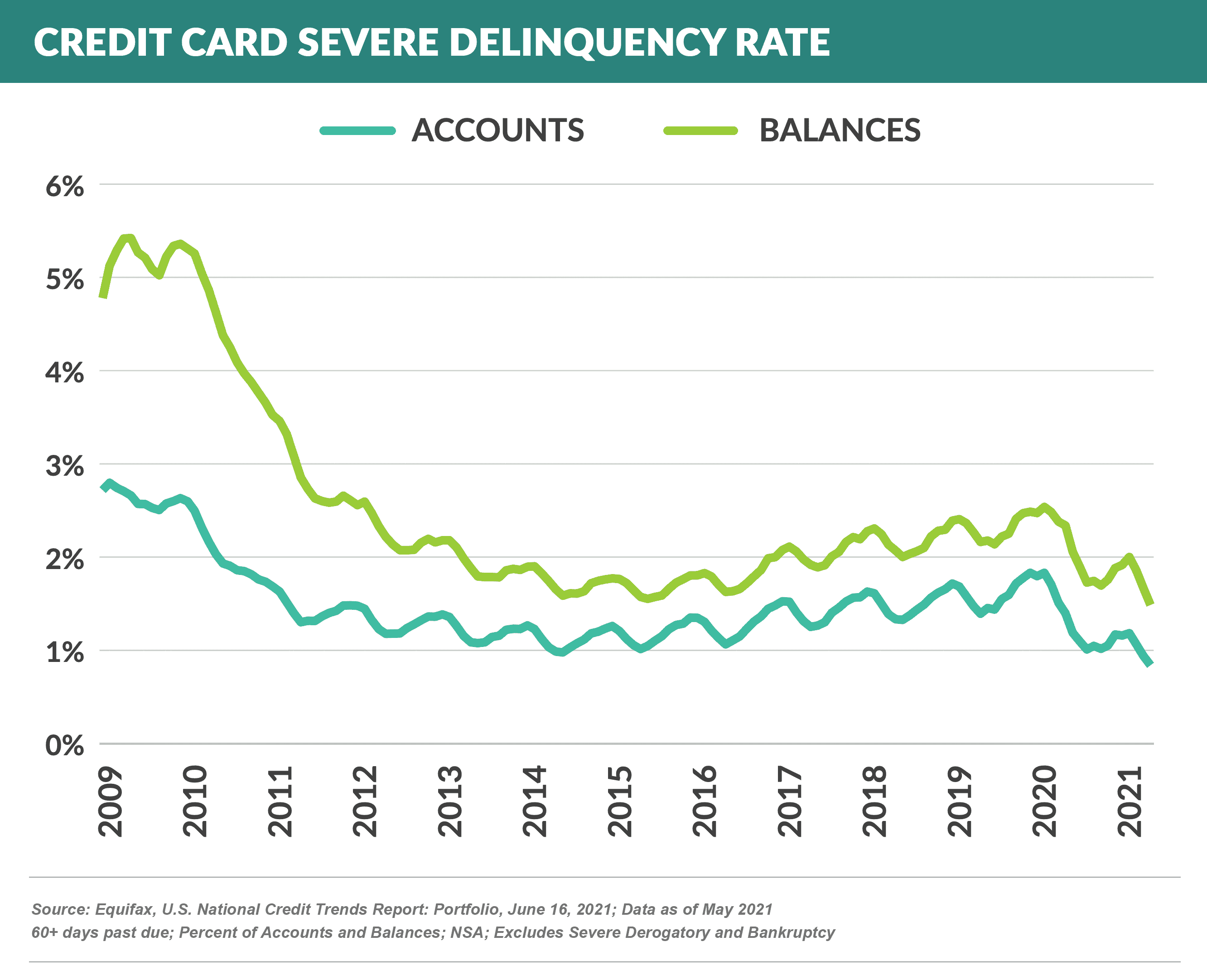

- The credit card sector has returned to a relatively positive state of health as growth has resumed, new products are being introduced, and delinquencies remain historically low

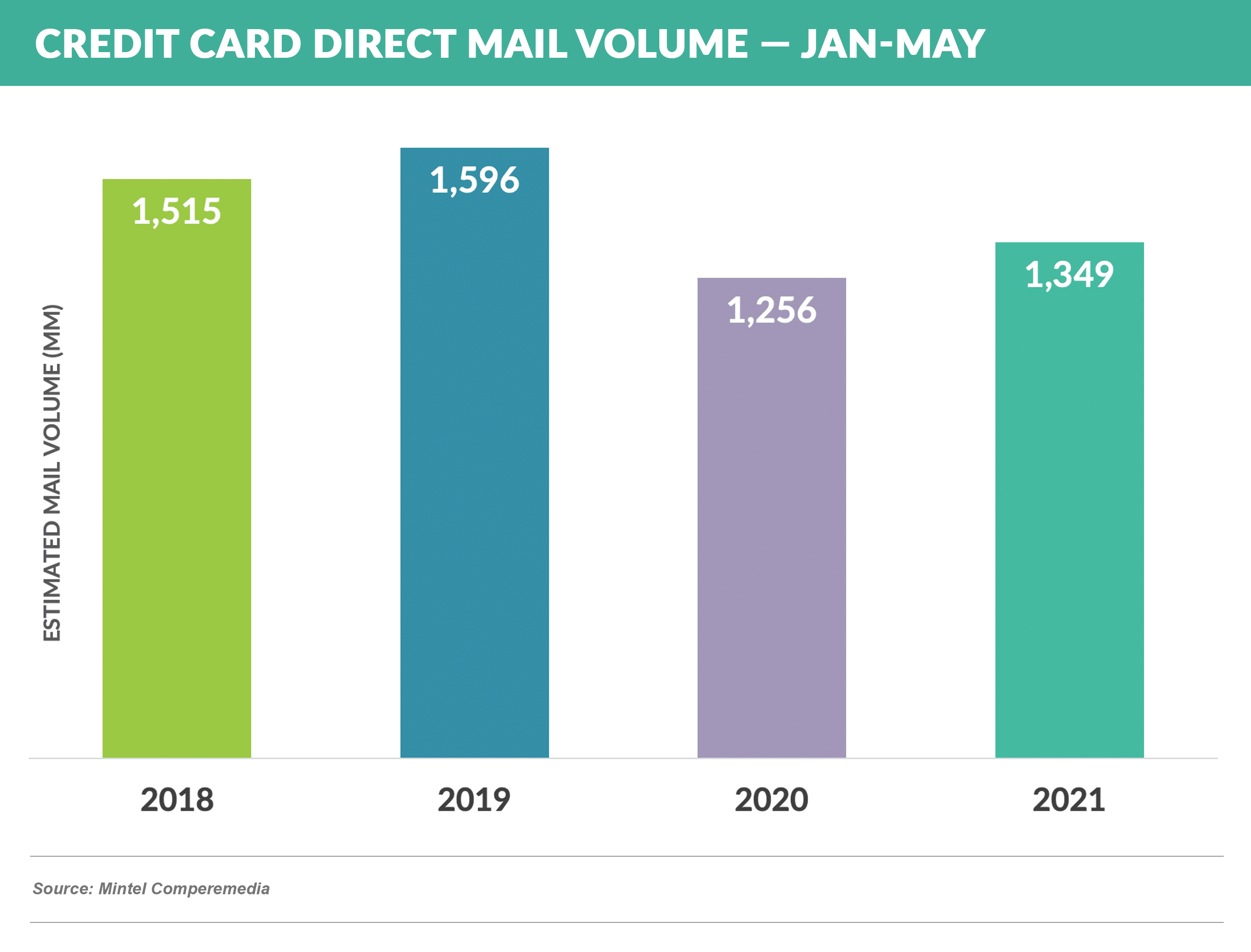

- Year-to-date (through May) new customer acquisition marketing, as measured by mail volume, has returned to levels 7.4% above the first five months of 2020, and within 10% – 15% of 2018 and 2019 volumes

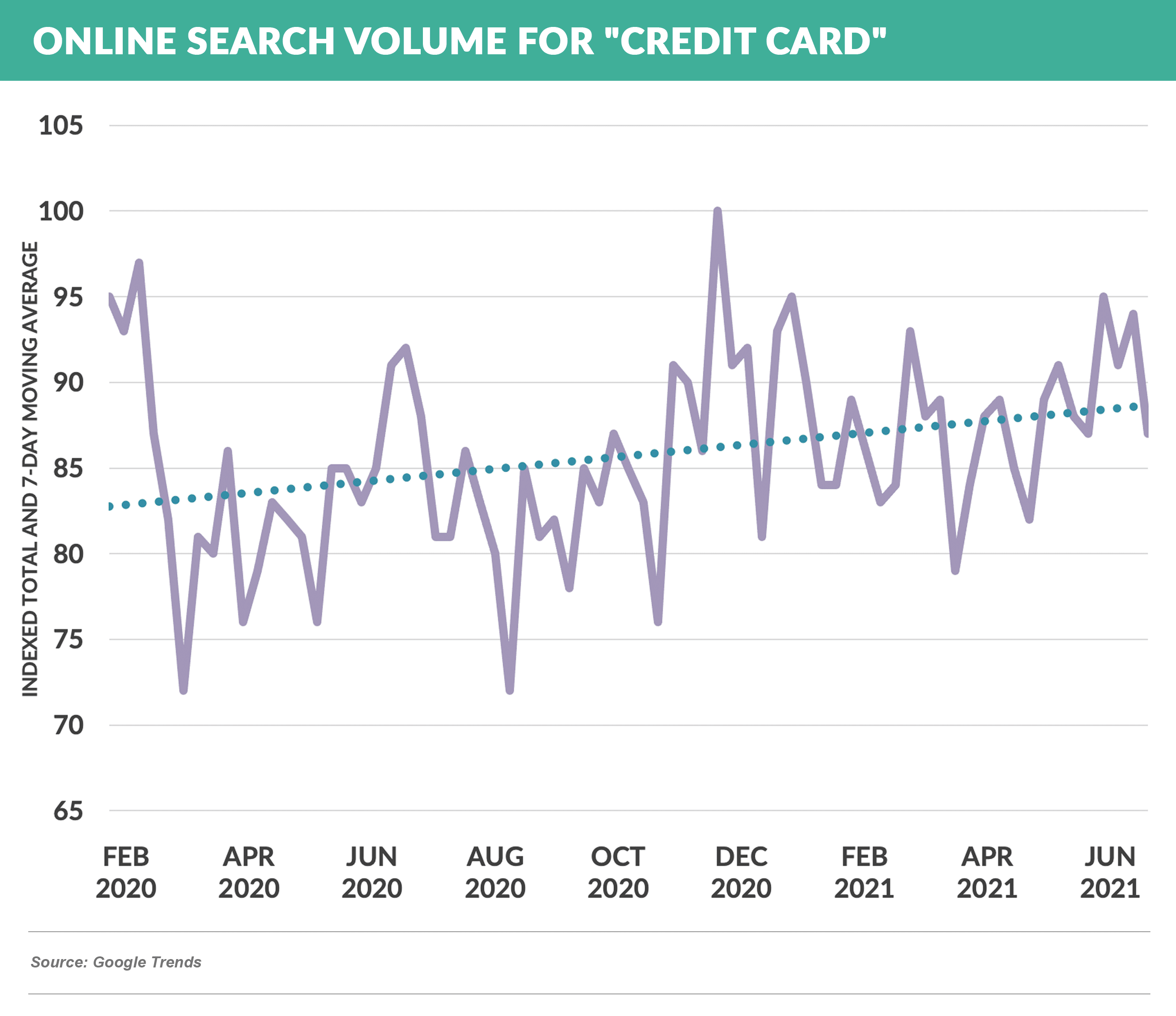

- Consumer demand for credit cards, as measured by online search activity, has trended steadily upwards over the past year

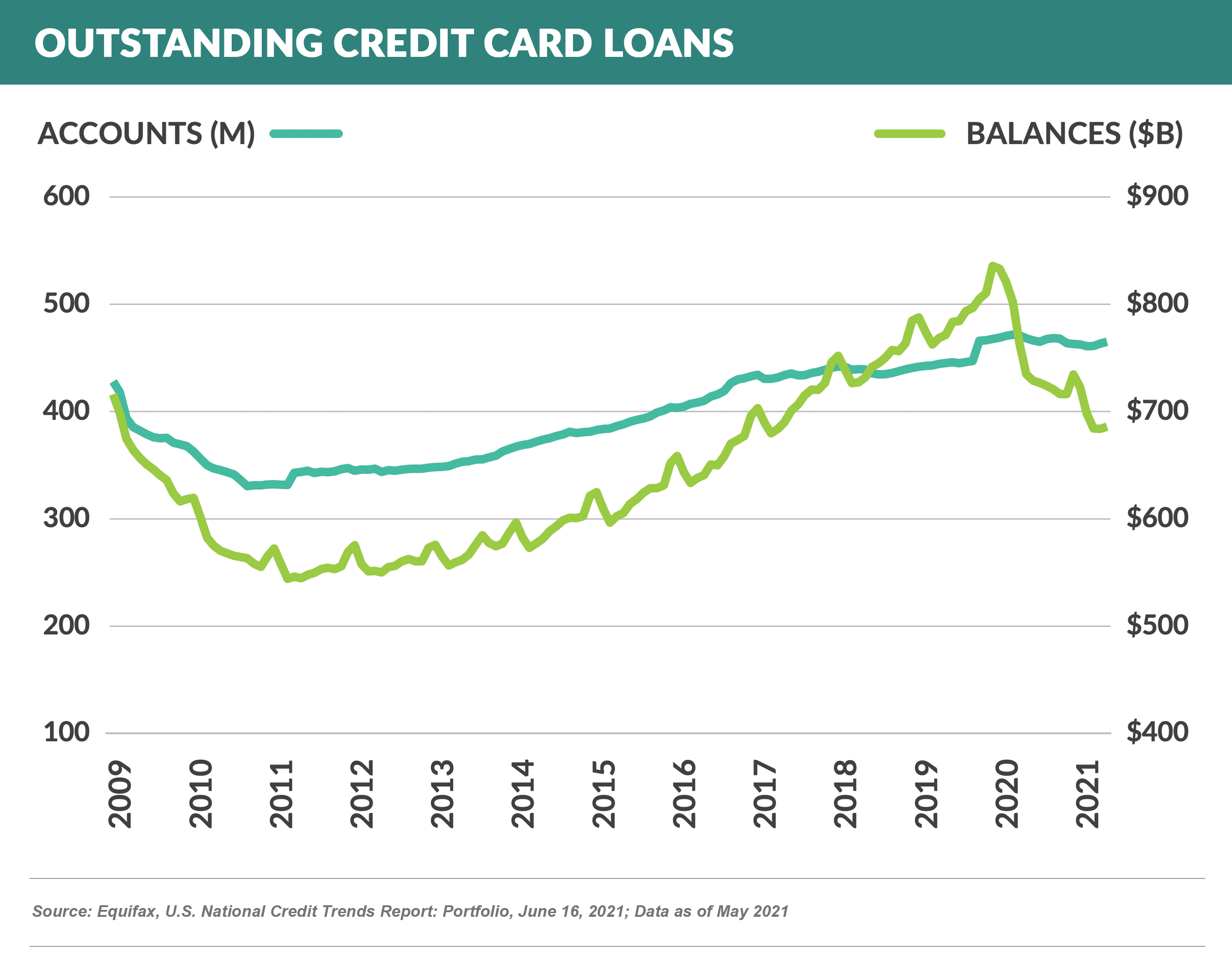

- After declining throughout 2020 and early 2021, card balances slightly improved in May – up 0.3% from April – but remain 6.7% below May ’20 and over 10% below May ’19 levels

- Card delinquencies continue to decline and are at the lowest level in recent history

- In addition to increased marketing activity, issuers have shown a renewed interest in growth through the introduction of new products

- Wells Fargo reported the debut of the “Active Cash” credit card, the first in a new “multi-card suite”, that offers an industry-leading 2% cash back on all purchases

- Citi has announced “Custom Cash”, a “next-gen” cash back card that gives 5% back on the top spending category each month

- Start-up Bilt Technologies is launching a credit card targeted at renters that will allow them to accrue reward points that can be put towards rent, other purchases, or a down payment on a house

- U.S. Bank announced the new “Altitude Go” card, a no fee offering with varying levels of cash back for different spending categories, including 4% on dining

- TD Bank launched the Double Up Credit Card, which offers up to 2% cash back if rewards are redeemed into an eligible TD deposit account

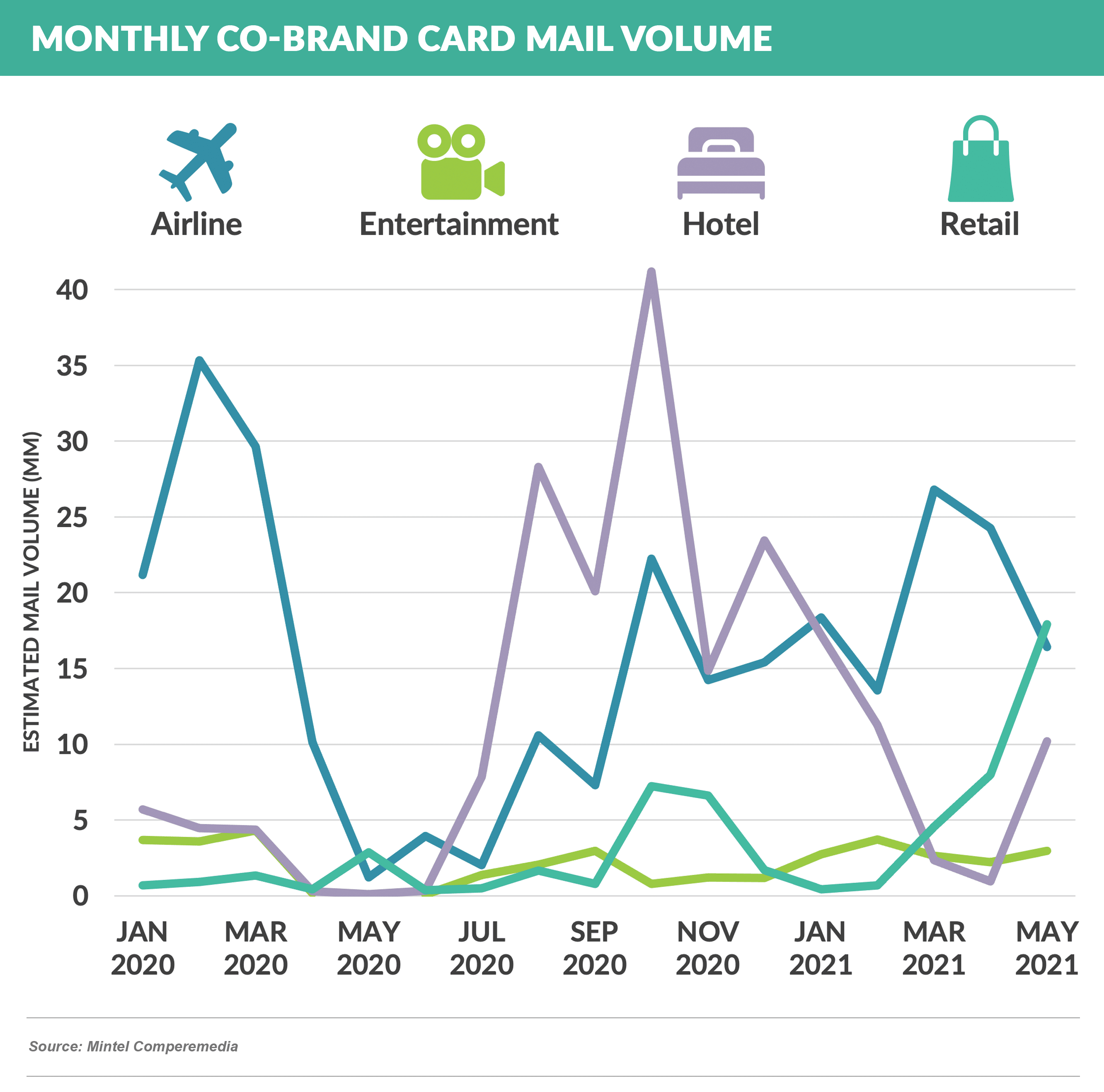

- Co-brand offers, which languished during the pandemic, have picked up the pace with the return of airline card programs to the mail and a recent pick-up in retail programs

- Lastly, large co-brand programs are in play, with Capital One taking over the Williams Sonoma program from ADS; but, the most notable recent news involves rumors that the Amazon card program, currently managed by Chase, is on the market

- The number of issuers that could absorb the reported $15 billion Amazon portfolio, which as a stand-alone program would be the 12th largest card issuer, is small (i.e., you could count them on one hand), but the rumor mill is abuzz with Bloomberg reporting that American Express and Synchrony are among the bidders, and we’ve heard of a few others that are involved

Personal Loan Issuers Remain Hesitant

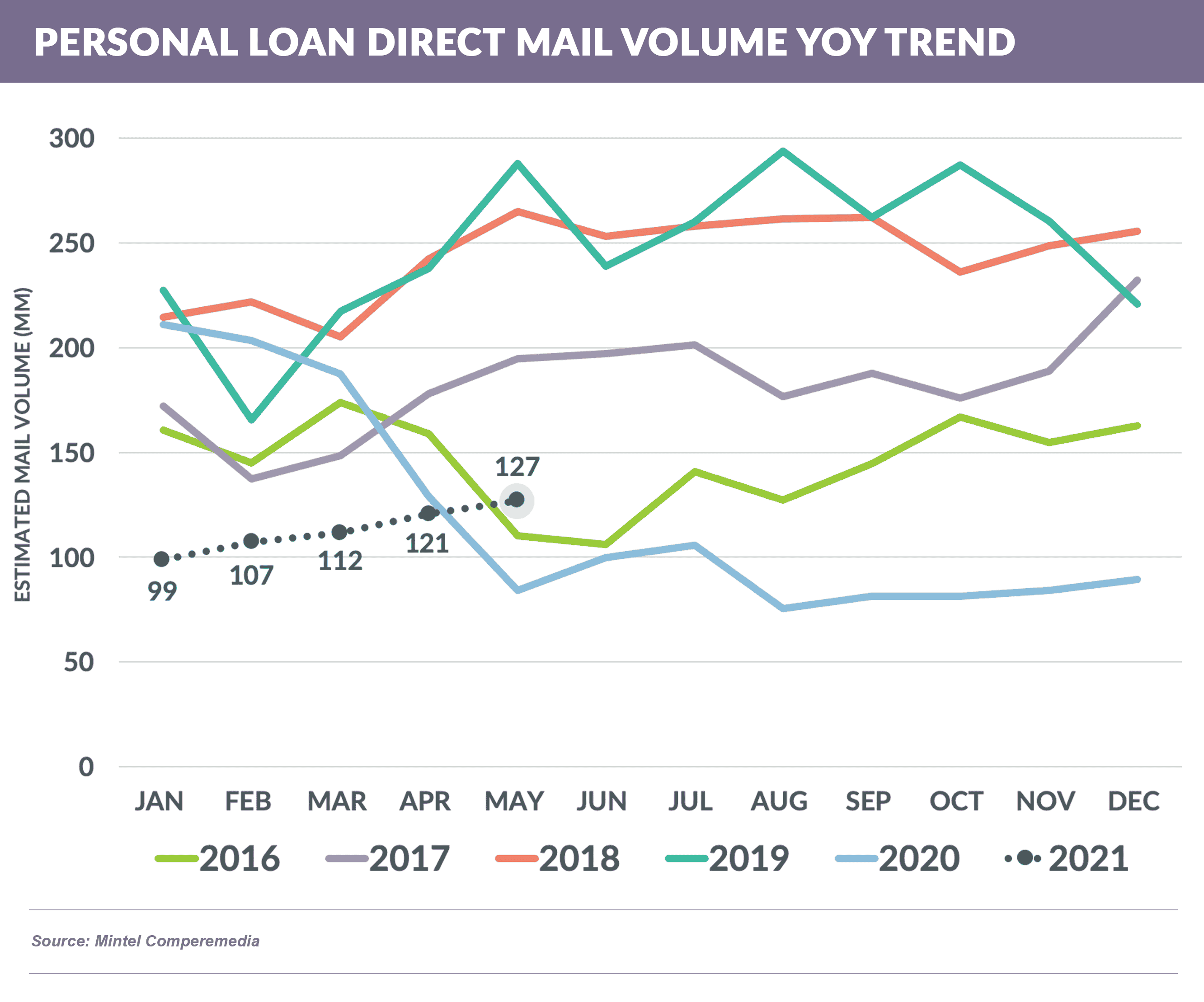

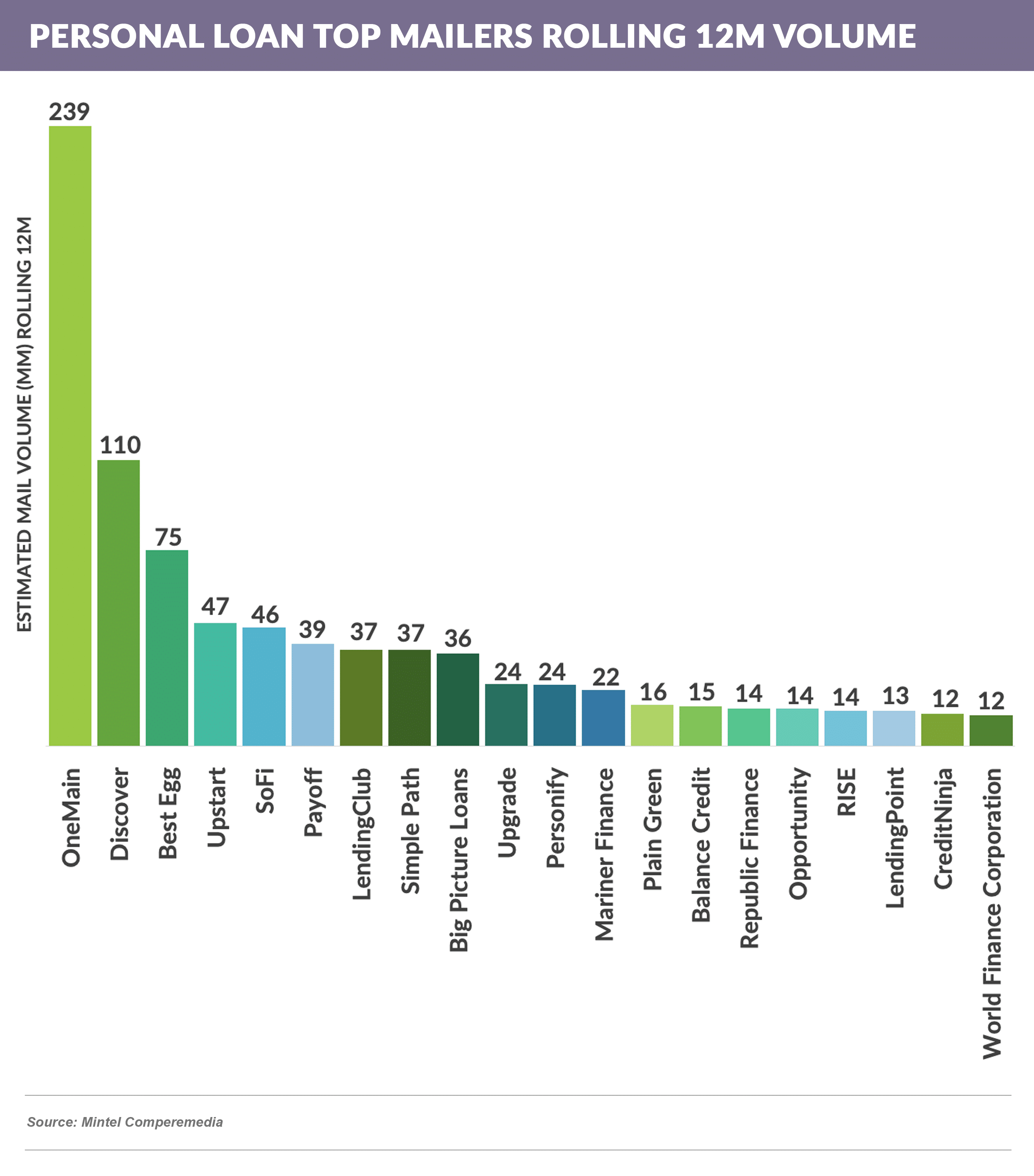

- Personal loan growth is still low compared to prior years as illustrated by direct mail volume that remains about half that of 2018 and 2019

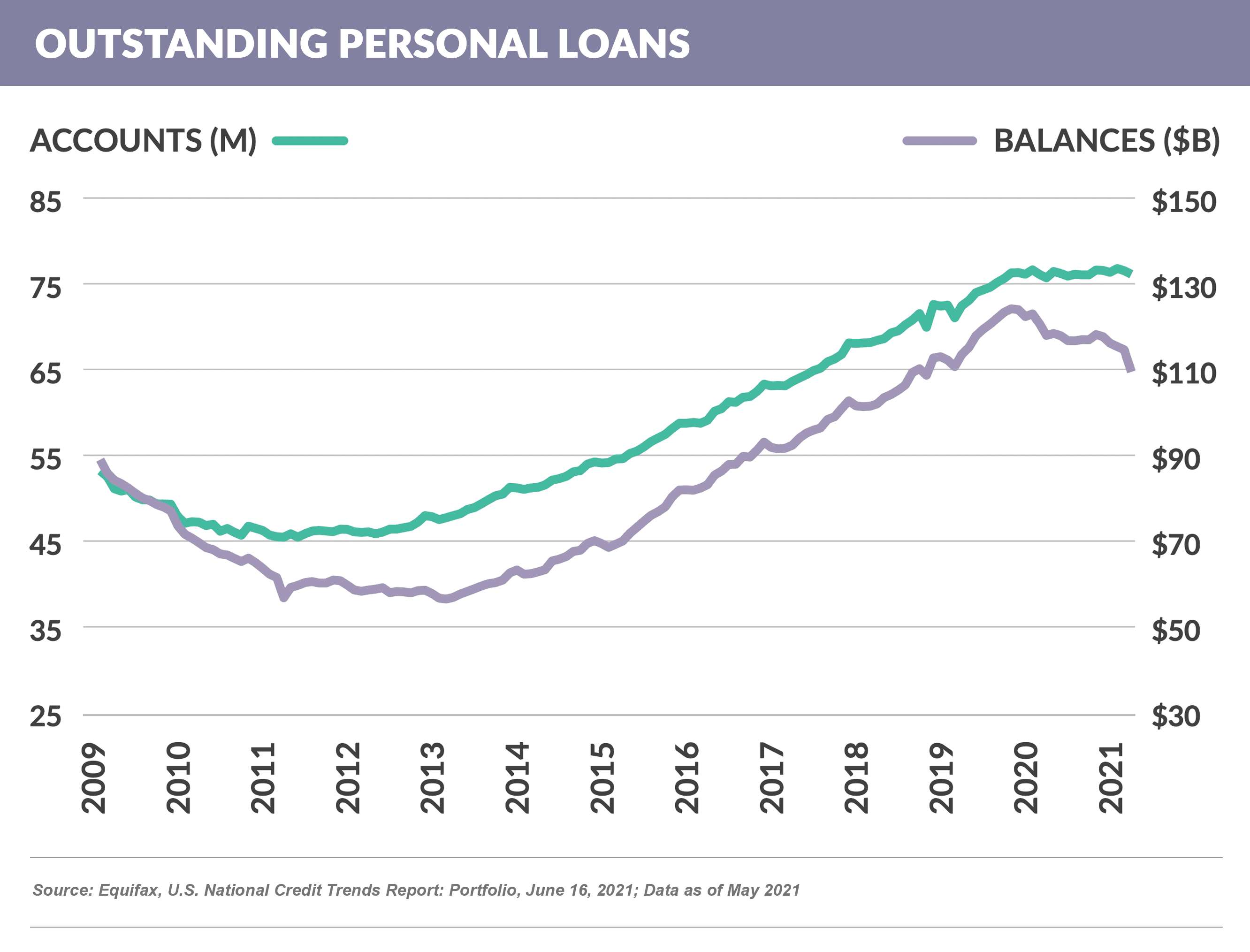

- Total balances are down 10% from Q1 2020 and at the same level as Q1 2019

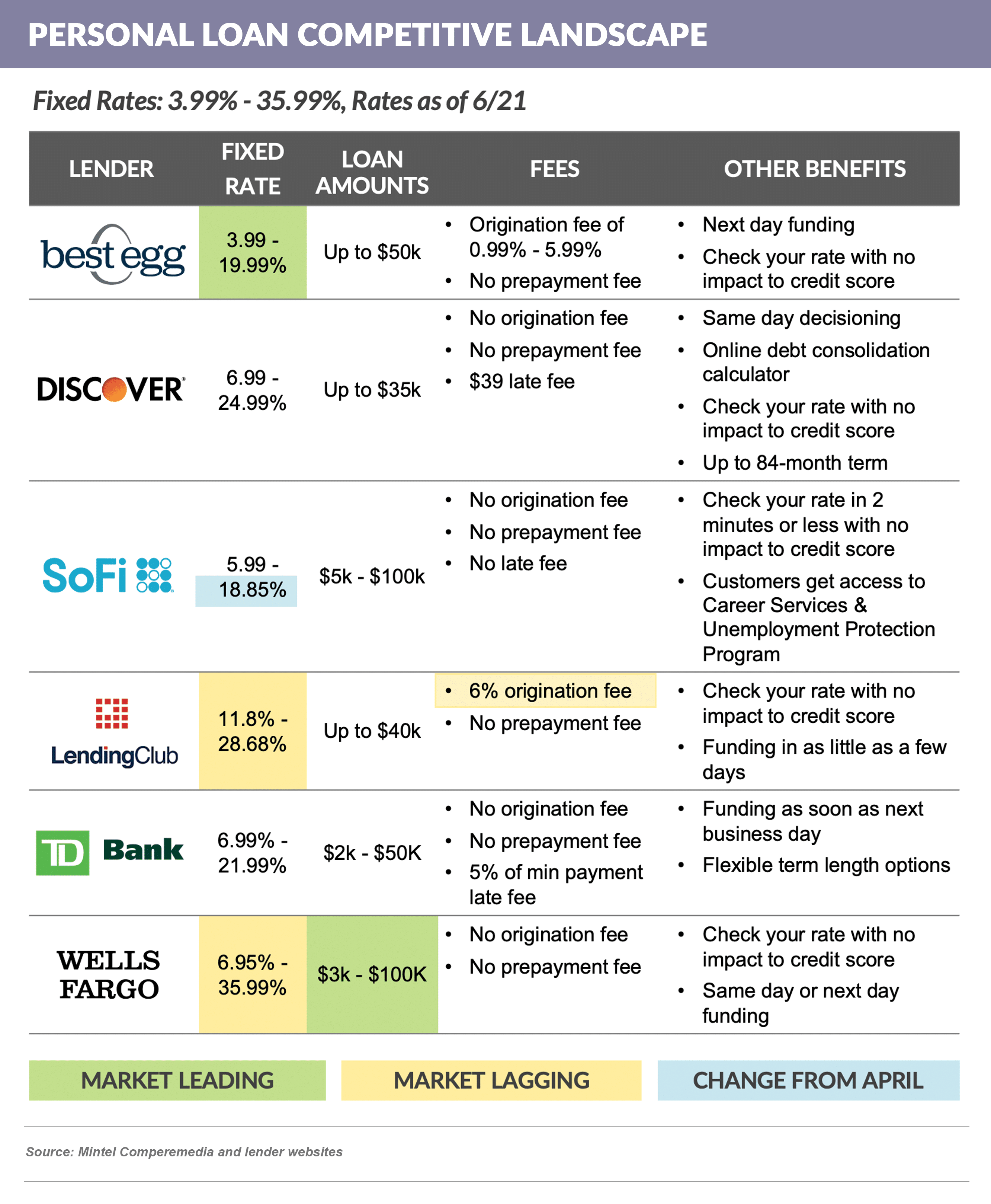

- A recent review of current offers shows a variety of “lowest advertised rates” and varying origination fees ranging from 0% to 6%

- And the obligatory monthly reminder that commercial banks are not active in this sector, and many issuers who are not exactly household names are

Quick Takes

- We’ve heard stories of potential issues with large printing houses – labor and paper shortages – that are impacting direct mail programs

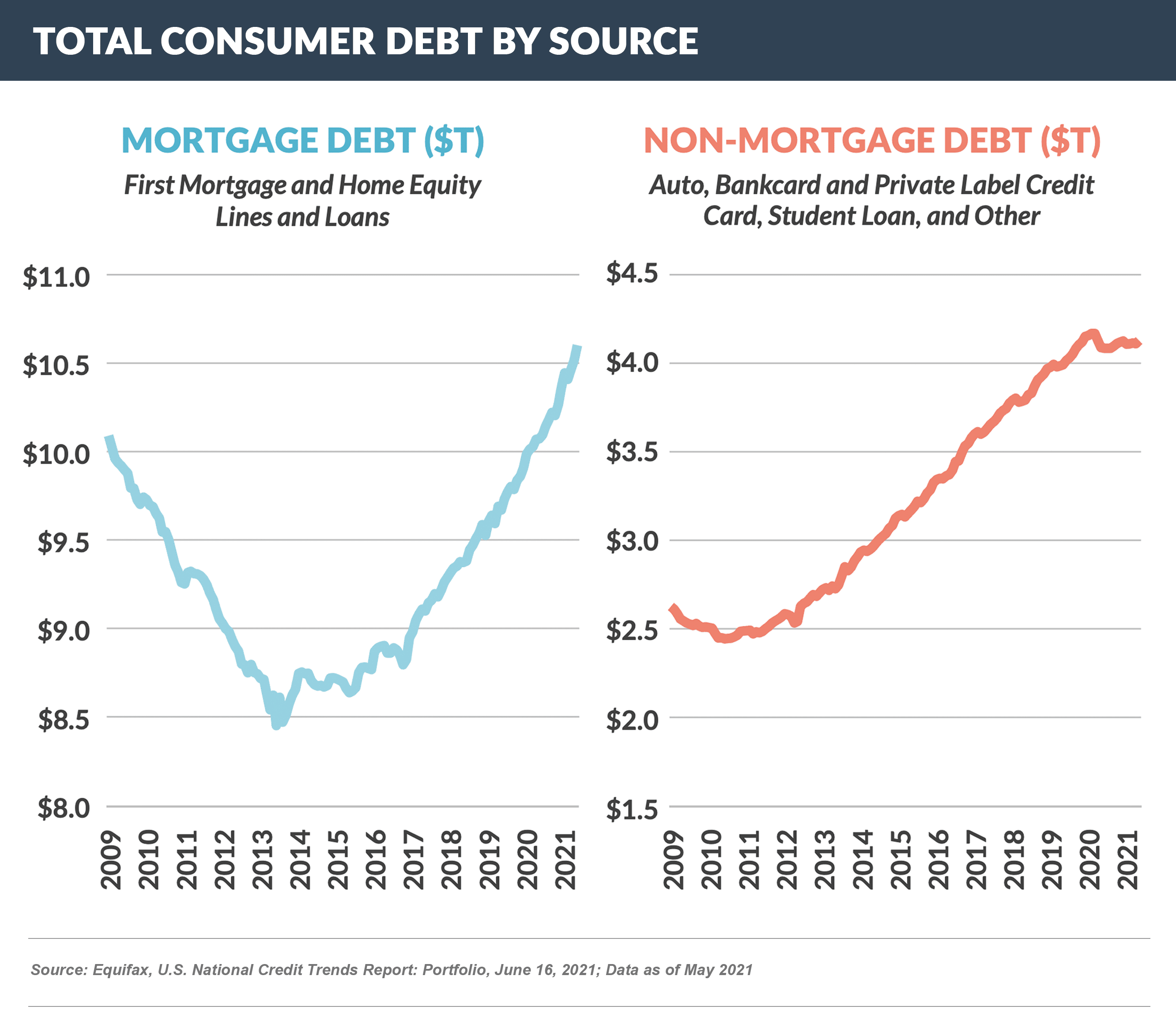

- Despite shrinkage in credit card and personal loan balances, total consumer debt is up, primarily fueled by growth in first mortgages

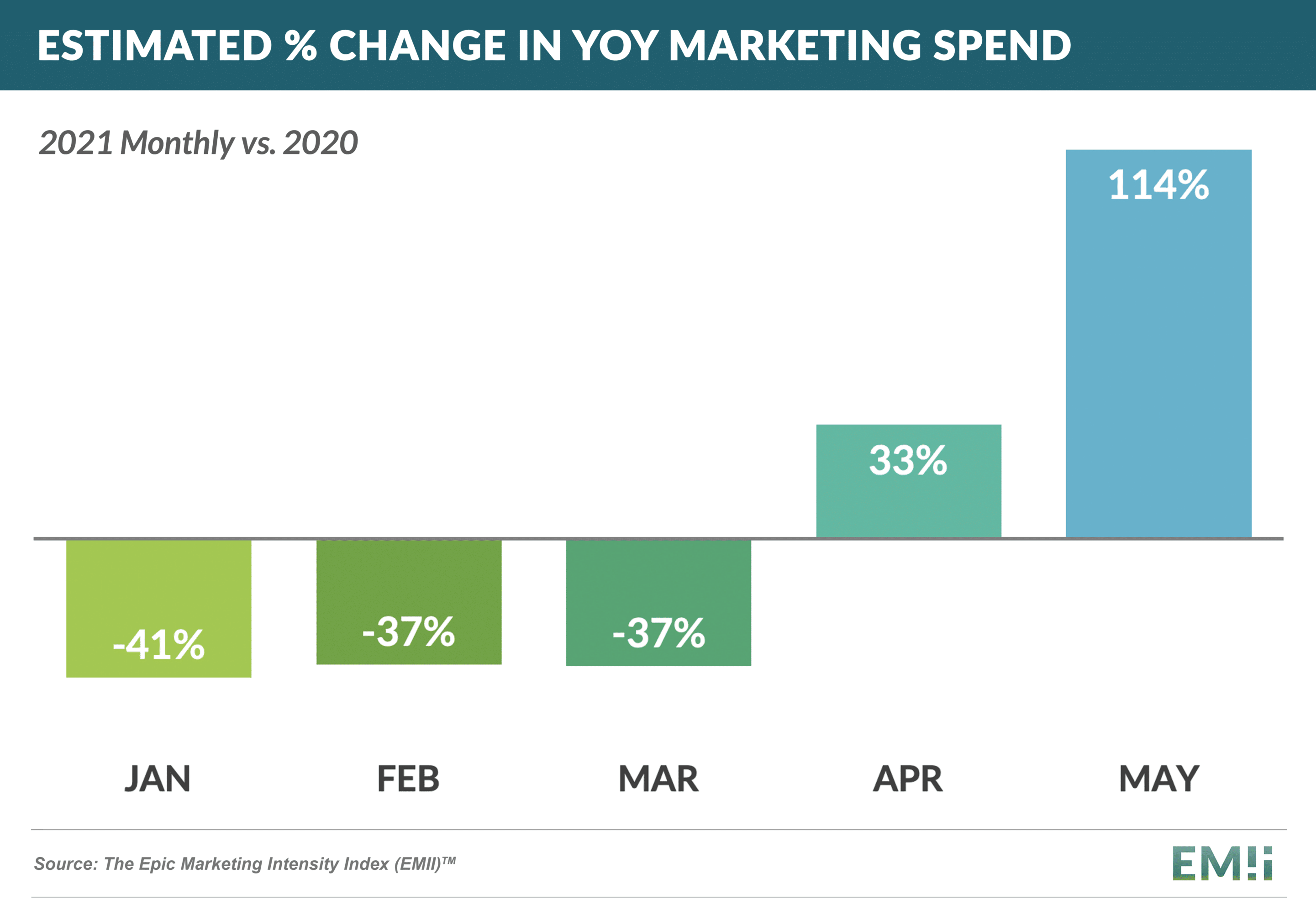

- The Epic Marketing Intensity Index (EMII) – which measures estimated marketing spend across direct mail, search, and paid digital – shows a continued trend towards higher overall spending across mail and digital channels, and is up over 100% from May 2020

Thank you for reading.

The Epic Report is published monthly, and we’ll distribute the next issue on Saturday, August 7th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research uses innovative, data-driven techniques to model, design, and execute high-performing direct marketing campaigns to help financial services companies acquire new customers. Click here to find out how we can help you.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here. To subscribe to our newsletter, click here.