Three Things We’re Hearing

- BTs gain as rates remain high

- Education lenders mine for gold!!!

- Barclays makes crafty move into personal loans!!!

A four-minute read

If the Epic Report was forwarded to you, add your name to the mailing list

Balance Transfers Gain as Rates Remain High

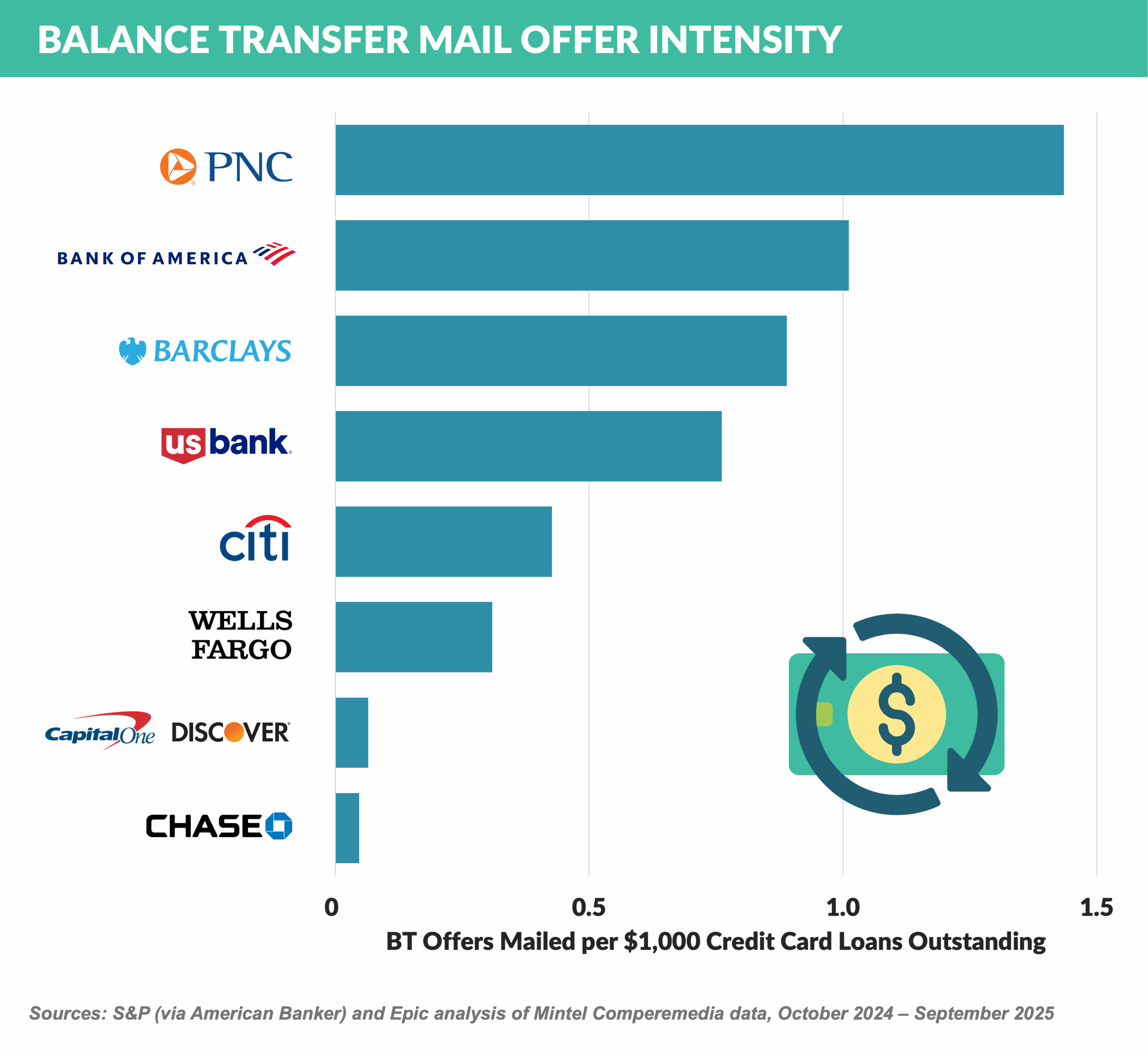

- Credit card issuers have varying strategies for sending balance transfer offers to their customers, with large issuers Citi and Bank of America significantly leading the rest of the field in BT mail volume

- The intensity varies widely when adjusted for portfolio size, with PNC and Barclays mailing at a much greater intensity than mega-portfolios Capital One and Chase

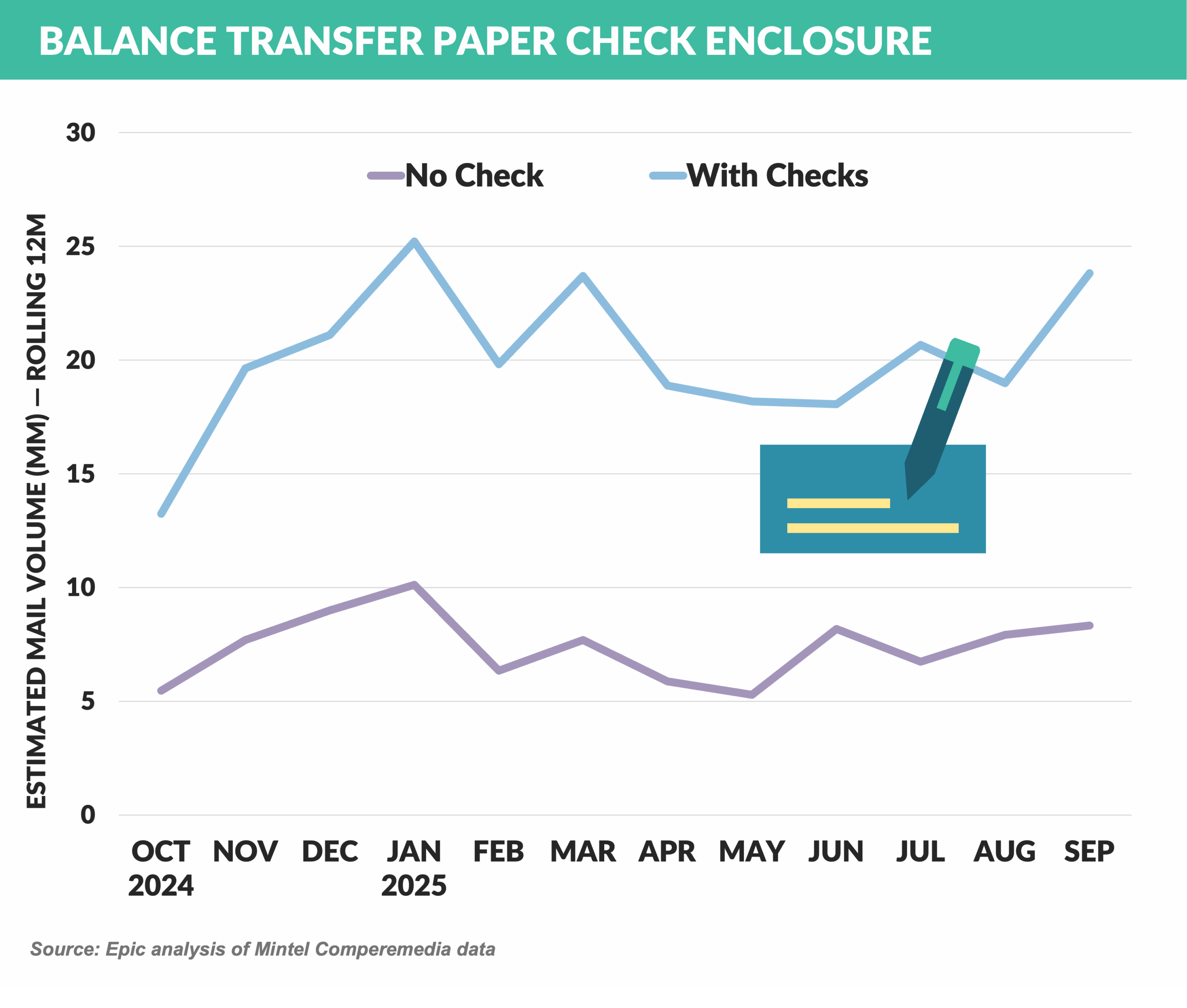

- While most BT mail in the past year included checks to activate the offer, over a quarter did not

- In 2025, BofA has included checks on roughly half of their offers while Citi has included them 90% of the time

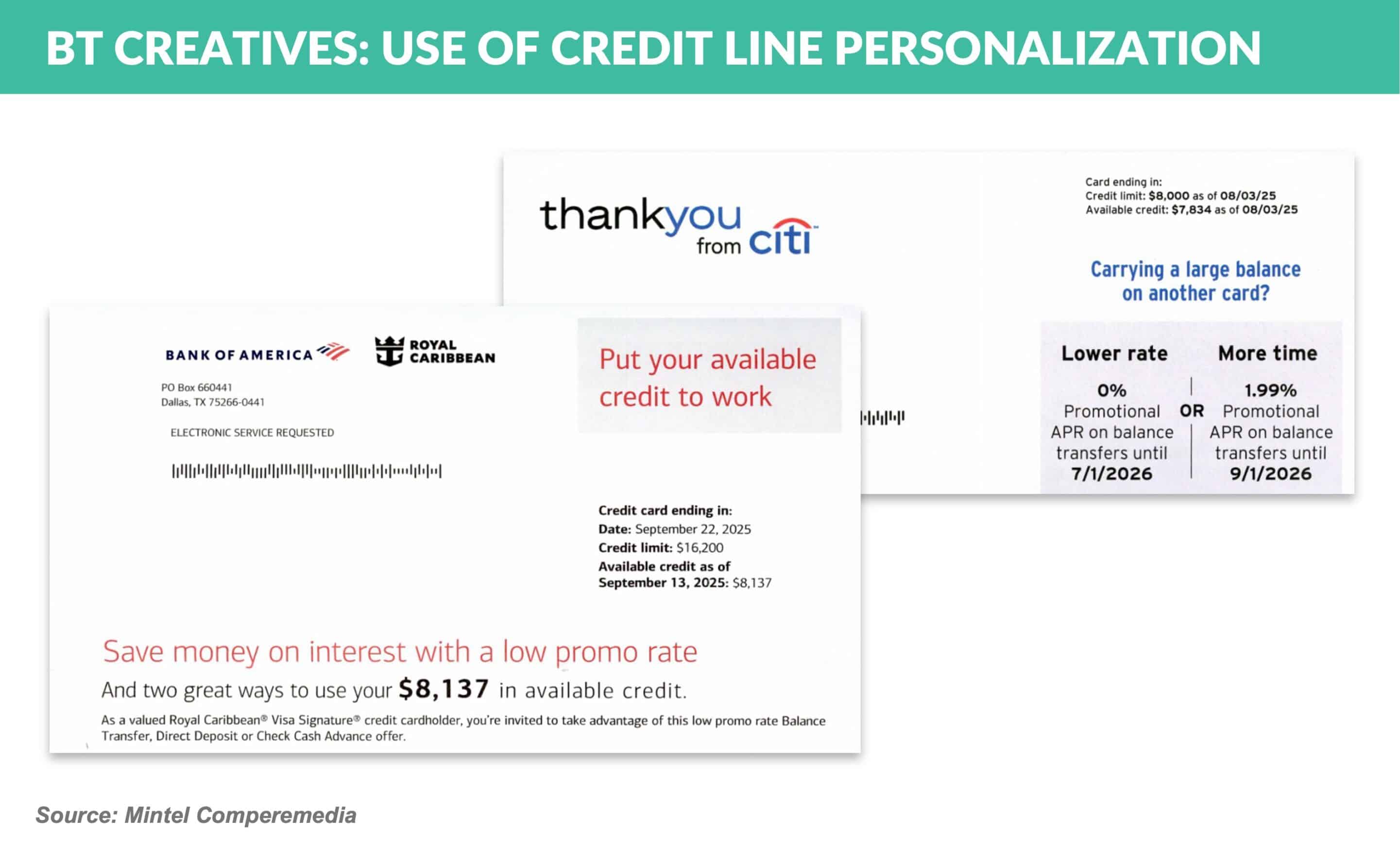

- Recent BT offer direct mail creatives have varying approaches to format and messaging

- BofA and Citi employ personalization, showcasing the customer's available credit line, to increase relevance and maximize dollars transferred

- Most outer envelopes, whether official or promotional in style, convey urgency to spur action

- KeyBank leans into the long-term value of the offer with “until 2027” language and further illustrates value through a savings chart, which is particularly effective with a non-0% offer

- Balance transfer fees have been trending up since 2023 — 3% fees declined to 9% of the mail in 2025 vs. 28% in 2023 — with a few 2025 offers reaching 5.49%

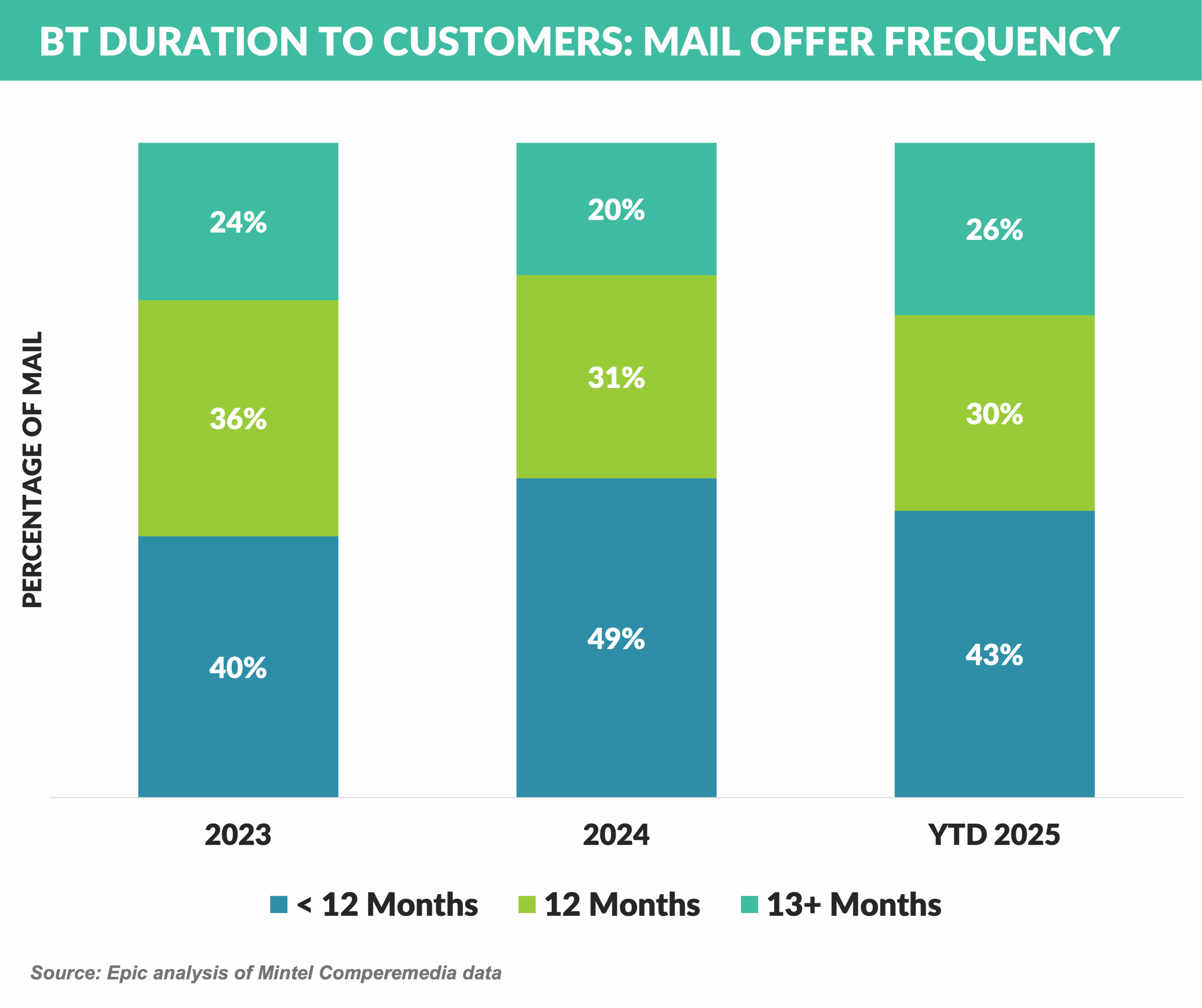

- 0% offers are dominating, with 91% of existing customer BT offers mailed so far in 2025 including a 0% promo for varying terms

- Our experience over the years has shown that citing a specific expiration date e.g., “0% until January 2027” draws a higher response than a similar term stated as “0% for 13 months” — you can often actually shorten the promo period by up to two months and get the same response!

Education Lenders Mine for Gold!!!

- Education lending remains a niche segment dominated by a few lenders for private student loans and refinancing

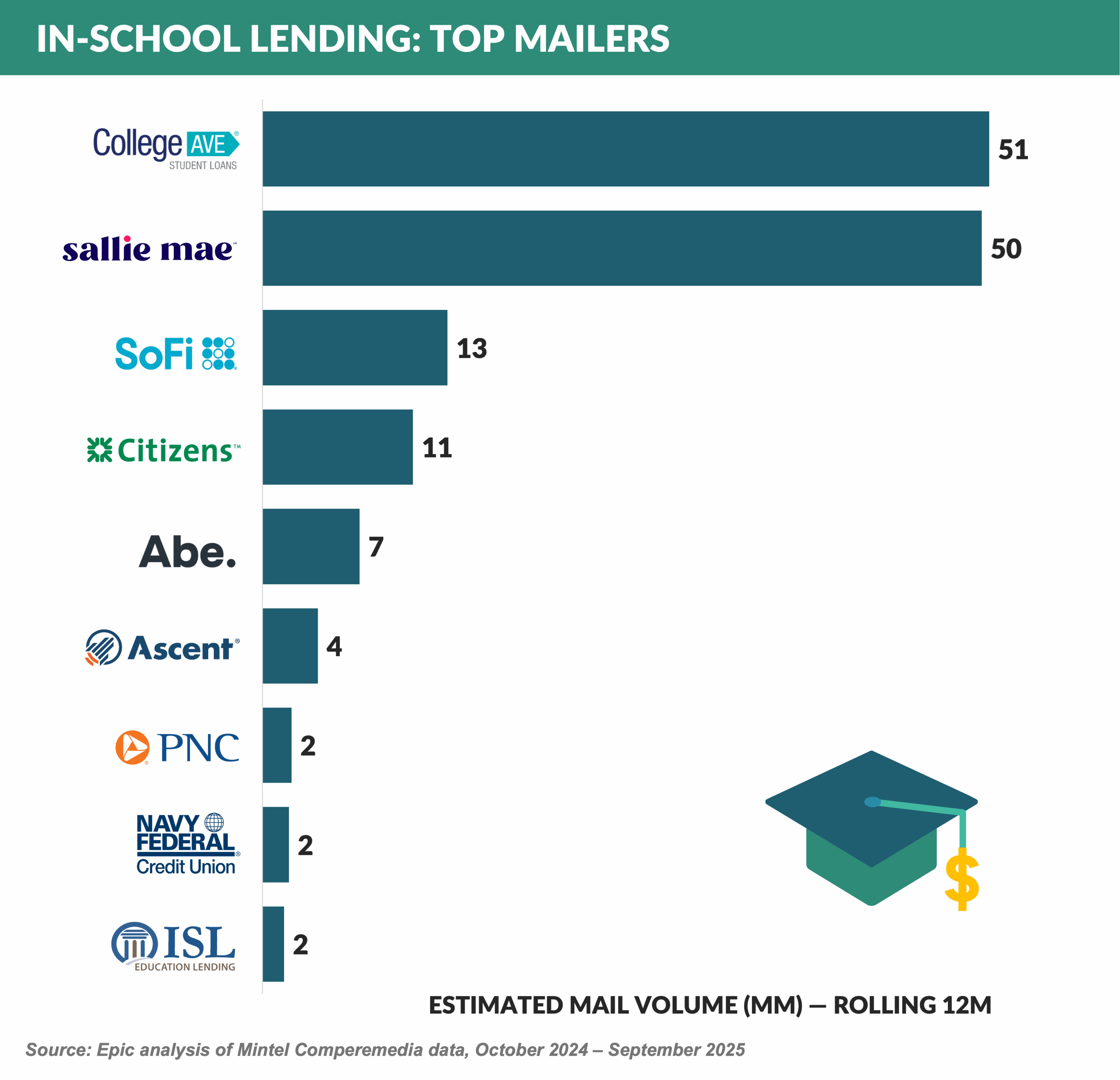

- In-school private student loans supplement government-provided federal loans and are primarily marketed by Sallie Mae, College Ave, SoFi, and Citizens — historic top marketer Discover ceased originating private student loans in Q1’24

- Recent legislation has restricted some federal loan volume — graduate and professional students will face new limits: annual borrowing caps (for unsubsidized loans) and lifetime caps; the Graduate PLUS program (which once allowed borrowing up to cost of attendance) is eliminated for new loans

- The combination of Discover’s 2024 market exit (leaving several billion in new annual originations up for grabs) along with the coming reduction in supply from federal loans has created a “gold rush” opportunity for the remaining private lenders as the market for new loans, which has typically been around $13 billion in recent years and could increase by 50% or more

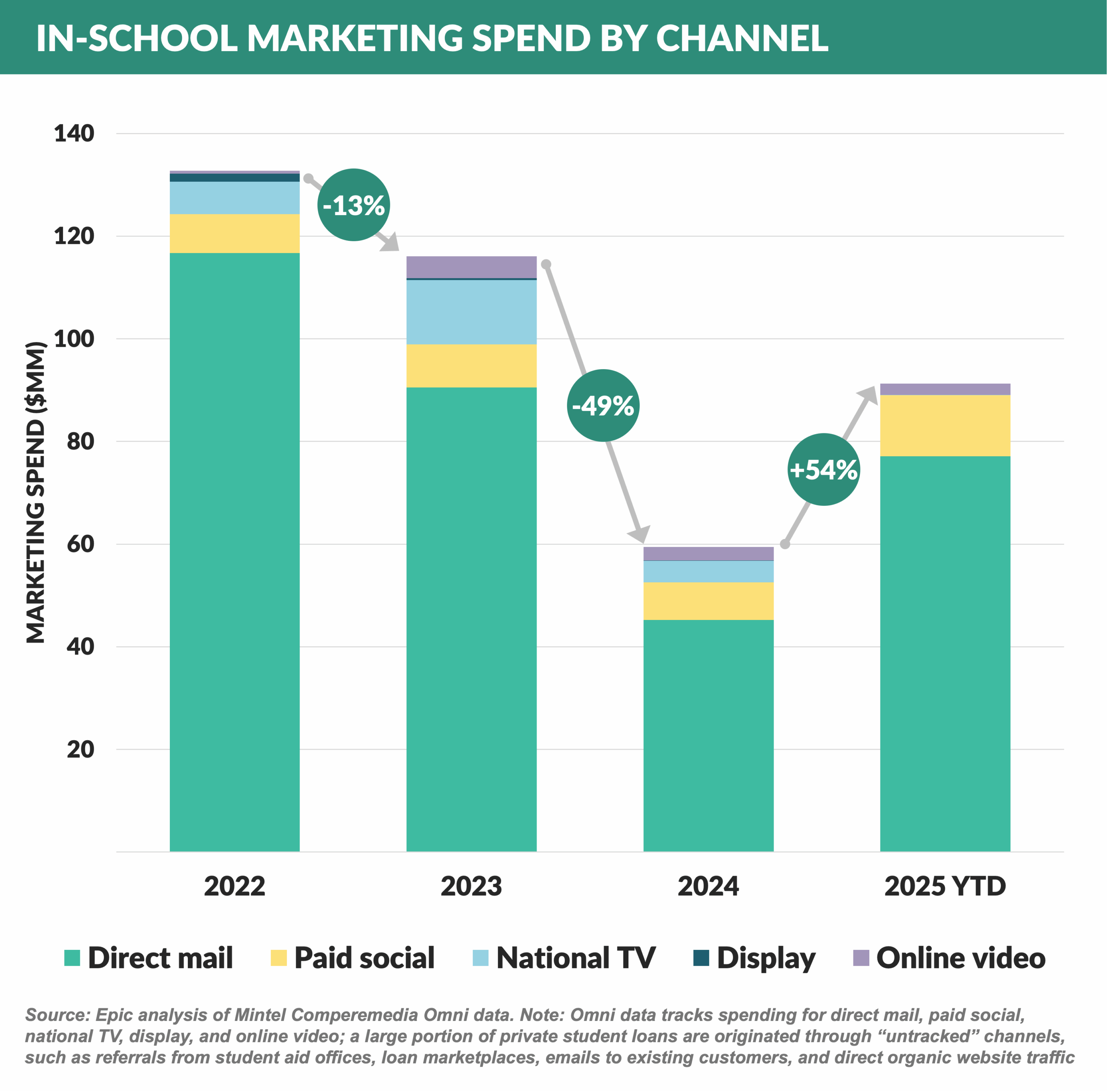

- With the bulk of the in-school lending “season” ending in September, tracked advertising spending through September 2025 is 54% higher for all lenders than full year 2024

- As in prior years, in-school direct mail activity peaked in July as lenders competed for share of voice and application volume during the prime borrowing window

- Google search volume suggests that consumer demand was well aligned with peak mail volume this year

- College Ave dominated tracked in-school marketing spending for the second year in a row, with their $28.1mm in spend up 12% compared to 2024

- Sallie Mae, originator of roughly half of all private student loans in recent years, quadrupled down in 2025, increasing their in-school spend from $6.8mm last year to a whopping $27.6mm YTD, rivaling College Ave’s spend

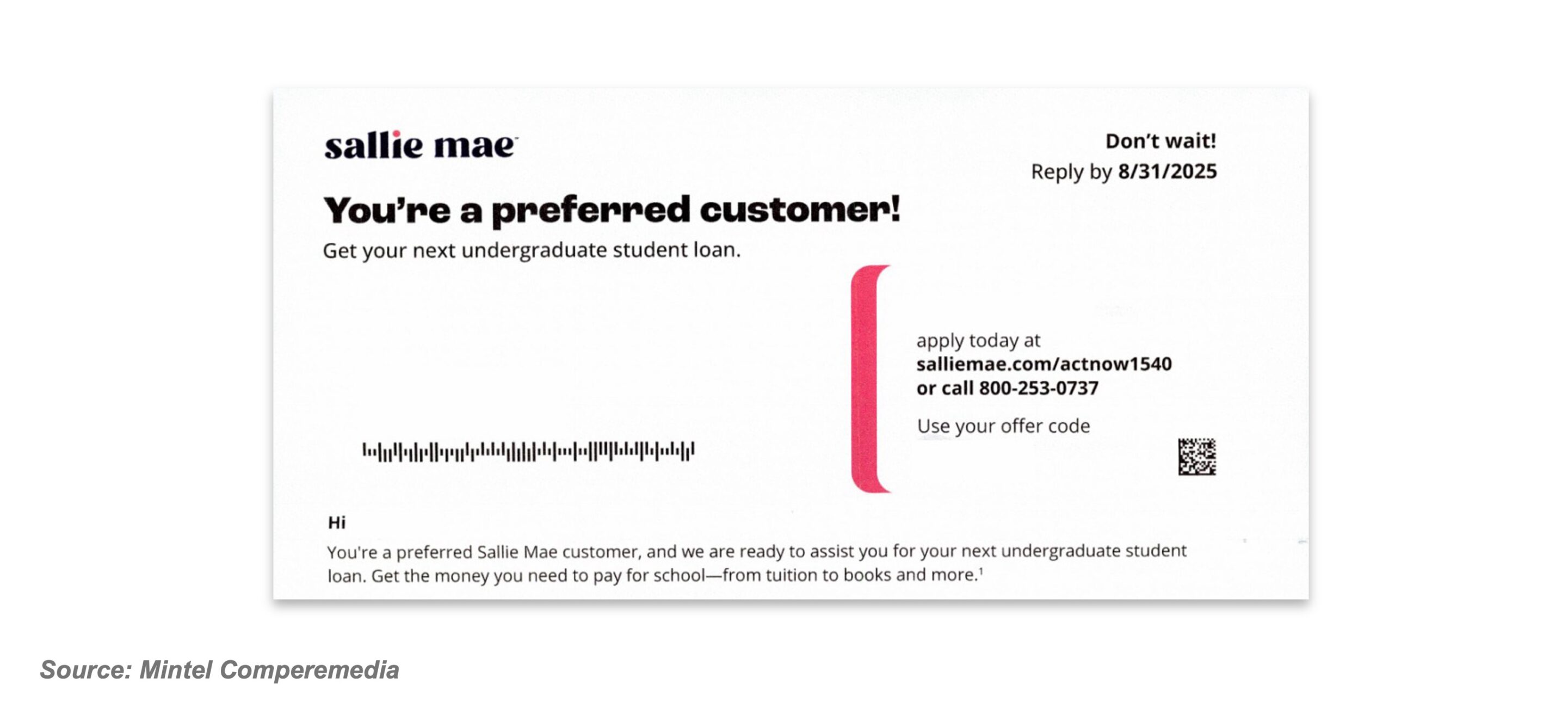

- Lenders are seeking longer-term relationships with student loan customers — unlike most lending categories, private student loans are serial by nature — the goal is to win a student as a freshman and retain any repeat business through graduation

- Sallie Mae’s direct mail creative leans into loyalty, inviting returning students to “get your next loan” with personalized, preferred-customer messaging

- Sallie Mae offers “Sallie” — a resource for students offering help with scholarships and financial aid in addition to loans

- Citizens further streamlines repeat borrowing with their Multi-Year Approval option — one approval covers multiple academic years

- Citizens recently launched their “Student Hub” that “brings together financial-education tools, college-search capabilities, and banking products into a unified digital experience for students and families

Barclays Makes Crafty Move into Personal Loans!!!

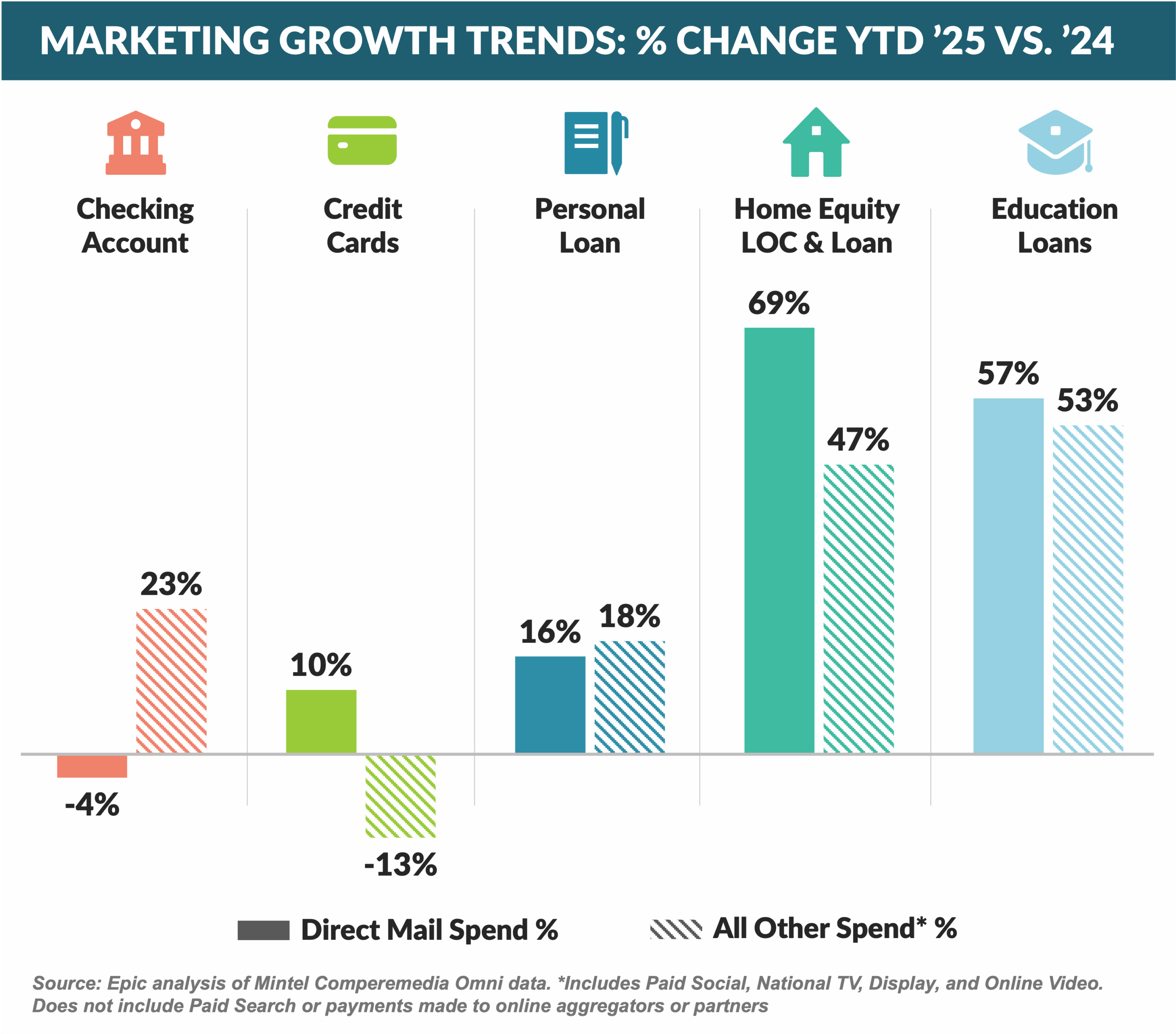

- Marketing spend for lending products remains on an upward trajectory, showing continued growth relative to 2024

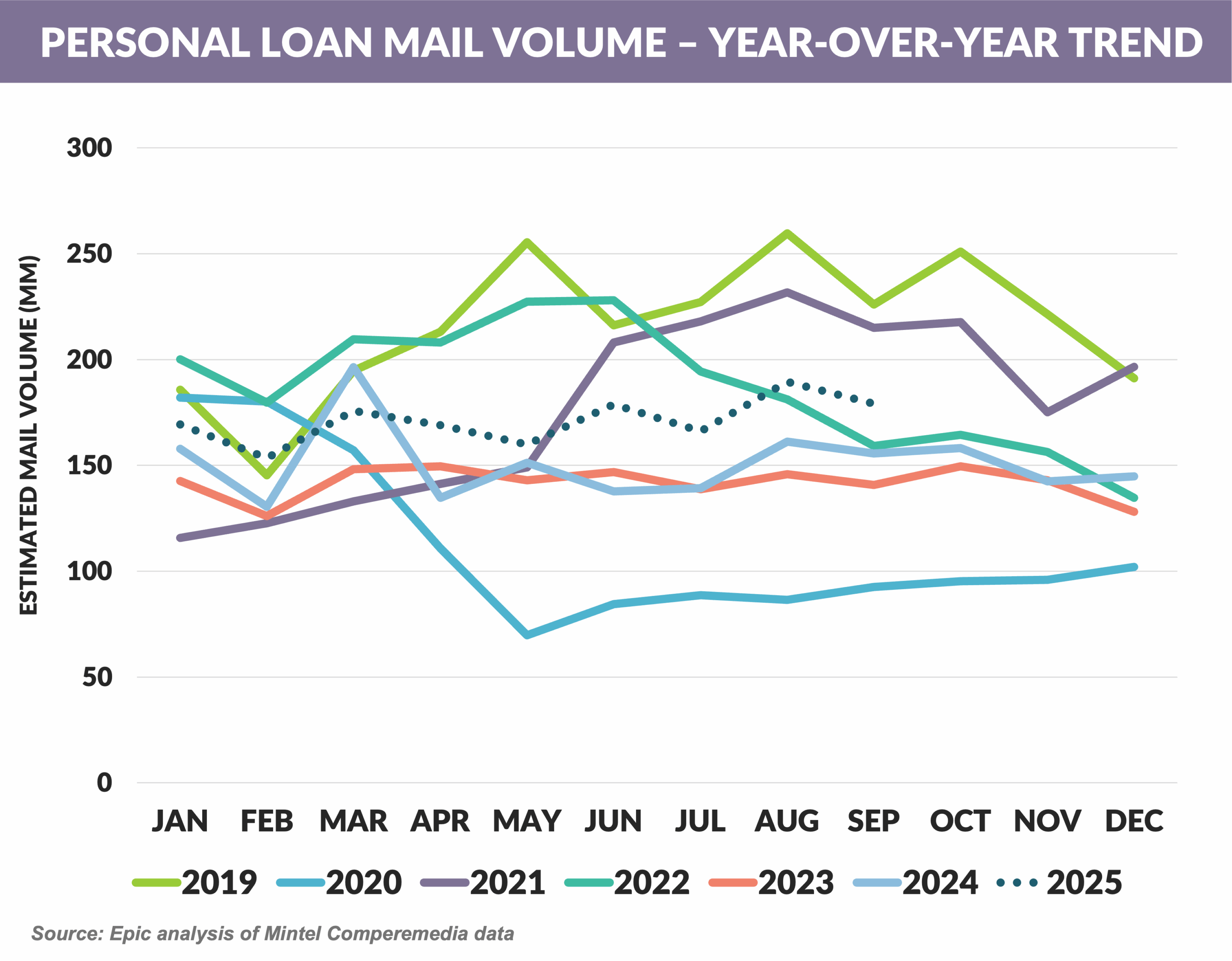

- Personal loan mail volume is higher than last year, but lags the levels of 2019 and 2021 when rates were lower

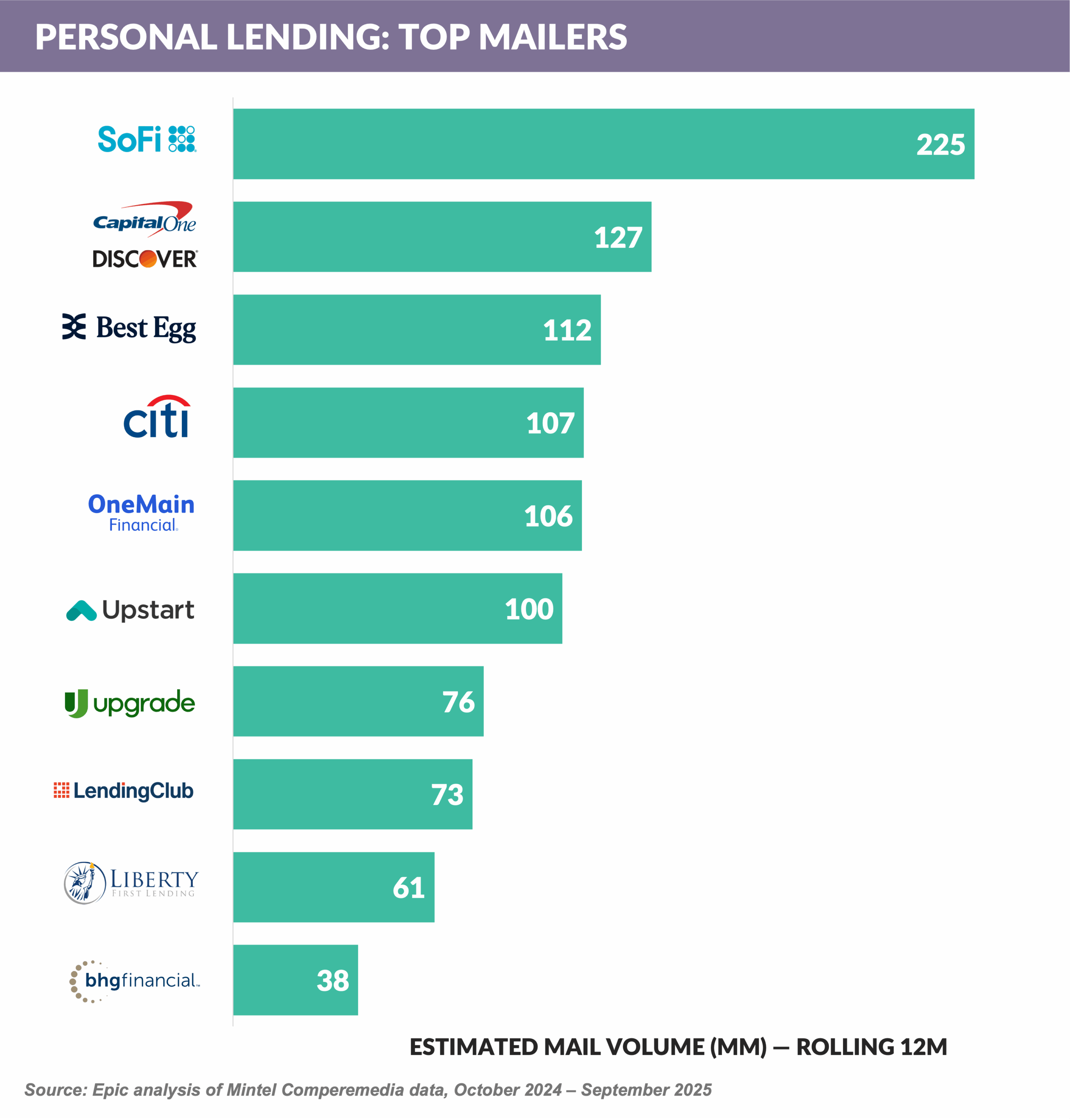

- SoFi has consistently topped the mail volume charts with almost twice the volume of number two Capital One/Discover, and number three mailer Best Egg will soon become Barclays making the top four mailers banks with their own charters!

- Barclays announced the acquisition of super lender Best Egg

- Barclays US consumer business includes credit cards (8th largest in US), high yield savings, and a relatively small personal loan business

- The complementary acquisition of Best Egg adds large scale personal loan originations ($7 billion this year) with substantial fee income from originations and servicing

- We view the combination very favorably with Barclays adding product diversification in their core consumer business with the addition of an elite lender in Best Egg — our grade on this acquisition is A+

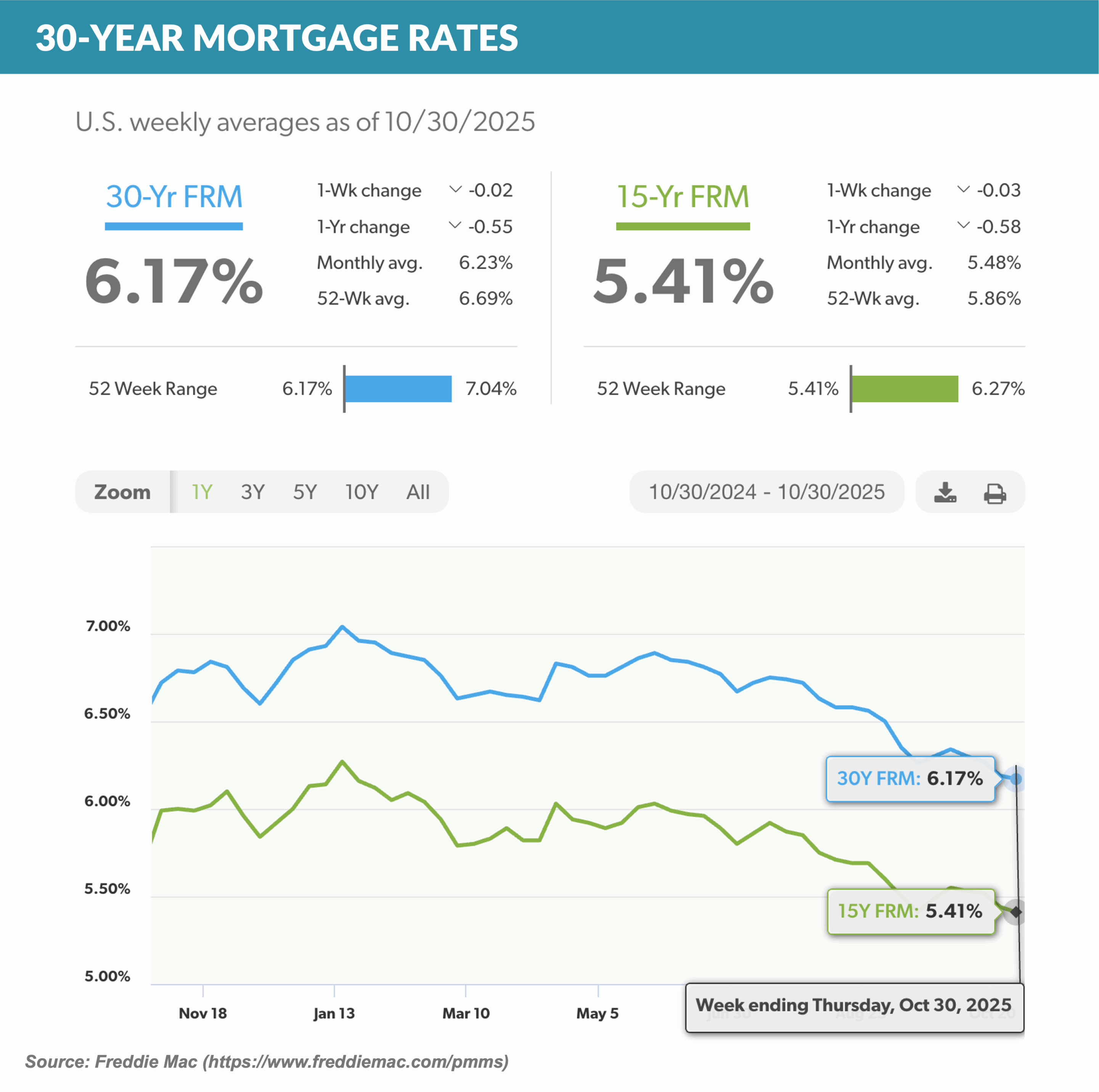

- 30-year mortgage rates reached their lowest level in over a year

- 30-year fixed rates averaged 6.17%

- At the beginning of 2025, 30-year rates exceeded 7%

- American Airlines and Citi launched the Citi AAdvantage Globe Mastercard

- Unlike recent super-premium card launches, the Globe Mastercard is billed as a “mid-tier” travel rewards card for travelers who fall between the occasional vacationer and the frequent flyer

- Citi cites $750 in value for the $350 annual fee card, including Admirals Club passes, free checked bags, preferred boarding, and a companion certificate

Thank you for reading.

Jim Stewart and Ben Brake

www.epicresearch.net

The Epic Report is published monthly, with the next issue in December.

Do you have a question about this issue or a suggestion about a future Epic Report topic? Please email us with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Reach out if we can help you achieve world class results!

Add jim@epicresearch.net to your contacts to avoid junk filter issues.