Three Things We’re Hearing

- BNPL 2.0 - What's next???

- Is ChatGPT displacing the aggregators???

- Capital One / Discover dominates card mail!!!

A four-minute read.

If you would like the Epic Report delivered right to your inbox, click here.

BNPL 2.0 – What’s Next???

(Regular readers of the Epic Report may recall that, after multiple years of skepticism about the future of BNPL, we committed to publishing nothing but glowing articles about BNPL in 2025. The below reflects our commitment to this promise, as well as an unbiased view of where BNPL is going from here)

- BNPL (Buy Now, Pay Later) began in the US in 2012 – 2015 as a digital reimagining of layaway, pioneered by fintechs like Affirm, Afterpay, and Klarna with their “pay-in-4” plans offering quick credit at checkout with transparent terms — often zero interest and no fees if paid on time

- Consumer awareness of BNPL was low, so early ads captured the essence of BNPL’s value proposition — convenient, clear, and consumer-friendly financing

- BNPL caught on as it benefitted both consumers and merchants

- Consumers, especially Gen Z and Millenials, embraced BNPL as a card alternative

- Merchants saw bigger baskets and higher conversion

- And growth was strong

- By 2021, Klarna had ~22M U.S. users, Afterpay ~13M, and Affirm ~6M

- Big deals followed: Amazon and Shopify partnered with Affirm, and Square (now Block) bought Afterpay for $29B

- PayPal, Apple, and major banks rolled out their own BNPL options

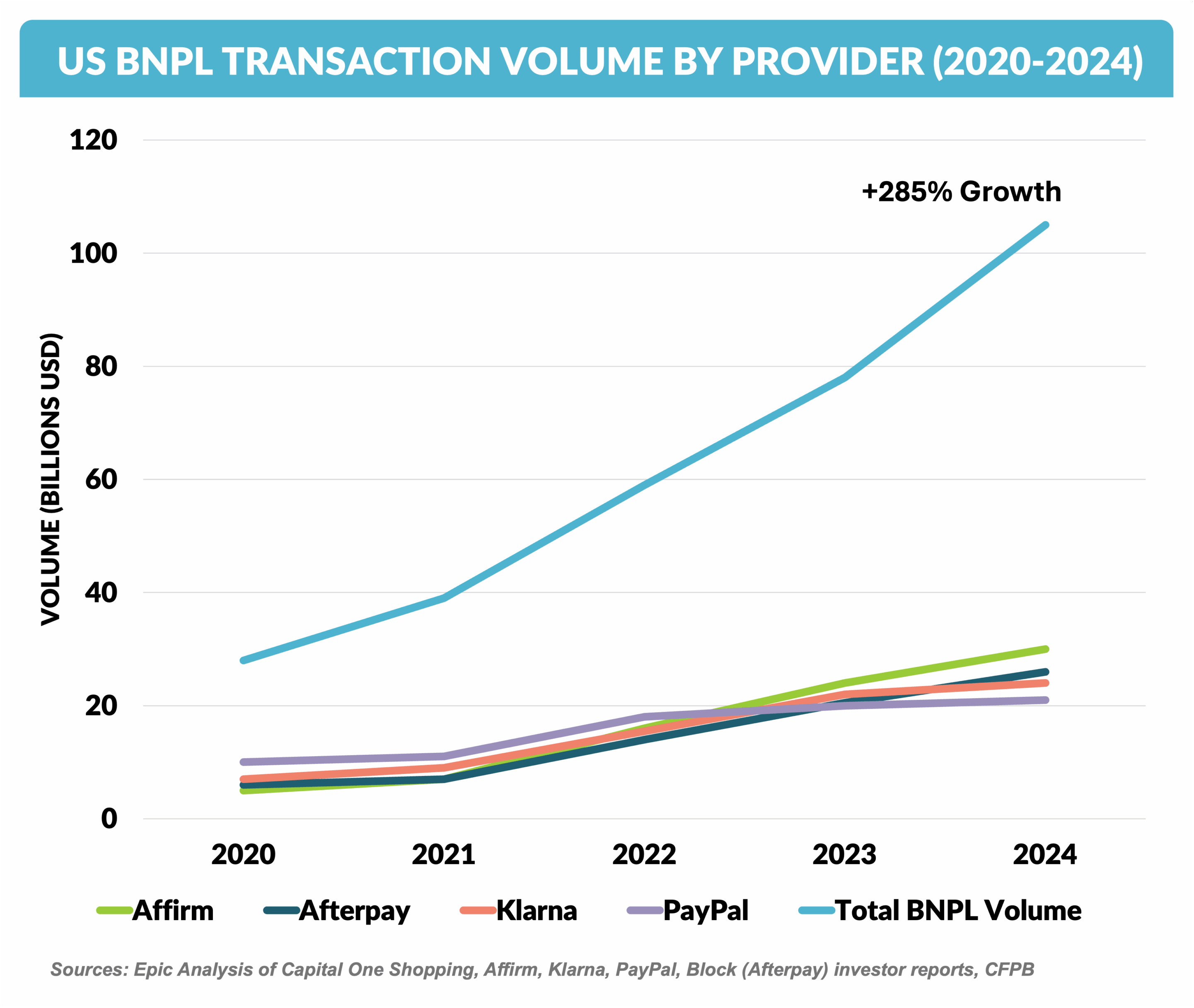

- U.S. BNPL volumes surged 285% from 2020 to 2024

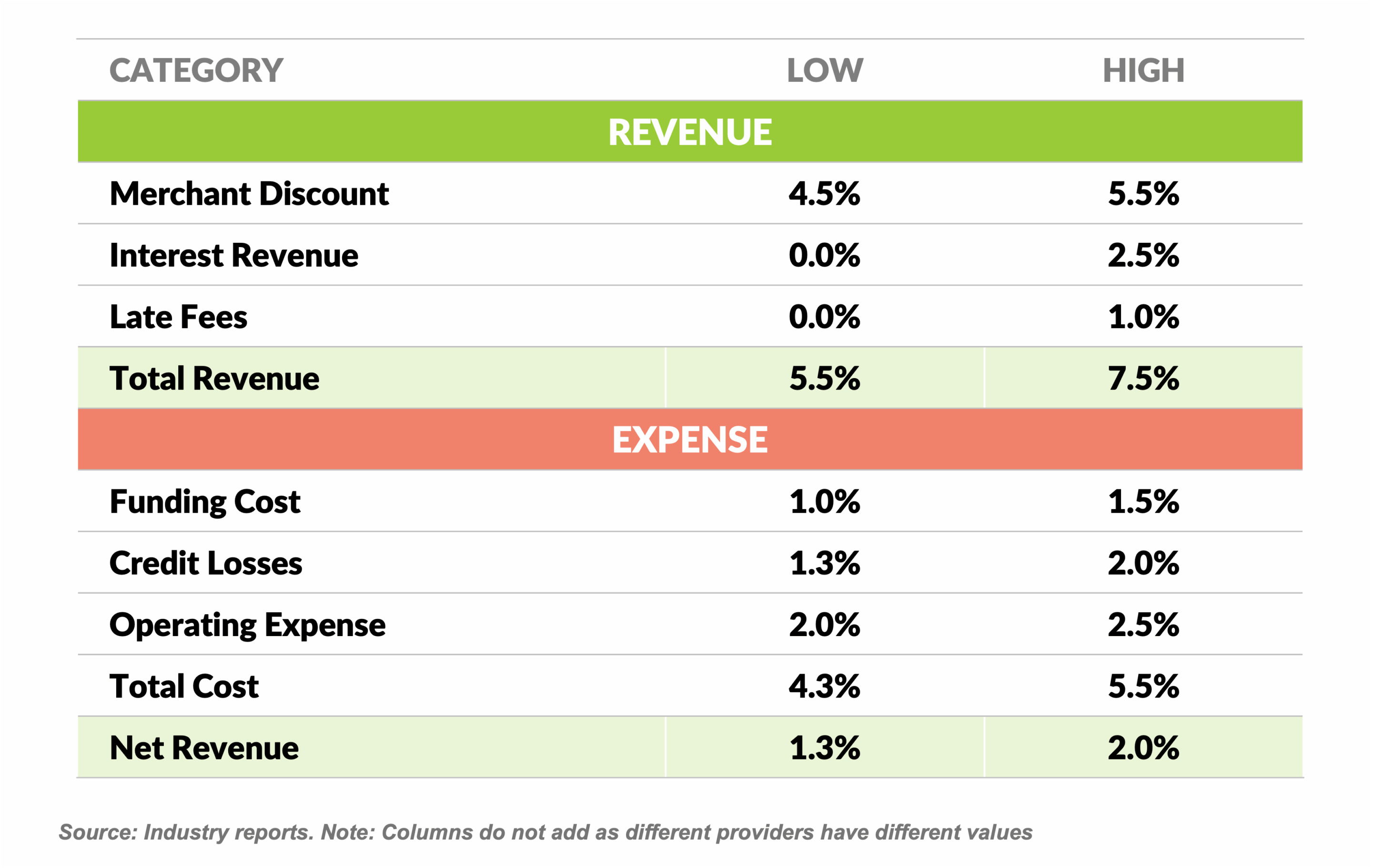

- Margins are thin – 1%-2% of sales – with funding costs and credit losses varying in different economic environments and competition pressuring merchant discount rates

- Inevitably, following such rapid growth, cracks begin to show

- Credit risk climbed: Over 40% of BNPL users missed a payment in 2023–2024

- Profitability pressure grew as funding costs rose; Klarna and Affirm posted major losses in 2022–2023

- Klarna’s valuation fell from $45.6B to a target range for its next funding of $15 - $20 billion

- Affirm, whose stock dropped to $10 from its peak of $164, has rebounded to the mid-60s, still just 40% of its all-time high

- Consolidation hit: Openpay went into liquidation, Zip exited some markets, and Capital One banned BNPL use on its cards

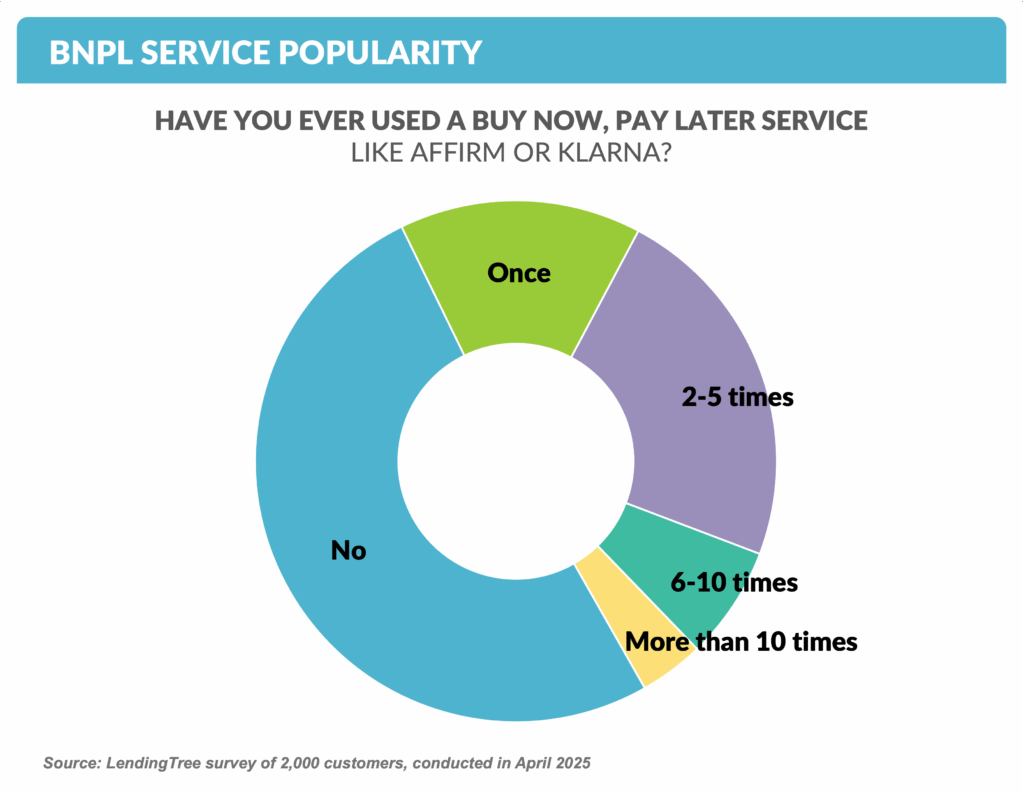

- Despite those challenges, BNPL is here to stay, with about half of US consumers saying they have used BNPL

- Key trends going forward

- Moderating Growth: BNPL continues to expand, although at a slower pace

- Blending with Traditional Credit: Expect more bank integrations, installment cards, and co-branded offerings

- Consolidation: Only the most capital-efficient and embedded players will survive

- Profit Pressure: Firms will monetize via interest-bearing loans, shopping rewards, and financial services

- Recession Readiness: Loss reserves and underwriting have improved; next downturn will be the real test

- Bottom line – BNPL is now a permanent feature of U.S. payments

- While the gold rush is over, the major players — especially Affirm, Klarna, and Block — are evolving from disruptors to scaled lenders, embedded in retail, fintech, and mobile ecosystems

- The challenge now: sustainable profits, responsible lending, and strategic positioning as the product matures into the credit mainstream

Is ChatGPT Displacing the Aggregators???

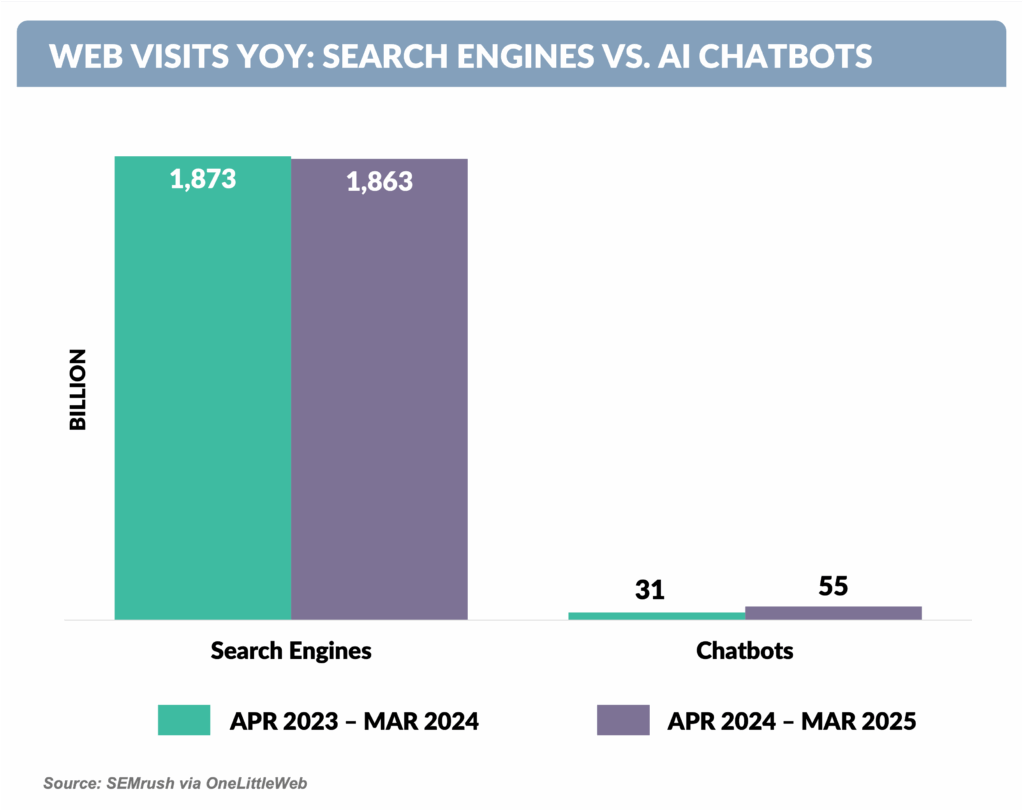

- Searches on chatbots such as ChatGPT have almost doubled in the past year, and while they remain a fraction of those from search engines like Google, the chatbots are having an impact on financial services digital marketing

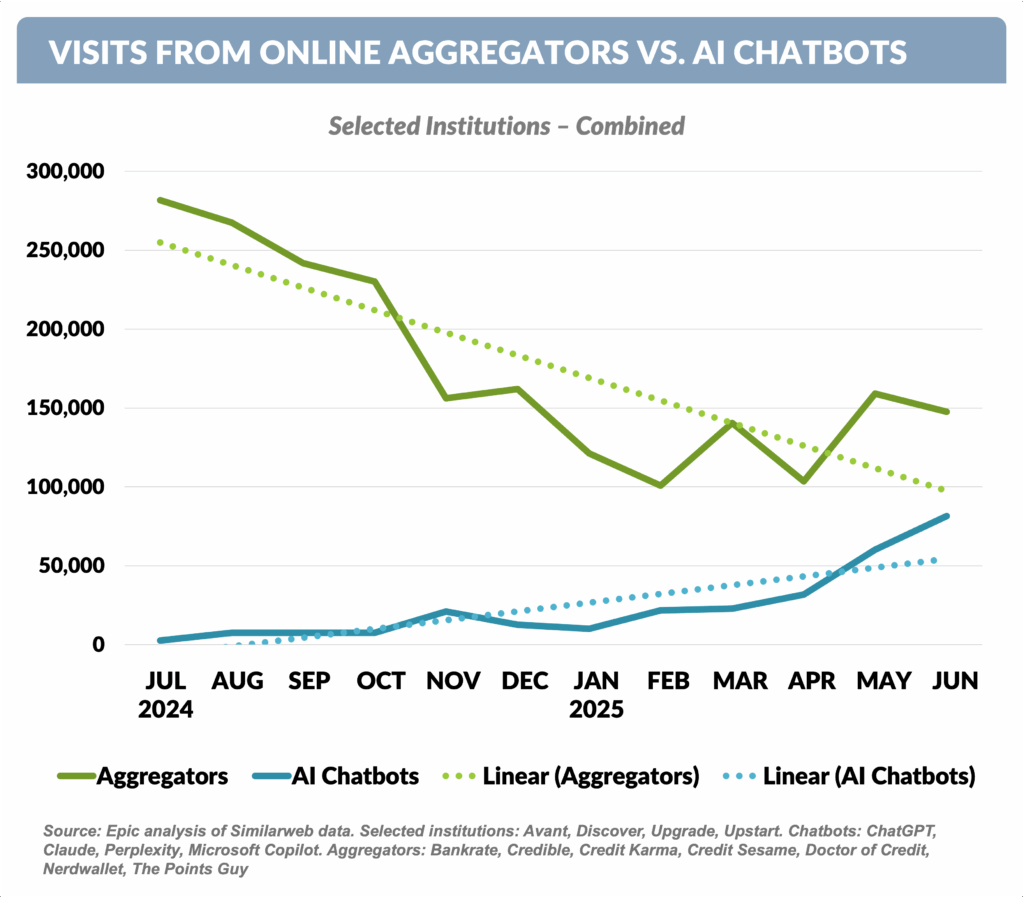

- As consumers use chatbots and link directly from there to financial institutions, some banks and other lenders have seen a significant decline in visits from online aggregators (marketplaces) such as Nerdwallet, Credit Karma, and Bankrate while traffic from chatbots has grown exponentially

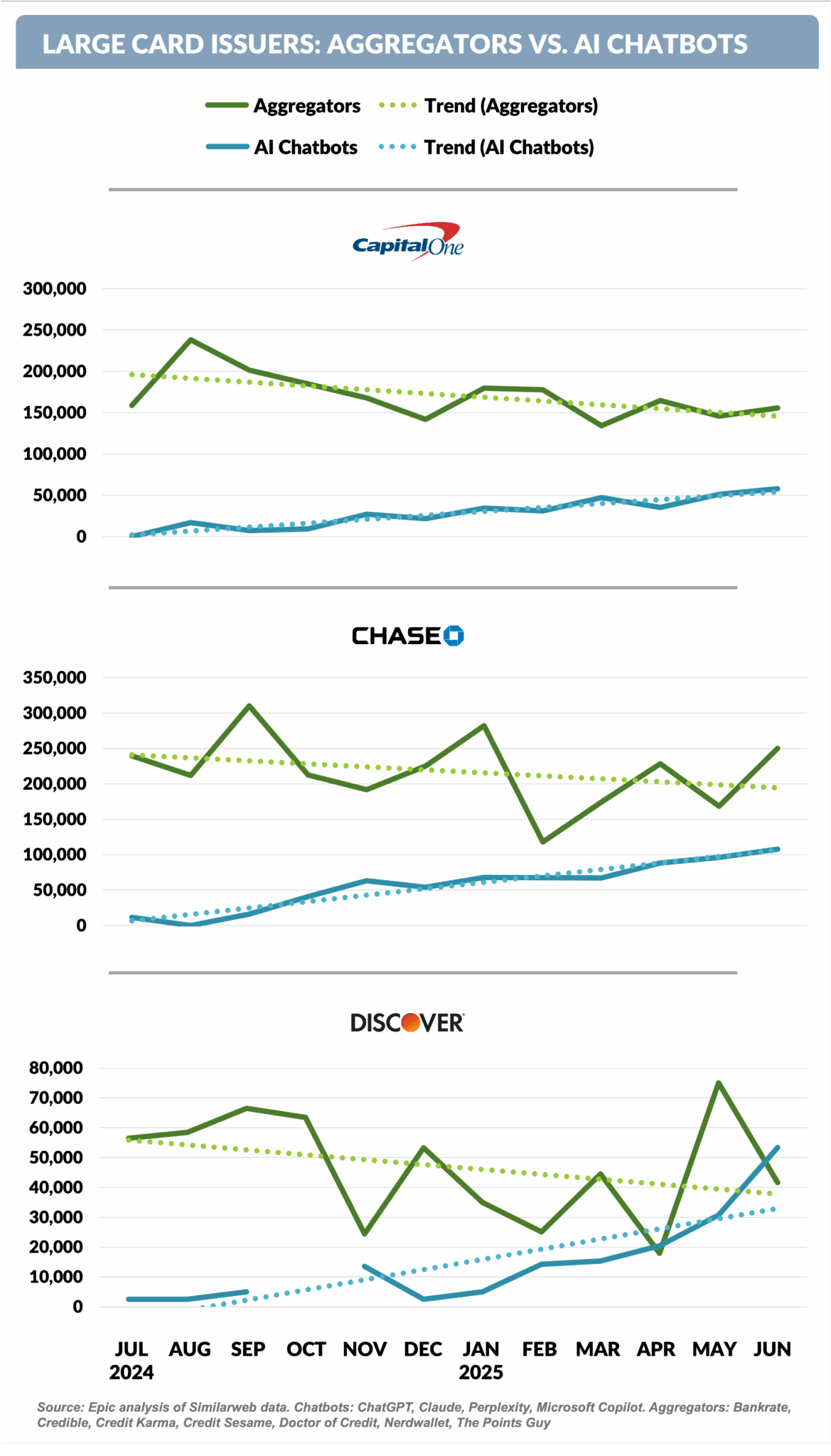

- Among large card issuers, Chase, Discover, and Capital One have seen a similar trend

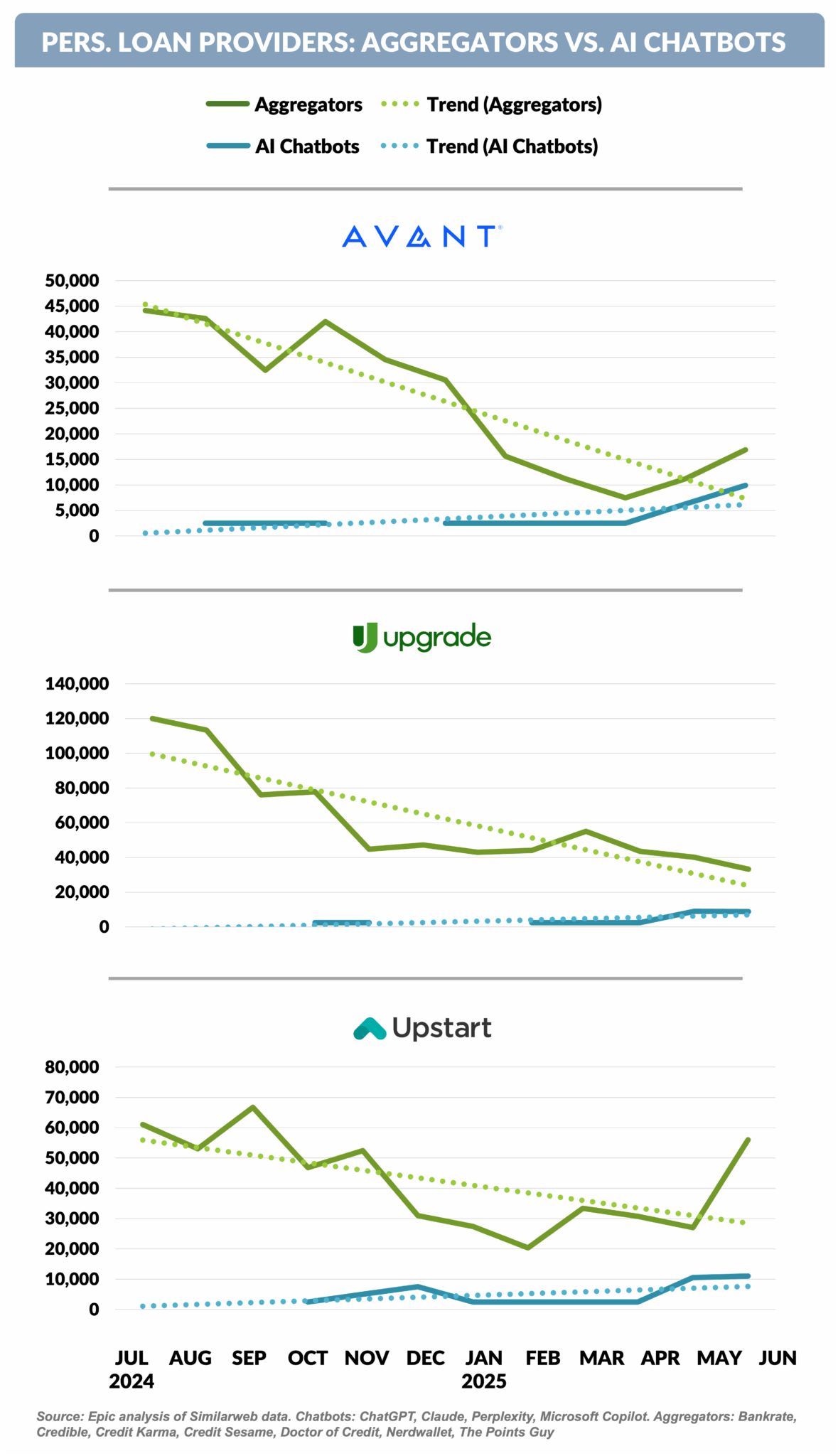

- As have personal loan providers Upgrade, Avant, and Upstart

- If the trend continues, aggregators will have to adapt their marketing strategies to maintain market share

Capital One / Discover Dominates Card Mail

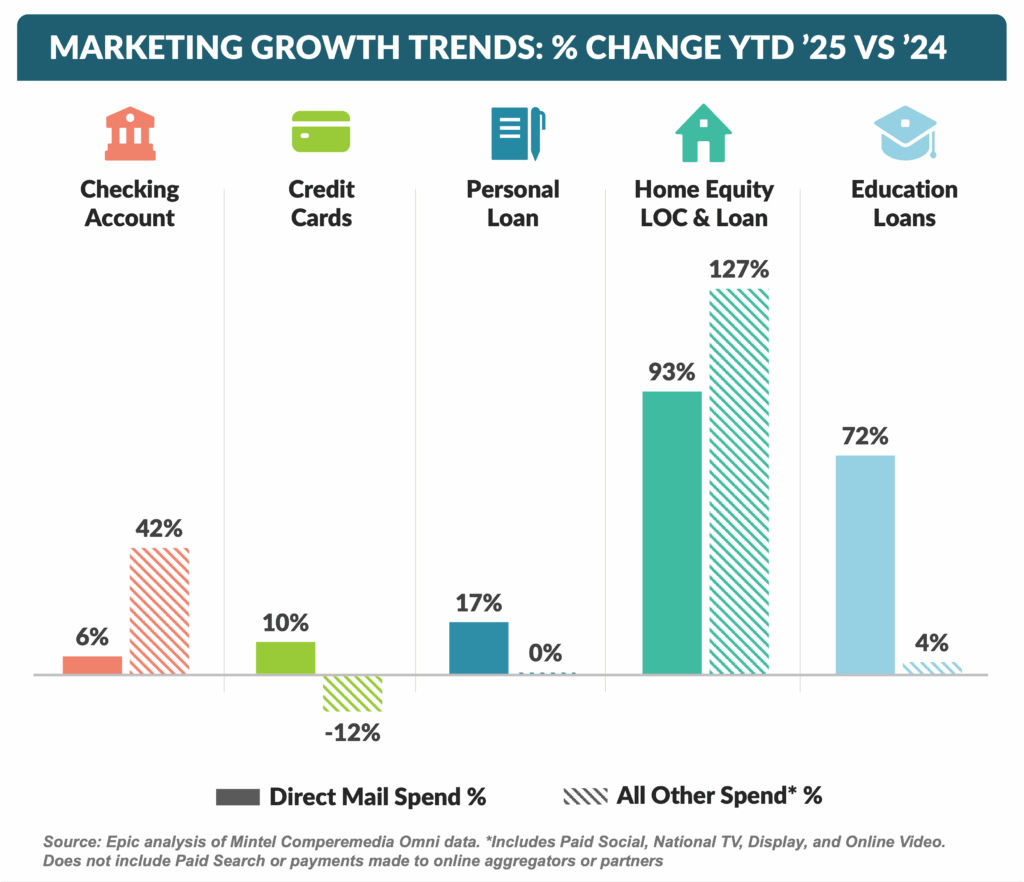

- YTD 2025 industry direct mail spending continues at higher levels for all products

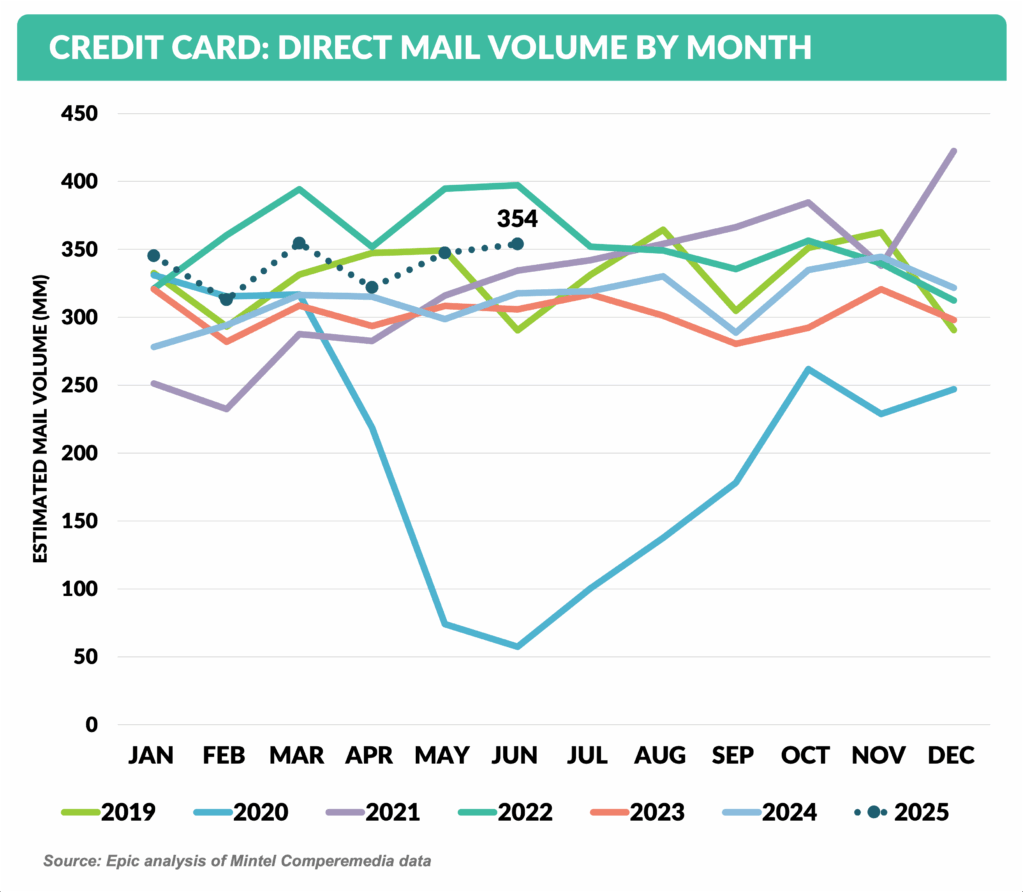

- YTD 2025, credit card mail volume is the second highest level in the past seven years and higher than pre-covid 2019

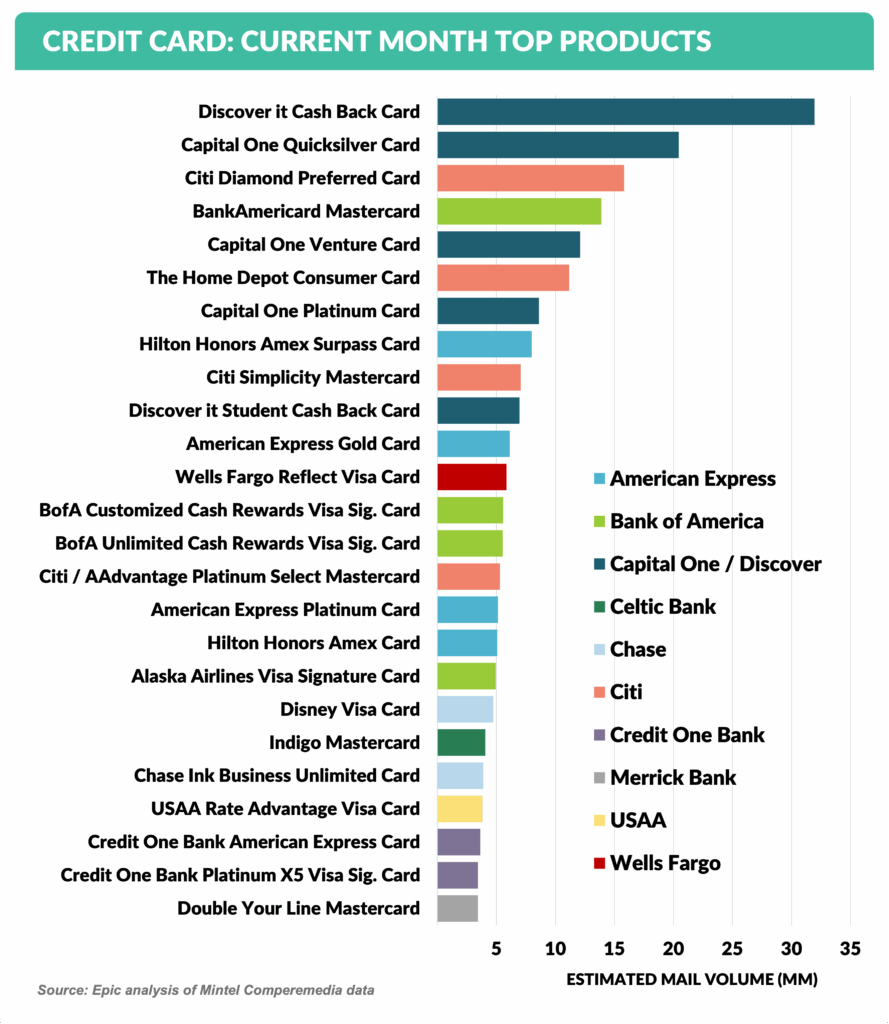

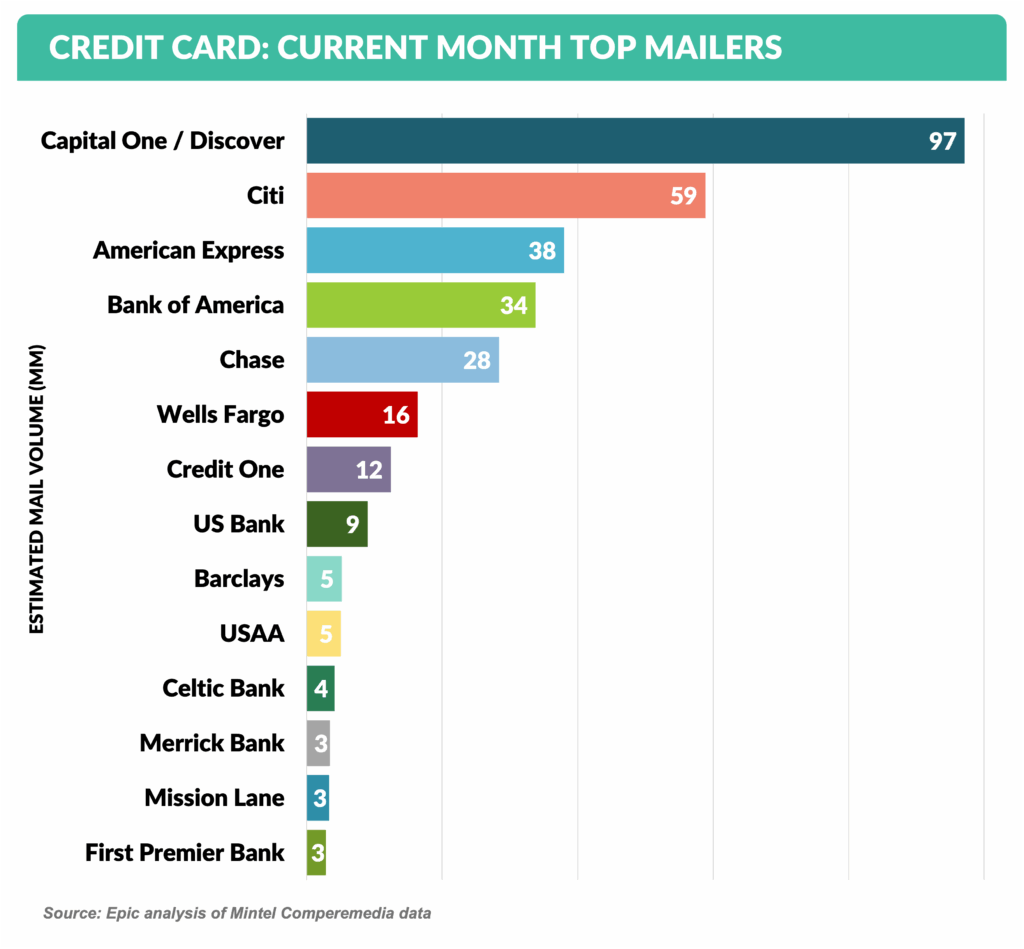

- Capital One / Discover had the two most mailed card products in June, and five of the top 10

- Citi had the same June volume as Capital One, but still 40% lower than the combined 97 million pieces from Capital One / Discover

-

The Wall Street Journal reported that JPMorgan Chase is in advanced talks to take over the Apple Credit Card program

- According to the report, Apple has told JPMorgan that it is the preferred choice to assume the program

- The program was launched by Goldman Sachs in 2019 and has grown to ~$20 billion in outstandings

- Profitability has been a challenge for Goldman due to the rich cardmember terms negotiated by Apple and by the high percentage of cardmembers (34%) with credit scores under 660

- Apple and Goldman have been in talks for two years about moving the program; however, no deal has yet been signed

-

We reported last month on the super-premium card “refreshes” for the Chase Sapphire Reserve and American Express Platinum Card, and Citi has now launched a new top-of-the line rewards card – Strata Elite

- In addition to enhanced spending tier rewards and other travel credits, Strata Elite offers lounge access at both Priority Pass and Admirals Clubs

- The $595 annual fee card marks Citi’s re-entry into the super-premium card market since stopping originations in 2021 for its $495-a-year Citi Prestige Card

-

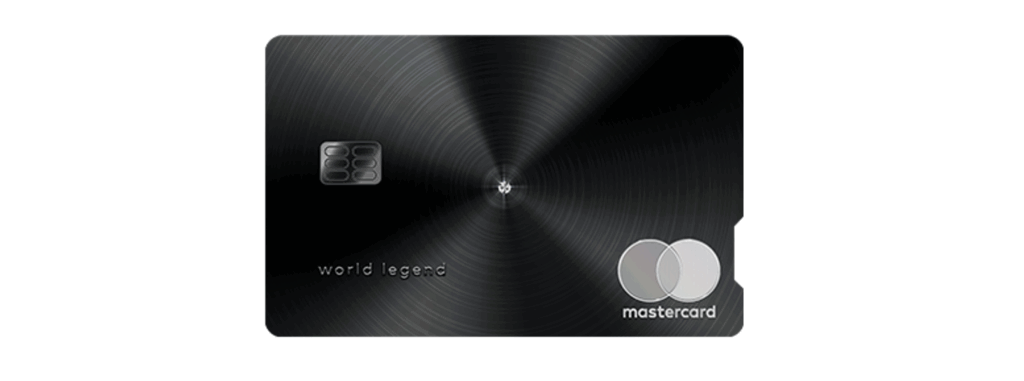

On a related note, Mastercard announced it is launching a new credit card tier called World Legend

- This will be the most premium card tier to date from Mastercard, higher than the existing World Elite tier

- The World Legend tier debuts to cardholders in the U.S. in 3Q25, followed by a broader international rollout

-

Following Wells Fargo’s early cobrand card exit, Bilt will launch the Bilt Card 2.0 in partnership with fintech Cardless in February 2026

- The restructured product will attempt to address the profitability-challenging features of the Wells Fargo card which offered rewards for charging your rent

- High losses were reported due to factors including lack of interchange income from cardholders’ landlords, minimal card use outside of rent payments, and low revolving balances

- The new Bilt Card will feature three tiered products—one basic and two premium, with the two premium cards featuring yearly fees of $95 and $495

Thank you for reading.

Jim Stewart

www.epicresearch.net

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Reach out if we can help you achieve world class results!

Add jim@epicresearch.net to your contacts to avoid junk filter issues.