Three Things We’re Hearing

- The Home Equity paradox!

- Cash Back card surge

- Direct mail still dominant

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

The Home Equity Paradox: Record Wealth, Shrinking Lending

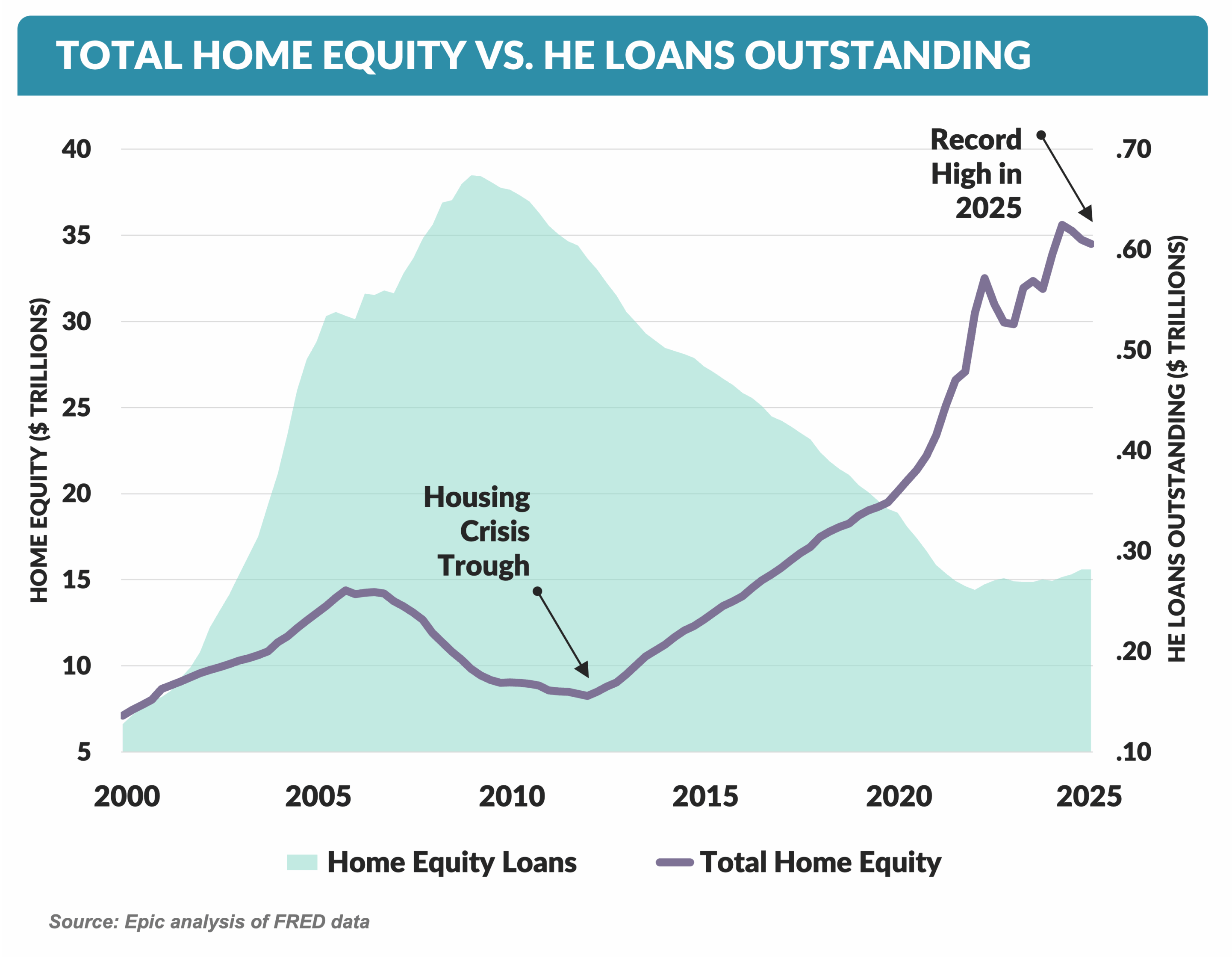

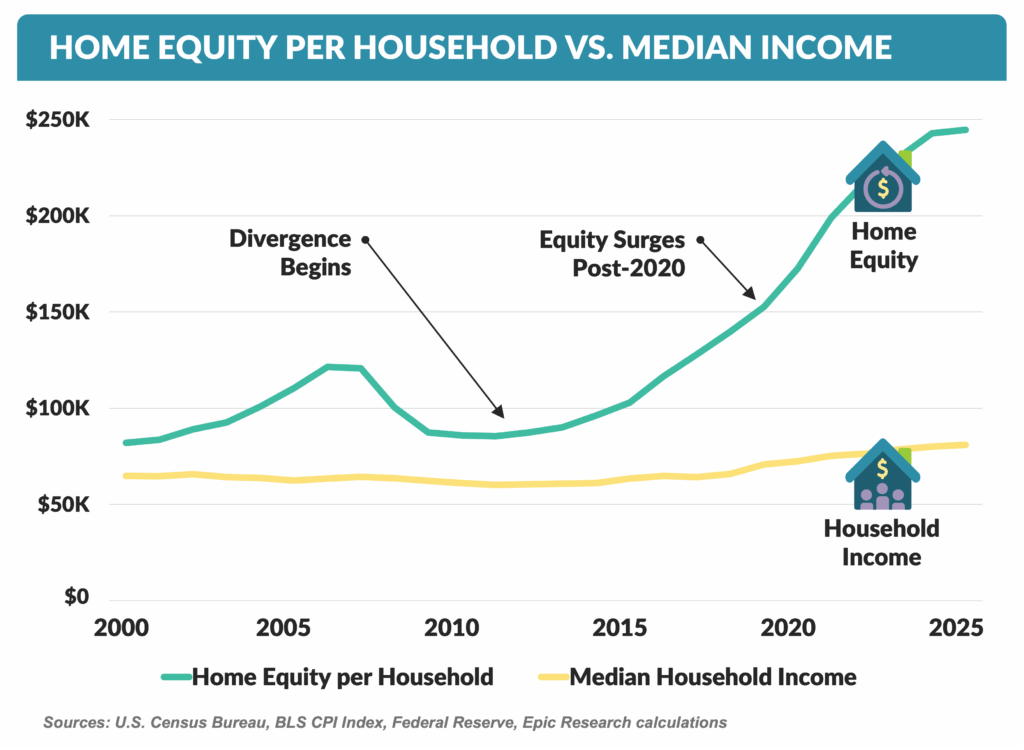

- Since the 2008–09 financial crisis, U.S. homeowners have built unprecedented housing wealth

- Total home equity has more than tripled, rising from ~$10 trillion in 2012 to $34.5 trillion in 2025

- In 2000, average household equity was about 125% of median income and by 2025, it’s nearly 300%

- But while equity has surged, home equity lending has not as outstanding balances have hovered near $300 billion, down ~40% from mid-2000s levels

- Why the Disconnect?

- Regulation – post-crisis reforms (Dodd-Frank, Basel III) made second-lien lending more expensive and capital-intensive

- Shifting Borrower Behavior – in the 2010s, ultra-low mortgage rates led many to refinance and cash out equity rather than open a HELOC

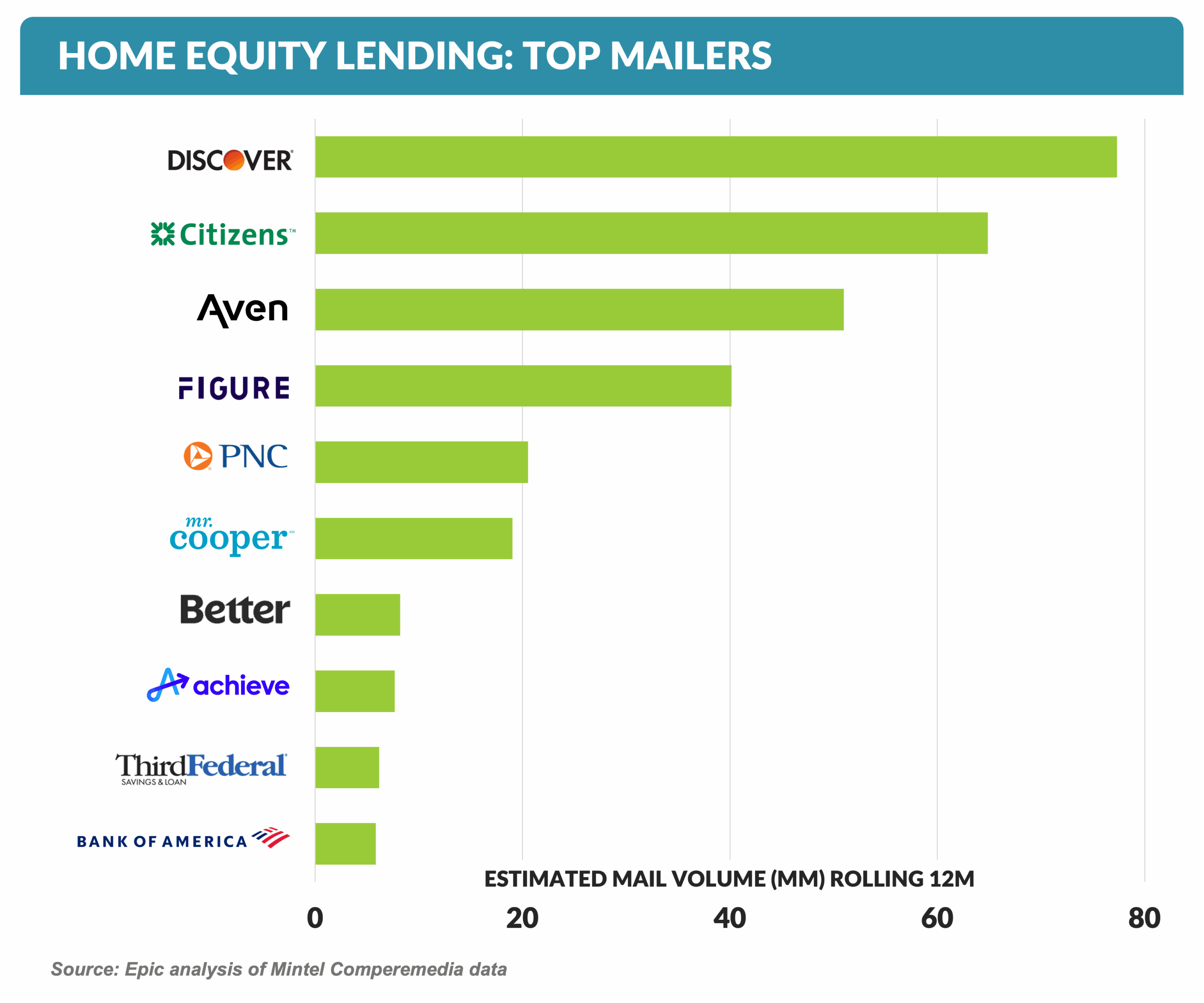

- Operational Retreat – major lenders like Wells Fargo and Chase pulled back from home equity, and today, Discover, Citizens, and a few fintechs dominate a quiet market

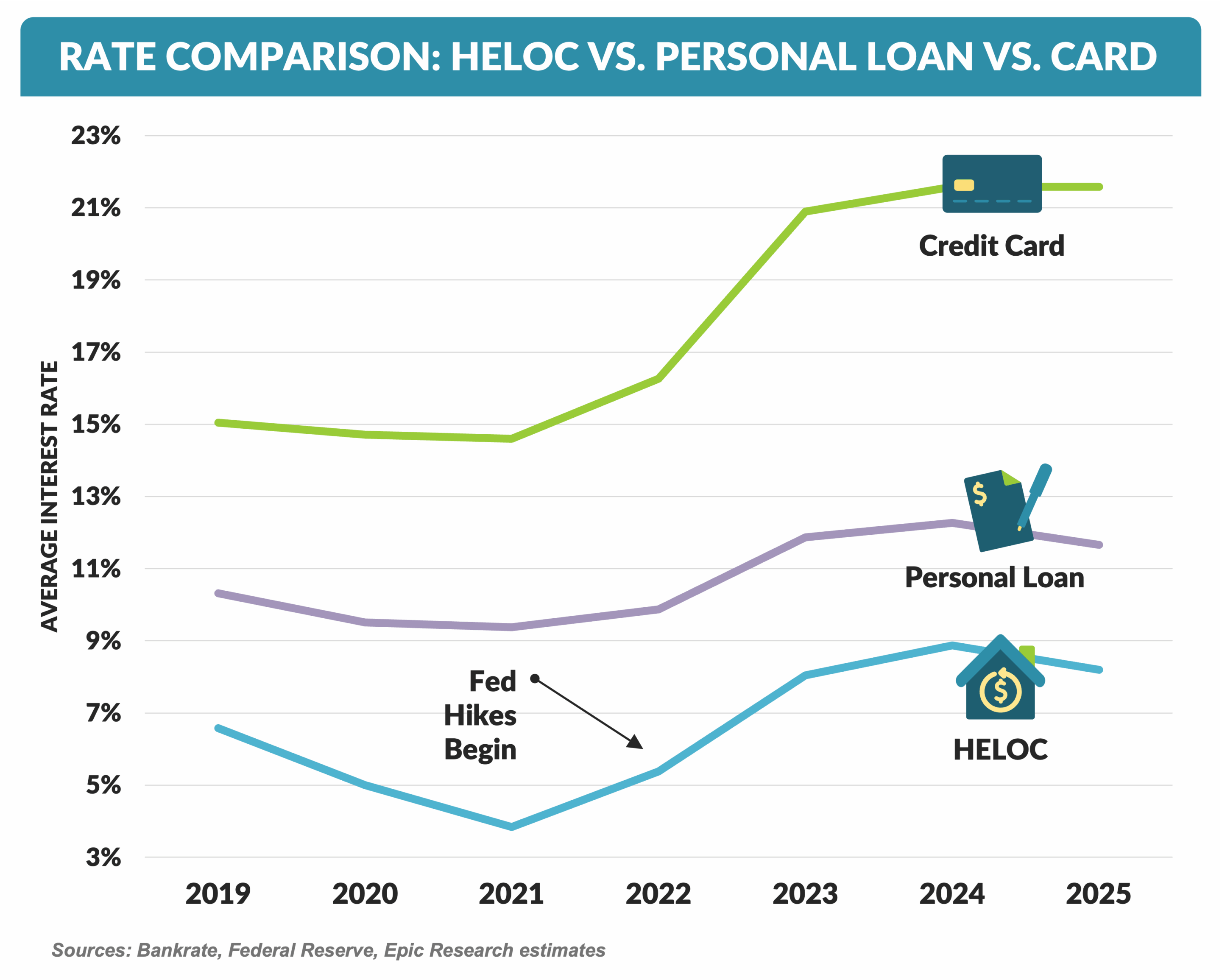

- Interest Rate Volatility – Since 2022, rising rates made HELOCs more expensive; and despite rate spread compression between HELOCs and personal loans, HELOCs remain ~300bp cheaper than personal loans and have much higher line sizes

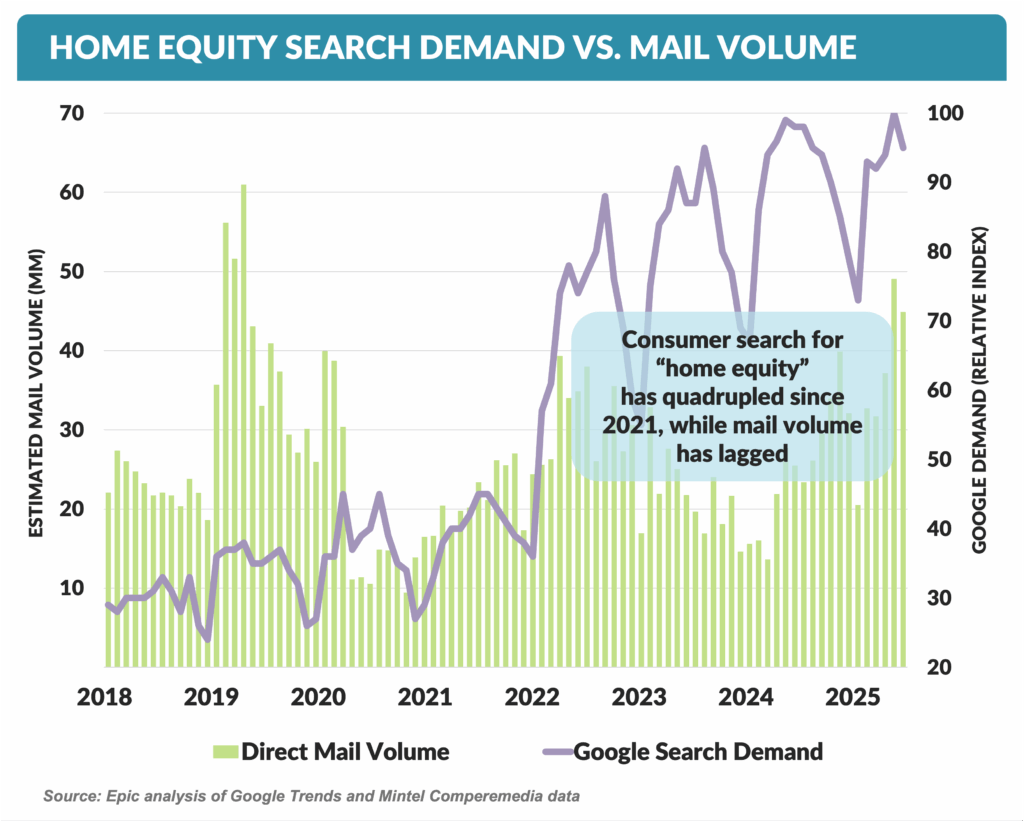

- Meanwhile, consumer demand is coming back — despite the pullback in home equity loan originations, demand is rising — search volume, online applications, and consumer survey data all show growing interest

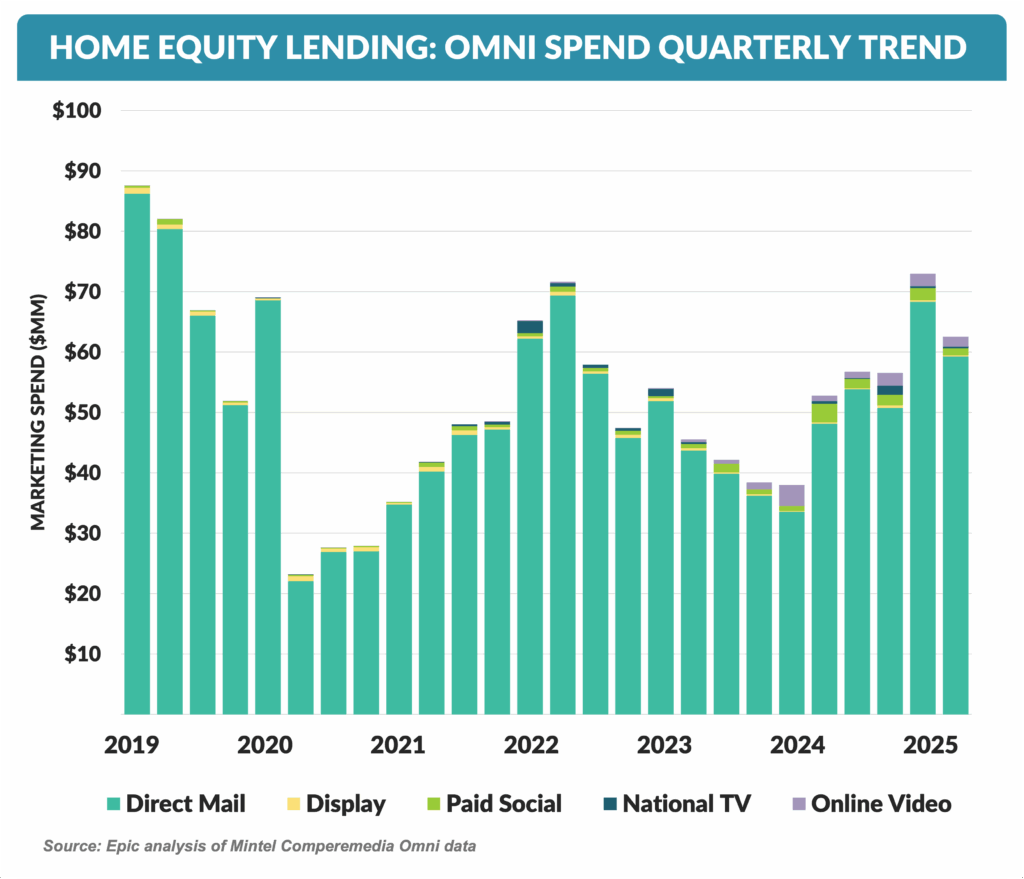

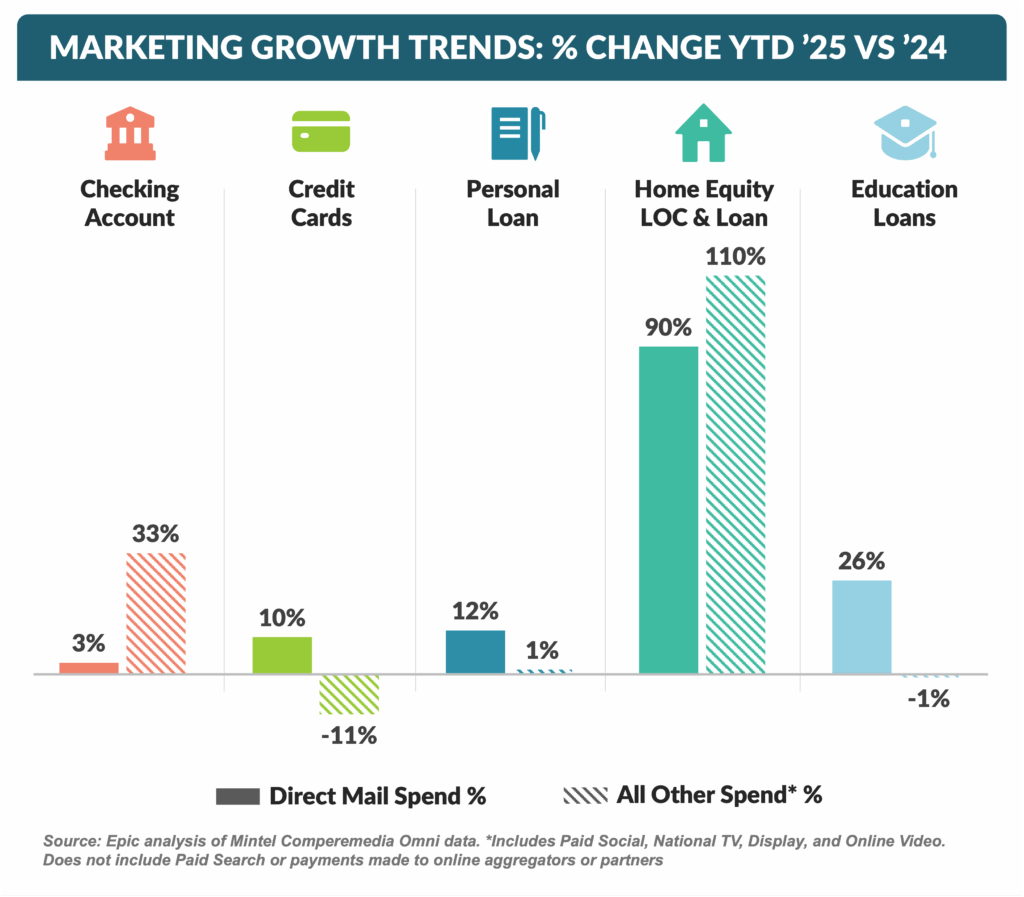

- Home Equity marketing is up 90%+ YTD; however, prior to that, home equity marketing was down, especially in the dominant direct mail channel

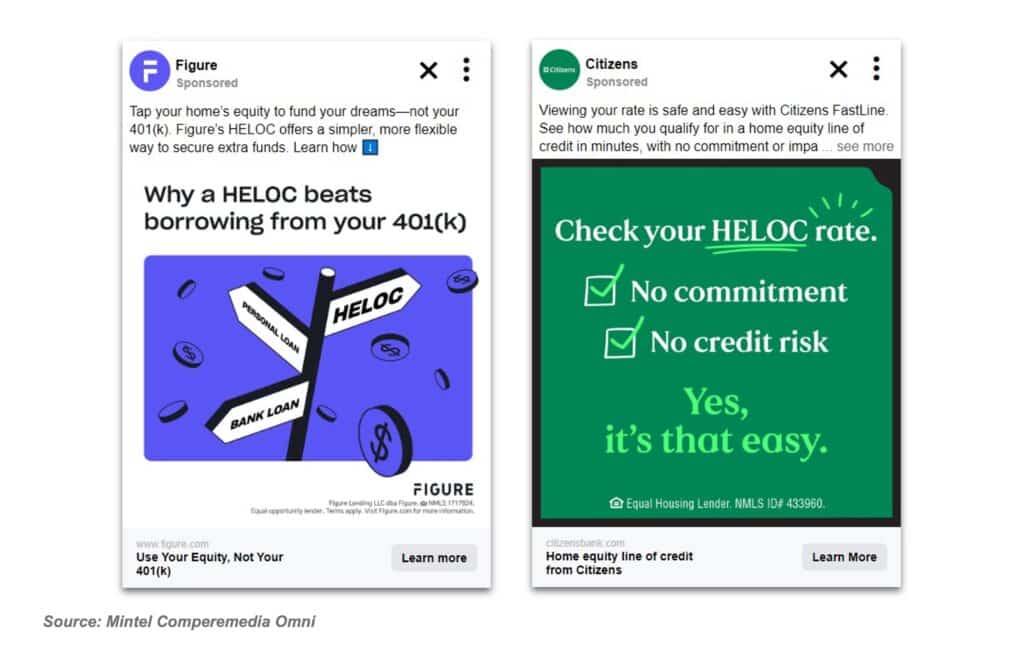

- Creative quality has been flat with few lenders showing consumers why home equity borrowing is cheaper than other options

- Despite the spike in 2025 marketing, home equity lending is at historically low levels, leaving a big opportunity for lenders!!!

- Average tappable equity per household now exceeds $245,000

- For borrowers locked into 3% mortgages, a HELOC is often the best path to liquidity

- Citizens and fintechs like Figure are responding with digital offers, yet most banks have left the field wide open

- There is $10–$12 trillion in tappable equity in U.S. homes, yet banks are lending as if it’s 2011 – with credit card APRs topping 20%, the case for smart home equity lending has never been stronger

Cash Back Card Surge

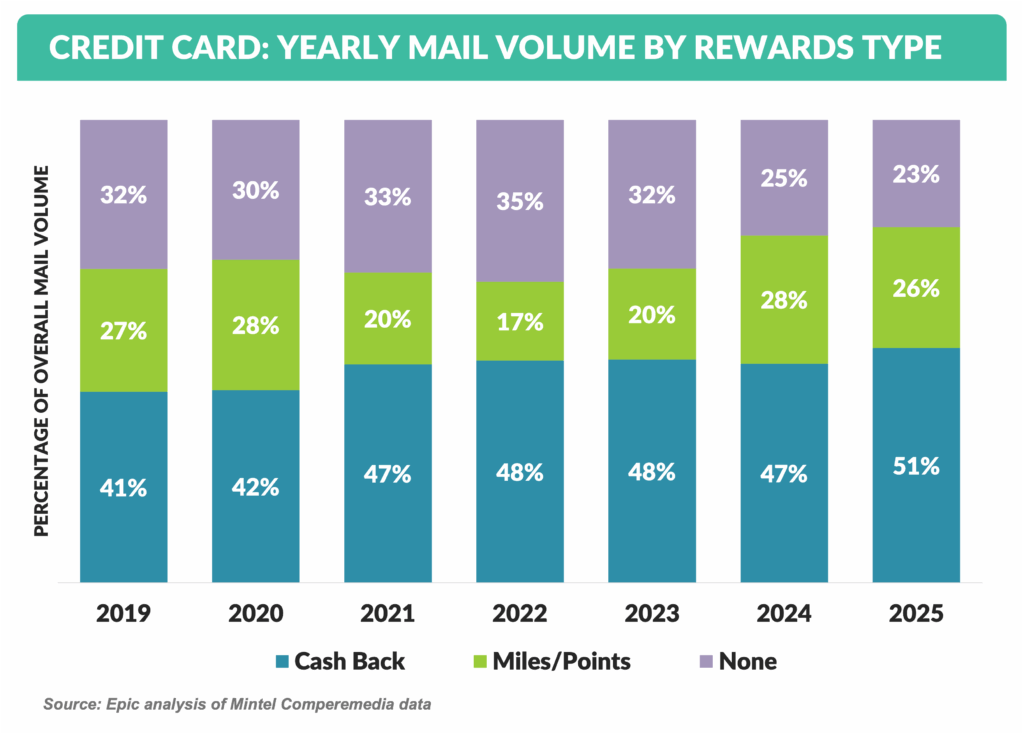

- Cash back has been the predominant credit card rewards type in recent years, accounting for roughly half of all card mailings

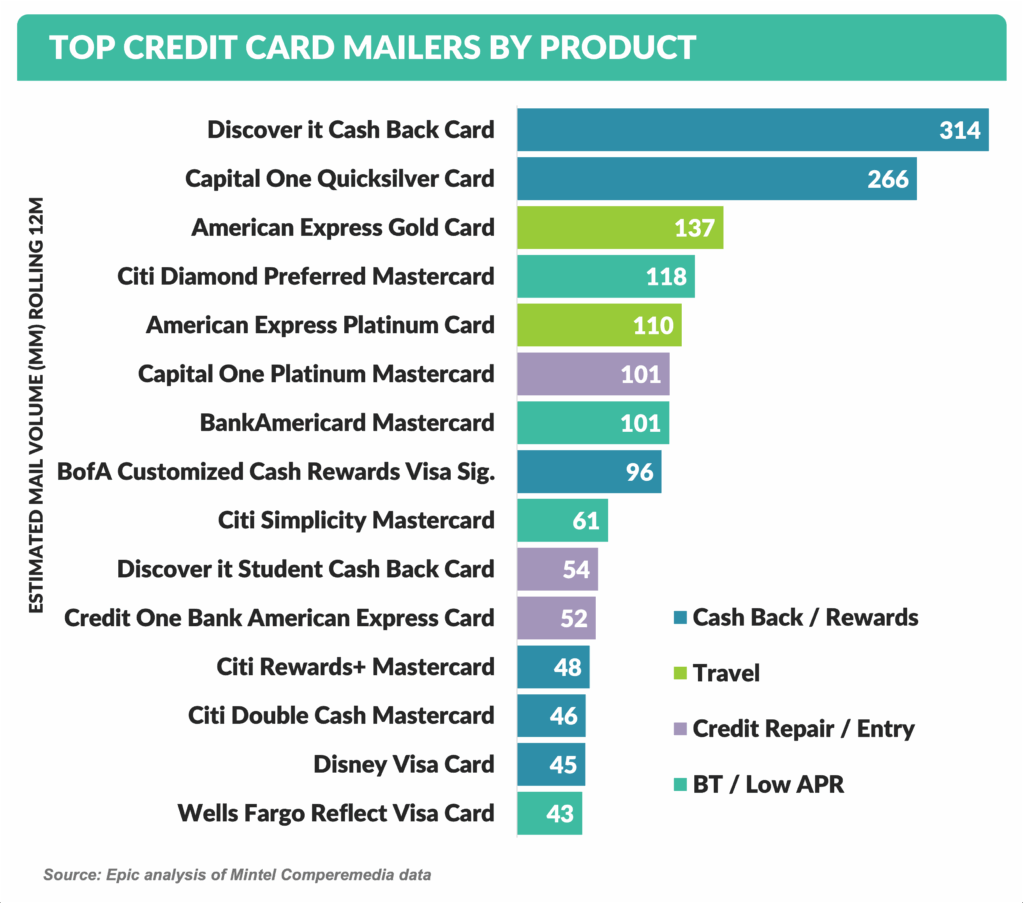

- Discover and Capital One (now the same company) have been the dominant mailers of cash back offers in the past 12 months, followed by Bank of America and Citi

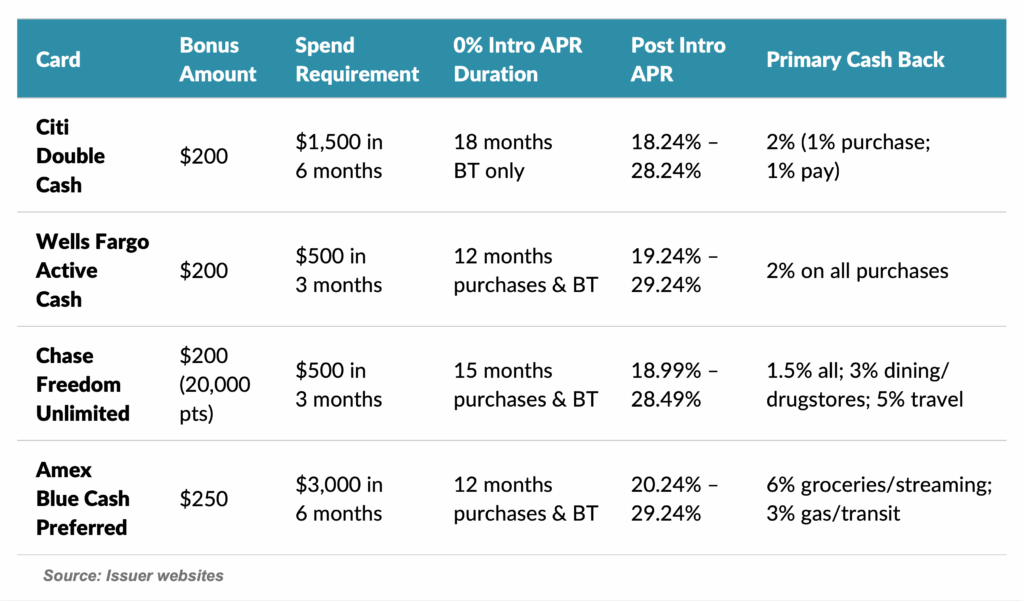

- Typical features of cash back cards include sign on bonuses, 0% APR, and no annual fee

- What determines the “best card” might depend on an individual’s spending patterns

- Best for ultra-simple rewards: Citi Double Cash and Wells Fargo Active Cash offer flat-rate cash back on all purchases with minimal hassle

- Category boosters: Chase Freedom Unlimited adds extra returns on travel, dining, and drugstores

- Big grocery earners: Blue Cash Preferred shines with 6% at U.S. supermarkets (capped), ideal for families

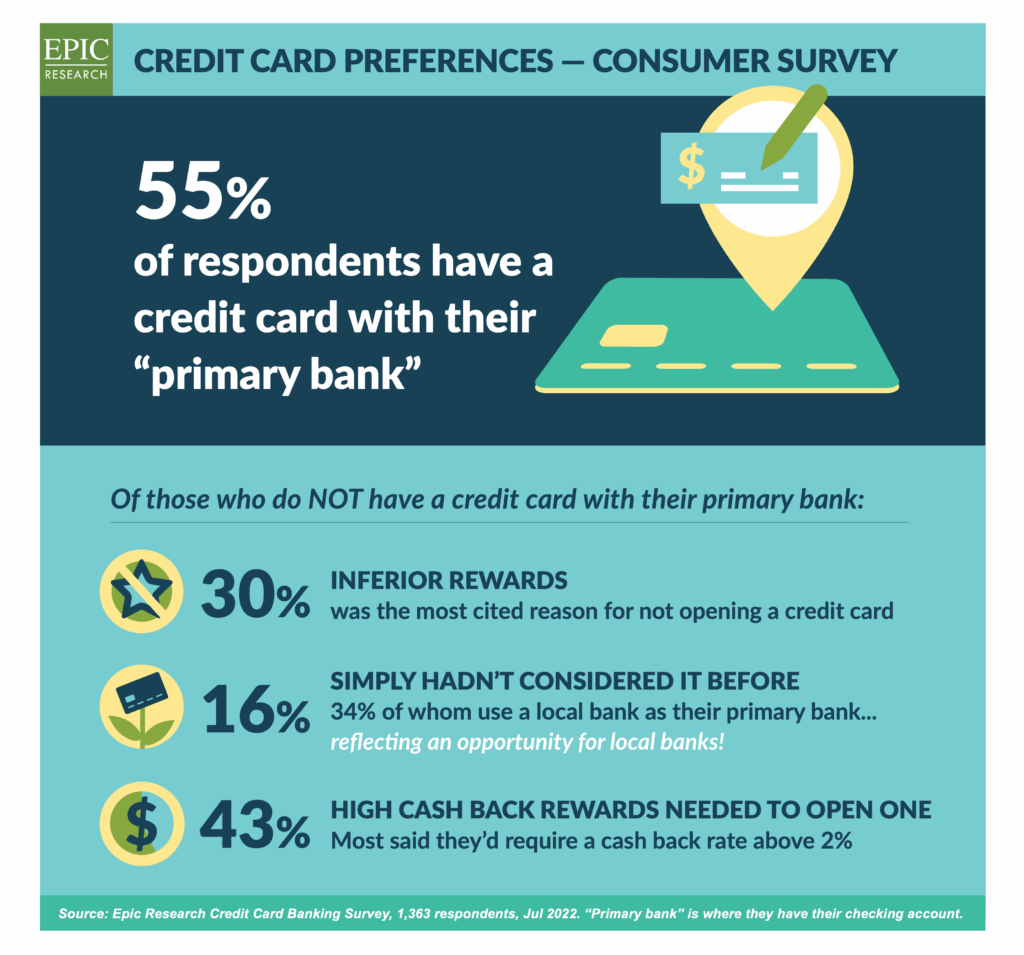

- Consumers have shown a preference for cash back cards, with many of them preferring their primary bank as issuer

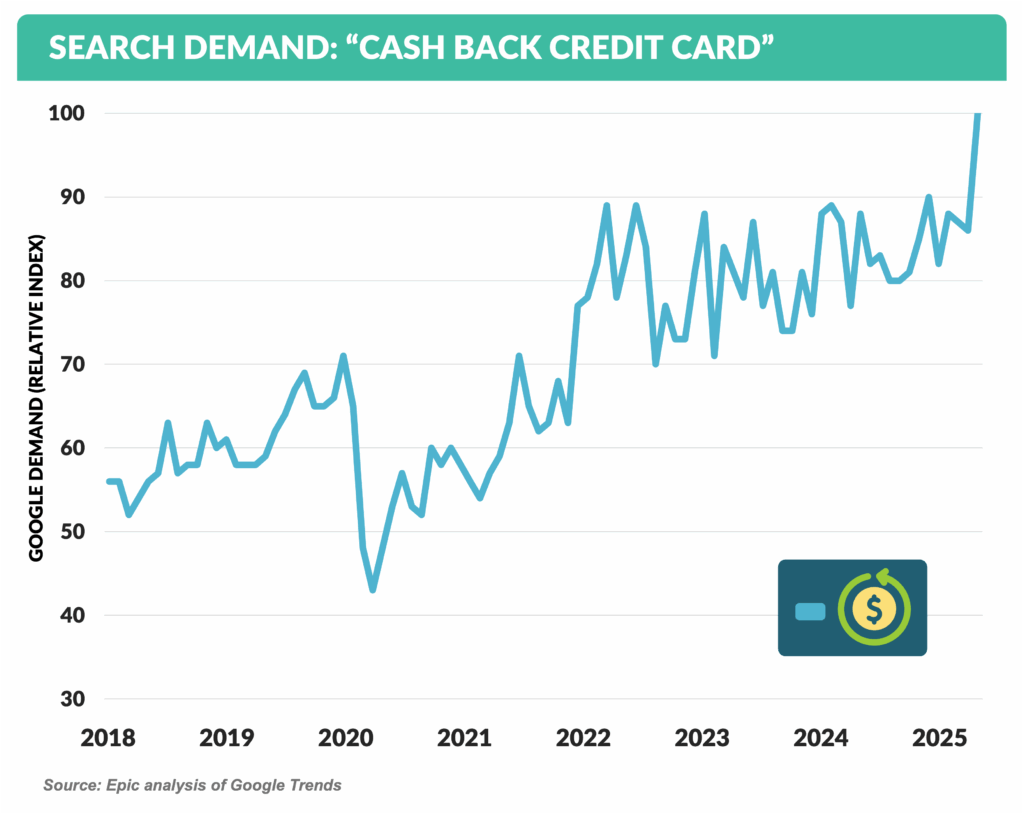

- Google trends show consumer interest in cash back cards has nearly doubled since 2018

- Given consumer interest in cash back, along with their preference for dealing with their primary bank, regional banks are well positioned to grow their card portfolios with a competitive cash back product

Direct Mail Still Dominant

- As noted above, YTD 2025, Home Equity marketing has shown the largest resurgence of the consumer finance products that we track

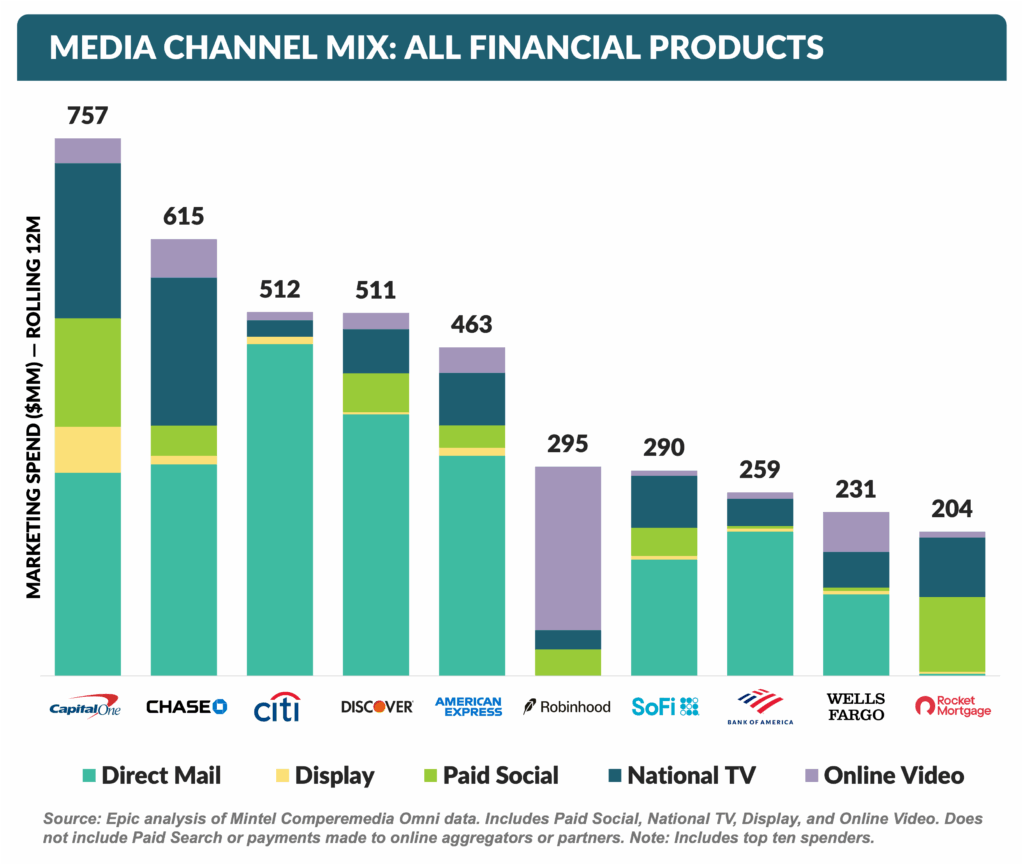

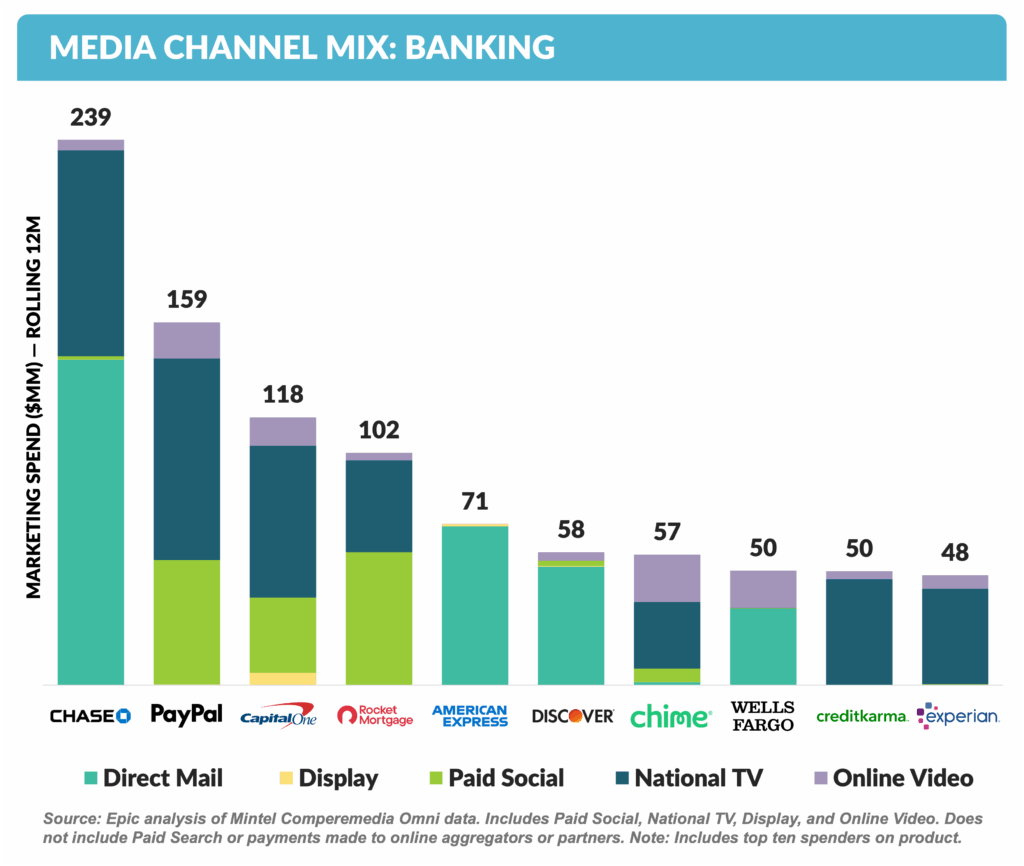

- Across all financial products, most large marketers use direct mail as their primary new customer acquisition channel

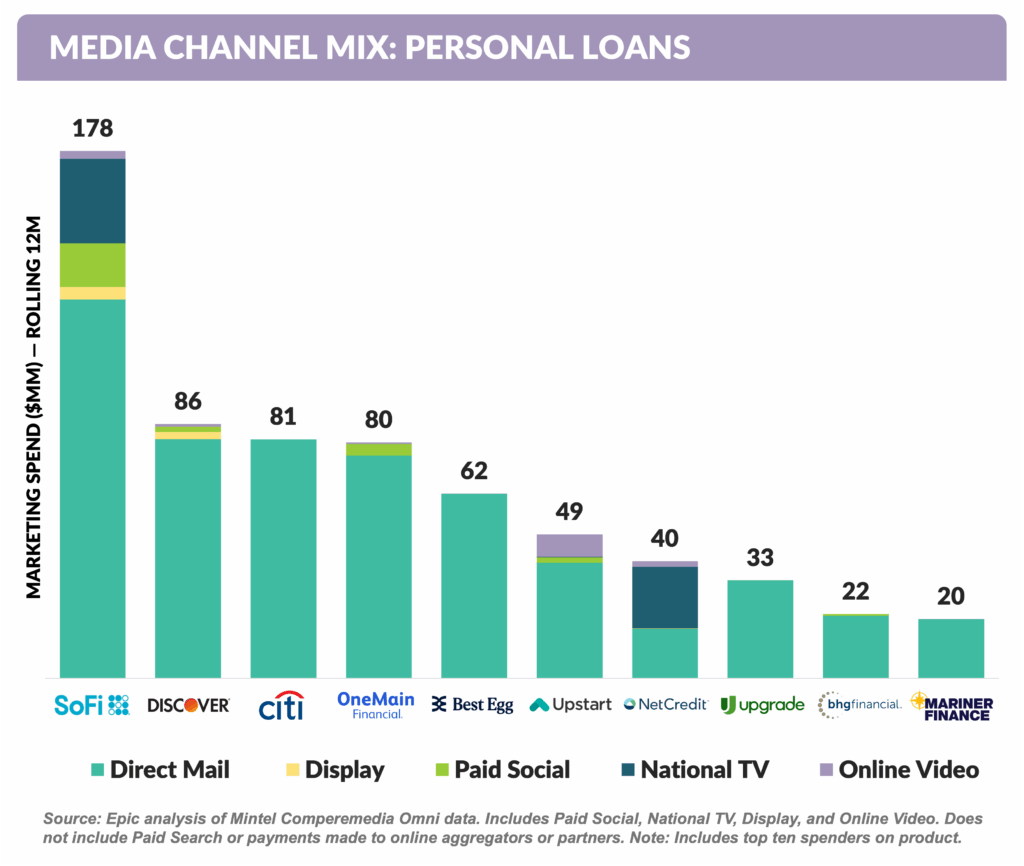

- Personal loan relies most heavily on mail

- While national television is used by some banking product marketers to augment other channels

- Amex Platinum refresh: American Express plans its “largest investment ever” in revamping both personal and business Platinum Cards in fall 2025 — including redesigned physical cards, expanded Centurion lounge access (adding Newark, Salt Lake City, Tokyo), enhanced dining perks, and likely higher annual fees

- Chase Sapphire Reserve overhaul: Effective June 23, 2025, annual fee rises from $550 to $795 with benefits including new 8× travel and 4× flight/hotel earn rates, Points Boost redemption (up to 2¢/pt), richer lifestyle credits, sleeker design — and a business version launch

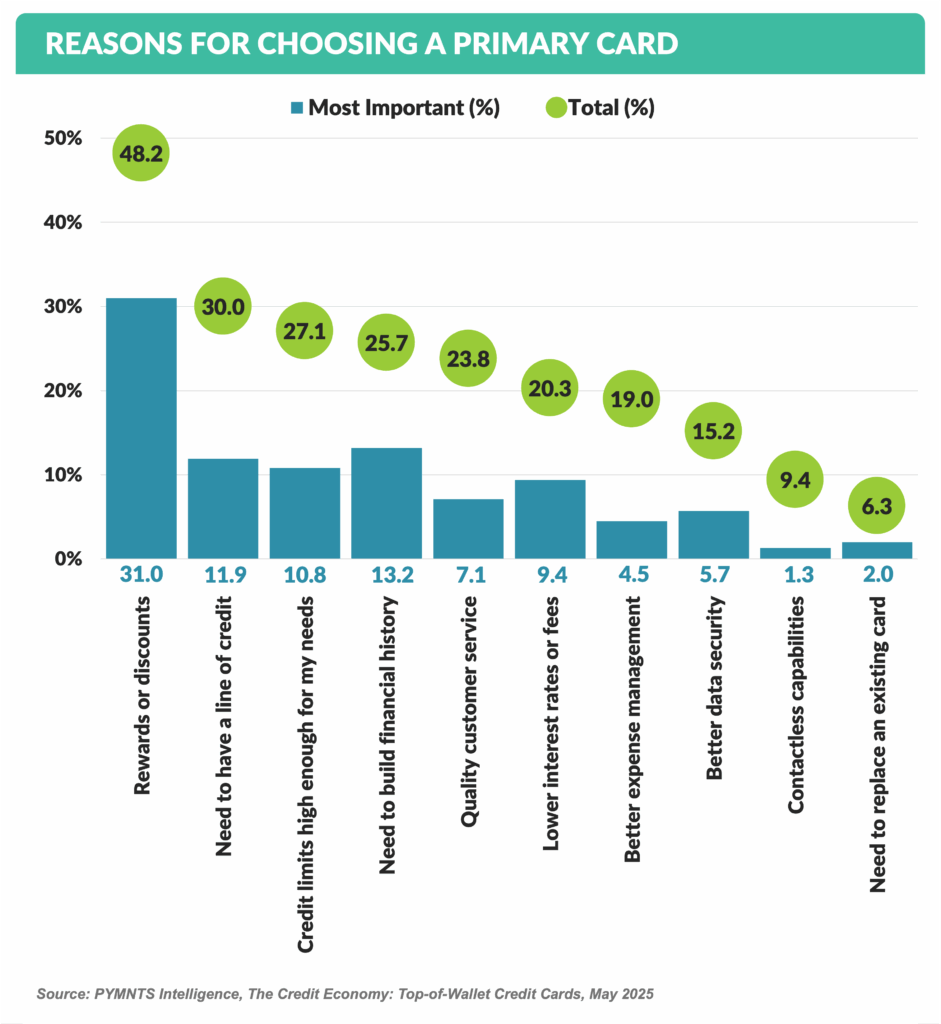

- A survey of Gen Z consumers (those born between the mid-90s and early 2010s) reveals that rewards or discounts as well as higher credit limits are the dominant reasons for them to choose a credit card

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue in August.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Find out how we can help you.