Three Things We’re Hearing

- Retail banks losing out in personal loan marketing!

- Meet super lender Best Egg

- HELOC originations and marketing continue climb

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Retail Banks Losing in Personal Loan Market

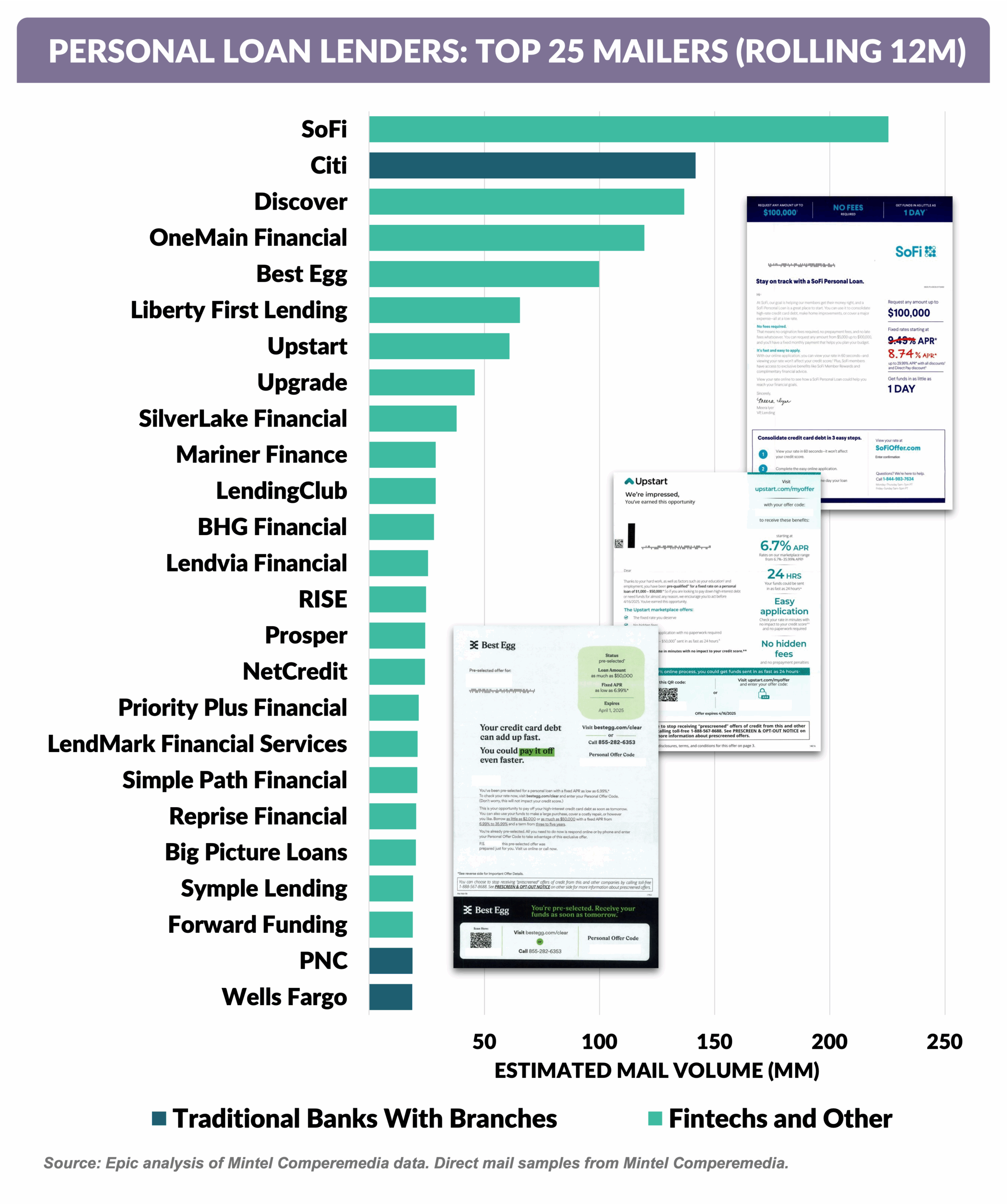

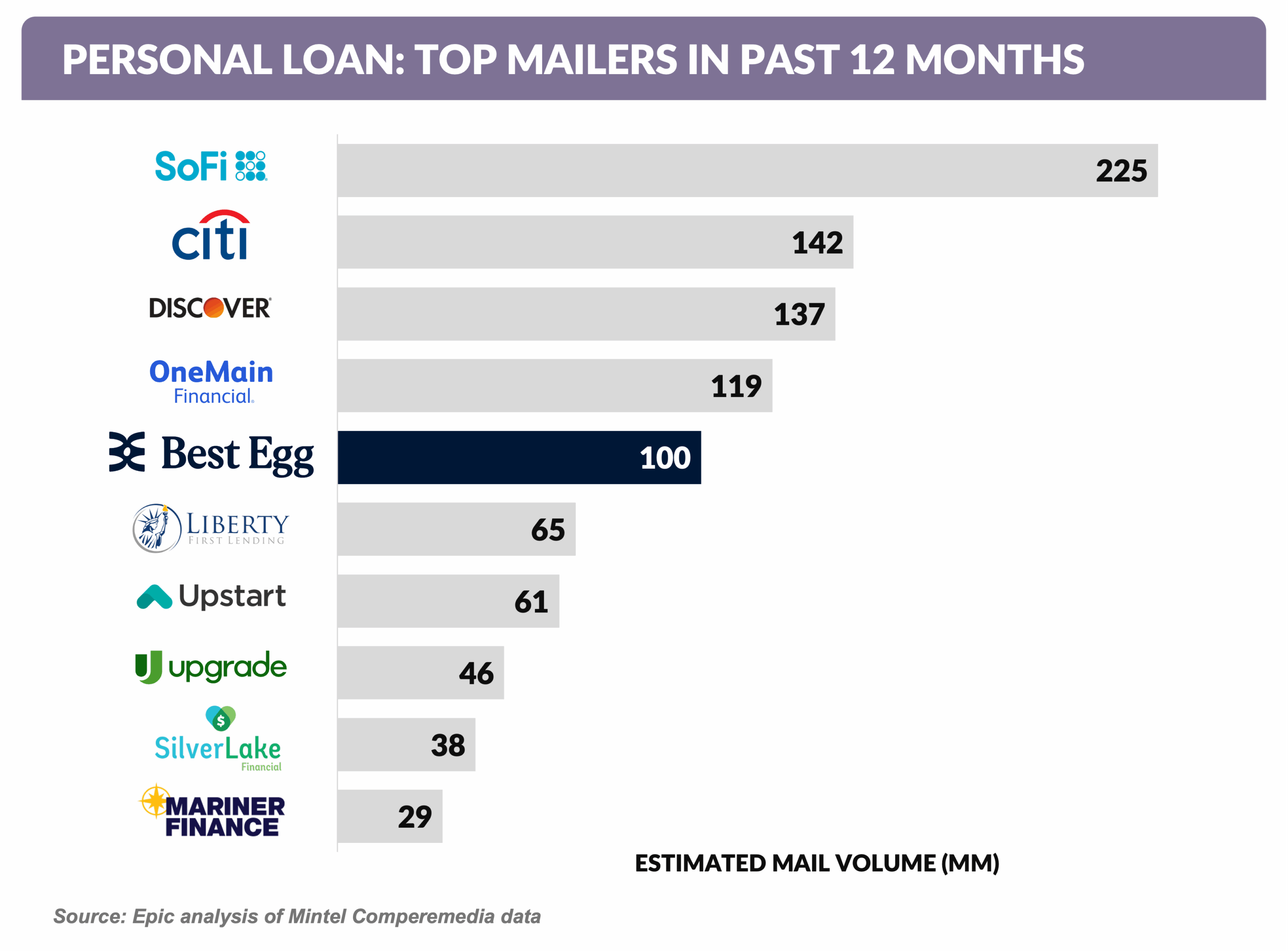

- The Epic Report has periodically noted the dominance of fintechs in the personal loan market, along with the relative absence of retail banks

- Retail banks have two major advantages over most fintechs:

- Low-cost, stable funding from retail deposits

- Brand awareness due to media advertising and branch presence resulting in higher response rates / lower acquisition costs

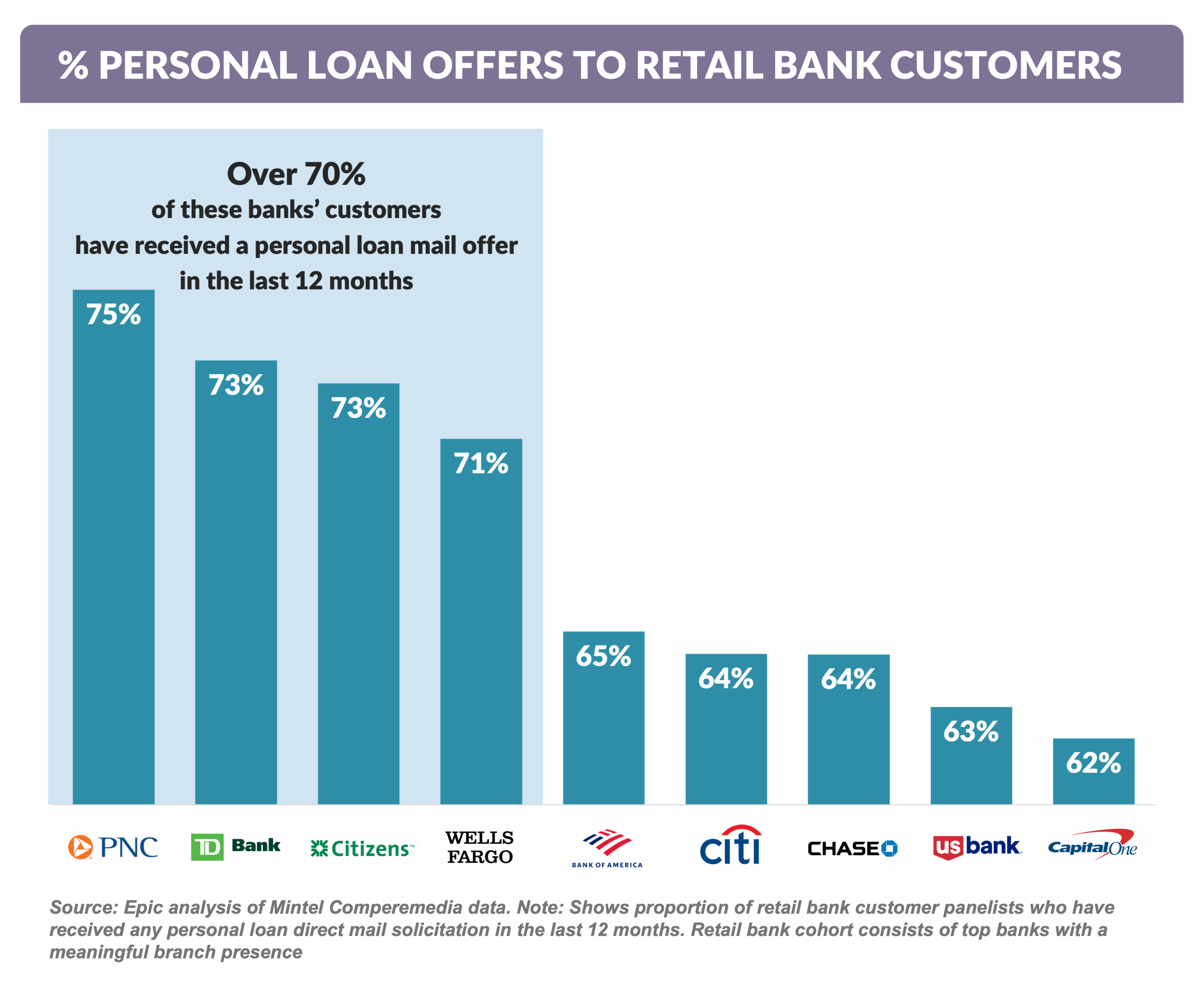

- Despite these advantages, retail banks have shied away from issuing personal loans primarily due to the required specialized credit expertise, while customers of retail banks are bombarded by personal loan mail

- With over 80% of that personal loan mail coming from fintechs

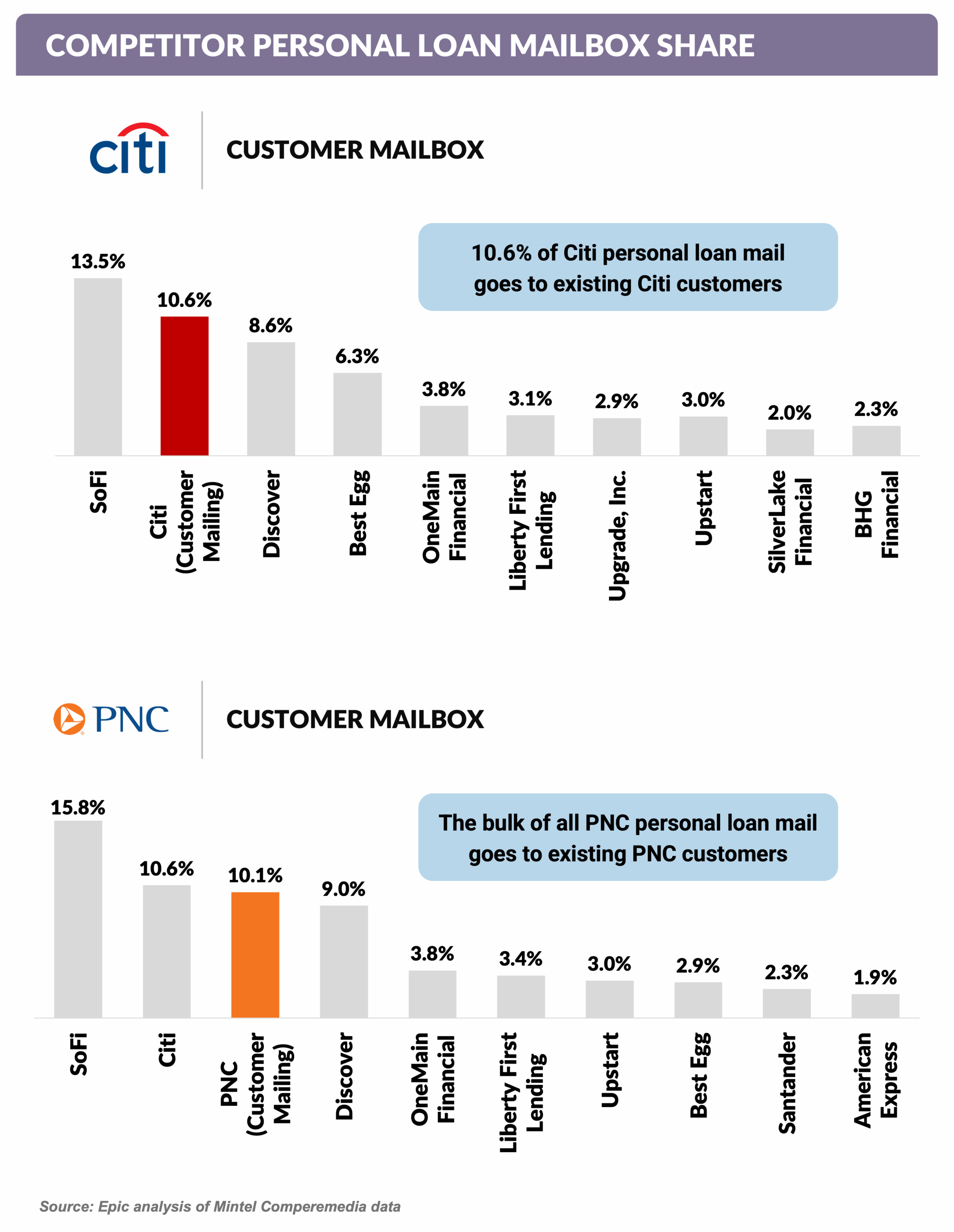

- Two of the retail banks that appear in the top 25 personal loan mailers, Citi and PNC, mail heavily to their own customer base

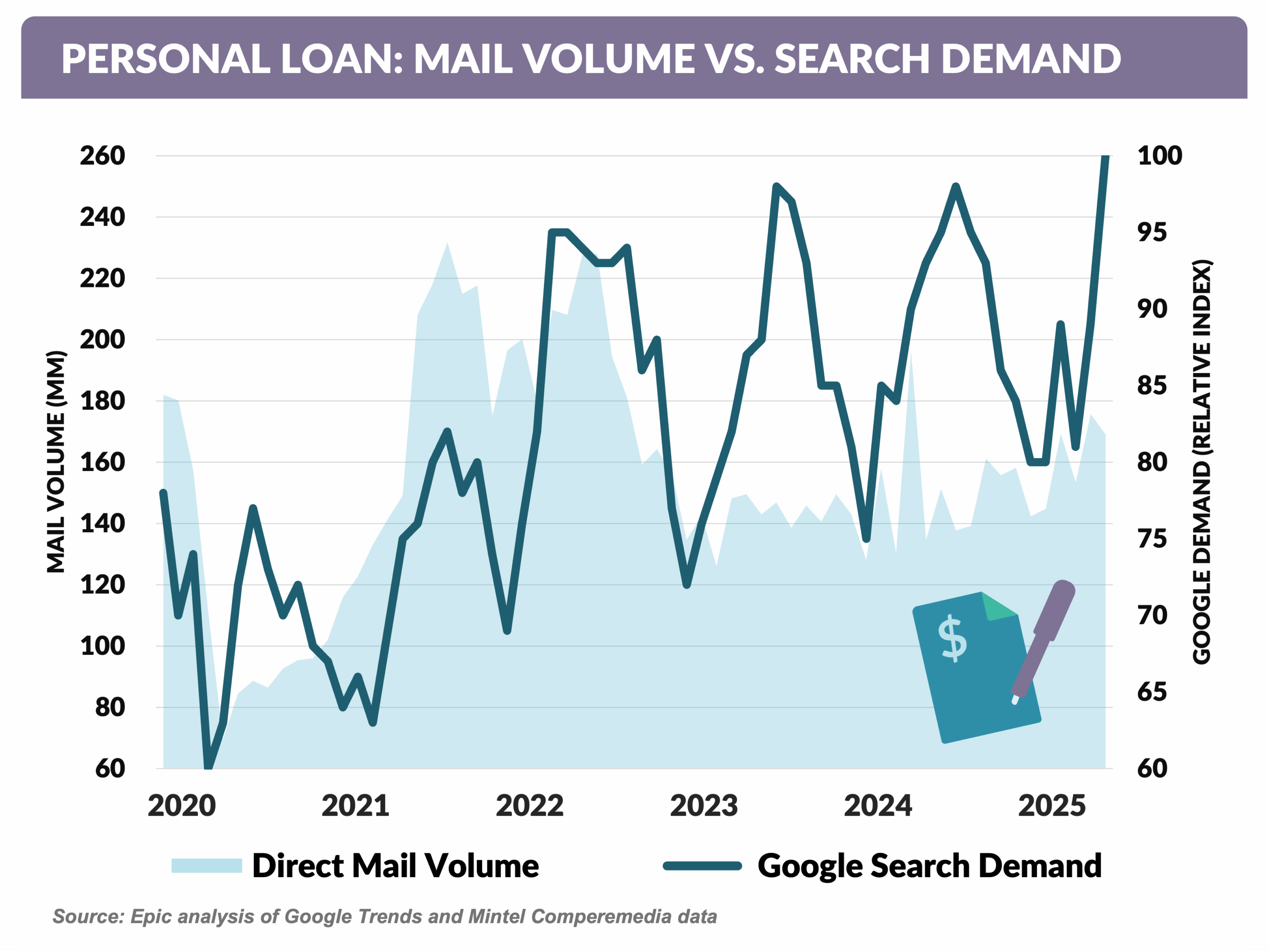

- There is an opening for new personal loan lenders

- Mail volume remains below pre-Covid levels

- There is a supply/demand gap

- The average credit card APR is in the mid-20% range

- Personal loans are available at 7% - 8% APR

- A substantial consumer benefit remains to refinance credit card debt with a personal loan

Meet Super Lender Best Egg

- Best Egg was founded in 2013 as Marlette Funding, one of the early entrants in the online lending space

- Today they are one of the top originators of personal loans, having originated over $38 billion in loans and ranking among the highest-volume mailers

- This year they anticipate originating over $8 billion in loans

- Paul Ricci joined Best Egg in 2014 as Chief Financial Officer and was named CEO in 2023

- Prior to joining Best Egg, Paul held senior financial roles at Juniper Financial, Barclays, Epic Research, and NRG Energy

- He has successfully led Best Egg through recent market headwinds associated with higher consumer delinquency and rising interest rates

We asked Paul about Best Egg’s position in the personal loan market and to what he attributes their success:

“I think objectively we are among the leaders in the fintech consumer lending space as measured by profitability, credit performance, and positive customer outcomes. Over the last 10 years we have developed the ingredients necessary to succeed in credit and marketing analytics, operations, capital markets, risk management, and technology – capabilities necessary to deliver our products.”

Best Egg’s Management Style

“We all work together as a team being focused on the core product and not trying to do too many things at once. A practice that we’ve had from the beginning is that every quarter as a team we go through and determine what’s the most important things for us to do as a company and make sure everybody’s on the same page with what we’re trying to work towards.”

Best Egg’s Market Segment

“We think about our core customers as people with limited savings that have generally good credit scores and good incomes but use credit to live the life that they want to live. As a result, they may not have much savings, making them consumers that deposit-focused banks might not target.”

Competing with Larger Retail Banks

“We talk a lot about focus on our personal loan product, whereas retail banks have large product sets and target the consumer that has a lot of deposit products, mortgages, and credit card spending. We know our consumers and focus on what they need. Having debt in several different places, at different rates, can feel overwhelming, and we work to help them manage their debt better or get access to funds if the water heater breaks or the car breaks down. We then help guide them to a better spot with our financial health tools and help them build a level of financial confidence that they didn’t have when they first started working with us.

The pace of change in technology is another area where we have an advantage over larger banks. We are in a better position to change because we’re smaller, more focused, and more nimble.”

What Advice Would You Give to a Younger Paul Ricci?

“I got pretty lucky in landing in some good positions early in my career, but looking back on that experience would tell me it’s really important to work with a good team. Culture means a lot and the people that you work with mean everything. Working in a place where people get things done without a lot of bureaucracy and politics is a huge asset. It is up to a young person starting their career to take control over their career and not to expect someone else to come to you with these opportunities – you really have to look for them yourself.”

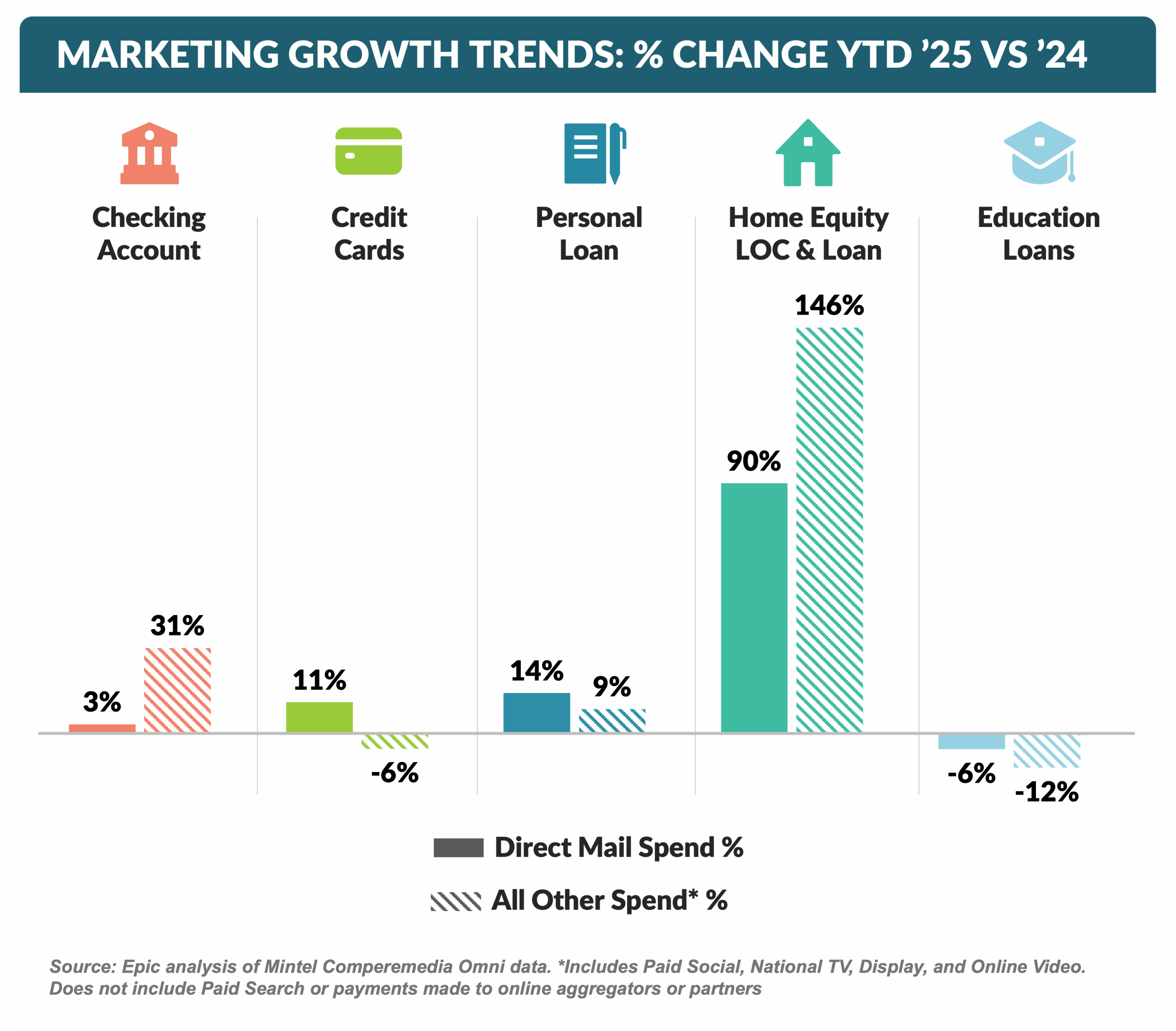

HELOC Originations and Marketing Continue Climb

- Personal Loan:

- Total mail volume was 169 million in April vs. 135 million April ’24 and 176 million last month

- LendingClub showed a resurgence of direct mail activity, mailing over 10 million pieces in May, the most they have mailed in a single month since 2022

- Home Equity:

- Continues to trend upwards with 49 million mail pieces in April vs. 28 million last April, and 37 million last month

- Discover’s driving the month-over-month increase, with 11 million pieces, nearly double their typical volume

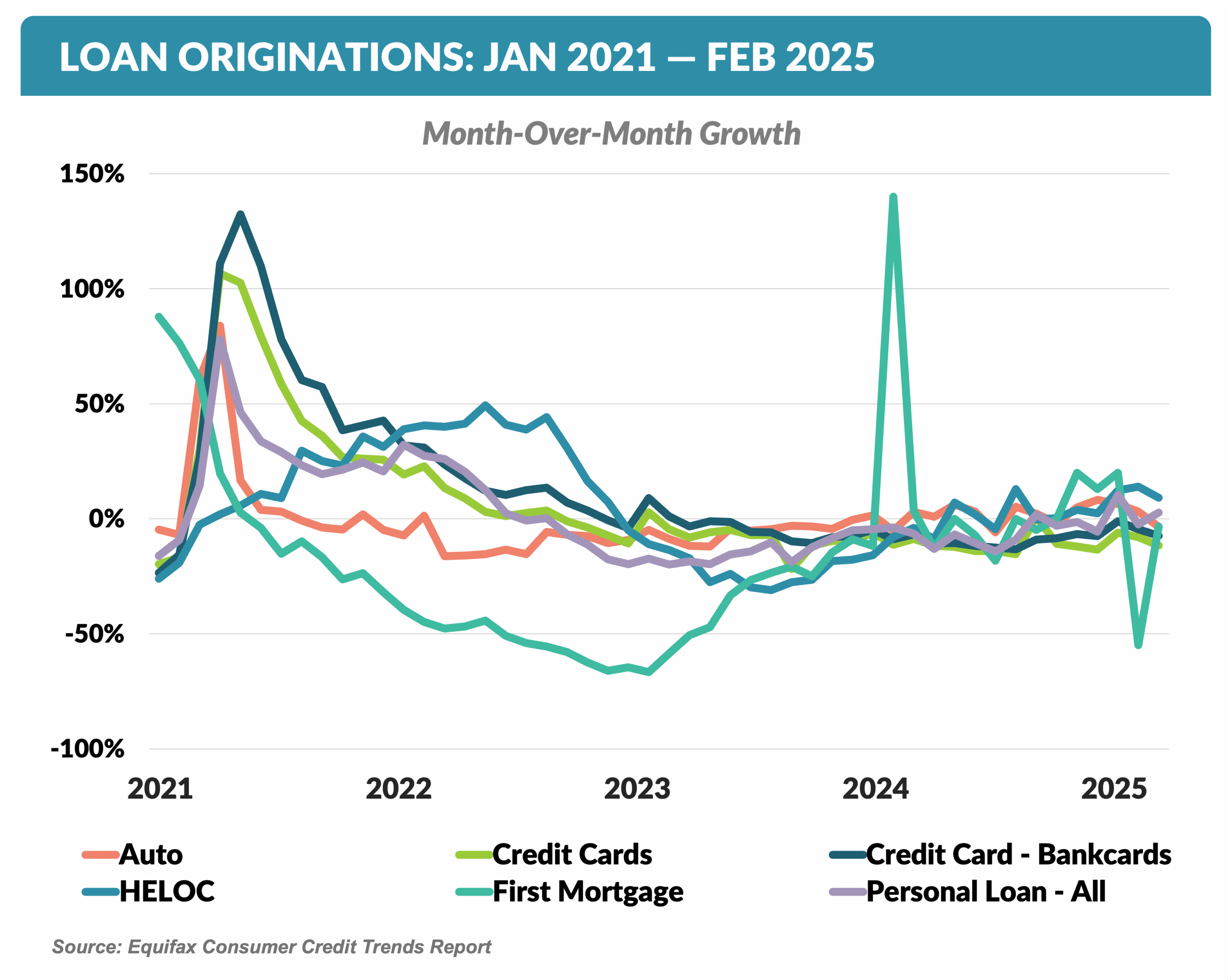

- The number of loan originations in the past few months has ticked up for auto, HELOC, and personal loan while declining slightly in bankcards and first mortgages

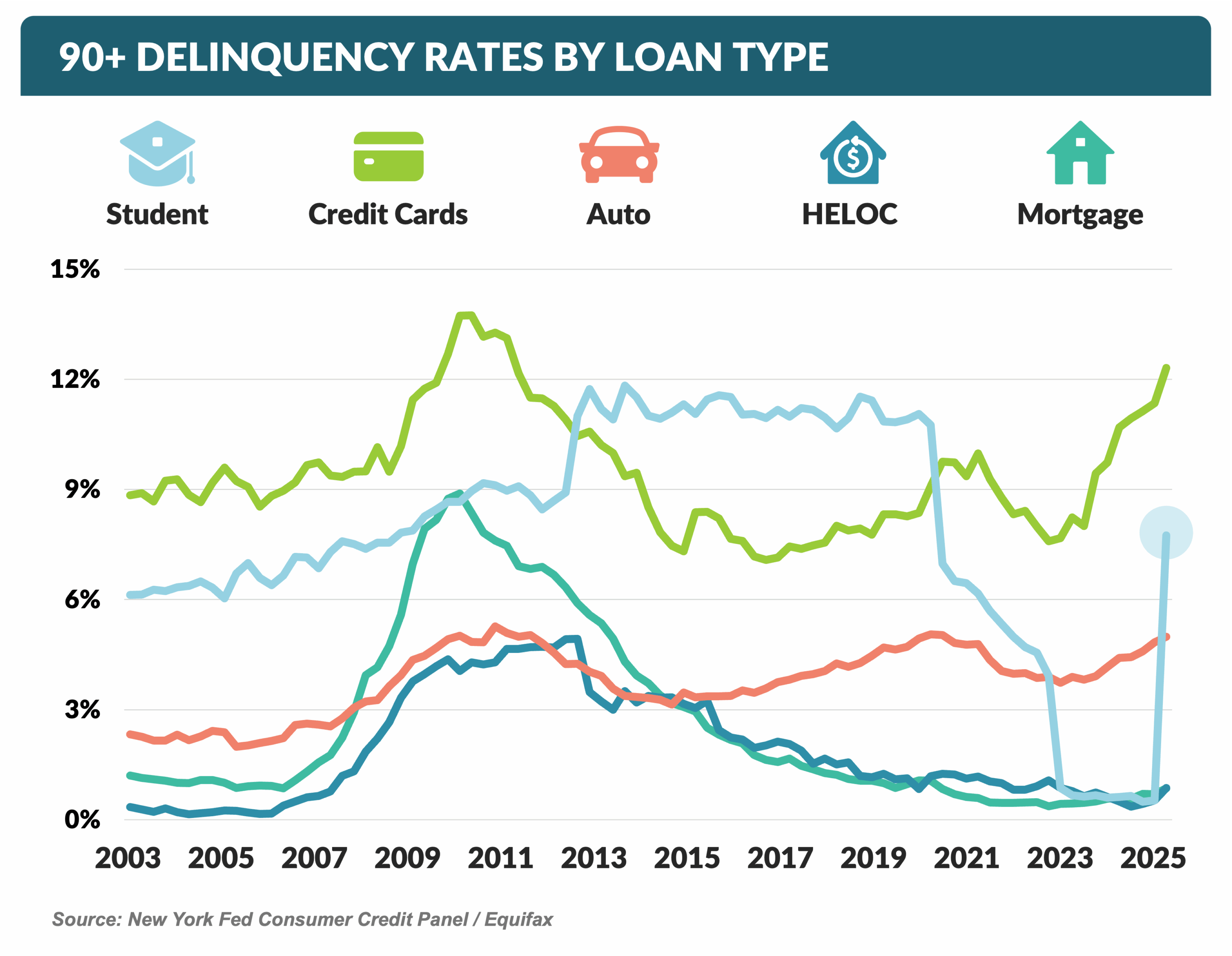

- Delinquency on federal student loans has skyrocketed following the late ’23 restart of payments and recent resumption of collections efforts

- As of February, 50.8% of subprime student loan borrowers were in serious delinquency, versus 38.8% in February 2020

- Among near prime borrowers 23.3% were in serious delinquency status, versus 9.1% in 2020

- Bank of America has enhanced its rewards offering for new customers

- New Customized Cash Rewards cardholders will earn 6% Cash Back in the category of their choice, and new Unlimited Cash Rewards cardholders will earn 2% Cash Back on all purchases for the first 12 Months

- Visa introduced Visa Intelligent Commerce, enabling consumers to “find and buy”

- Visa Intelligent Commerce is a new initiative designed to support AI-powered shopping

- As AI agents begin to handle more of the buying process — from browsing and selecting products to making purchases and managing orders — this program aims to help enable secure, personalized consumer experiences

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue in July.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Find out how we can help you.