Three Things We’re Hearing

- Areas of opportunity for local banks

- Advertising spend down across channels

- Auto insurance spending won’t slow down

A two-minute read

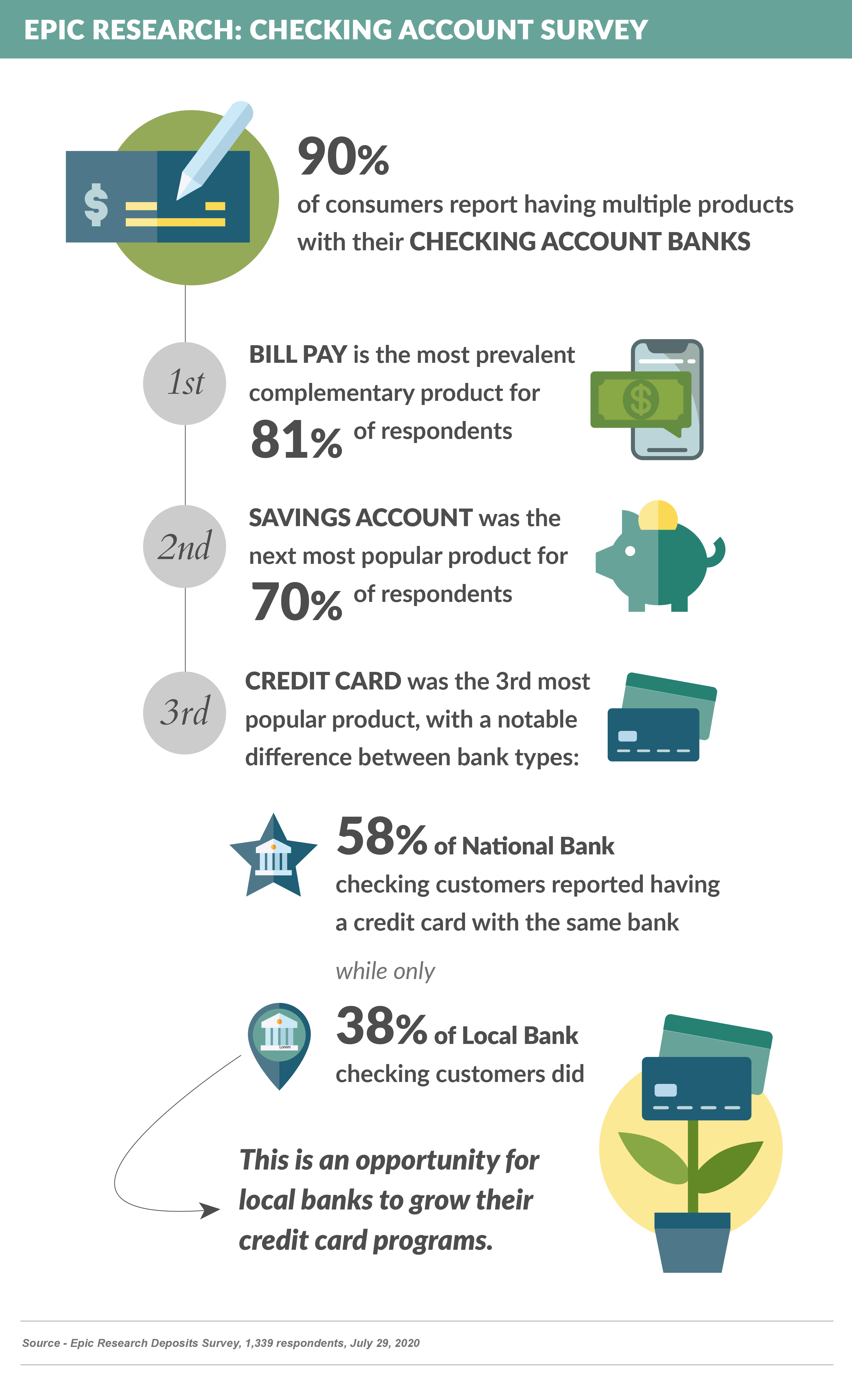

Areas of Opportunity for “Local” Banks

- Epic surveyed 1,339 consumers across the U.S. and found differences in checking account preferences for consumers with “Local”, “National”, and “Online” banks

- Other areas of difference include:

- Online Bank checking customers are twice as likely to have a personal loan, student loan, or investment account with the same bank than customers at their National and Local Bank competitors

- Local Bank checking customers put less importance on digital capabilities than others, with only 14% of Local Bank customers having chosen their banks for that reason vs. 28% for National Bank customers and 44% for Online Banks

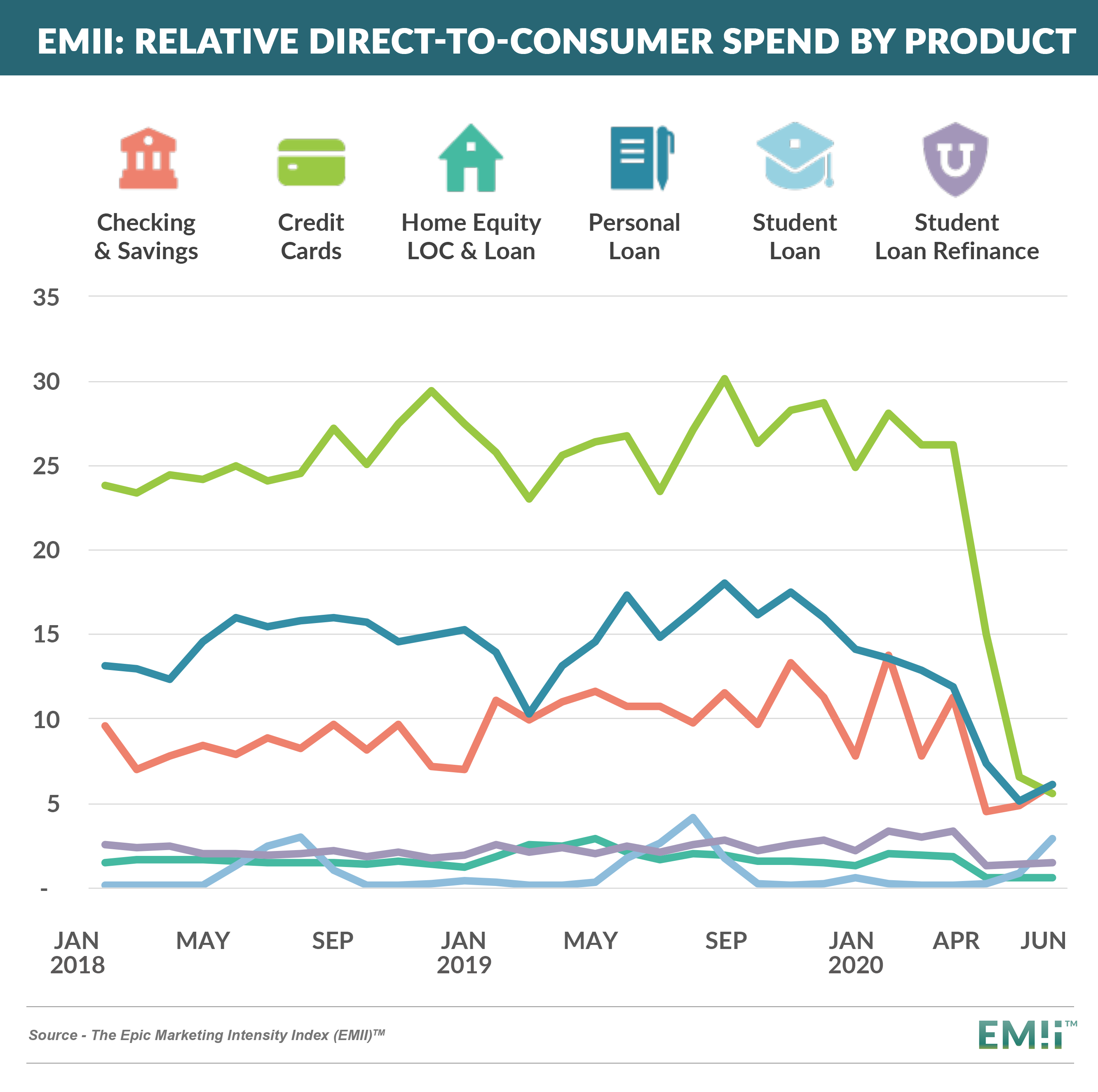

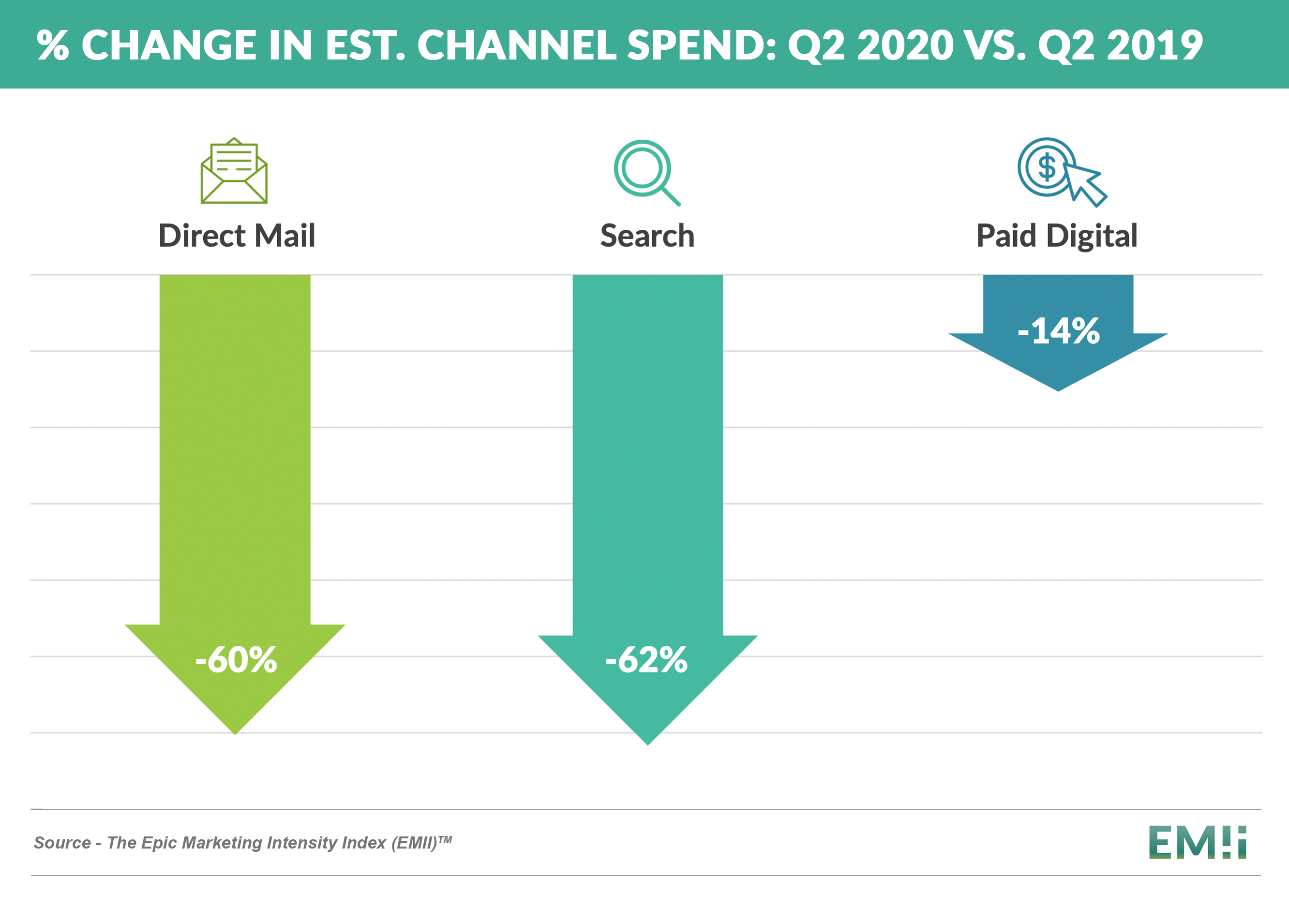

Advertising Spend Down Across Channels and Products

- The Epic Marketing Intensity Index (EMII) – which measures advertising spending across direct mail, online search, and paid digital channels – shows a consistent spend drop across most products through the end of Q2

- Student loans are the exception, given the seasonal nature of the product

- Both direct mail and online search were down 60%, with paid digital faring somewhat better, down only 14% from Q2 2019

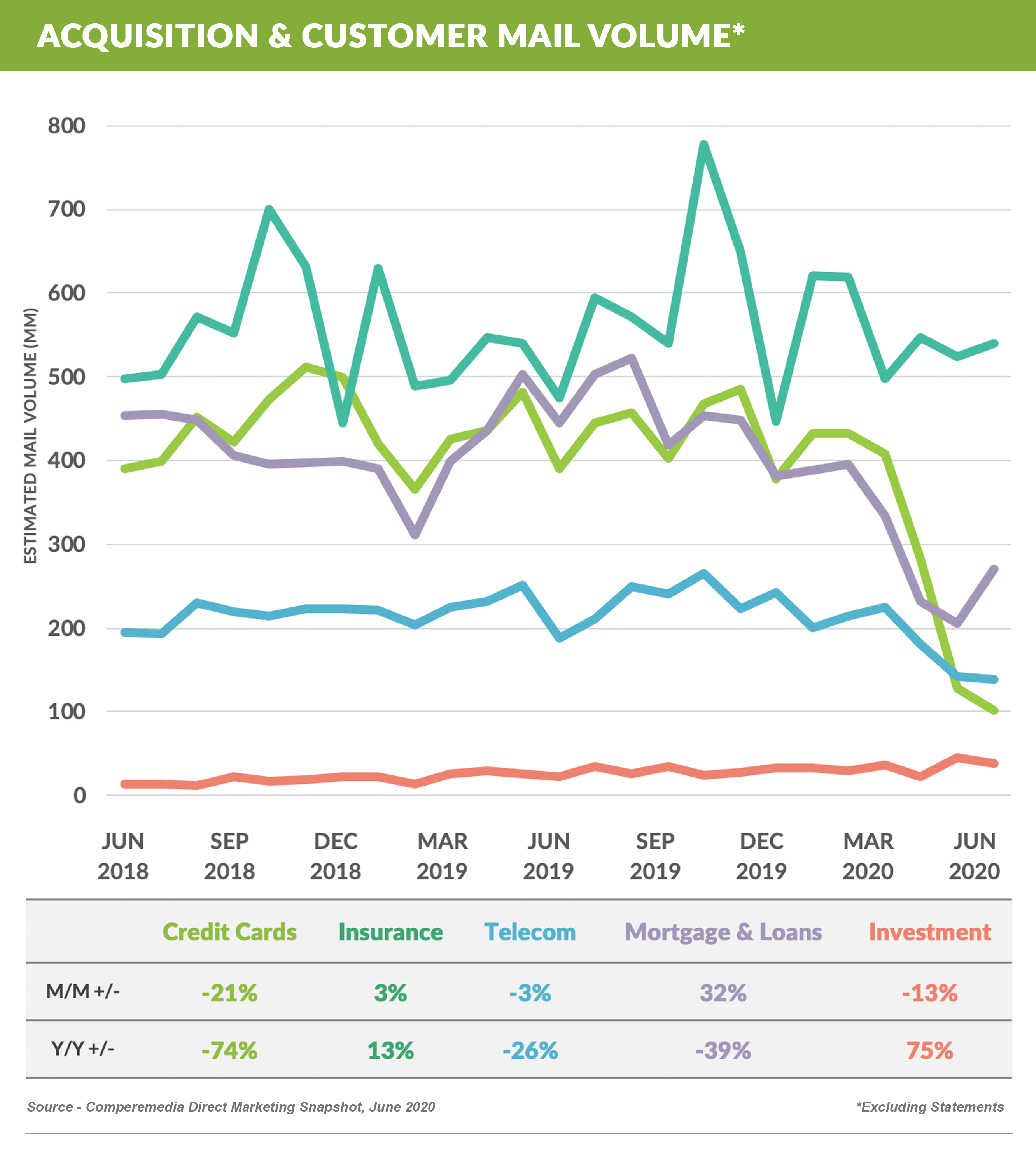

Auto Insurance Acquisition Spending Won’t Slow Down

- Unlike consumer loan products, insurance and investment mailings are growing year-over-year, with insurance mailings leading the pack with a 13% increase over last year and investments up 75% (on a much lower base)

- Given the number of insurance ads we’re seeing on TV (Liberty Mutual, GEICO, Progressive, State Farm, Allstate, USAA, etc.), this doesn’t come as much of a surprise – GEICO auto insurance alone mailed 10.4 million mail pieces in June

Quick Takes

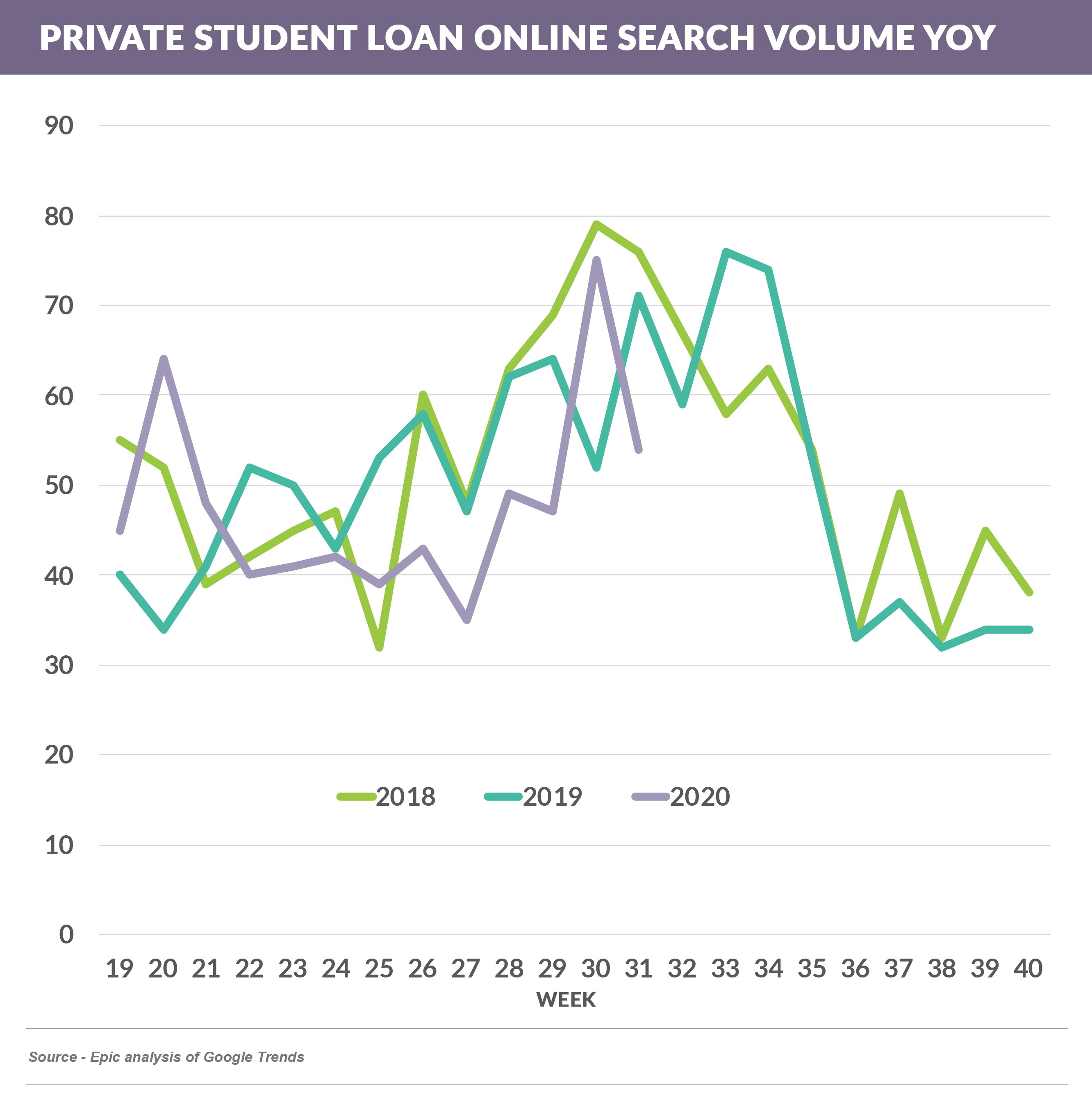

- As noted above, Student Loan demand always picks up in mid-summer, however the shape of the curve has been lower this year due to uncertainty surrounding the pandemic and back-to-school plans

- The question remains as to whether the curve is elongated, or if there will simply be less loan demand this year – to date, anecdotal data shows fewer loans at higher average balances

Going Forward

- Consumer lending executives are currently in a similar situation as educators when planning for the fall, with most waiting to see if they will execute on their “normal” or “hybrid” plans

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.