What We’re Seeing

The Covid-19 pandemic has created an unprecedented environment for consumer lenders. In our daily discussions with our clients and industry contacts, everyone seems to be looking for information regarding impacts and actions among financial institutions. Below is some data, along with other anecdotal observations. Please email us your thoughts regarding this topic.

Consumer Demand

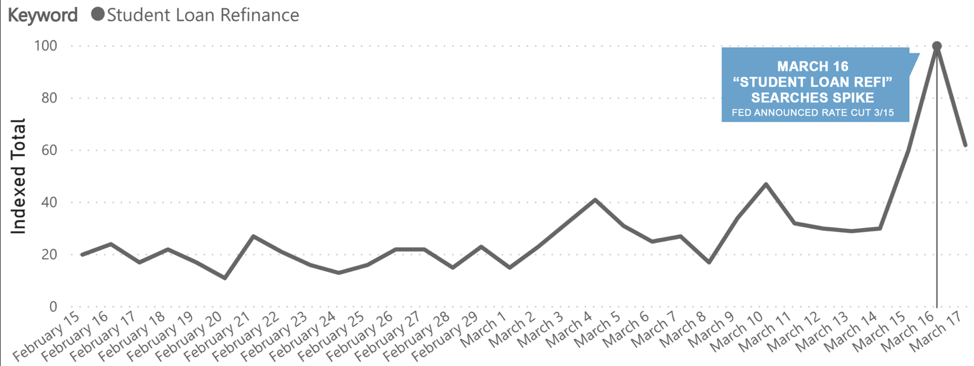

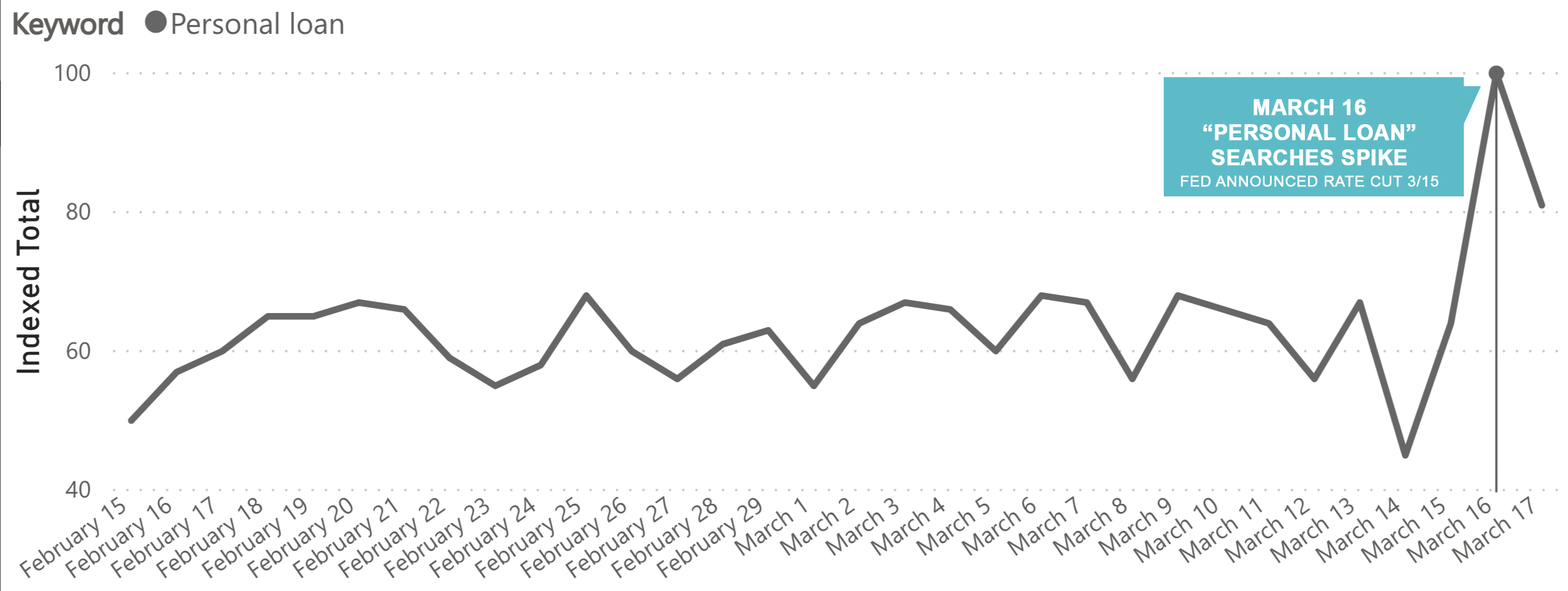

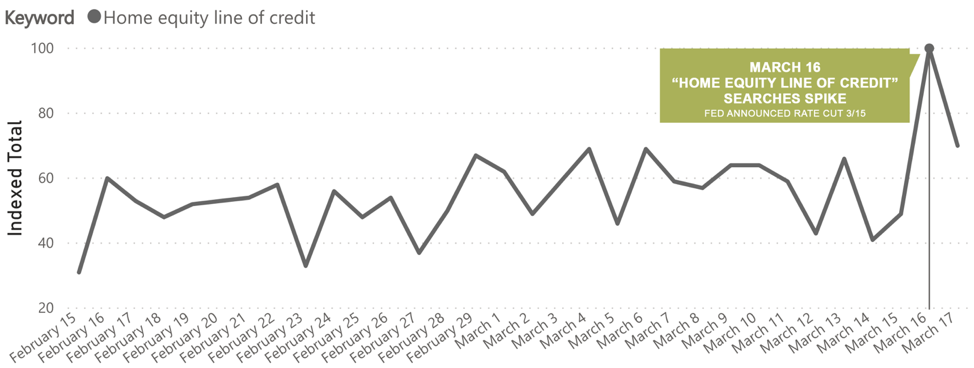

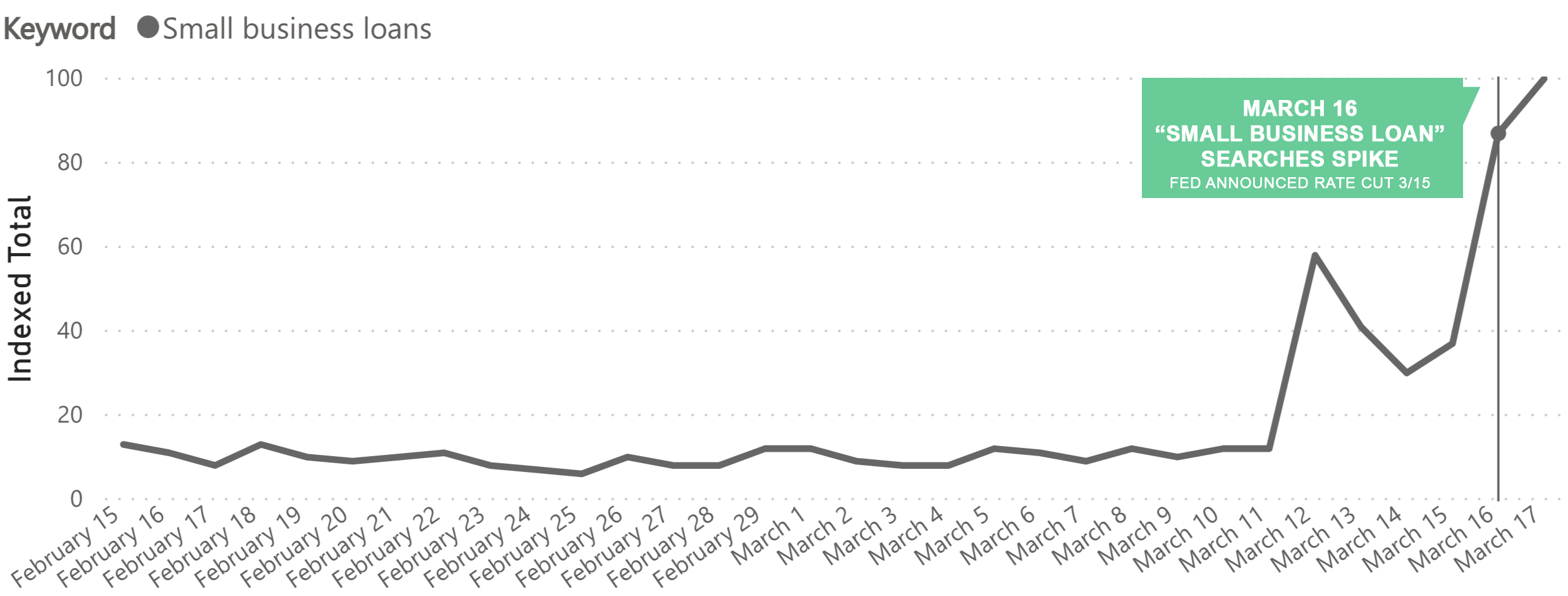

Recent rate cuts have driven spikes in demand for most lending products, including student loan refinance, personal loans, and small business loans.

Online search volume for Credit Cards and Private Student Loans is up slightly.

However, online search volume for several other products increased dramatically in the past 90 days.

- Student Loan Refinance – up 400%

- Personal Loan – up 60%

- Home Equity Loans – up 100%

- Small Business Loans – up 900%

Student Loan Refinance – Online Search Volume Up 400%

Personal Loan – Up 60%

Home Equity Loans – Up 100%

Small Business Loans – Up 900%

Source: Epic analysis of Google Trends

Lender Activity

- On a call with CBA staff on Thursday, they mentioned that lenders were not suspending marketing campaigns.

- Our anecdotal information is that many lenders are both postponing and cutting back on campaigns.

- Lenders reliant on capital markets funding appear to be pulling back as illustrated by Lending Club’s exit from the aggregator space.

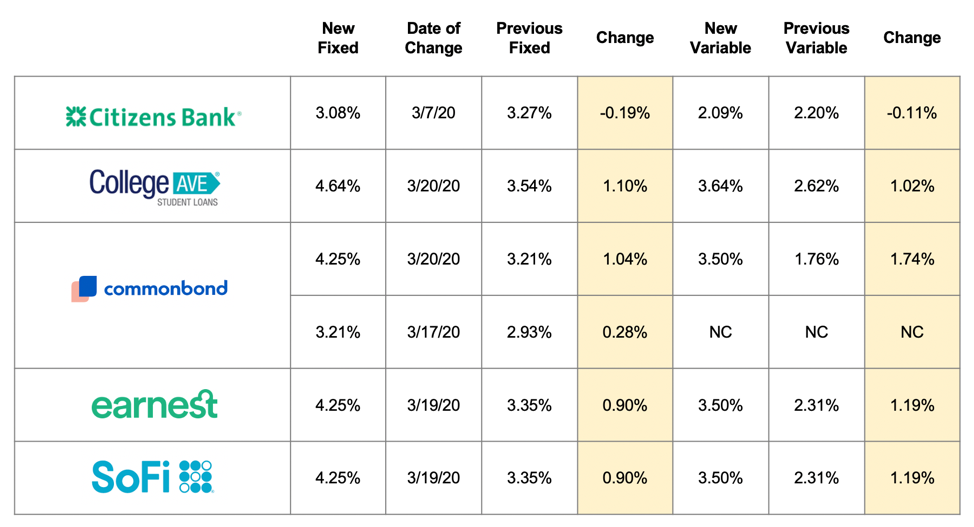

- Despite the Fed’s rate reduction, lenders in some products are raising rates, particularly in the student loan refinance segment.

Source: Epic analysis of student loan refinance aggregator sites: Credible, NerdWallet, Nitro College, Student Loan Hero

Going Forward

- Lower interest rates and decreased competition provide a unique opportunity to add high credit-quality loans — especially through targeted channels such as direct mail.

- Consumers will have a greater need for loans, but the question is whether they are the consumers who can ultimately pay us back. The good news is that lower interest rates will increase demand from the best borrowers.

- Additionally, some less-sophisticated lenders will overreact and stop lending altogether, and lenders lacking stable deposit-based funding will be forced to slow their solicitation efforts as well. The resulting lower levels of competition will result in higher response from the most creditworthy borrowers.

- When targeting prime consumers who have many choices, having a competitive product and an efficient booking process will draw substantial positive selection in the best credit segment.

Across the markets that we serve, actual early results show strong increased demand from creditworthy borrowers across many lending products.