Three Things We’re Hearing

- BNPL’s death rattle!

- 2024 Predictions – two BNPL issuers will blow up

- Advertising in 2023 – loans down, deposits up!

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

BNPL’s Death Rattle

- BNPL has shown rapid growth over the past few years with fintechs such as Affirm, Klarna, and Afterpay leading the way along with incumbent PayPal

- When asked by bank executives “what should we be doing about BNPL?” our answer is generally

- The POS BNPL market is hyper-competitive

- Banks with card portfolios have a built-in advantage for structuring on-card transactions into installment loans

- And OK, “death rattle” might be a little strong (we do like the sound of it), but we have viewed the long-term viability of fintechs in the BNPL space with skepticism

- BNPL industry growth has come predominantly in a period of unusually low interest rates – how will non-depository institutions fare when interest rates normalize and access to capital markets becomes more challenging?

- In an unusually benign credit environment, BNPL risk underwriting was “unconventional” and credit performance was not reported to credit bureaus – how will these consumers perform as the credit cycle returns to historical levels? (although Affirm seems to have their delinquencies in check)

- Competition for new merchant partnerships is very stiff, with new BNPL entrants arriving regularly (Moody’s says over 200 companies claim to offer BNPL services), and some BNPL lenders employ hundreds of merchant sales people – will merchant discount rates hold up or will competition significantly lower this revenue source?

- Market leaders Affirm and Klarna have lost billions since inception, and, combined with the factors above, you might wonder how long institutional investors will continue to pour money into the sector

- In a recent report, Moody’s pessimistically stated:

“Few BNPL companies will remain independent.” “Some may be acquired, others may cease operations if their products cannot remain competitive in the market, or if they are unable to navigate the impending wave of regulation”

- While there will undoubtedly be survivors in the space, either as standalone companies or via sale to a commercial bank, our view continues to be that banks are better positioned in the BNPL segment, especially when converting on-card transactions into installment loans as a feature of their existing card portfolio

- PayPal should also be a beneficiary of consolidation due to its scale and market position, especially given the current focus on streamlining the check-out experience

- We recently surveyed 812 consumers regarding their BNPL preferences at the point of sale vs. post-transaction on an existing credit card

Predictions for 2024

- We reviewed our 2023 predictions in the January Epic Report, and despite our “mixed” record, we are undaunted and offer these bold new predictions for 2024

- Low interest credit cards will make a comeback

- Most credit card products in the market feature either cash-back, credit building, or cobrand rewards

- With credit card APRs at an all-time high (mid-20s), there is an opening for issuers to attract revolvers with low ongoing rates

- Card APR marketing is mostly limited to 0% introductory rates, but a low- to mid-teens “go-to” rate (with no rewards) would attract a meaningful segment of credit worthy revolvers – and, as a bonus, try offering a fixed rate!

- Discover’s student lending business will be sold to a private equity investor

- Discover announced it will sell its student loan portfolio and will stop accepting new student loan applications

- Commercial banks largely exited the private student lending business over the past 10-15 years due to the “reputational risk” associated with student loans, leaving the business concentrated primarily with Sallie Mae, Discover, Citizens, and College Ave

- With Discover selling their substantial portfolio, it would make strategic sense for a large bank to add such a new, low credit risk, and relatively less competitive product to their portfolios

- There are also non-banks that might be a good fit for the Discover business, such as Navient (Earnest) or one of the other incumbent lenders…

- But we predict that no commercial bank will be able to get beyond the reputational hangover of the student loan business, leaving a private equity entity as the most logical buyer

- At least TWO BNPL providers will blow up in 2024!

- OK, so we’ve been “early” on this one the past two years, but we’re so committed to this prediction, we’re doubling down!

- High growth, high interest rates, rocky capital markets, rising delinquencies, hundreds of competitors – what part of the word “bubble” don’t you understand???

- In the unlikely event we’re wrong on this one (again), we’ll publish nothing but glowing articles about the BNPL industry for a year

- Unlike most of those who make predictions, we hold ourselves accountable, so tune in next January to see how we did!

Advertising in 2023 – Loans Down, Deposits Up!

- Higher interest rates and tightened credit criteria resulted in lower 2023 marketing volumes for lending products

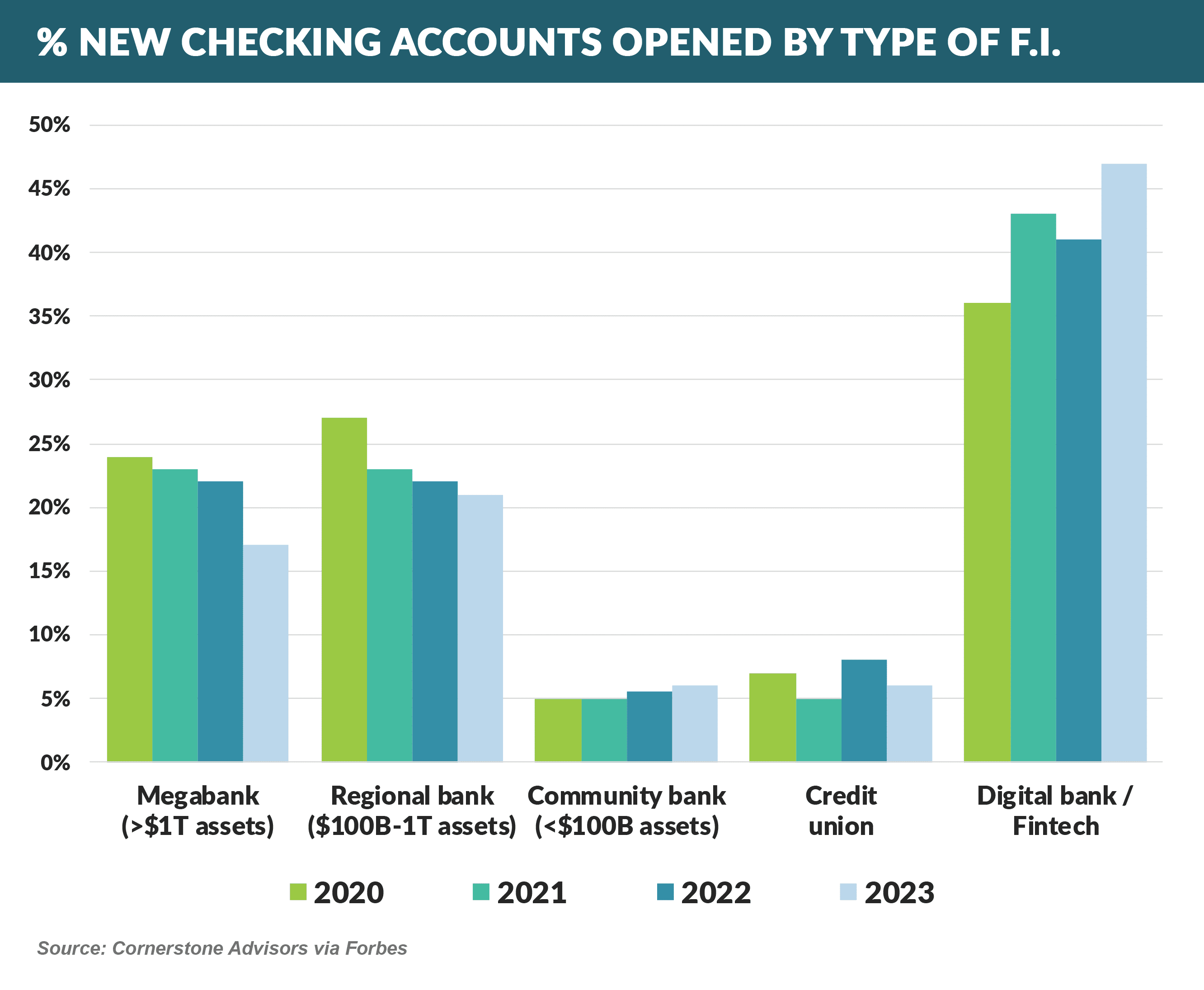

- Conversely, advertising spending for checking account direct mail was up 25% in 2023 vs. 2022, as low yield deposits fled to higher yielding money market accounts

-

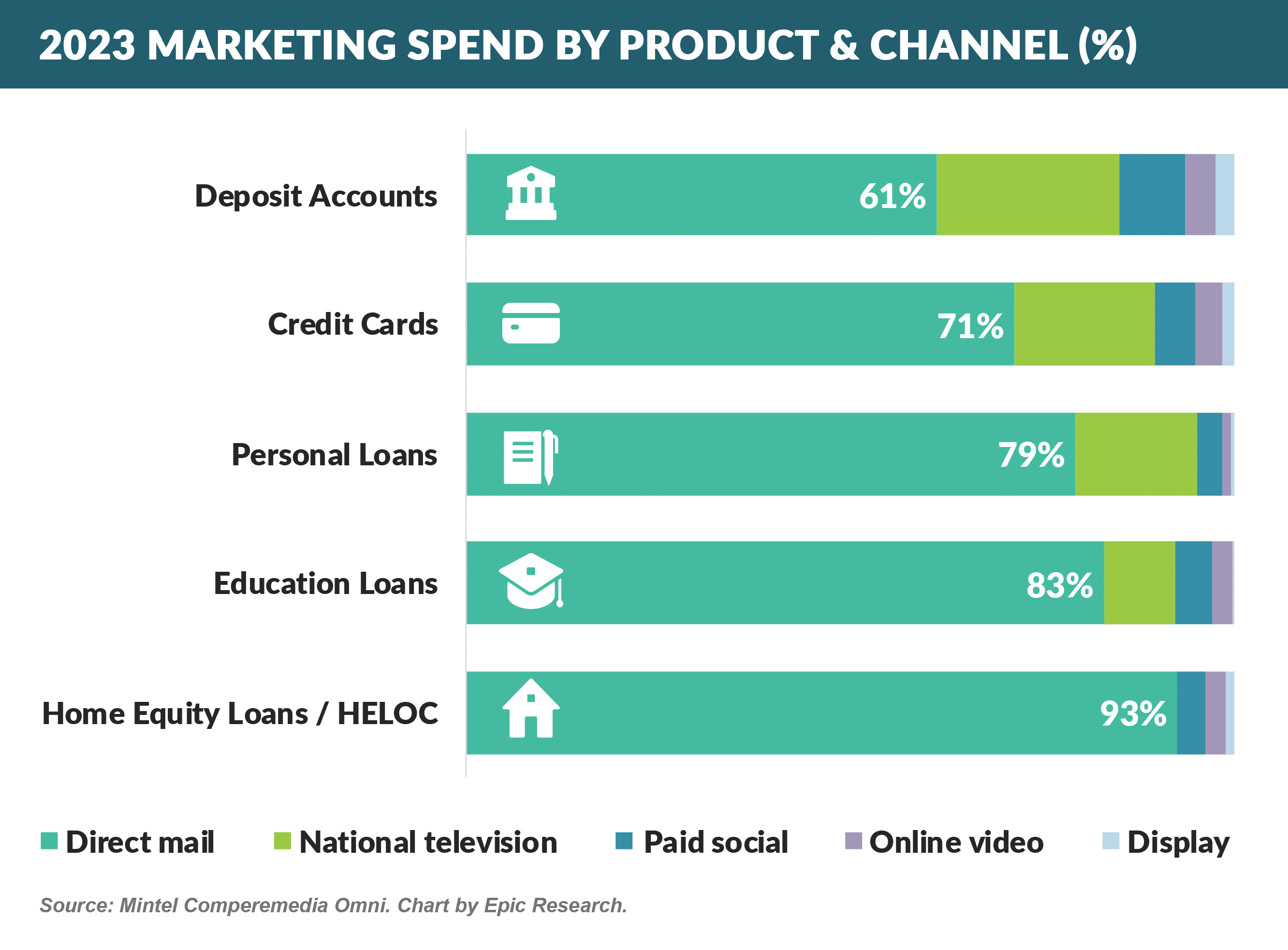

Direct mail remained as the dominant consumer financial services marketing channel accounting for 60% - 90% of total spend across all tracked* channels

*Note: Tracking does not include paid search advertising, and spending between bank and cobrand partners or marketplace sites such as NerdWallet, Credit Karma, or Bankrate

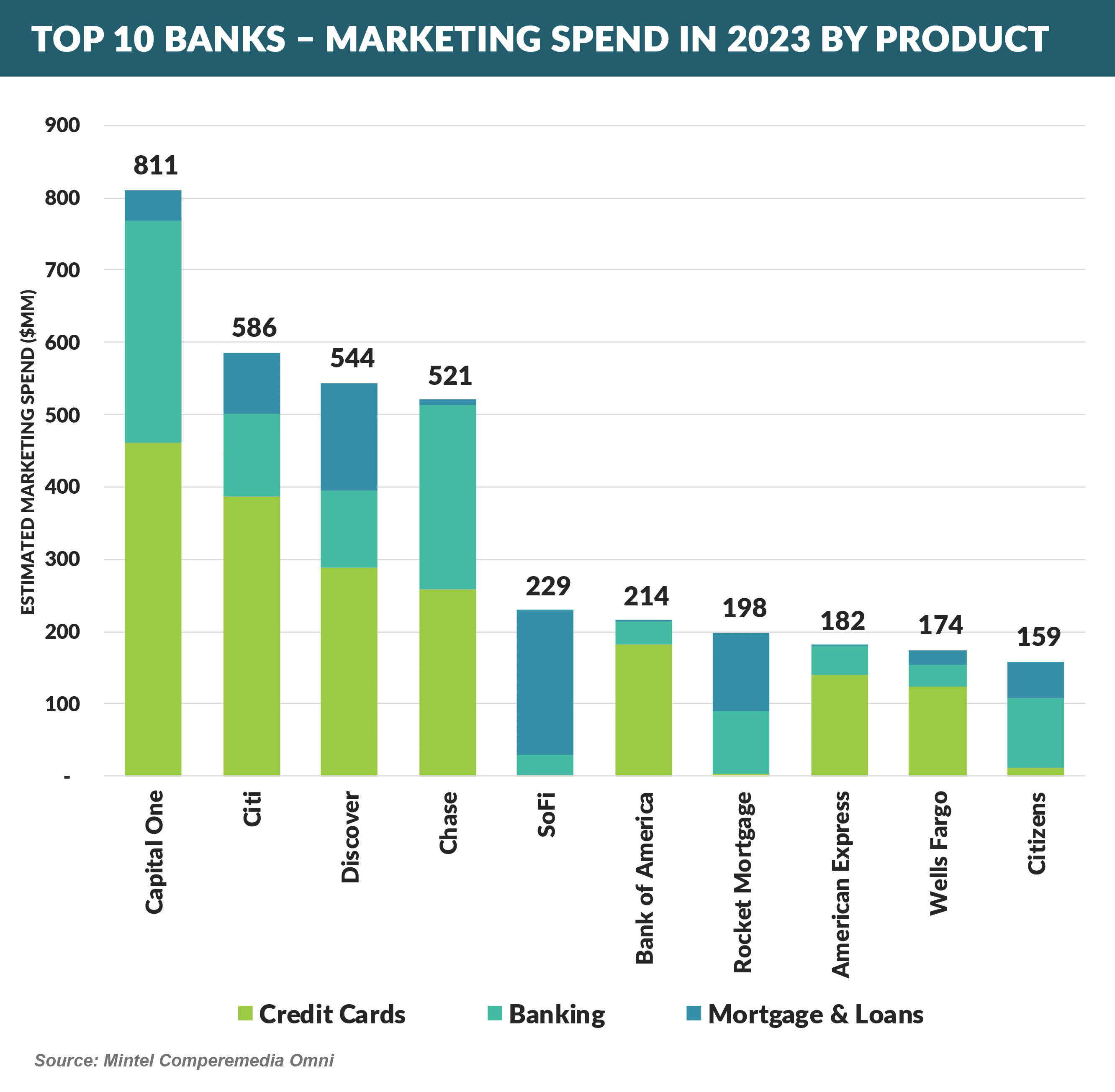

- Capital One, Citi, Discover, and Chase were the top marketers and, along with SoFi, spent more than the rest of the industry combined

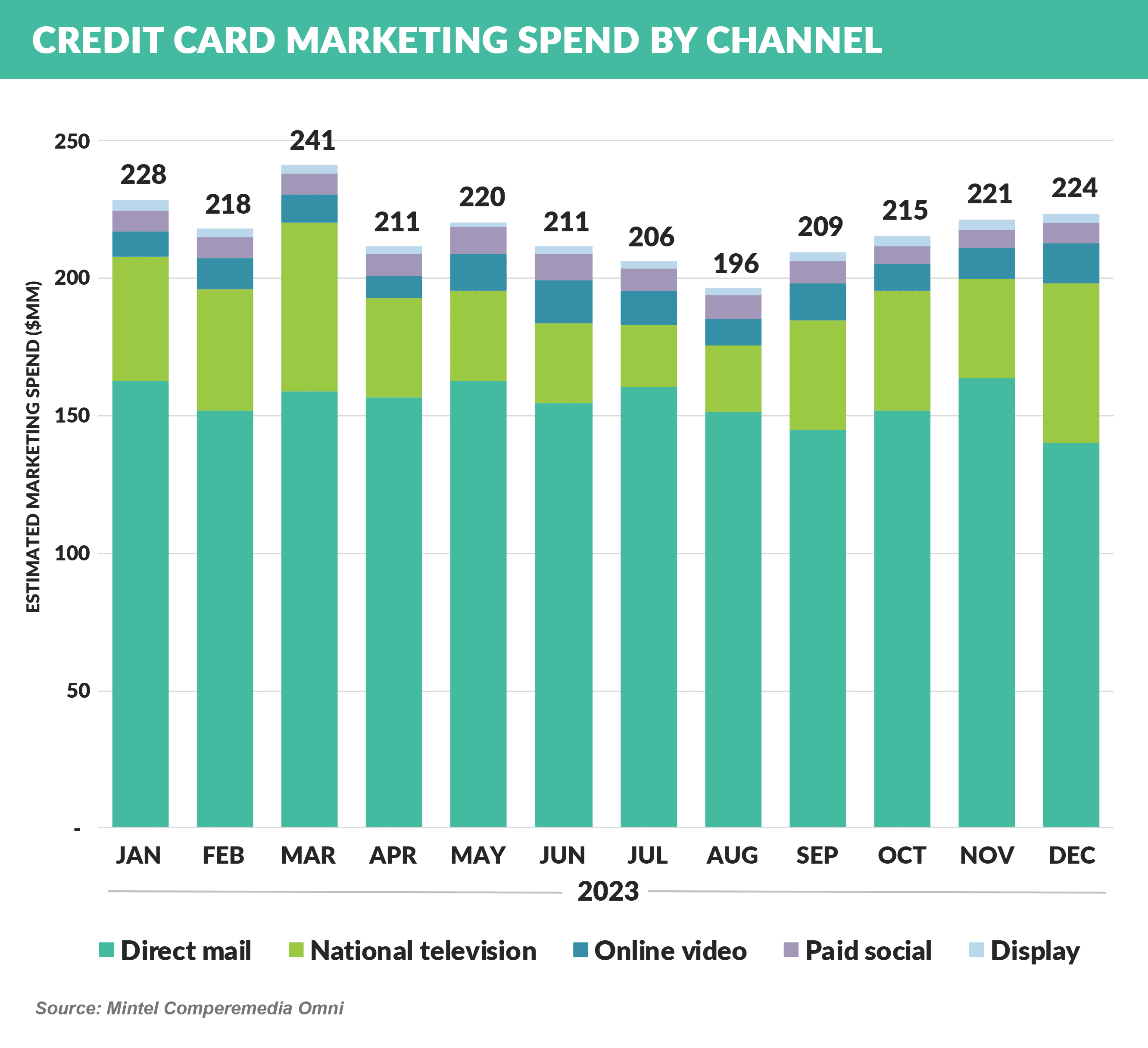

- Card spending was remarkably consistent month-to-month

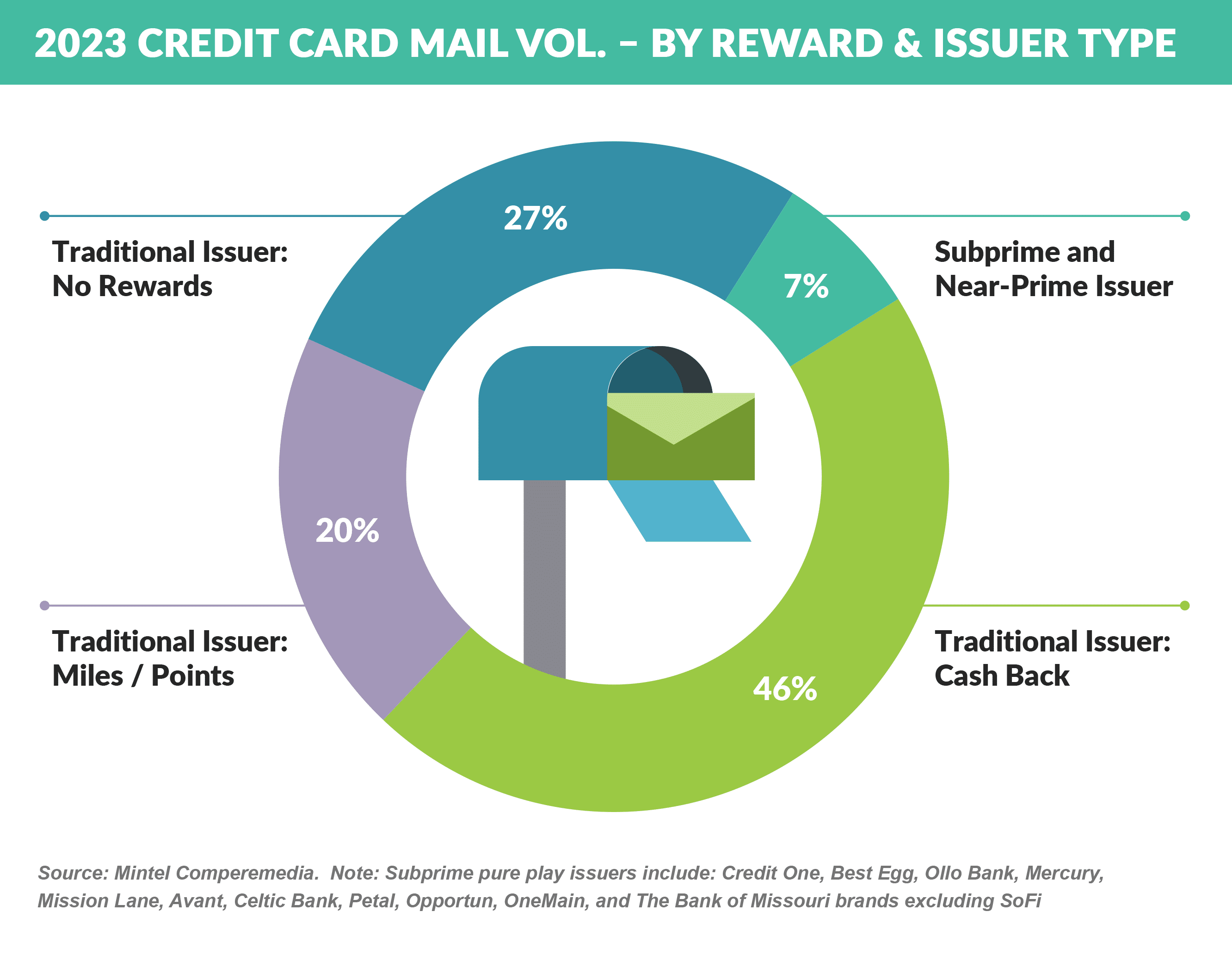

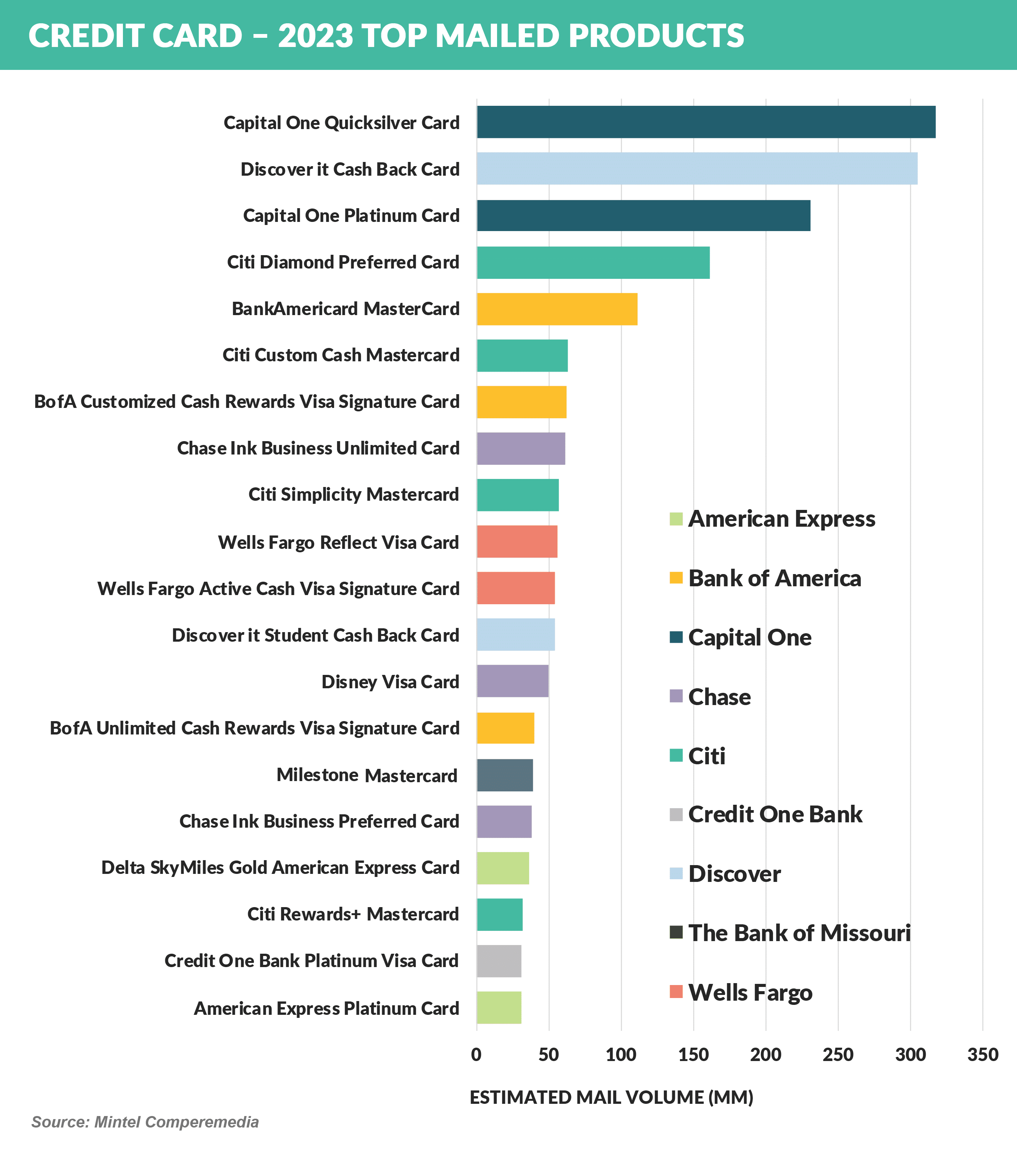

- Credit card mailings were dominated by cash back offers (e.g., Discover it, Capital One Quicksilver, and Chase Freedom Unlimited)

- “Near-prime” products (offers from Mercury, Credit One, Milestone, and Mission Lane) were among the most frequently mailed individual products

- Notably, there were only two cobrand cards among the top 20 products mailed in 2023, reflecting the dependence on partner channels for customer acquisition

- Creative trends

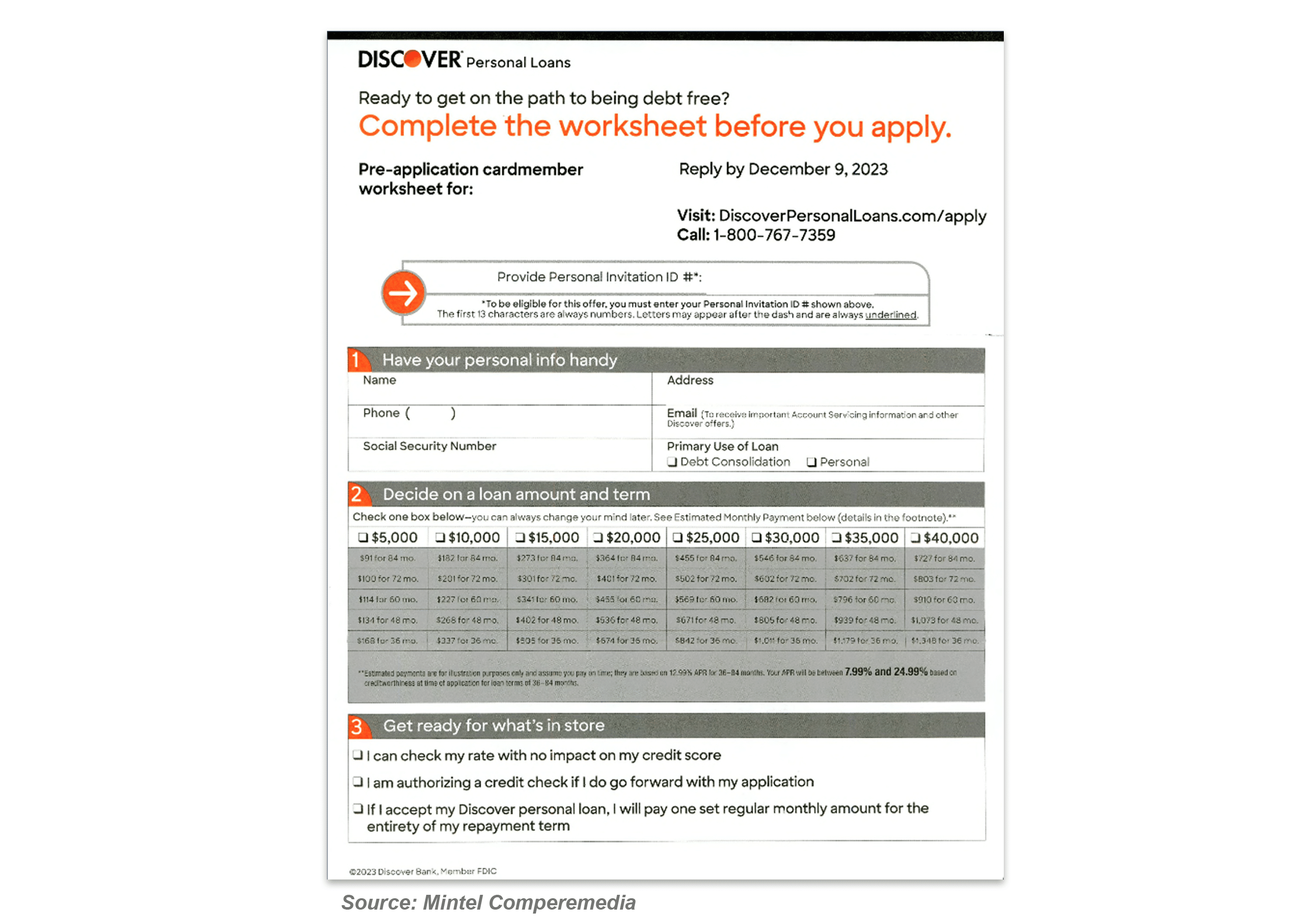

- Direct mail copy across banks and products has remained consistent over the years, but every now and then something “new” comes along

- This personal loan creative from Discover adds a “worksheet” for the applicant to fill out prior to applying, a step that may help limit application abandons and increase engagement

- Fintechs accounted for 47% of all new checking accounts opened in 2023, up from 36% in 2020, with the bulk of the gain in share coming from mega and regional banks

- Apple reported that over 12 million Apple Cards have been issued and that there are over $10 billion in deposits in its Apple Savings Account

- The card paid over $1 billion in cash back rewards

- At 1.5% of spend, this might imply per card spending of ~$5,500 which is roughly in line with other cash back cards, but much lower than the $15,000 - $20,000 average on airline cobrand cards

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on March 9th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.