Three Things We’re Hearing

- Credit card mail volume continues to normalize

- Personal loan mail volume recovery stalls

- Financial services marketing coming back to varying degrees

A three-minute read

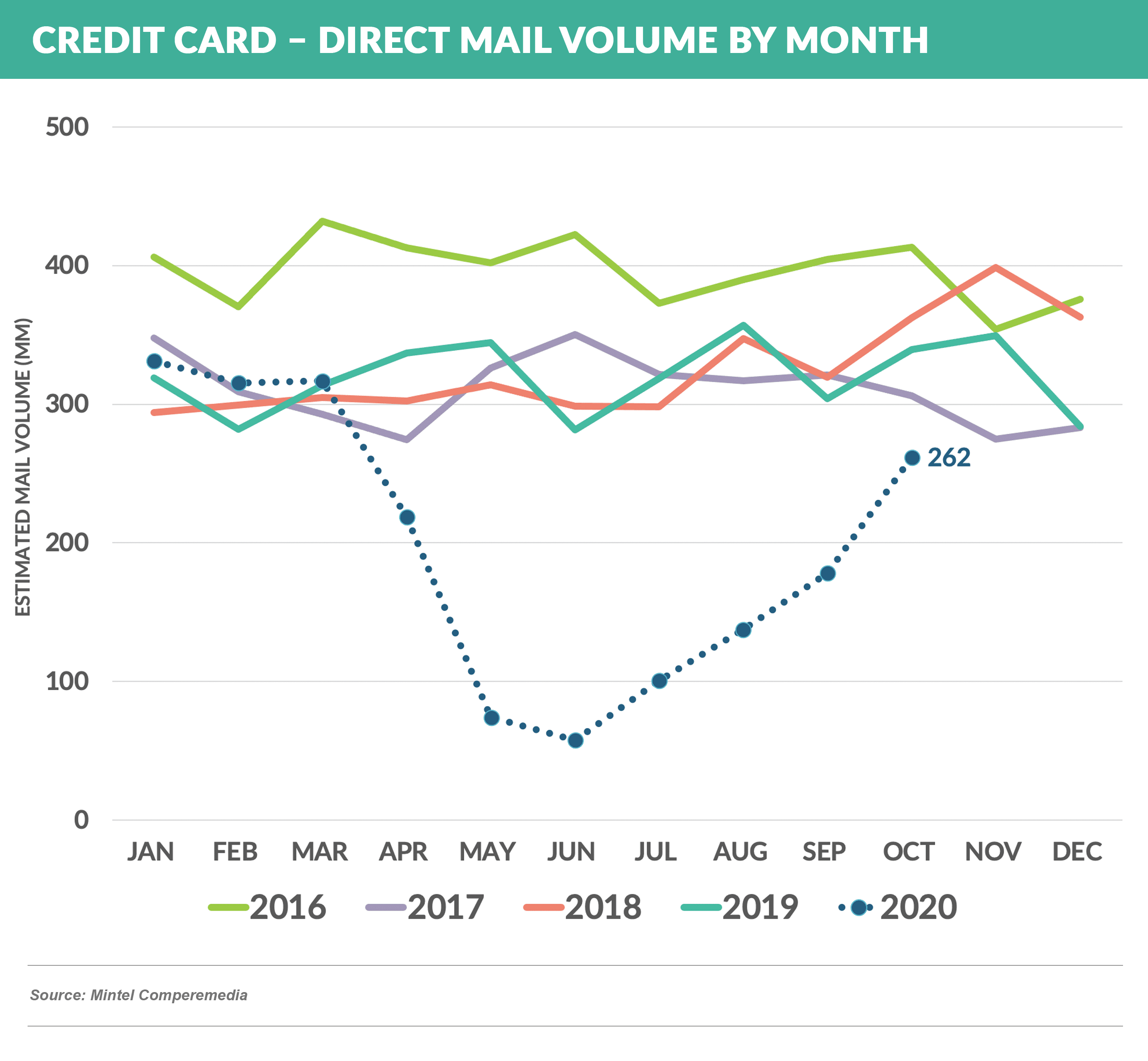

Credit Card Mail Volume Continues to Normalize

- Since reaching a historic bottom in June, credit card mail volume has steadily climbed back toward pre-pandemic levels

- October volume was up 47% from September, at 262 million pieces, and down only 23% from October ’19

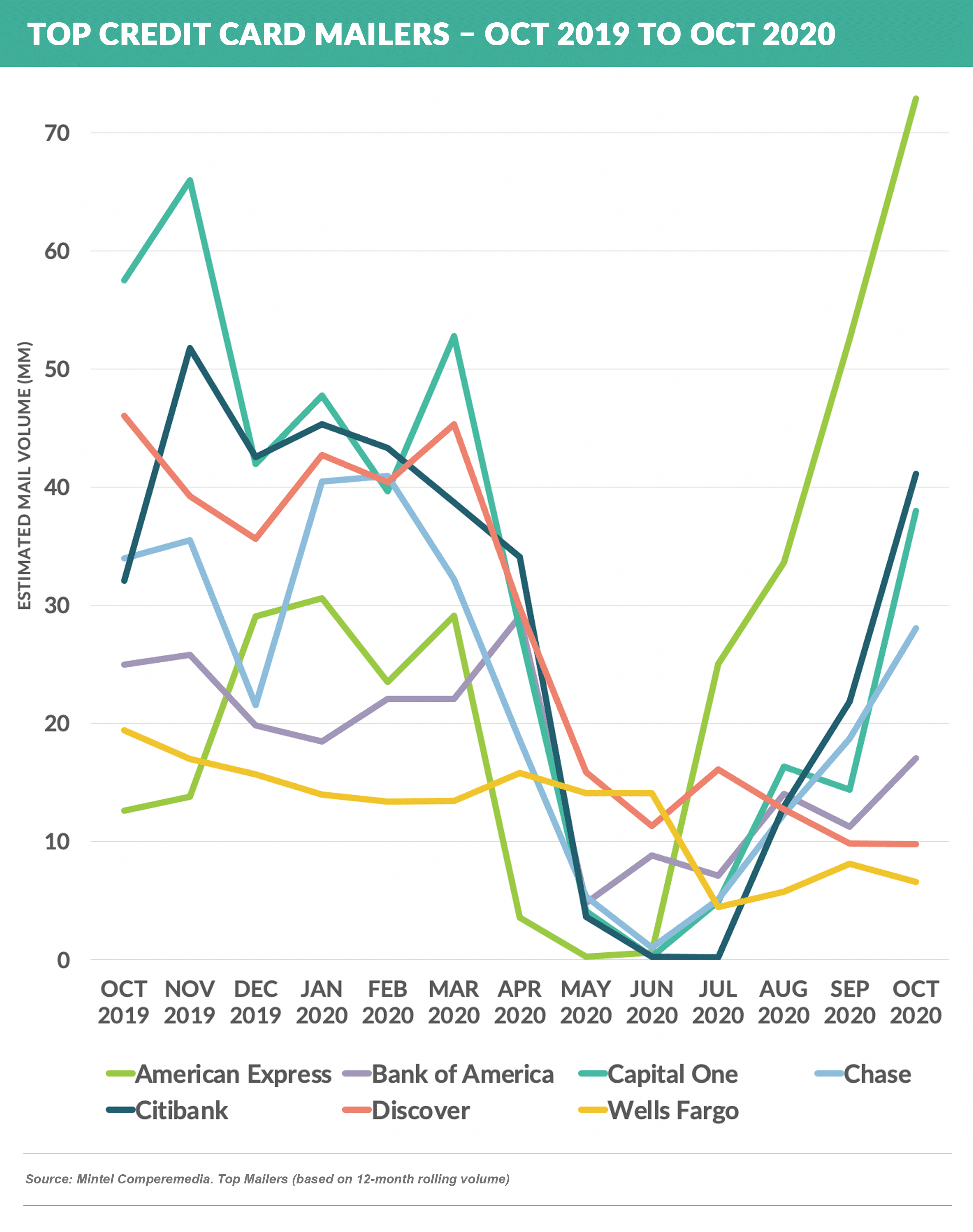

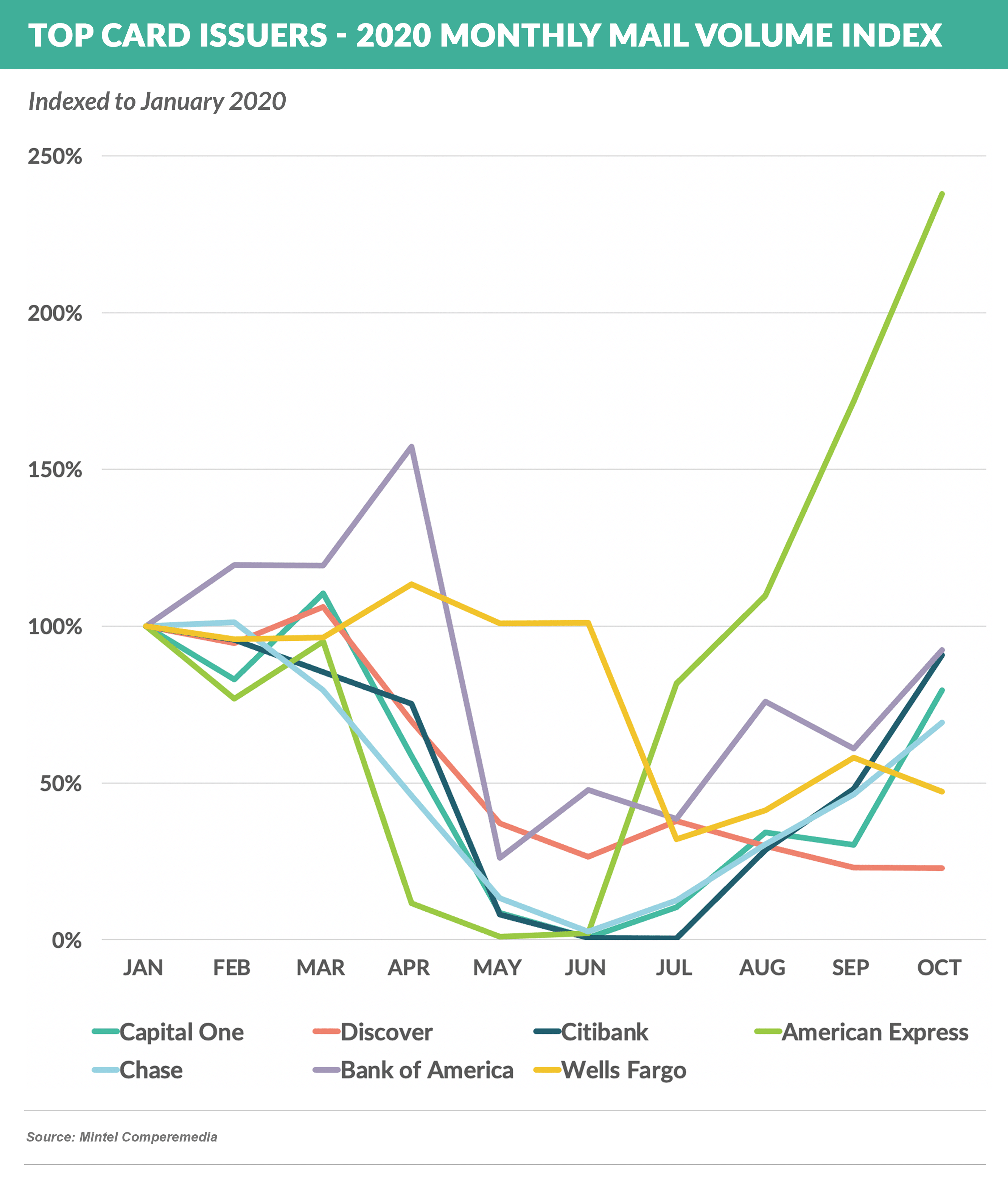

- Individual issuer volume was up across the board, with American Express, Citibank, and Capital One leading the way

- Amex continued its breakneck pace of the past few months, mailing 73 million pieces – up 38% from September and up 463% from October 2019!

- In addition to Amex, Bank of America, Citi, and Capital One have all recovered to within 80% - 90% of January levels

- At this pace, credit card mail volume appears headed back to pre-COVID levels within the next several months

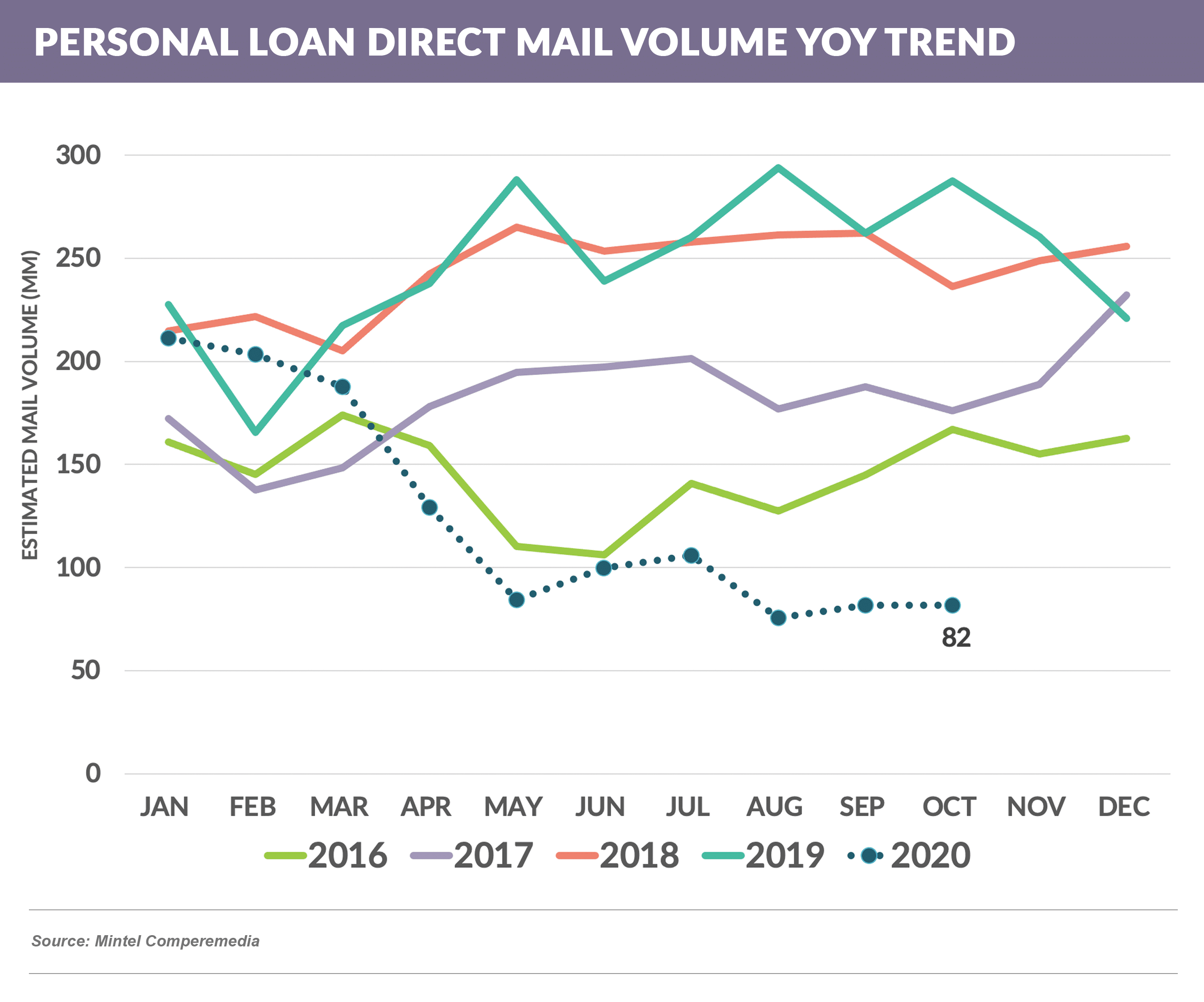

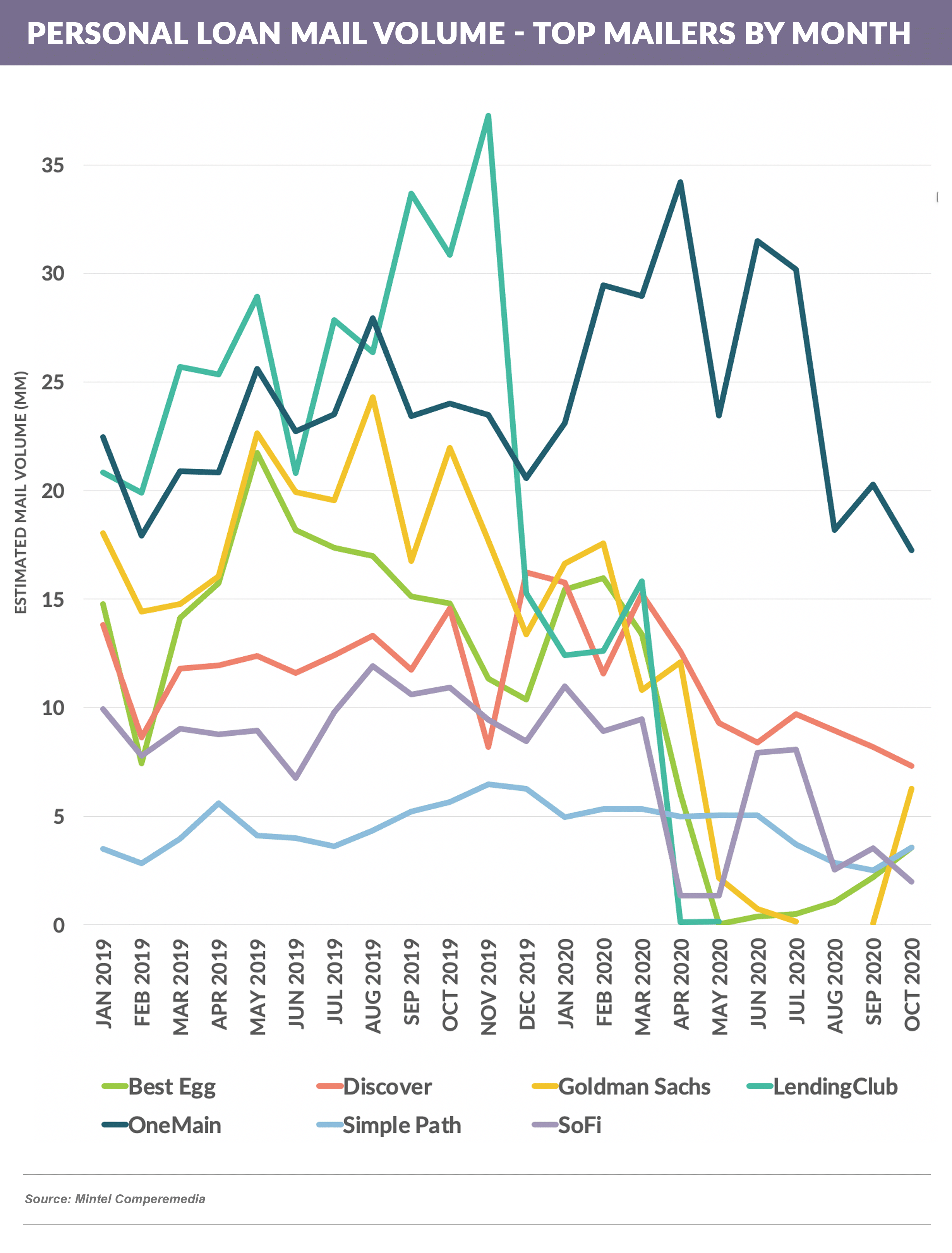

Personal Loan Mail Volume Recovery Stalls

- In contrast to credit cards, the slow recovery in personal loan mail volume has stalled, remaining 72% below October 2019

- OneMain, the largest mailer over the past year, has reduced volumes in the last few months while maintaining the lead

- Best Egg has reappeared as a mailer in the last two months, as has Marcus, although at sharply lower volumes than last year

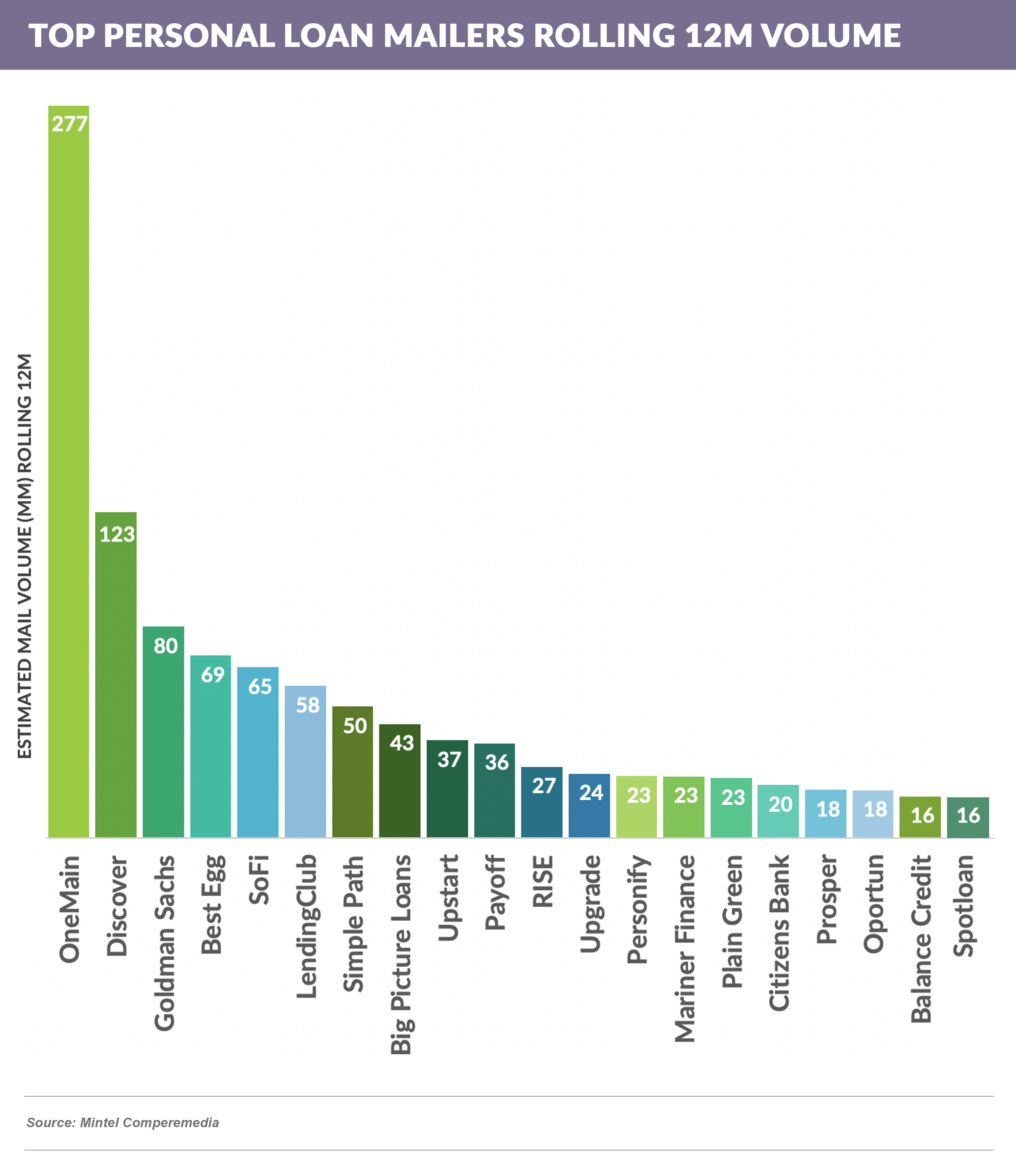

- A look at the top personal loan mailers for the past 12 months shows OneMain leading with over double the volume of second highest mailer Discover

- There are many unfamiliar names in the top 20 mailers, and only one “traditional” retail bank (Citizens)

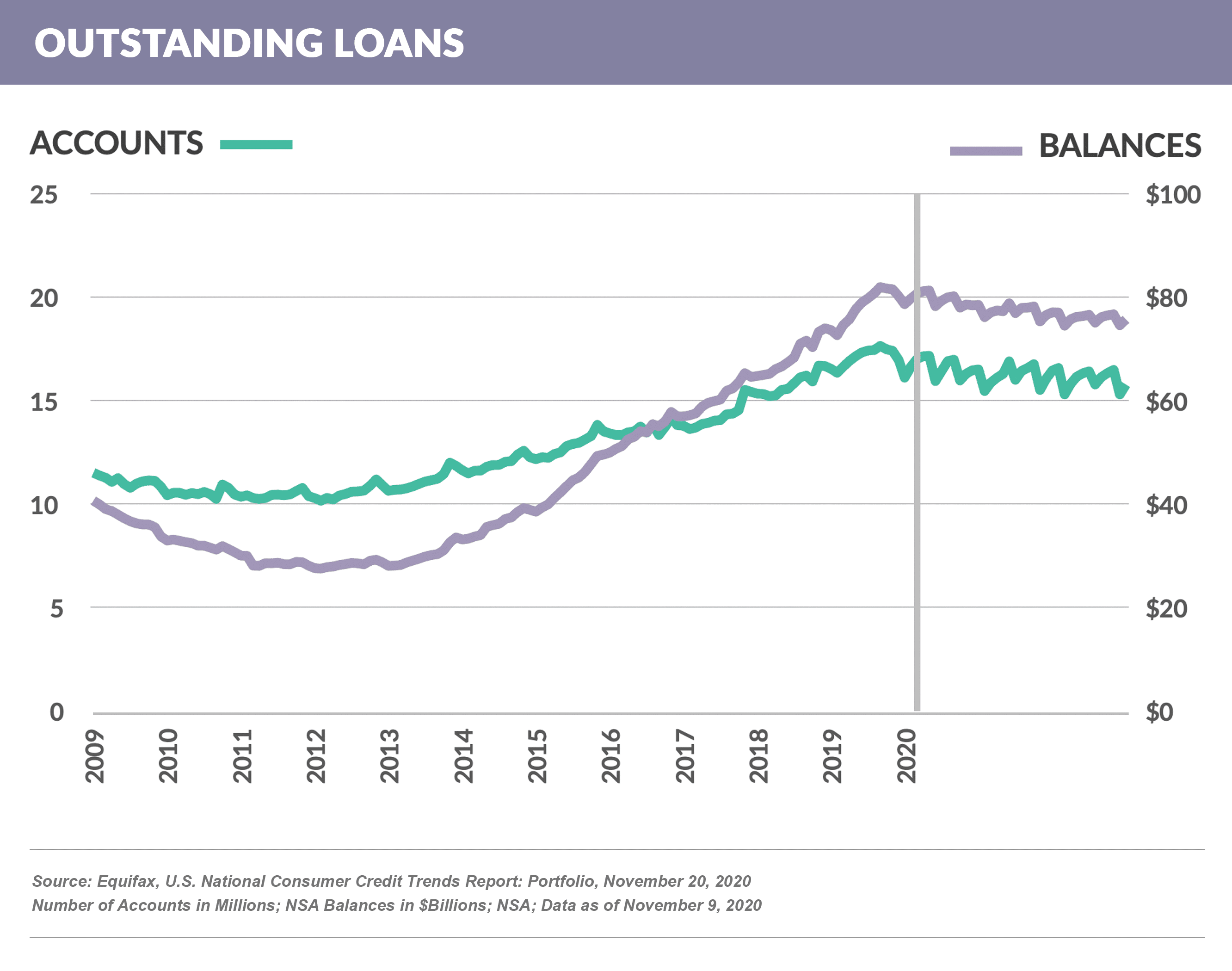

- The drop in 2020 mail volume has caused overall balances in the previously fast-growing personal loan sector to flatten

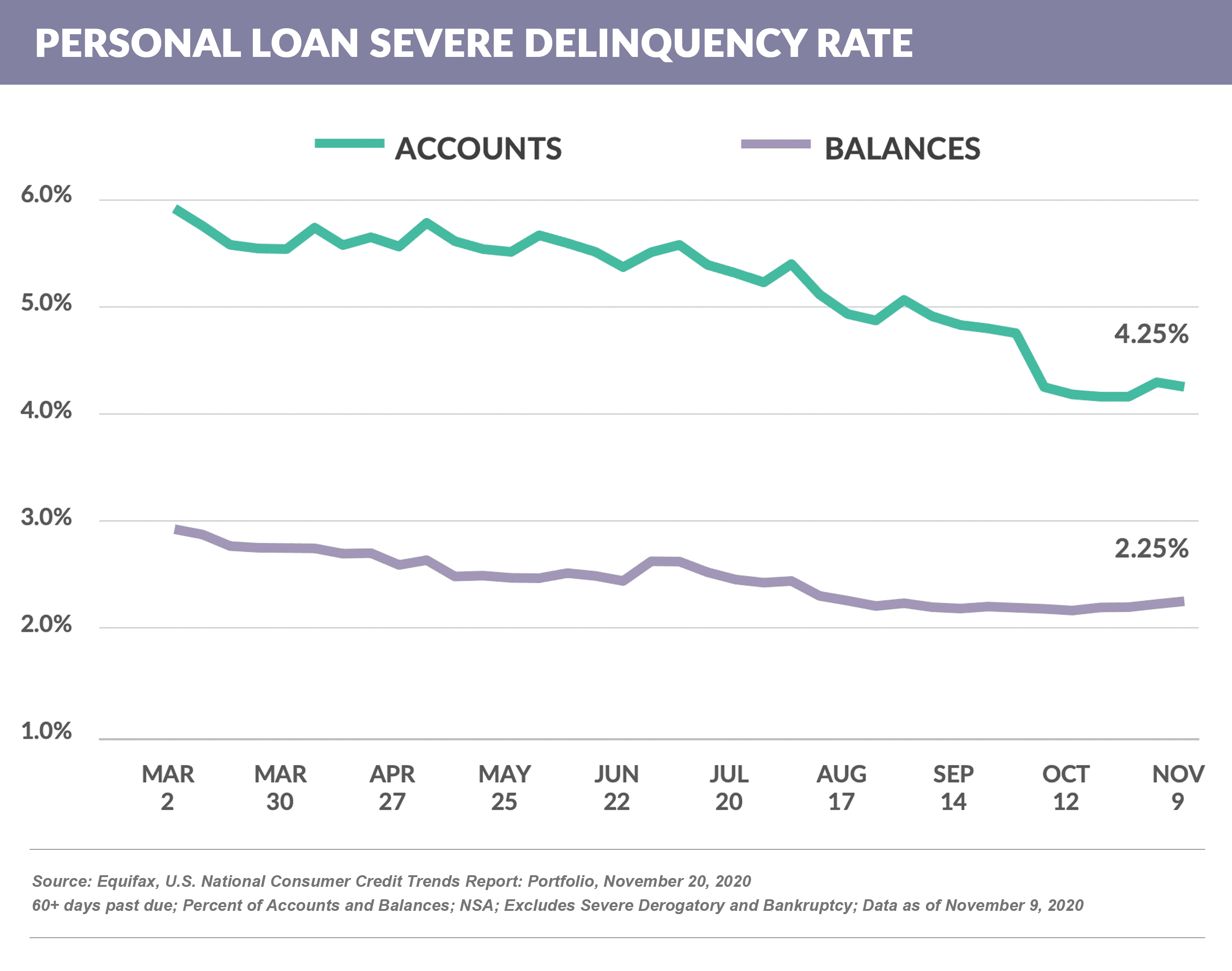

- Despite benign delinquency rates, many lenders remain hesitant to resume full blown personal loan acquisition volumes pending sustained stable asset quality metrics

Financial Services Marketing Coming Back to Varying Degrees

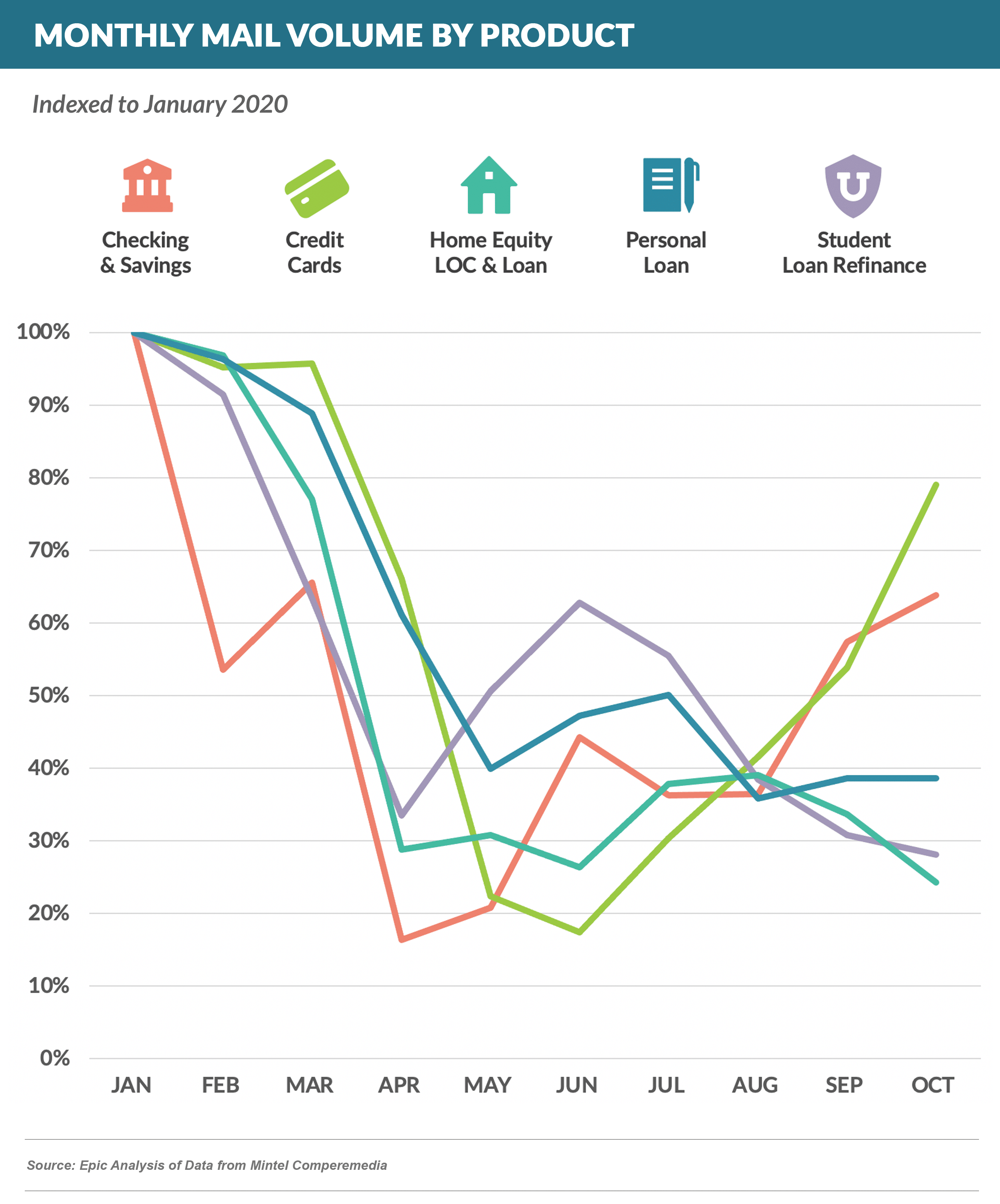

- As previously observed, overall mail volume for consumer financial products dropped massively following the March news of the pandemic

- Since then, different products have resumed marketing at different rates, with credit cards and checking solicitations rebounding the fastest, and HELOC and student loan refinance being the laggards

- Credit card and checking volumes fell the most – each down over 80% at one point – and have since rebounded the fastest – now down only 21% from January

Quick Takes

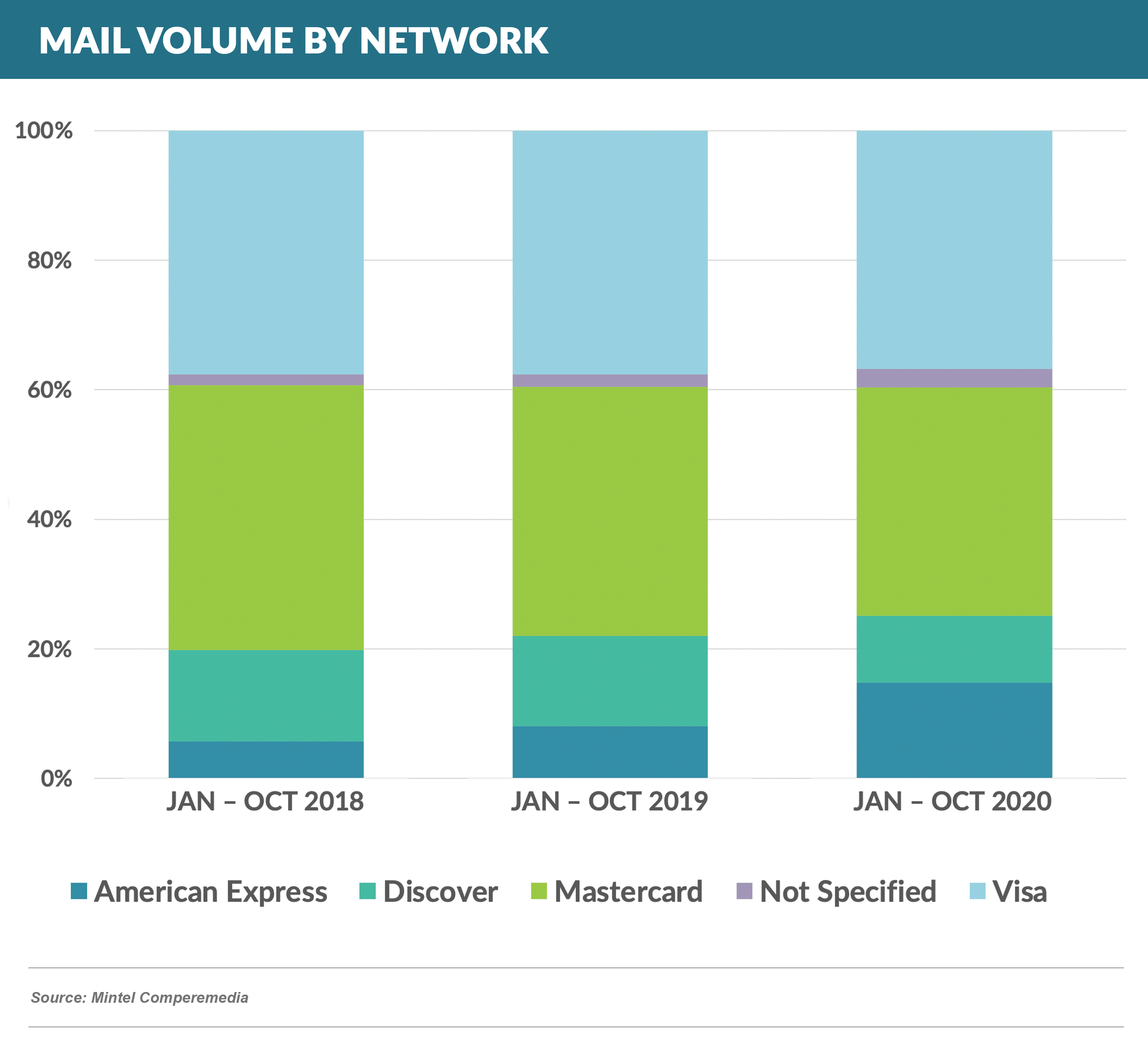

- Despite the market volatility over the past several years, it is interesting to note that the network market share of mail volume has remained stable, with Visa and Mastercard each regularly commanding 35% - 40% of volume

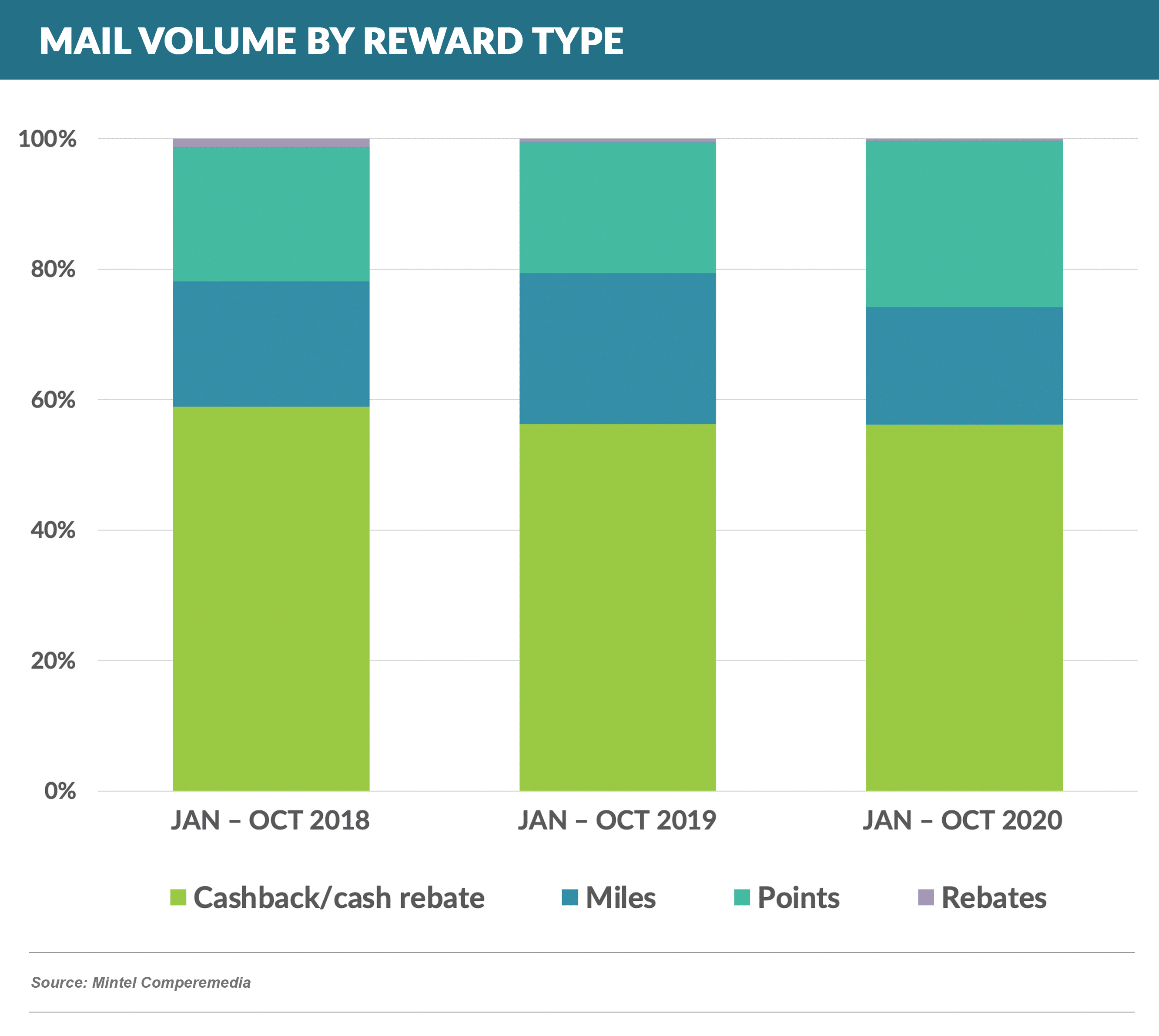

- The mix of “rewards-type” cards has also remained fairly consistent over the past few years, with “cashback” accounting for just over half of all rewards mail offers

- Figure, the fintech started by former SoFi founder Mike Cagney, has applied for a special bank charter

- If granted, the charter would allow Figure the benefit of exporting rates nationally, but would avoid much of the regulatory oversight of more traditional charters

- A recent survey of U.S. consumers by Experian shows signs of optimism:

- One third of consumers feel that the economy has either mostly or fully recovered—the most optimistic globally

- Half of consumers anticipate increasing spending on items purchased online in the next 3-6 months

- Source: Experian, Global Insights Report: Changing Consumer Behaviors and Evolving Business Strategies, November 2020 Release

Thank you for reading.

The next Epic Report will publish in two weeks on December 19th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.